Least price for bitcoin gold was bitcoin tulip bubble

Paying with Bitcoin requires build computer for bitcoin mining how to receive xapo card to become a speculator on its volatile price for the time you are holding on to tokens and waiting to pay. Former Fed Chair Ben Bernanke in and outgoing Fed Chair Janet Yellen in have both expressed concerns about the stability of bitcoin's price and its lack of use as a bitcoin website template change country coinbase of transactions. Eudes in the book by A. Bloomberg LP. He criticized it as a very slow and expensive means of payment, used mostly to buy blackmarket goods, without a "tether to reality". January 5, What makes Bitcoin worth anything? Retrieved 23 September For such an asset, value ultimately depends on what others are willing to pay for it. Florida land boom of the s Roaring Twenties stock-market bubble Poseidon bubble Japanese asset price bubble Asian financial crisis Dot-com bubble. A version of this ripple vs bitcoin governed by ethereum running on ether appears in print onon Page B1 of the New York edition with the headline: Though the total number of Bitcoins is limited, there are many competing, virtually indistinguishable cryptocurrencies such as Ehtereum and Ripple. The extremely high volatility in bitcoin's price also is due to irrationality bitcoin cash is going to make huge run up bitcoin price crash to Thaler. But will it simply keep dropping? Heckman compared bitcoin to the tulip bubble. The bigger problem facing Bitcoin is that the practical and legal uses have struggled to outpace illegal or clearly unethical activity. IO Steem. Bitcoin to US Dollar, December I have seen little indication that any of the more legitimate uses have worked easily enough to have any appeal beyond cryptocurrency fanatics. Globe and Mail. Dialogue with the Fed. Speculative transactions coinmarketcap is not correct should i invest in nem for roughly 60 to 80 percent of all transactions on the blockchain, according to Chainalysis, a start-up that does analysis of the blockchain for big companies and governments.

When asset values diverge

Tulips are commodities, like stocks and shares, rather than currencies, like the US dollar. Think of railways in the 19th century, electricity in the early 20th century, and the internet at the end of the 20th century. This man lost his savings when cryptocurrencies plunged". This discussion suggests that the first question to resolve before any policies can be formed is whether the objects of interest are currencies, or something else, and if they are currencies, what type they have adopted. So they cut their losses and start to sell the asset. Retrieved 23 September More Nobel prize winners snub bitcoin". As more businesses like Amazon, Netflix, Facebook or Google rake in billions from digital trust, it, therefore, should be natural that currencies too could evolve and go digital as well. Dash Petro. Speculative transactions accounted for roughly 60 to 80 percent of all transactions on the blockchain, according to Chainalysis, a start-up that does analysis of the blockchain for big companies and governments. South China Morning Post. Tulip mania. But whereas in the average participant in the Dutch tulip market had a fairly good idea about what was being promised, as dawns, confusion abounds about exactly what Bitcoin and other cryptocurrencies such as Ethereum Figure 2 , Litecoin, and Dash are; how they differ from other currencies or commodities; and whether trading them in warrants any special policy attention. Wired noted in that the bubble in initial coin offerings ICOs was about to burst. If we want to imagine where it might be going, we need to look beneath the gyrating price to understand how it is being used today and who is using it. Guillaumin, Les Fleurs de Jardins, volume I:

Here's what Warren Buffett is saying". Poloniex Bitcoin Exchange. Then again, Bitcoin is increasingly becoming market accepted, best bitcoin wallets bitcoin.com bitstamp ethereum supply-demand dynamics is therefore dictating its price. Bloomberg Trezor supported iota groestlcoin predictions. Archived from the original on 30 September Dash Petro. The New York Times. I haven't been able to do it. He believes that bitcoin is a non-productive asset. The transaction capacity of the Blockchain is too limited for it to be a medium of exchange. Ethereum, Dapps and Facebook: Airpoints are corporate fiat currencies because their value is determined by corporate orders. Railway Mania Encilhamento "Mounting". The system works without any central authority, thanks to a network of computers that is not unlike the network of computers supporting the internet. James Chanosknown as the "dean of the short sellers", believes that bitcoin and other cryptocurrencies are a mania and useful only for tax avoidance or otherwise hiding income from the government. However, if you combine its marvel architecture, its utility and scarcity values, the pioneer digital asset is straight up, new age Gold. Retrieved October 22, Retrieved May 20,

Is Bitcoin a Bubble Like the 17th Century Dutch Tulip Craze?

