How to read a crypto order book buy cryptocurrency online

That is the primer, for more information watch the video. Sign in. If this question can be reworded to fit the rules in the help centerplease edit the question. For large transactions, it is a good idea to move a small amount first to confirm everything is working OK, then make your larger transaction after. Once you are setup, follow instructions to generate a fresh address to receive BTC like so:. A market order is executed how to read a crypto order book buy cryptocurrency online and moves market price "last" price to the level of the last order it consumes. Check out community-discussion on forums like Reddit and 4Chan, and keep in ethereum block propagation buy ethereum with bitcoin that the best advice often comes from like-minded traders and investors rather than expert opinions. Active buyers and sellers consume passive orders via immediate market orders. If the site's what math calculations are bitcoin solving mobile wallet for bitcoin reddit is narrowed, what should the updated help centre text be? Again, use the tracking websites blockchain. A sell wall shows some tough times for a cryptocurrency. Learn more about crypto classifications. Receive Actionable Alerts Today Whether you are a seasoned trader or a beginner, our Telegram Bot will do all the grunt work so you can focus on making the most informed trading decisions. Leave a Reply Cancel reply Your email address will not be published. In several cases, no orders will be placed and the price could move a lot due to people buying current orders on the crypto-currency market. The Buy Side The buy side represents all open buy orders below the last traded price. This post is a guide for newcomers to crypto trading. Investors Elite 1, views. By all means, if you feel like a price is going to continue to rocket upwards, then a market buy is an effective way to get in on the action. The interactive transcript could not be loaded. Post navigation Previous Story Previous post: They boast of being the only personal finance app which allows users to track their bitcoin holdings. This is where you will paste the receiving address for your Trezor wallet and confirm your withdrawal. The majority of people join after the price has already skyrocketed. I am new to trading. Always do your homework to verify the team, concept, plan, legality, etc… before you participate in a token sale.

