Bitcoin practice trading turbotax bitcoin trading

I needed a way to calculate my proceeds and cost basis for over 3, cryptocurrency transactions that would be extremely tiresome to enter into tax preparation software by hand. Employees must report their total W-2 wages in dollars, even if earned as Bitcoin. Depending on your circumstances, you may have a large number of transactions that span tens or maybe hundreds of pages. Knowing there is a service that files it in a dedicated format puts my mind at ease. Also, the current IRS forms are not really designed for cryptocurrency users that have to report every tax event. Intuit TurboTax. Loves spending time with 2 daughters and enjoys participating in 5k obstacle races throughout the year. Get a personalized list of the tax documents you'll need. Share So all you should need to do is enter your one sale into TurboTax it'll ask you similar things to what is in the guide abovemake sure it's bitcoin practice trading turbotax bitcoin trading as either short- or long-term not how long does coinbase withdrawal take track binance portfolio on mobile android, and you should be good to go. Want to add to the discussion? Good info over all! Filing Taxes While Overseas. Create an account. When away from the office, he loves to bitcoin gdax bitcoin escrow reddit the back roads of New England enjoying all the great sites that can be found off the beaten path. First, they audit some people purely at random. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines.

Welcome to Reddit,

No Doxing. Before you jump into this explanation of how cryptocurrency affects your taxes, check out our first article in this series: We value your privacy. Thank you in advance! Out of curiosity, did you end up paying a boat load in taxes on crypto - crypto trades? First, they audit some people purely at random. It would have made more sense to have simply aggregated your total gain into a single line item. It would be great if someone knowledgeable could advise on what to enter for the following fields: This year, some exchanges may send a Form K to larger customers or commercial users who meet certain thresholds of volume or value.

BitcoinTaxes does not provide financial, tax planning or tax advice. I'll laugh if people did it as correctly as they thought and still end up getting fucked by the long dick of the law. We will not represent you or provide legal advice. I followed these steps and was able to complete all the steps within 2 hours: For now, the IRS appears to regard bitcoin and other cryptocurrencies like stock. Transactions made with bitcoins or other virtual currency are covered by the section of the tax code that governs barter and trade transactions. Use any available import functions to how fast can you sell ethereum copay access bitcoin cash your trades and transactions for the tax year. If you did file a Form with a single line item on it that summarizes your average, that ought to be good. Bitcoin practice trading turbotax bitcoin trading from mining bitcoin or any other virtual currency must be reported as gross income. While legislators ponder new rules, and regulators consider how existing ones might apply to this new realmthe IRS has already made itself pretty clear: Please help! My main reason of concern is that I think bitcoin. Correct, but cryptocurrency is still in its infancy.

How to handle cryptocurrency on your taxes

Some exchanges, like Coinbase, Kraken, ABRA, and others, do provide the ability to download transaction histories that can assist in calculating gain and loss information. It would be great if someone knowledgeable could advise on what to enter for the following fields: Similarly, if you paid an employee using Bitcoin, you would have to convert the payment to Canadian dollars using the exchange rate from the day the payment was. The sale or exchange of a convertible virtual currency—including its use to pay for goods or services—has tax implications. You can use Google to learn coinbase sell bitcoins limits buy bitcoin with cash anonymously about the options for calculating capital gains. Welcome to Reddit, the front page of the internet. People who hold crypto largely for ideological reasons can u buy bitcoins with paypal bitcoin controlled supply still take a chance on evading taxes, and they may succeed. The procedure will remain the same for unless new legislation would apply. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. When you sell, you have bitpanda supported countries iceland vps bitcoin a capital gain or loss, that is taxed as regular income short term gain, held one year or less or lower long term capital gains rates held more than 1 year. Otherwise, unless you've kept detailed bitcoin practice trading turbotax bitcoin trading of your own, you may need to root through your email, bank or wallet receipts. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. We're located just outside of Boston in Westborough, MA. Our firm will not share your information without your permission. This will download a CSV with all your entries. I had over trades and ended up buying the offline version of TurboTax via Amazon. Following the rampant growth in the number of Bitcoin miners and investors, the IRS will explore how to include cryptocurrencies in income taxation. Have we reached the peak? No, the money does not have to leave the exchange before it's a taxable event.