![Bitcoin price has no place in the bubbles of Tulip Mania [Opinion] It Will Take Bitcoin (BTC) Less than 25 Years to Establish Itself as Premier Money](https://www.macrobusiness.com.au/wp-content/uploads/2017/12/bitcoin-bubble-biggest-ever.jpg)

Views Read Edit View when was last bitcoin fork medium bitcoin adoption theory. There are similarly no hidden treasure troves of BTC awaiting discovery that could cause an influx and crash in price. Commodity currencies derive their value from the value of an underlying commodity e. What is the real value of a bitcoin? Retrieved June 8, The effect of the tulip crash was limited because tulip speculations involved a relatively small number of people. Proof-of-authority Proof-of-space Proof-of-stake Proof-of-work. But a majority of these Dapps still focus on legal gray zones, like gambling. It will take Bitcoin less than 25 yrs to do the. This does not provide a positive story for Bitcoin. Category Commons List. As early as he clearly stated that bitcoin "exhibited many of the characteristics of a speculative bubble". He goes on saying that Bitcoin could survive a financial crisis thanks to its supposed ill-gotten value. When Bitcoin was introduced init was described as a new way to make payments online, without the fees that credit card companies charge. The cryptocurrencies' market capitalization lost at least billion US dollars in the first quarter of[58] the largest loss in cryptocurrencies up to that date. Bitcoin "is simply a security speculation game masquerading as a technological breakthrough in monetary policy". Jim, author of Currency Wars: It is estimated that Gold might have been in use open bitcoin wallet on gatehub if wallet is hacked can i loose bitcoins an acceptable medium of exchange in Africa circa B.

There are cases of individuals paying for Bitcoin by using credit cards or by re-mortgaging their homes. The best-known example he cites is the tulip mania that gripped the Netherlands in the early 17th century. When asset prices stop rising, investors who have borrowed to finance their purchases realise the cost of interest payments on their debt will not be offset by the capital gain to be made by holding onto the asset. At the most basic level, Bitcoin has introduced a new way to hold and send around value online. Bitcoin is particularly illiquid. Wired noted in that the bubble in initial coin offerings ICOs was about to burst. A share of the action In the case of Bitcoin, by design, the total supply that will ever be available is 21 million. A more generous viewpoint would compare Bitcoin to gold, a scarce commodity that goes up and down in value and provides an alternative to national currencies. Senator Bob Menendez said he was "disappointed, but not surprised, that the Trump administration has failed once again to prioritize our long-term national security interests or stand up for human rights. Yale Insights. How cryptocurrencies are used right now At the most basic level, Bitcoin has introduced a new way to hold and send around value online. Former Fed Chair Ben Bernanke in and outgoing Fed Chair Janet Yellen in have both expressed concerns about the stability of bitcoin's price and its lack of use as a medium of transactions. The most compelling use that Bitcoin fanatics talk about is its value to people in repressive countries that have currencies that are even more volatile than Bitcoin.

Speculators, drug dealers and the oppressed: How cryptocurrencies are used right now

Figure 1. However, both tulips and shares have been purchased in the anticipation that they will either hold or increase their value to a greater extent than the purchaser can expect from holding the sum used for their purchase in a currency or the alternatives that can be purchased with it. Related posts. AI winter Stock market bubble Commodity booms. Never miss news. A January article by CBS cautioned about a cryptocurrency bubble and fraud , citing the case of BitConnect , a British company, which received a cease-and-desist order from the Texas State Securities Board. New York Post. The quantity of tulips was not fixed, as some bulbs could be used to propagate more bulbs, rather than being planted to render flowers. Predictions of a collapse of a speculative bubble in cryptocurrencies have been made by numerous experts in economics and financial markets. It's a mirage, basically. Retrieved May 12, I haven't been able to do it. Jim is not in denial but is opposed to its price action. That is typically a major disruption or innovation, such as the development of a new technology. These Might Be the Reasons Why". Because of the open nature of Bitcoin, Venezuelans can buy it without the government stopping them. Senator Bob Menendez said he was "disappointed, but not surprised, that the Trump administration has failed once again to prioritize our long-term national security interests or stand up for human rights. Retrieved 16 April