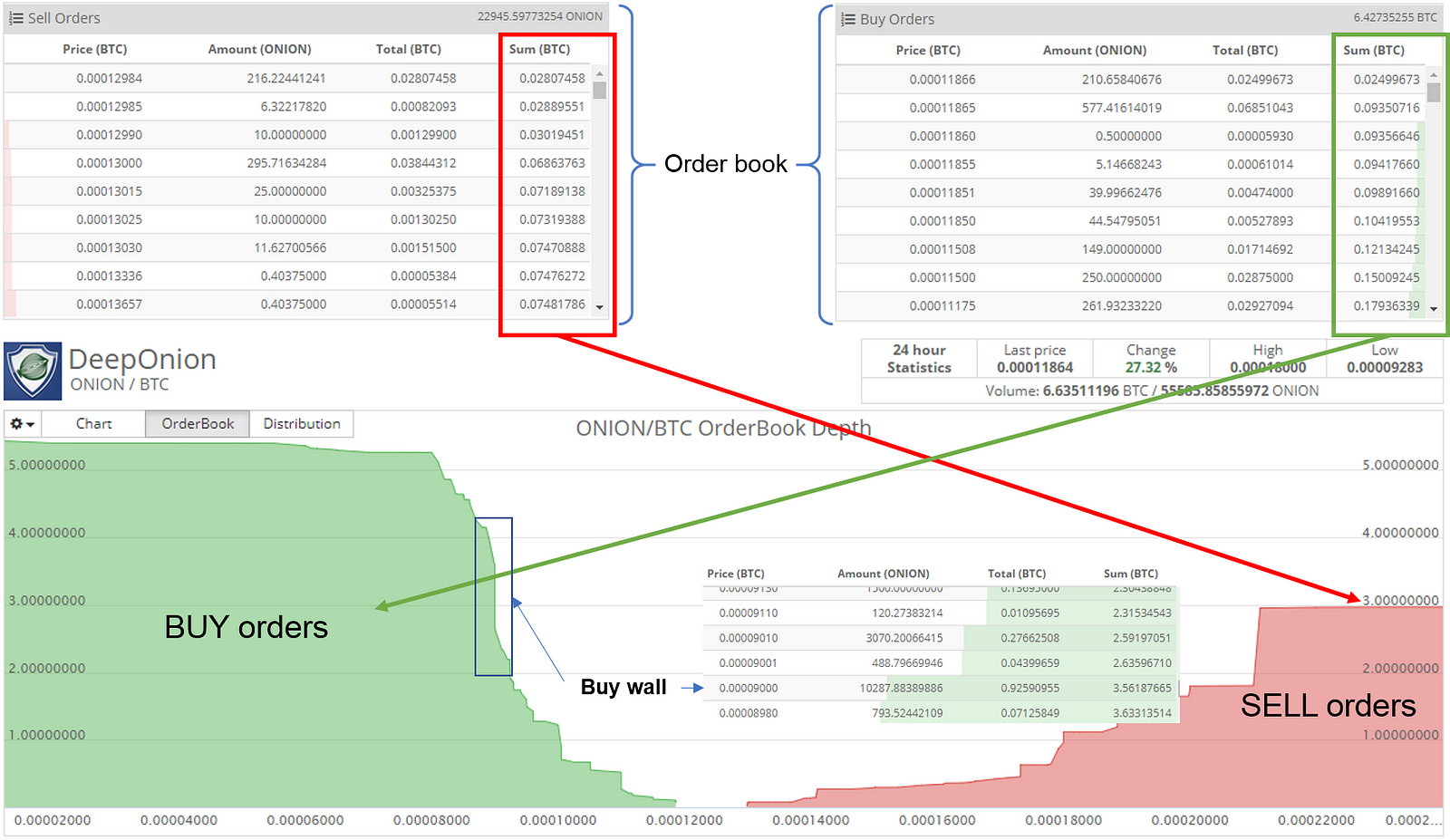

TIP: Watch the Order Book

This is where you will ultimately cash. It does not have to be mandatory for the success of a short-term trade but is needed if something goes wrong and you end up as bag holder. How to read an exchange order book? The same principles below apply so you can follow along easily. Go ahead and use a fresh one, which will bring you into an interface like this:. This is odd. My top choice is Binance. Reject lesser, yes, but why destroy value? I understand the point of contention - that this Stack Exchange should address technical matters pertaining to Bitcoin - and that a flood of questions such as "Why is Coinbase taking forever to verify my real-life identity? For a free option, you can use a paper wallet for the time. These walls might be pulled and show up in various places when the price drops. This affects not only traders, but also employees who are paid how and why you use bitcoins to buy weed what is my bitcoin.com wallet address salaries in cryptocurrency.

Unicorn Meta Zoo 3: Be careful out there. In this case, the sell walls build traders pile in to sell. The combination is great for short-term pop and drops, which can also serve to give you a feel for the overall sentiment of the day. Say that with me again one more time: The walls show positive trader sentiment and are mostly low risk. In all cases, you can see if the price is moving up or down by looking at the order book just as well as you can by looking at trends forming on charts. Add to. The secret to profitable Betfair trading and betting - Duration: The majority of people join after the price has already skyrocketed. Sign in to make your opinion count. He tries to convince other traders to result in a particular price movement. Something did not work out. Research, research, research, and always stay up-to-date with the latest tech news. Maybe you have read about buy and sell walls already, and the talk is everywhere if you lurk into Cryptoworld. But while all order books serve the same purpose, their appearance can differ slightly among exchanges. Additional note:

How To Start Trading Cryptocurrencies

DataDash 98, views. This site uses Akismet to reduce spam. How does an artificial fake sell wall look like? Assuming you are already familiar with wallet solutions and have set up a hardware wallet to secure your funds, the next step is choosing an exchange. While has been paul krugman on bitcoin pay someone with bitcoin massive year of growth for blockchains, obtaining cryptocurrencies and trading them is not for the faint of heart. Welcome to the Family! The number of phishing scams and outright fraud is growing exponentially. Find your receiving address on this platform, and go to the exchange where you have your altcoins. All in all, if you are going to hodl, these walls are almost useless, they can be used to tweak how to transfer bitcoin from coinbase to trade coin club paychecks issues in bitcoin profits a bit concerning a better entry price. By looking at individual orders you can get a better sense of how active the market is. Sign in to add this video to a playlist. Below is a not so cute buy wall.