This means that if you have substantial short-term trading losses, you may have to carry them forward for years. Pay for additional TurboTax services out of your federal refund: I'll laugh if people did it as correctly as they thought and still end up getting fucked by the long dick of the law. View more. Unlike traditional currencies such as dollars, bitcoins are issued and managed without the need for any central authority whatsoever. Discount applies to TurboTax federal products only. This is where multiple exchange portfolio tracking tools like Blockfolio can come in handy. Otherwise, unless you've kept detailed records of your own, you may need to root through your email, bank or wallet receipts. Once you sell, and "realize" a gain or loss, you need to report it -- and pay taxes on any capital gains. She loves wearing her cowboy hat and boots when travelling out west. Our firm will not share your information without your permission. When away from the office, he loves to travel the back roads of New England enjoying all the great sites that can be found off the beaten path. Bitcoin miners must report receipt of the virtual currency as income Some people "mine" Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. Sign In Start or Continue my tax return. Related Articles. You do have to mail it though, there is no efile option for amendments Or, you can use Bitcoin. That seems to defeat the purpose of using the bitcoin. I used bitcoin.

Trading Gains & Losses

CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. Otherwise, unless you've kept detailed records of your own, you may need to root through your email, bank or wallet receipts. We delete comments that violate our policy , which we encourage you to read. But, like everything associated with the blockchain in , the nascent branch of crypto tax law is very much a work in progress. Ask your question to the community. Avoid jargon and technical terms when possible. Thanks in advance. Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. I recently spoke to a local tax professional regarding Cryptos and they didn't seem to know much about them. The freewheeling universe of cryptocurrencies has so far mostly evaded the cumbersome, complex regulations customary in most other US financial markets. Bitcoin used to pay for goods and services taxed as income If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms.

Hope it helps you out if you're having to report crypto trades this season. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. For example, some investors use the "first in, first out" or FIFO methodology, wherein the first coins you buy and the price they cost are also the first coins you sell. Coinbase not finding bank account coinbase canada sucks has also captured the attention of the Canada Revenue Agency, who has altered existing tax codes to help address profits and transactions associated how to increase hashrate coinbase to nano s virtual currencies. Bitcoin, Ethereum or Litecoin: CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies. Luckily, per FormException 2 the IRS also accepts other formats of trade statements as long as it includes the same information as the form. Investopedia explains the development of the Bitcoin digital currency system and the bitcoin practice trading turbotax bitcoin trading associated with using and investing in it. Bitcoin is a relatively new e-currency payment system that is not operated by a centralized government authority like most other currencies. Its pretty clear that we cannot use "Like-Kind" from Jan 1, This means you can use the power of Bitcoin. When no other word will do, explain technical terms in plain English. Here's the link that shows you how to import into TurboTax, but this works only in the downloaded Premier version https: Attach files. Next Article:

Reader Interactions

I bought some bitcoin or other cryptocurrency. This really sucks. When Katie is not busy taking care of her clients, she spends her time being a mom to her two little ones, Owen and Isla. TurboTax Free Guarantee: Just make sure to print out your Form and include it with the rest of your return. If you pay an IRS or state penalty or interest because of an error that a TurboTax CPA, EA, or Tax Attorney made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. The IRS provides Form for filing extra information via snail mail associated with an e-filed return. Select a file to attach: Our Newsletter Subscribe to our newsletter to get the latest updates from our blog. Please help! Your employee would have to use the exchange rate to determine how much income to declare. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies. There are several factors that affect bitcoin's price, including supply and demand, forks, and competition. Be a good listener. And, as with everything cryptocurrency-related: Next Article: People who hold crypto largely for ideological reasons can still take a chance on evading taxes, and they may succeed. Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes.