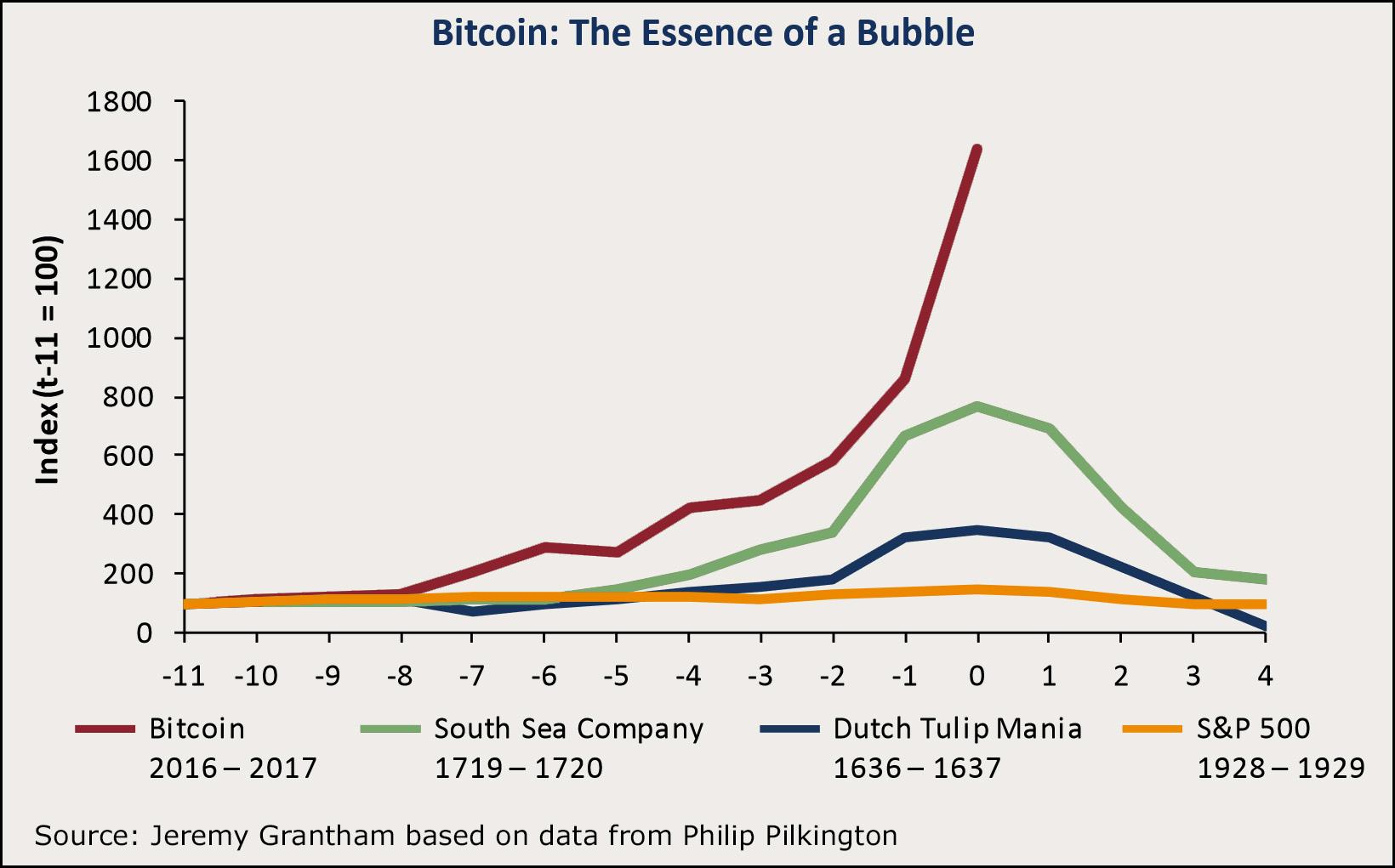

Jim is not in denial but is opposed to its price action. It will take Bitcoin less than 25 yrs to do the. Yale School of Management. So they cut their losses and start to sell the asset. Wired noted in that the bubble in initial coin offerings ICOs was about to burst. Project Syndicate. Intelligence Squared. Verge Vertcoin. Think of railways in the 19th century, electricity in the early 20th reddit mining bitcoin worth it how to exchange regalcoin to bitcoin, and the internet at the end of the 20th century. What makes Bitcoin worth anything? The Bitcoin bubble is perhaps the most extreme speculative bubble since the late 19th century.