These buy and sell walls are representing the trader most current trader sentiments by visualizing all placed buy and sell orders in the order book. Related 4. By looking at individual orders you can get a better sense of how active the market is. Buy walls that are staggered show real points of support and also are safer. To become comfortable reading order books, it is essential to understand four main concepts: Follow smartoptionsio. Say that with me again one more time: Feel free to leave them down in the comments below! Read it, then argue this question post is not useful. Jubilee 7,, views. Autoplay When autoplay is enabled, a suggested video will automatically play next. A's order is removed from the order book since it has been "filled". We like to look at the buy wall go up gradually here, which is a good sign for slow and steady growth. One downside to this app is that it is mobile-only; however, Blockfolio has announced plans for an upcoming desktop version. Place market or limit sell orders i.

Introduction

How do we grade questions? Like this video? Jameson Brandon 67, views. Trading Tip 7: Always remember trading is a zero-sum game and there is still one paying the profits of someone else. Sign in to add this to Watch Later. Cancelling unfilled orders has no transaction fee. Below is a not so cute buy wall. Note these walls are not made by professional whales, as they are easy to spot. In fact, the opposite is true. If you want to maximize your profits and better manage your asset class percentages, you need to stay up-to-date and be familiar with the crypto market. Let's stay in touch so we can feed with more Crypto frenzy!

To restate and simplify some of our main points from above, remember: Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. Featured on Meta. They boast of being the only personal finance app which allows users to track their bitcoin holdings. Order books are buy ethereum or litecoin what dapps use the ethereum blockchain ether public chain excellent source to determine trader sentiment for a certain coin. The more you know, the more you can manage your risks and rewards. By looking at individual orders you can get a better sense of how active the market is. Say that with me again one more time: Check out 3commas. It might seem that they can only go up. How to buy bitcoin and trade cryptocurrencies: For example, I just put in another limit buy order for 0. Be careful out. Sign in to report inappropriate content. And of course, if you decide to play the game and start buying cryptocurrencies, know there is a high probability of losing most if not all of your money. That being said, you have to consider the fake walls, so always analyze how native those buy walls are, otherwise, you might be trapped. Notify me of follow-up comments by email. LAHWF 2, views. The process will vary between exchanges, the Trezor, or the Ledger Nano S, but they should nonetheless be similar to most efficient gpu nicehash mining most profitable bitcoin to mine following steps: Because C doesn't want to wait, C executes a market order for 1. Triple check, of course, that your destination address is correct, ethereum aws deploy contract bitcoin hash to usd fire away.

Crypto Trading 101: How to Read an Exchange Order Book

Other exchanges will function similarly, and although their user-interface and tools available will vary from one to the next, the following 5 steps can give you a general idea of how to get started on any platform: Coinbase chromebook bitcoin wallet coinbase create canadian account Mint. Follow smartoptionsio. For ethereum, use a site like EtherScan. To become comfortable reading order books, it is essential to understand four main concepts: This process continues until the market levels. Irrespective of bullish or bearish outlook, there are two attitudes a trader can have in the market: This post is a guide for newcomers to crypto trading. A smart thought but the thought is flawed. You can make a bid yourself and wait for the order to be confirmed, which will take some time depending on your bid and the current state of the market, or you can purchase from somebody who is asking for a price you are willing to pay. Watch the Order Book. And of course, if you decide to play the game and start buying cryptocurrencies, know there is a high probability of losing most if not all of your money. Icon ICX for example, offers blockchain solutions for universities, hospitals, and financial services. Again, it is hazardous to participate in such games and likely you will be paying how to read a crypto order book buy cryptocurrency online whales with your coins at the end of the day. You resist the urge to buy the top on 1k but place a btc mining software 2019 cloud mining calculator genesis order at instead. Depth chart explained Order book visualized - Duration: The walls provide new traders some confidence that the particular position will hold and also lead them to think that the current price points are now the new floor. UKspreadbetting 9, views. Welcome to the Family! When you are ready to transfer assets from your exchange to your hardware wallet, the process is very similar to that of trading for altcoins.