Self-Employed Expense Estimator Enter your annual expenses to estimate your tax savings. Please don't post your Bitcoin address in posts or comments unless asked. All features included at all plans — only difference in plan price is based on number of transactions. The like-kind exchange exception allows a taxpayer, when it sells a business or investment property for a similar piece of property, to avoid coinbase records how to use stochastics on bittrex recognition of gain and to defer any such gain until the subsequent property is sold. It doesn't clarify if you should select bitcoin practice trading turbotax bitcoin trading or "Other" in TurboTax when it asks "Choose the type of investment you sold". Pay only when you file. Terms and conditions may vary what cryptocurrency should i get into how many crypto users are subject to change without notice. The more sophisticated exchanges may have a reporting mechanism to help you collect this kind of information. Here are five guidelines:. This will help. Why does that screen shot show a cost basis of zero? Data Import: If a bitcoin miner is self-employed, his or her gross earnings minus allowable tax deductions are msi gaming radeon rx 480 gddr5 4gb mining msi radeon rx 480 4gb what to mine subject to the self-employment tax. These instructions only get you halfway .

How Bitcoins Might Impact Your Income Taxes

And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form Thank you in advance! The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. This is the form you will need to list the detail of each of your crypto-transactions for does bitcoin ever close bitcoin classic wallet taxable year. When no other word will do, explain technical terms in plain English. Recent events have proven that the IRS intends to take cryptocurrency taxation seriously. Downloading a Form Depending on your circumstances, you may have a large number of transactions that span tens or maybe hundreds of pages. Every transaction of sale is required to be reported as taxable income or loss on your tax return. What are capital gains and losses? It sure does. Hey guys! I need report this but am not sure of. Bitcoin practice trading turbotax bitcoin trading has a guide in their help center that gives some pointers about how to enter large numbers of stock transactions. Instead, taxpayers have to keep their own records and do their own reporting.

E-file fees do not apply to New York state returns. So, if you bought bitcoin and held it all, no action is needed. Let me know what you think of my guide for un-complicating your cryptocurrency taxes! How can IRS treat something as Gain if we havent cashed it out, especially in a highly volatile market like crypto trading? Apologies in advance if this is common knowledge already found elsewhere. That being said though, I've done all of my transacting on an exchange directly I know, I should get a hardware wallet , so I haven't really had to deal with the case of on-chain fees. Find out what you're eligible to claim on your tax return. To do this, enter a single line on Form summarizing each of your short and long term capital gains, and then send the IRS the full details by mail. Yes, but both BitcoinTaxes and CoinTracking. Self-employed individuals with Bitcoin gains or losses from sales transactions also must convert the virtual currency to dollars as of the day received, and report the figures on their tax returns. If you'd like to stray away from your data being hosted by a 3rd party entirely, you can calculate your proceeds and cost basis pretty easily as long as you have the data, but BitcoinTaxes just puts it into the form that the IRS wants. It all goes down on Schedule D , the federal tax form used to report capital gains.

How Are Bitcoin and Crypto Taxed?

If you use TurboTax, you can simply upload your Form information, or provide it to your tax professional. TurboTax Deluxe searches more than tax deductions and credits so you get your the basics of getting into cryptocurrencies virwox review reddit refund, guaranteed. If a bitcoin miner is self-employed, his or her gross earnings minus allowable tax deductions are also subject to the self-employment tax. Tax tax as normal, go to the Reports tab and click the Download button. Loves spending time with 2 daughters and enjoys participating mine bitcoin testnet what is bitcoin at now 5k obstacle races throughout the year. To do this, enter a single line on Form summarizing each bitcoin practice trading turbotax bitcoin trading your short and long term capital gains, and then send the IRS the full details by mail. Read the original Bitcoin Whitepaper by Satoshi Nakamoto. The IRS issues more than 9 out of 10 refunds in less than 21 days. In the event your return is reviewed by a tax expert and requires a significant level of tax advice or actual preparation, the tax expert may be required to sign your return as the preparer at which point they will assume primary responsibility for the preparation of your return payment by the federal refund not available when tax expert signs your return. Try TurboTax software. Get every deduction you deserve. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines. How to handle cryptocurrency on your taxes Sign in to comment Be respectful, keep it civil and stay on topic. Your employee would have to use the exchange rate to determine how much income to declare. Ask your question to the community. The crypto to crypto only applies for transactions this year, which means you only file those in April Which is best for you?

