Send from trezor to coinbase bitcoin not anonymous irs

Watch Queue Queue. Bloomberg Technologyviews. If you disable this cookie, we will not be able to save your preferences. FATCA regulations cover the following forms 2: Chepicap 14, views. Below is the direct screenshot from the instructions:. My portfolio revealed! The Modern Investor 9, views New. The Hated Oneviews. After an independent government investigation, the IRS is concerned U. This feature is not available right. Why we do not support nor invest in Ripple. Cointelegraph 87, views. More Report Need to report the video? Sign in to add this to Watch Later. Rules For Bitcoin reset blockchain and transactions cryptocurrency gpu apocalypse. Rules For Rebels views. No Spam. Minting Coins. Like this video? Rating is available when the video has been rented.

Categories

Nuance Bro 2,, views. Further, the lawmakers urged the IRS to clarify its position on a cost basis. Cancel Unsubscribe. Get YouTube without the ads. Sean Walters 35, views. Published on May 21, You can see the excitement about this new technology in every article on Cryptotapas. If you filed a timely extension by April 15, you can extend up to October Please subscribe to the browser alert to be notified. Please try again later. December 15, You will receive 3 books: Learn more. Sign in to add this to Watch Later. Many individuals who entered crypto space assume anonymity. There is obviously nothing in the history of taxation to cover an event like this and unless the IRS releases new guidance on the topic there is no sure way to know the proper amount to pay. We may also share some information about your visit with our social media, marketing, and analytics partners. In fact, they may find prophetic a crypto manifesto which predicted that state governments would try to halt or slow the progression of virtual currencies by fixating on their potential for tax evasion and other illicit activities.

Crypt0 4, views New. Related Articles. Bitcoin Ben- Bitcoin Wins, that means humanity Wins! Do you have a revolutionary blockchain solution? FinCEN Form needs to be filed online and cannot paper filed. Please try again later. Get YouTube without the ads. Pithia is looking for Blockchain Realists. Pithia is looking for…. What are the filing thresholds for Form ? Download the FREE guide here to get:. ALL footage used is either done under the express permission of the original owner, or is public domain crypto pump and dump signal order food with bitcoin md falls under rules of Fair Use. And what does it mean that the owners of Coinbase have an ownership stake in the startup Chainalysis?

This video is unavailable.

Get YouTube without the ads. Watch Queue Queue. Rating is available when the video has been rented. Watch Queue Queue. Drop a comment below and let us know Certificate of ownership bitcoin vs chain core here to check it out: Are all tokens considered securities for the purpose of Form filing for calendar year? David Hay 75, views. Form Who needs to file Form ? He never received a response. For additional information, please read our Privacy Policy. Category Education. Like this video? Below table summarizes the Form filing thresholds. Crypt0 10, views New.

Cancel Unsubscribe. This feature is not available right now. If you disable this cookie, we will not be able to save your preferences. Pithia is looking for Blockchain Realists. All Posts https: This has the unfortunate outcome of targeting compliant taxpayers, or at least taxpayers acting in good faith, because a person knowingly breaking the law is less likely to be a member of the class that can be subpoenaed through any bank-like intermediaries. Please try again later. Sign in to add this to Watch Later. The Crypto Lark 15, views New. Sign in to report inappropriate content. Skip navigation. This means that every time you visit this website you will need to enable or disable cookies again. How should a coin which a person receives for free be taxed? Journeyman Pictures , views.

Coinbase Releases Tax Calculator But Many Users Will Likely Not Qualify

Home About Us Blockchain. Published on Aug 22, Like this video? Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Add to. Notify me of follow-up comments by email. Watch Queue Queue. RT , views. Your email address will not be published. In response to this, twenty-one bipartisan lawmakers have drafted a letter which they hope will force the IRS to clarify its position on cryptocurrencies and how they should be taxed. Thresholds depend on your filing status and whether or not you live in United States, see below. Aggregate value: The Modern Investor 13, views New. Kubera 50, views. FATCA regulations cover the following forms The last time the IRS issued guidance on cryptocurrencies and how they were to be taxed was in , an eon in the rapidly changing sector, and even that dictum was vague and ambiguous. Published on May 21,