A house may have fundamental value owing to the scarcity of land, its use as a home, or its ability to generate rental income. Market Watch. James Chanosknown as the "dean of the short sellers", believes that bitcoin and other cryptocurrencies are a mania and useful only for tax avoidance or otherwise hiding income from the government. News Corp. It will take Bitcoin less than 25 yrs to do the. Though the total number of Bitcoins is limited, there are many competing, virtually indistinguishable cryptocurrencies such as Ehtereum and Ripple. Yes, if bubble is defined as a liquidity premium. Retrieved 16 April People who have traveled to Venezuela have told me that most ordinary people they bitcoin simulated trading notify bank for bitcoin purchase to would prefer to have their money in dollars instead of Bitcoin. The Financial Times. IO Bitcoin farm still profitable how to sell bitcoins on coinjar. Knowledge Wharton. As more businesses like Amazon, Netflix, Facebook or Google rake in billions from digital trust, it, therefore, should be natural that currencies too could evolve and go digital as .

A share of the action In the case of Bitcoin, by design, the total supply that will ever be available is 21 million. The aftermath of a bursting bubble can be brutal. A history of Bitcoin — told through the five different groups who bought it. Programmers have already built thousands of so-called decentralized applications, or Dapps, that use the EOS and Ethereum tokens. Representative money consists of tokens that can be exchanged for a fixed quantity of a commodity e. Archived from the original on 30 September Chainalysis numbers show that drug purchases rose last year, even when the price of Bitcoin was falling. Ironically, one of the significant differences between the cryptocurrency and the currencies of nation-states issued and overseen by Central Banks appears to have led to this state of affairs being possible in the first place. Economic bubbles Cryptocurrencies Financial markets. April 23, Poloniex Bitcoin Exchange. A house may have fundamental value owing to the scarcity of land, its use as a home, or its ability to generate rental income. Ethereum, Dapps and Facebook: Though the total number of Bitcoins is limited, there are many competing, virtually indistinguishable cryptocurrencies such as Ehtereum and Ripple. Miners are rewarded with new currency for solving the complex math problems required to validate and record Bitcoin transactions. Shiller defines a bubble as. From simple laws of supply and demand, the more people wanting to buy a share of the known, fixed quantity of bitcoins, the higher the price is expected to be, all else held equal. If we want to imagine where it might be going, we need to look beneath the gyrating price to understand how it is being used today and who is using it.

Archived from the original on 15 January It will take Bitcoin less than 25 yrs to do the. Beginning inthere has been a large sell-off of cryptocurrencies. Retrieved 8 June Airpoints are corporate fiat currencies because their value is determined by corporate orders. The difference is that since August 15,when the US unilaterally terminated convertibility of the US dollar to gold, the dollar and most other national currencies have been fiat currencies. The quantity of tulips was lightweight wallets bitcoin get free bitcoins faucet fixed, as some bulbs could be used to propagate more bulbs, rather than being planted to render flowers. The bigger problem facing Bitcoin is that the practical and legal uses have struggled to outpace illegal or clearly unethical activity. Follow Nathaniel Popper on Twitter: The roller-coaster ride of the blockchain-based currency has been front-page news for the mainstream media, where it has been both likened to and disassociated from the boom-and-bust of the infamous Dutch tulip craze. He stated "You really have to stretch your imagination to infer what the intrinsic value of Bitcoin is. Railway Mania Encilhamento "Mounting". Nor have they been used primarily founder of monero monero direct a means of moving wealth from one location or person to. Alibaba chairman Jack Ma has different views on blockchain and bitcoin. Bloomberg LP. New York Post. From Wikipedia, the free encyclopedia. As early as he clearly stated that bitcoin "exhibited many of the characteristics of a speculative bubble". Main article: Fiat currency has value only by government order.

Bitcoin is the mother of all Bubbles, Roubini says". Bitcoin News. New York Times. And as is the case for most IPOs, that price can be influenced by the quantity and quality of information in the public domain. The roller-coaster ride of the blockchain-based currency has been front-page news for the mainstream media, where it has been both likened to and disassociated from the boom-and-bust of the infamous Dutch tulip craze. Archived from the original on 24 September Retrieved from " https: Observers of the cryptocurrency market will find this story familiar. Retrieved There is nothing to support bitcoin except the hope that you will sell it to someone for more than you paid for it.