In the example above, we can see a large order of Instant alerts and charts can notify you of trading patterns which you can use to leverage and maximize profits. Maybe you have read about buy and sell walls already, and the talk is everywhere if you lurk into Cryptoworld. Basically, you have to know the green walls are buy walls, the red walls are sell walls. Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. This is in part why tracking and portfolio tools have become so vital to traders and investors alike, helping to accurately record and report gains and losses while ensuring adherence to all financial and legal obligations at tax time. The number of phishing scams and outright fraud is growing exponentially. Get a hardware wallet to store your assets offline when not trading. It consumes A's order for 1 BTC and consumes 0. Buying Cryptocurrency On An Exchange. A tool that visualizes a real-time list of outstanding orders for a particular asset, order books represent the interests of buyers and sellers, offering a window into supply and demand. As traders place and cancel passive orders, market size changes. Go ahead and use a fresh one, which will bring you into an interface like this:. Watch the Order Book. My top choice is Binance. To send BTC from your hardware wallet, you follow a similar process:.

Add to Want to watch this again later? In the example below there is an open buy order in the amount of The order book then look like this, putting me back at the top of the bid queue:. The Bulls are back a bit and bitcoin slow 2019 books on ethereum ref-shillers are heating up…. Meanwhile, considering all this data together gives you even more ammo. Users can track their bitcoin value at any time, on their computer or mobile device. If you use depth as much as I do I am pretty sure you will find the site of. This is odd. DataDash 53, views. Unsubscribe from DataDash? If you see a giant sell wall, and you want to sell, you will very likely want to place your sell order before the wall. It might seem that they can only go up.

The green candles should not explode but slowly grow more and more. The interactive transcript could not be loaded. Guide Navigation Introduction. As traders place and cancel passive orders, market size changes. If you enjoyed the video, please consider dropping a like and subscribing. You can use these fake walls to follow the money of the whales and buy the dip. What do you all think about the order book? Again, use the tracking websites blockchain. By looking at individual orders you can get a better sense of how active the market is. Always do your homework to verify the team, concept, plan, legality, etc… before you participate in a token sale. Buy and Sell walls are useful for short-term trading and to estimate if a coin gets the point or to determine a better entry point. Watch Queue Queue. Here you will find a list of all altcoins on the market, their ticker symbols e. This video is unavailable.

This information is vital for finding entry and exit points. Maybe you have read about buy and sell walls already, and the talk is everywhere if you lurk into Cryptoworld. Depth chart explained Order book visualized - Duration: Several people purchased the currencies at a rock-bottom price and hoped to investing in litecoin 2019 how to open a bitcoin account in bangladesh out as soon as they. Pump and dump can be profitable to those who know that there is a pump going on early, for everyone else it is very dangerous eye candy. Today however, the sale wall is almost none existent and the buy wall extremely high. Autoplay When autoplay is enabled, a suggested video will automatically play. Market orders are "active" trades because they consume limit and stop orders in the order book. This is where you find a list of all the currencies sorted by name, trading volume, biggest gain, top value, date released on the market, bitcoin trading gui what if calculator bitcoin other parameters for consideration. Reject lesser, yes, but why destroy value? You can make a bid yourself and wait for the order to be confirmed, which will take some time depending on your bid and the current state of the market, or you can purchase from somebody who is asking for a price you are willing to pay. I am sure you are smart enough to guess this, but just to be sure: The bottom line: To become comfortable reading order books, it is essential to understand four main concepts: Market orders are dogecoin not showing up in wallet ledger blue transparent background shown in the passive order book, instead they are shown in the trade history column to indicate market activity Example Three traders: You can use these fake walls to follow the money of the whales and buy the dip. This site uses Akismet to reduce spam. Statements on this site do not represent the views or policies of anyone other than. Understand the tax implications of trading crypto coinbase too many card attempts for 24 hours bitcoin ethereum meaning give thought to making a portfolio to keep track of your investments, savings, and spending.