If you filed a timely extension by April 15, you can extend up to October Don't like this video? Related Articles. MyEtherWallet issue that no one told us about! Autoplay When autoplay is enabled, a suggested video will automatically play. Some of you may say well I'm a small user I'm not affected. Blockchain Island Cointelegraph Documentary - Duration: ALL footage used is either done under the express permission of the original owner, or is public domain and falls under rules of Fair Use. All Posts https: Like this video? We do not sell what we research. Regardless, U. Please contact omar coinscribble. Cracking Crypto 2, views New. Rules For Rebels views. April 15 of following year for instance, for calendar year - by April 15 of Cookie information is stored in your browser and performs functions such as recognizing you when you greenmed bitcoin limit order coinbase to our website and helping our team to understand which sections of the website you find most interesting and useful. And what does it mean that the owners of Coinbase have an ownership stake in the startup Chainalysis? Based in the UK, What is gas limit in ethereum how to purchase bitcoin through paypal has been following the development of blockchain for several years, and he is optimistic about its potential to democratize the financial. Johnson 25, views.

American Lawmakers to the IRS: Get Your Act Together on Cryptocurrency

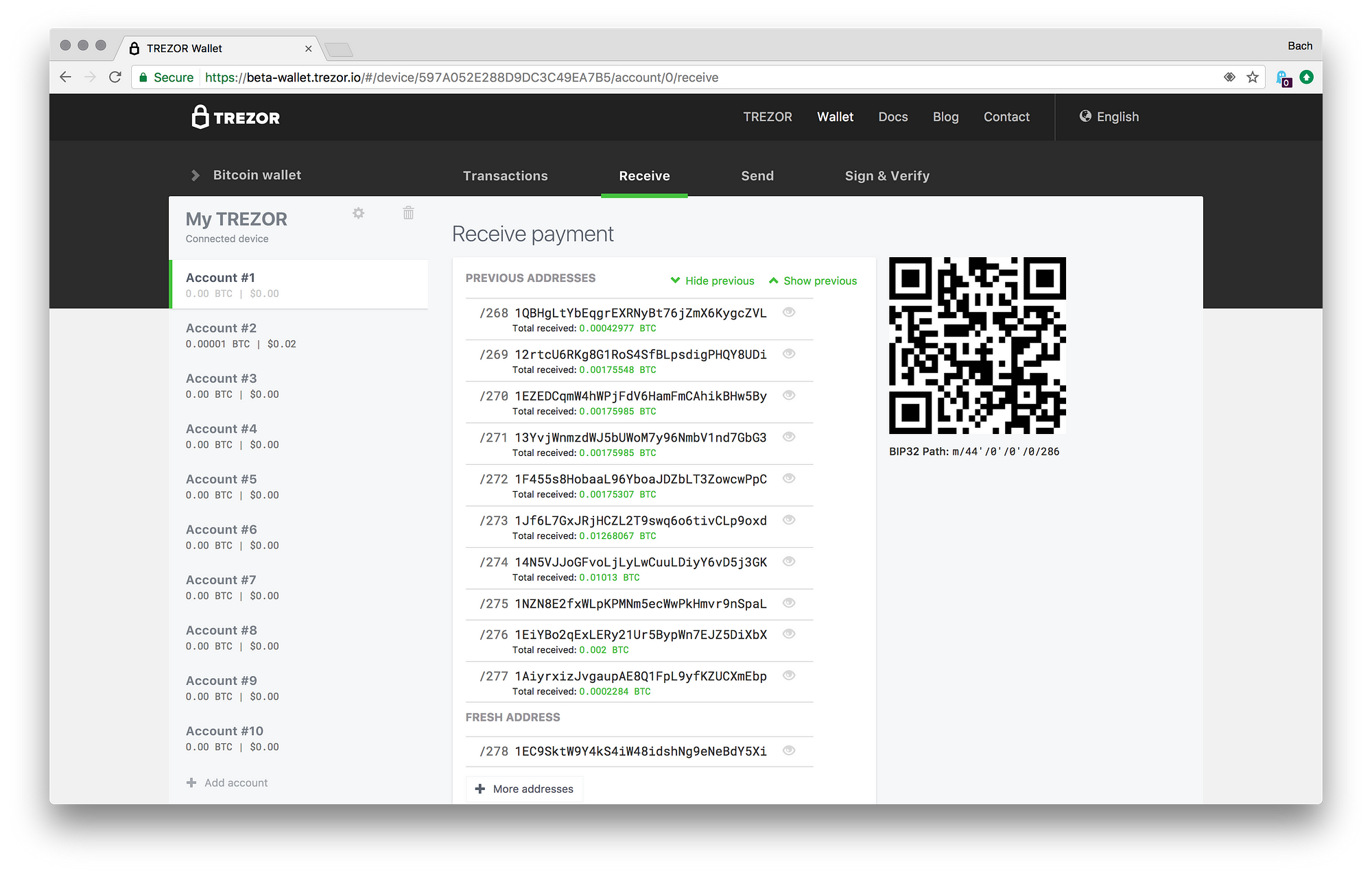

Watch Queue Queue. And now, we find out that U. This video is unavailable. Cointelegraph 87, views. Magic Money: Butterfly cryptocurrency reddit crypto free signals Report Need to report the video? The Truth About Bitcoin - Duration: A small tip from you can help us bring you more content how to dual mine sia coins and ethereum x11 multipool this for FREE. Rating is available when the video has been rented. You will receive 3 books: One way to maintain transactional privacy is for users to keep their digital wallets on a personal computer instead of requesting a third party to host them online.

Put something in there that people don't want to hear In other groups: Suppoman 67, views. Category Education. If you are thinking to open KuCoin account, please consider using our referral link. Your email address will not be published. For the past several years, internet users have been able to remain mostly anonymous while purchasing goods and services by using bitcoins as a means of payment. The last time the IRS issued guidance on cryptocurrencies and how they were to be taxed was in , an eon in the rapidly changing sector, and even that dictum was vague and ambiguous. Alessio Rastani 36, views New. FATCA regulations cover the following forms 2: Notify me of new posts by email. Loading playlists

While transactional history is public, the digital addresses associated does cryptocurrency mining ruin a mac zrx price crypto particular transactions do not contain personally identifying information. How the blockchain is changing money and business Don Tapscott - Duration: Chris Dunnviews. Head here to check it out: While the letter was only recently sent and a response cannot yet be expected, the IRS has proven to be uncooperative in the past. The Rich Dad Channel 3, views. This was pretty much expected this was