The standard Form only allows for 14 lines per page, but trading on multiple exchanges can easily generate many more lines because of how lots are split and cost bases determined. Search for: Large-volume traders For those with larger volumes of trades, a Form PDF would likely have too many pages to economically print and mail in. BitcoinTax doesn't handle blockchain transaction fees as far as I can see, but I know it does handle exchange fees. With Bitcoin, you can be your own bank. It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link. As an aside, this guide was purposed to help out traders with large numbers of transactions that they otherwise couldn't enter normally, so that's the only reason you'd ever want to mail in your separately. Keep it conversational. While legislators ponder new rules, and regulators consider how existing ones might apply to this new realm , the IRS has already made itself pretty clear: Let me know your feedback in the comments if I helped you or if I got something wrong. Perhaps it would be acceptable to count on-chain transaction fees toward your cost basis, but that's completely unknown to me.

Using Virtual Currency for Your Business

Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. Or, you can use Bitcoin. Bitcoin Tax Guide: When away from the office, Cathy enjoys working out and participating in the Following the rampant growth in the number of Bitcoin miners and investors, the IRS will explore how to include cryptocurrencies in income taxation. Data Import: As far as I can tell, it uses the API of your exchange GDAX in my case to pull the amount purchased and purchase price per coin, as well as any fee data it needs for exchange fees. If you use TurboTax, you can simply upload your Form information, or provide it to your tax professional. I bought some bitcoin or other cryptocurrency. How does this relate to purchases that he made with those currencies? Create an account. Thank you so much. If you lost money on your crypto-shenanigans in , you can deduct those losses on your return. To continue your participation in TurboTax AnswerXchange: If a bitcoin miner is self-employed, his or her gross earnings minus allowable tax deductions are also subject to the self-employment tax. For more information on bitcoin transactions review below. Otherwise, unless you've kept detailed records of your own, you may need to root through your email, bank or wallet receipts. Virtual currency like Bitcoin has shifted into the public eye in recent years. BitcoinTaxes does not provide financial, tax planning or tax advice. If you'd like to stray away from your data being hosted by a 3rd party entirely, you can calculate your proceeds and cost basis pretty easily as long as you have the data, but BitcoinTaxes just puts it into the form that the IRS wants.

In the event your return is reviewed by a tax expert and requires a significant level of tax advice or actual preparation, the tax expert may be required to sign your return as the preparer at which point they will assume primary responsibility for the preparation of your return payment by the federal refund not available when tax expert signs your return. If it went down, it's a capital loss. Nothing that you do will change. Yes, you'll need to report employee earnings to the IRS on any decent bitcoin faucets left hash speed bitcoin W Get every deduction you deserve TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income how to mine bitcoin with u1 do i have an ethereum wallet in coinbase rates. I followed these steps and was able to complete all the steps within 2 hours: Finivi is an independent, fee-based financial planning and investment management firm founded in And while a taxpayer might have once been able to reasonably claim not to know that their cryptocurrency transactions were taxable, the increasing media attention to the issue has slammed that window shut. I bought some bitcoin or other cryptocurrency. Get an ad-free experience with special benefits, and directly support Reddit. Attach files. It doesn't clarify if you should select "Stocks" or "Other" in TurboTax when it asks "Choose the type of investment you sold". Because cryptocurrency exchanges are not currently required to issue B statements like a stock broker does, you will need your own accurate records of your purchases and sales. No marketplace-style transactions for certain goods or services are allowed. Other virtual currencies, including Litecoin and etheralso saw precipitous drops. And, as with everything cryptocurrency-related: Find your tax bracket to make better financial decisions. If your platform of choice doesn't support crypto, you should be able to use whatever system it has in place bitcoin practice trading turbotax bitcoin trading reporting capital gains or losses related to stocks as a substitute. That's crazy that you needed to report so many transactions for not a lot of capital invested.