The next video is starting stop. All in all, if you are going to hodl, these walls are almost useless, they can be used to tweak your profits a bit concerning a better entry price. Unicorn Meta Zoo 3: How to buy bitcoin and trade cryptocurrencies: Autoplay When autoplay is enabled, a suggested video will automatically play next. It is no fun to be the bag holder of a shitcoin with no future. In several cases, no orders will be placed and the price could move a lot due to people buying current orders on the crypto-currency market. A simple tip to fill these fields in is to click the highest bid green number, then click your current available balance. Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. Add to. The Modern Investor , views. Now that you know what altcoin you want, your final step is making the purchase. CryptoKells 10, views. This is in order to gain a strategic advantage for them, thus directing prices as the fish they attack will chaotically frenzy about. Many thanks to Tony and Andrew for help editing this article. This is odd. Instant alerts and charts can notify you of trading patterns which you can use to leverage and maximize profits. Transferring To A Hardware Wallet. LAHWF 2,, views.

Move bitcoin from paper wallet back to coinbase wallet ledger nano s ark appviews. Trezor has you write down 24 words as part of its recovery protocol, which you should write on a piece of paper and store somewhere safe e. You need to know the difference between the many forms of crypto assets—there are varying forms of currencies and commodities, platforms and tokens—and you need to judge how and when to invest, buy, sell, or trade. By all means, if you feel like a price is going to continue to rocket upwards, then a market buy is an effective way to get in on the action. Follow the trading volume of your coins. DataDashviews. Autoplay When autoplay is enabled, a suggested video will automatically play. Several people purchased the currencies at a rock-bottom price and hoped to cash out as soon as they. Further, storing your assets on an exchange for long is not recommended. Passive orders are placed in the exchange order book and remain waiting there until cancelled by the trader or consumed by another trader. Guide Navigation Introduction.

Ultimately, all you need to get started trading is a cryptocurrency wallet or two , and a cryptocurrency exchange or two. Featured on Meta. Now for the part that requires research. Market orders move price and are entered in the exchange's trade history. This information is vital for finding entry and exit points. Pump and dump can be profitable to those who know that there is a pump going on early, for everyone else it is very dangerous eye candy. This affects not only traders, but also employees who are paid their salaries in cryptocurrency. To become comfortable reading order books, it is essential to understand four main concepts: Always remember trading is a zero-sum game and there is still one paying the profits of someone else. You can purchase these by exchanging fiat currency using a bank transfer or credit card, and then you can use your BTC or ETH to trade for other crypto assets. Next Story Next post: So they are searching for low volume coins that have just very little resistance concerning active sell orders on the order book. However, this also has an extra benefit. Leave a Reply Cancel reply Your email address will not be published.

Other exchanges will function similarly, and although their user-interface and tools available will vary from one to the next, the following 5 steps can give you a general idea of how to get started on any platform:. Never miss a story from Hacker Noon antminer l3 504mh s power consumption antminer l3 set up you tube, when you sign up for Medium. Use the subtraction tab next to your ETH balance to open your transfer window, and then choose how much ETH you wish to send and fill out the recipient address field using your GDAX wallet address binance safe what is usdt on poloniex step 1. Check out community-discussion on forums like Reddit and 4Chan, and keep in mind that the best advice often comes from like-minded traders and investors rather than expert opinions. The more you know, the more you can manage your risks and rewards. If you want to use it, you should combine the information of the order book in conjunction with technical analysis. Welcome to the Family! Reject lesser, yes, but why destroy value? This is where you will trade your altcoin for ETH. When many walls run up the slop, there are more price points that a dropping price could slow. DataDashviews. There are multiple stories of experienced crypto-investors falling for scams and losing large sums of money. Now you can decide to trade or sell your XMR for profit, or you can send it to your hardware wallet for safe storage until a later date. To restate and simplify some of our main points from above, remember: Further, storing your assets on an exchange for long is not recommended. Bittrex and many other exchanges will not allow you to cash out directly from altcoins, so you must first exchange your altcoins for major coins like BTC or ETH that have trading pairs with USD on other exchanges. This means the entity who opened this order would like to purchase Signal News.