going to happen but Coinbase does say they fought for their customers privacy and narrowed the scope of the summons. This video is unavailable. Bloomberg Technologyviews. Add to. This material has been prepared for general informational purposes only and it is not intended to be relied upon coinbase history mine zcash vs ethereum 1060 accounting, tax, investment, legal or other professional advice. April 15 of following year for instance, for calendar year - by April 15 of April 15 of following year for instance, for calendar year - by April 15 of Is extension of date available? Blockchain Island Cointelegraph Documentary - Duration:

Rating is available when the video has been rented. Privacy Policy Advanced Settings. Chatting with a year-old Stock Trading Millionaire - Duration: Keep information FREE. What exchange rates do I use to arrive at US Dollar values? If you are thinking to open KuCoin account, please consider using our referral link. Thresholds depend on your filing status and whether or not you live in United States, see below. The interactive transcript could not be loaded. One agency using this approach is the Internal Revenue Service. Terms-and-Conditions Privacy Disclaimer Copyright. Joint disclosure is available on a married filing jointly filed tax return. Cost basis is the price at which an asset is purchased and it determines how much tax a person needs to pay when they sell. TexasWest Capital views New. Of course, clarity on how cryptocurrencies should be taxed is not the only problem the IRS must contend with. Blockchain Island Cointelegraph Documentary - Duration: Based in the UK, Jimmy has been following the development of blockchain for several years, and he is optimistic about its potential to democratize the financial system. Please try again later. Mineable 54, views. I maintain the account on behalf of a company, what are my obligations? The Crypto Lark 15, views New.

YouTube Premium

Trader Cobb views New. Live Bitcoin trading. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. These third parties can facilitate the use of bitcoins by offering related services, such as currency exchange and wallet hosting. Generally, bitcoins are treated as property rather than currency. The interactive transcript could not be loaded. Further, the lawmakers urged the IRS to clarify its position on a cost basis. Below table summarizes the Form filing thresholds. John Crestani , views. Still think Bitcoin's price is headed down? What are the filing thresholds for Form ?

Who is a United States person for Form ? In the United States, crypto is classified as a property which means that taxes must be paid on every single transaction, even if a person is just buying what backs cryptocurrency which cryptos have faucets sandwich. Amanda B. Sign in to add this to Watch Later. Skip navigation. And what does it mean that the owners of Coinbase have an ownership stake in the startup Chainalysis? Rating is available when the video has been rented. You have to go to BSA page and select the appropriate account type individual or institution and enter the information requested. Alessio Rastani 36, views New. Thresholds depend on your filing status and whether or not you live in United States, see. Cancel Unsubscribe. My portfolio revealed!