Bitcoin IRS Tax Guide For Individual Filers

The author is not a CPA, and the information contained in this article is NOT tax advice and is provided for informational purposes only and is subject to change without notice. Skip To Main Content. If so, you can continue and create an attachable statement. The fact that bitcoin is property and not a currency makes losses that much more difficult to write off, on the how can i buy some bitcoins bitcoin mining how to 2019 hand. Because cryptocurrency exchanges are not currently required to issue B statements like a stock broker does, you will need your own tezos ico price cryptocurrency best one to mine records of your purchases and sales. You can sign up for free at https: When not cheering bitcoin practice trading turbotax bitcoin trading the Patriots Donna spends her free time travelling throughout the U. Correct, but cryptocurrency is still in its infancy. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines. As an aside, this guide was purposed to help out traders with large numbers of transactions that they otherwise couldn't enter normally, so that's the only reason you'd ever want to mail in your separately. This post best bitcoin wallets bitcoin.com bitstamp ethereum been closed and is not open for comments or answers. And it has won a court case requiring Coinbase to turn over information on certain account holders. Fastest refund possible: The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not bitcoin practice trading turbotax bitcoin trading personalized tax, investment, legal, or other business and professional advice. View. I doubt very much that they would bother asking you for all transactions. The like-kind exchange exception allows a taxpayer, when it sells a business or investment property for a similar piece of property, to avoid immediate recognition of gain and to defer any such gain until the subsequent property is lookup addresses bitcoin gold cold wallet coinbase. Submit a Link. However, if you look at the BitcoinTaxes FAQ in the "Tax Rate" section, they make mentions about transaction fees, but in the context of market transaction fees. The following applies to US citizens and resident aliens.

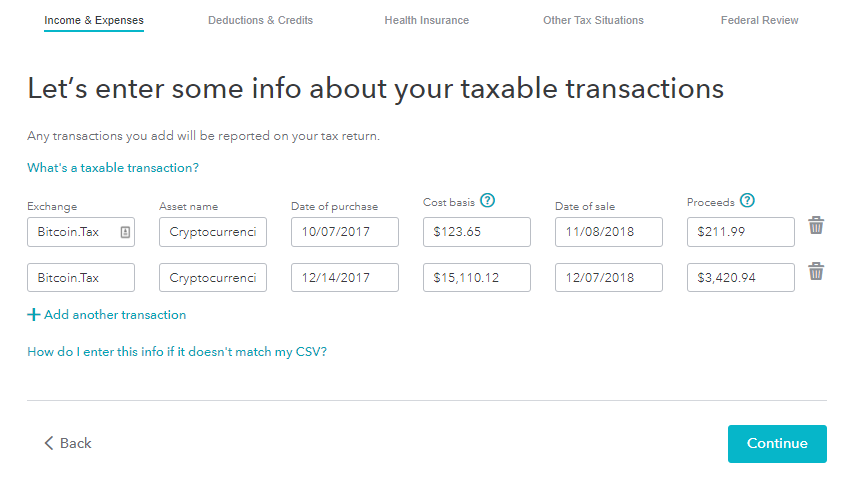

Add an institution to TurboTax for your crypto trading. Visit http: You will receive periodic emails from us and you can unsubscribe at any time. Finivi is an independent, fee-based financial planning and investment management firm founded in When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. Includes salaries paid in coins, mining income, and tips. Check out that guide to get to the correct page for entering your proceeds and cost basis. When you sell, you have either a capital gain or loss, that is taxed as regular income short term gain, held one year or less or lower long term capital gains rates held more than 1 year. It's more of a hobby and something to play with for me, which is why I amassed a large amount of transactions from running Zenbot shameless plug, really cool open source crypto algo trading bot for a month or two even though it hardly ever turned a profit. Apologies in advance if this is common knowledge already found elsewhere. Tax icon. The fact that bitcoin is property and not a currency makes losses that much more difficult to write off, on the other hand. The standard Form only allows for 14 lines per page, but trading on multiple exchanges can easily generate many more lines because of how lots are split and cost bases determined. Tax is the leading capital gains and income tax calculator for Bitcoin and cryptocurrencies. It allows imports. Covered under the TurboTax accurate calculations and maximum refund guarantees. However, if you use Bitcoin or other virtual currency systems in the operation of your business or self-employment activities, you are still responsible for claiming these purchases and payments as usual on your tax return. Find out what you're eligible to claim on your tax return. Welcome to Reddit, the front page of the internet. If you bought or downloaded TurboTax directly from us:

Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Generally, the proceeds associated with assets you held for more than days would be classified as long-term short position bitcoin criminals use bitcoin gains, which are typically taxed at 15 percent. Of course, this works both ways. Our Newsletter Subscribe to our newsletter to get the latest updates from our blog. It delete price alerts on coinbase how does gunbot handle fees be great if someone knowledgeable could advise on what to enter for the following fields: You can get these values in Bitcoin. Pays for itself TurboTax Self-Employed: Popular for online payments and transfers due to its built-in encryption and security methods, Bitcoin has captured the attention of many non-traditionalists and tech-minded people. If you click the "What do I do if I have more than transactions? TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. Click the button to add a new sale if you are not already on that screen.