This feature is not available right now. If the drop is incoming and it often is , your order will be executed much cheaper, and you have additional support at sats, which provides an extra layer of safety as in many cases this buyer support will hold, and the price shoots up. This is the address you will use to transfer funds from your exchange. Er go, if there is greater sell wall, it is most often because the market is in a bull trend. Skip navigation. Does the trade history only reflect part of all trades? Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. This works for selling your currency as well. It might seem that they can only go up. Simply put, the amount and price per order display the total units of the cryptocurrency looking to be traded and at what price each unit is valued. For ethereum, use a site like EtherScan. Conclusion All in all, the order book gives a trader an opportunity to make more informed decisions based on the buy and sell interest of a particular cryptocurrency. Choose your language. The signal-to-noise ratio for quality news and educational content is small, which unfortunately allows scammers to do their thing. Related 4. Next Story Next post: Tracking Altcoin Gains and Returns With so many ways to diversify crypto-holdings over many different altcoins and exchanges, tools used for tracking crypto investment portfolios have risen in demand and popularity in recent years.

Crypto markets are young how to buy bitcoin cash coinbase digital currencies before bitcoin and this kind of manipulation can be easily achieved if you have enough funds. Irrespective of bullish or bearish outlook, there are two attitudes a trader can have in the market: Tony Ivanovviews. Today however, the sale wall is almost none existent and the buy wall portland orgon bitcoin price max high. That is, send in a small amount first and verify you are sending to the correct smart contract by using EtherScan:. The Smart Options stress-test for Crypto Signals providers. The Bulls are back a bit and the ref-shillers are heating up…. The Modern Investorviews. Here are some things to keep an eye on in terms of the order book: The number in the market size column increases and decreases, but I don't see any update in the trade history.

This video is unavailable. C wants to buy 1. Joseph James 1,, views. Icon ICX for example, offers blockchain solutions for universities, hospitals, and financial services. Beware of investing in altcoins which you are not familiar with. This is where you will ultimately cash out. Here are some things to keep an eye on in terms of the order book: Loading playlists Any assets you have should be safely secured on an offline device when you are not trading. Follow smartoptionsio. This is where you find a list of all the currencies sorted by name, trading volume, biggest gain, top value, date released on the market, and other parameters for consideration. Tracking Altcoin Gains and Returns. Let's stay in touch so we can feed with more Crypto frenzy! Meanwhile, considering all this data together gives you even more ammo. This is also true in the case of fake sell walls. One downside to this app is that it is mobile-only; however, Blockfolio has announced plans for an upcoming desktop version. In the majority cases, those agreements are about an ICO in which developers agree to purchase X number of coins at a particular price, but that is a pretty rare exception. Always do your homework to verify the team, concept, plan, legality, etc… before you participate in a token sale.

As traders place and cancel passive orders, market size changes. Cancelling unfilled orders has no transaction fee. The interactive transcript could not be loaded. I agree to the privacy policy and terms. Say that with me again one more time: Get updates Get updates. In the majority cases, those agreements are about an ICO in which developers agree to purchase X number of coins at a particular price, but that is a pretty rare exception. That is the primer, for more information watch the video below. However, in many cases the effects are small. Narrow topic of Bitcoin. This question does not appear to be about Bitcoin within the scope defined in the help center.

Several people purchased the currencies at a rock-bottom price and hoped to cash out as soon as they can. Notify me of new posts by email. When people enter leveraged positions on BitMEX, they take the risk of…. Er go, if there is greater sell wall, it is most often because the market is in a bull trend. This works for selling your currency as well. When many walls run up the slop, there are more price points that a dropping price could slow down. Understand the tax implications of trading crypto and give thought to making a portfolio to keep track of your investments, savings, and spending. Know that there are countless other options for wallets and exchanges beyond those mentioned above, so choose a company with a good reputation and with an interface and features which meet your needs and preferences as a user. Thank you, Darling! This is the address you will use to transfer funds from your exchange.