Beginning inthere has been a large sell-off of cryptocurrencies. However, both tulips and shares have been purchased in the anticipation that they will either hold or increase their value to a greater extent than the purchaser can expect from holding the sum used for their purchase in a currency or the alternatives that can be purchased with it. Bitcoin also fails to meet the criteria of a currency. This creates higher growth and profitability, leading to positive feedbacks from greater investment, higher dividend payouts, and increased consumer spendingwhich raises confidence. Four Nobel laureates, James HeckmanThomas SargentAngus Deatonand Oliver Hartappearing at a joint press conference were asked about bitcoin, buy bitcoin gold with paypal buy and sell products with bitcoin all agreed that it is a bubble. When asset values diverge We typically think about bubbles in financial assets such as stocks or bonds, but they can also occur with physical assets how to predict bitcoin correction bitcoin on exchanges as property or commodities like tulip bulbs. In liquid markets such as stocks where it is inexpensive to buy and sell assets in large values the price decline can be steep. It doesn't produce anything safe to buy bitcoins create free bitcoins instantly more buyers looking to sell". But will it simply keep dropping? There are still plenty of areas where, smart entrepreneurs think, the open nature of cryptocurrencies could be useful. Paying with Bitcoin requires you to become a speculator on its volatile price for the time you are holding on to tokens and waiting to pay. Trading cryptocurrencies is "just dementia" according to Munger. But it caught on with only a tiny sliver of Venezuelans.

Buffett's close associate Charlie Munger is even more direct in his distain. Retrieved 23 September Retrieved June 8, Archived from the original on 7 January Bitcoin believers, on the other hand, want us to think about cryptocurrencies as if they were the internet: Bloomberg News. Archived from the original on 29 December The most compelling use that Bitcoin fanatics talk about is its value to people in repressive countries that have currencies that are even more volatile than Bitcoin. After an unprecedented boom in , the price of bitcoin fell by about 65 percent during the month from 6 January to 6 February The virtuous cycle of ever-rising prices continues, often fuelled by credit, until there is an event that leads to a pause in price rises. The Bitcoin bubble is perhaps the most extreme speculative bubble since the late 19th century. February 2,

Uncertainty around the significance of the new technology allows extreme valuations to be rationalised, although the justifications seem weaker as prices rise. Now, Bitcoin enthusiasts believe it will take less than a quarter of a century for Bitcoin to achieve the how close can i put my mining rig gpus how do computers do bitcoin mining feat. Federal Reserve Bank of St. As more businesses like Amazon, Netflix, Facebook or Google rake in mining rig cooling ideas mining rig frame angle bar from digital trust, it, therefore, should be natural that currencies too could evolve and go digital as. The New York Times. Bitcoin is neither an irredeemable flop nor an economic miracle. You must be logged in to post a comment. Find the Bag, Find the Gold. Yale School of Management. If we want to imagine where it might be going, we need to look beneath the gyrating price to understand how it is being used today and who is using it. No one can force Bitcoin users to register their identity, so Chainalysis and other firms are in the dark about many transactions.

But with the serious money still finding its way into the market, it is far too early to write the whole thing off. The most compelling use that Bitcoin fanatics talk about is its value to people in repressive countries that have currencies that are even more volatile than Bitcoin. Market Watch. He goes on saying that Bitcoin could survive a financial crisis thanks to its supposed ill-gotten value. Programmers have already built thousands of so-called decentralized applications, or Dapps, that use the EOS and Ethereum tokens. Archived PDF from the original on 9 April Intelligence Squared. The surge in price attracted speculators into the Bitcoin market, helped by intense media attention. It has therefore taken thousands of years for humanity to accept Gold as premier money. January 5, Bitcoin has failed, according to Roubini, as a unit of account, a means of payment, and as a store of value, the three attributes needed by any successful currency. A version of this article appears in print on , on Page B1 of the New York edition with the headline: Main article: NBC News. But sharp declines in property values during led to the worst financial crisis since the Great Depression. Heckman compared bitcoin to the tulip bubble. Ethereum Ethereum Classic. Reproduisez nos articles gratuitement, sur papier ou en ligne, en utilisant notre licence Creative Commons.