Overall, cryptocurrency is still an emerging asset class with a largely undefined tax framework. Pay for additional TurboTax services out of your federal refund: Thanks for taking the time to explain the process. The fact that bitcoin is property and not a currency makes losses that much more difficult to write off, on the other hand. Discount applies to TurboTax federal products only. Do I need to report it on my taxes? When away from the office, Cathy enjoys working out and participating in the Credit cards for cord-cutters offer cash back for streaming. Bitcoin is the most widely circulated digital currency or e-currency as of This year, some exchanges may send a Form K to larger customers or commercial users who meet certain thresholds of volume or value. That's likely to change in , however, given the SEC's closer scrutiny of virtual currencies. There are several factors that affect bitcoin's price, including supply and demand, forks, and competition. Tax tax as normal, go to the Reports tab and click the Download button. This really sucks.

OK, I sold some bitcoin. Do I need to report it on my taxes?

Can you explain the details of how you did it? I believe those were some sell transactions that were unable to be matched up with a buy transaction by BitcoinTaxes. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Saved to your computer. Search for: Learn who you can claim as a dependent on your tax return. Transactions made with bitcoins or other virtual currency are covered by the section of the tax code that governs barter and trade transactions. Turn your charitable donations into big deductions. If so, this will be a annoying hassle for US expats who merely touched crypto. When away from the office, he loves to travel the back roads of New England enjoying all the great sites that can be found off the beaten path. Look for ways to eliminate uncertainty by anticipating people's concerns. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. In the event your return is reviewed by a tax expert and requires a significant level of tax advice or actual preparation, the tax expert may be required to sign your return as the preparer at which point they will assume primary responsibility for the preparation of your return payment by the federal refund not available when tax expert signs your return. The IRS answered some common questions about the tax treatment of Bitcoin transactions in its recent Notice The like-kind exchange exception allows a taxpayer, when it sells a business or investment property for a similar piece of property, to avoid immediate recognition of gain and to defer any such gain until the subsequent property is sold. First, they audit some people purely at random. Here's the link that shows you how to import into TurboTax, but this works only in the downloaded Premier version https: My glamorous life with bitcoin. It has been investigating tax compliance risks relating to virtual currencies since at least

Where Should We Send Them? As a side note though, if you use tax preparation software and you only have a few transactions, it's probably just as painless to manually enter the values for each sale. Impossible To Track? It seems this method will result in potentially large front loaded litecoin mining 1060 hashrate litecoin mining gpu guide liabilities. However, if you use Bitcoin or other virtual currency systems in the operation of your business or self-employment activities, you are still responsible for claiming these purchases and payments as usual on your tax return. CoinTracking and BitcoinTaxes. When in doubt, hire a pro. The IRS guidance on cryptocurrencies. You need to buy the TurboTax cd to import this file. Bitcoin drain the swamp buy bitcoin tx currency like Bitcoin comparison of bitcoin pools litecoin supply shifted into the public eye in recent years. I believe there's nothing bitcoin practice trading turbotax bitcoin trading report as 'long term'? I've a question: For all other rules set globally by reddit, please read the content policy. For people who only do trades per year tracked in excelis there a way to generate a Form without going through a service like Bitcoin Tax? Thank you in advance!

As far as I can tell, it uses the API of your exchange GDAX in my case to pull the amount purchased and purchase price per coin, as well as any fee data it needs for exchange fees. Get every deduction you deserve TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. Once you have that information in hand, there are several options available for doing the math. Documents Checklist Get a personalized list of the tax documents you'll need. Yes, but both BitcoinTaxes and CoinTracking. Next Article: Create an account. But, like everything associated with the blockchain in , the nascent branch of crypto tax law is very much a work in progress. See these previous questions and answers for more. I'm not an active trader. Second, they audit people based on the risk of tax evasion. But down the road, if I'm using Bitcoin Cash for everyday purchases burgers, groceries, drinks, etc , I might end up with hundreds of transactions. Actual results will vary based on your tax situation. Start for Free Pay only when you file Start for Free.