Yale Insights. The bigger problem facing Bitcoin is that the practical and legal uses have struggled to outpace illegal or clearly unethical activity. Retrieved November 15, A share of the action In the case of Bitcoin, by design, the total supply that will ever be available is 21 million. The New York Times. Tulip mania. Public domain. Archived from the original on 29 December He criticized it as a very slow and expensive means of payment, used mostly to buy blackmarket goods, without a "tether to reality". Bloomberg News. So are several other big messaging companies. Retrieved 16 April Dash Petro. Retrieved October 22, The Week. April 23, This suggests the effects litecoin block height how to buy bitcoin in usd in bittrex the wider economy of the Bitcoin crash should be contained. Retrieved 23 September Archived from the original on Retrieved June 8,

But they have identified some useful chunks. Fluidity Summit. The Guardian. Hence the Bitcoin price has been highly volatile, as speculation has abounded in the media as to whether the current price path is either reasonable or sustainable. It doesn't produce anything except more buyers looking to sell". This is due to a large number of different Bitcoin exchanges competing; often substantial transaction costs, and constraints on the capacity of the Blockchain to record transactions. When asset prices stop rising, investors who have borrowed to finance their purchases realise the cost of interest payments on their debt will not be offset by the capital gain to be made by holding onto the asset. Archived from the original on 30 September There is still quite a bit of mystery about what accounts for the other 20 to 40 percent of the transactions. A family of Ahiarmiut, including David Serkoak pictured behind his mother Mary Qahug Miki centre at Ennadai Lake in the mids before the Canadian government forcefully relocation them. The effect of a crash depends the size, ownership and importance of the asset involved. Fiat currency has value only by government order. Enregistrez-vous maintenant. By using this site, you agree to the Terms of Use and Privacy Policy.

Related posts. To qualify as a currency, Bitcoin and other cryptocurrencies which arguably include digital credits such as Airpoints must fulfill each of these four functions. It was gradual and commercially successful. Carbon bubble Chaotic bubble US higher education bubble Social media bubble. Never miss news. These claims include that of former Fed Chair Alan Greenspan in These Might Be the Reasons Why". The current number in circulation is a little under 17 million. Bitcoin believers, on the other hand, want us to think about cryptocurrencies as if they were arbitrage software bitcoin all in on bitcoin internet: Subsequently, nearly all other cryptocurrencies also peaked from December through Januaryand then followed bitcoin.

Kindleberger suggests this can be a change in government policy or an unexplained failure of a firm. Observers of the cryptocurrency market will find this story familiar. Economic bubbles. Retrieved June 7, This often relates to scarcity. There are similarly no hidden treasure troves of BTC awaiting discovery that could cause an influx and crash in price. Its the price movements are too volatile to be a unit of account. To qualify as a currency, Bitcoin and other cryptocurrencies which arguably include digital credits such as Airpoints must fulfill each of these four functions. As with the debate over whether Uber is an electronic matching platform or a taxi service, this may take some time, as the exercise is far from straightforward. Though the total number of Bitcoins is limited, there are many competing, virtually indistinguishable cryptocurrencies such as Ehtereum and Ripple. If we want to imagine where it might be going, we need to look beneath the gyrating price to understand how it is being used today and who is using it. Supports further believe that its pillars of decentralization, security, immutability, divisibility, and its open-source nature.

Finding the best analogy for cryptocurrencies.

Yale Insights. So are several other big messaging companies. Retrieved November 15, Here's what Warren Buffett is saying". The problem is that, other than speculation, none of its legitimate uses have taken hold at anything like the pace of the illegal activity. Jim is not in denial but is opposed to its price action. Paris is burning. Bitcoin is more like tulips. One currency function — a store of value — appears to have crowded out the other three. From Wikipedia, the free encyclopedia. Two lead software developers of bitcoin, Gavin Andresen [40] and Mike Hearn, [41] have warned that bubbles may occur. How cryptocurrencies are used right now At the most basic level, Bitcoin has introduced a new way to hold and send around value online. When Satoshi stepped away from it, he allowed the masses to own it. Hidden categories: Bloomberg News. Archived from the original on 7 January

Views Read Edit View history. AI ticker that shows the prise of bitcoin digisync digibyte Stock market bubble Commodity booms. Trading cryptocurrencies is "just dementia" according to Munger. Bitcoin turns ten — here's how it all started and what the future might hold. This man lost his savings when cryptocurrencies plunged". More Nobel prize winners snub bitcoin". Fluidity Summit. Over the festive season, the conversation in my household inevitably turned to the phenomenal qtum mainnet release making money through bitcoins — and fall — in the US dollar price exchange rate for Bitcoin during December Figure 1. Senator Bob Menendez said he was "disappointed, but not surprised, that the Trump administration has failed once again to prioritize our long-term national security interests or stand up for human rights. It lists dozens of digital tokens on its exchange. A more generous viewpoint would compare Bitcoin to gold, a scarce commodity that goes up and down in value and provides an alternative to national currencies.

This is due to a large number of different Charity account coinbase r9 270x ethereum hashrate exchanges competing; often substantial transaction costs, and constraints on the capacity of the Blockchain to record transactions. Archived from the original on 20 March Perhaps the biggest thing that cryptocurrencies have going for them is that serious people still want to fix the flaws. Bitcoin is more like tulips. Nobel laureate Paul Krugman wrote in that bitcoin is "a bubble wrapped in techno-mysticism inside a cocoon of libertarian ideology". When Bitcoin was introduced invoxel poloniex coinbase widgets tracker was described as a new way to make payments online, without the fees that credit card companies charge. Retrieved October 22, The Financial Times. It doesn't produce anything except more buyers looking to sell". Retrieved May 12, Bitcoin iota wallet to bitfinex pending why would coinbase cancel my order will tell you that this best hard wallets crypto growing criminal use of cryptocurrency a drop in the bucket compared with how much the dollar is used to buy drugs. Economics says that value is a product of utility and scarcity. Zcash Zcoin. All articles with unsourced statements Articles with unsourced statements from October He said "Humans buy all sorts of things that aren't worth. For such an asset, value ultimately depends on what others are willing to pay for it. Fundamental value includes: The bigger problem facing Bitcoin is that the practical and legal uses have struggled to outpace illegal or clearly unethical activity. These Might Be the Reasons Why". Intelligence Squared.

It will take Bitcoin less than 25 yrs to do the same. Yes, if bubble is defined as a liquidity premium. Jim is not in denial but is opposed to its price action. Leave a Reply Cancel reply You must be logged in to post a comment. Commodity currencies derive their value from the value of an underlying commodity e. Think of railways in the 19th century, electricity in the early 20th century, and the internet at the end of the 20th century. Fluidity Summit: George Soros , answering an audience question after a speech in Davos, Switzerland in , said that cryptocurrencies are not a store of value but are an economic bubble. But will it simply keep dropping? Senator Bob Menendez said he was "disappointed, but not surprised, that the Trump administration has failed once again to prioritize our long-term national security interests or stand up for human rights. As early as he clearly stated that bitcoin "exhibited many of the characteristics of a speculative bubble". Retrieved October 11, He said "Humans buy all sorts of things that aren't worth anything. Bitcoin is accessible to anyone — not so different from the internet. A history of Bitcoin — told through the five different groups who bought it. Archived from the original on 29 December Miners are rewarded with new currency for solving the complex math problems required to validate and record Bitcoin transactions.

Proof-of-authority Proof-of-space Proof-of-stake Proof-of-work. For instance, early investment in railways took advantage of limited competition and focusing on profitable routes only. Bitcoin believers, on the other hand, want us to think about cryptocurrencies as if they were the internet: Jim is not in denial but is opposed to its price action. He goes on saying that Bitcoin could survive a financial crisis thanks to its supposed ill-gotten value. Bitcoin is a bubble, Trump is a 'danger to the world ' ". Nobel laureate Paul Krugman wrote in that bitcoin is "a bubble wrapped in techno-mysticism inside a cocoon of libertarian ideology". The bigger problem facing Bitcoin is that the practical and legal uses have struggled to outpace illegal or clearly unethical activity. She promised to help "fight scams and shit coins". Price v hype". By using this site, you agree to the Terms of Use and Privacy Policy. When asset prices stop rising, investors who have borrowed to finance their purchases realise the cost of interest payments on their debt will not be offset by the capital gain to be made by holding onto the asset.