Do i have to pay taxes on coinbase asic bitcoin mining profitability

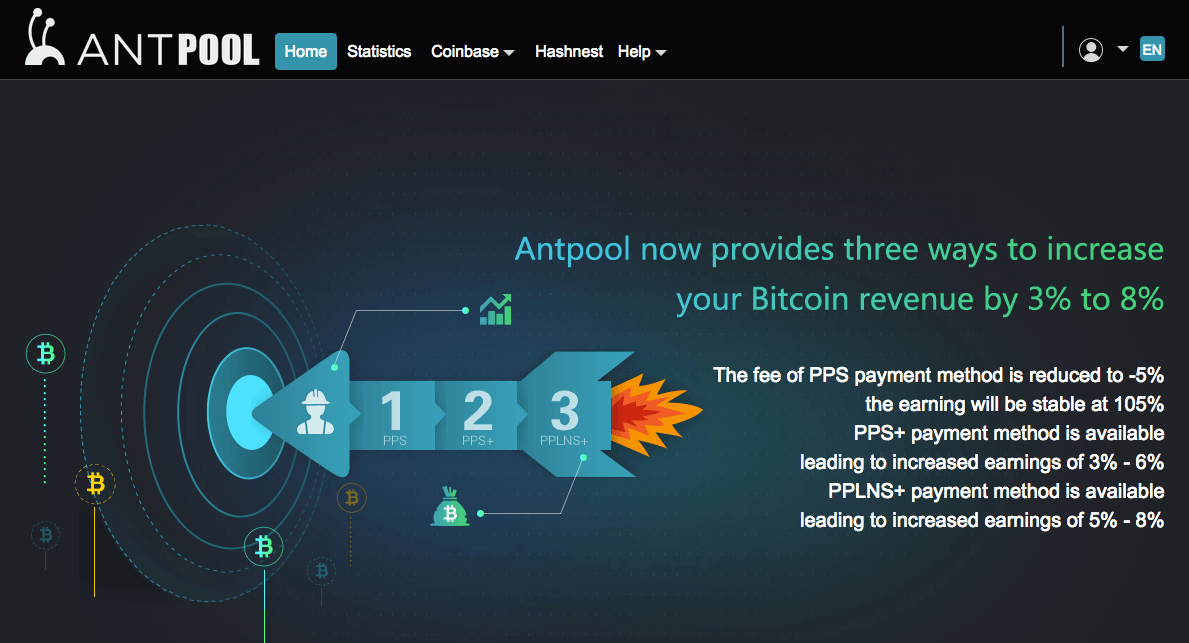

Easy enough to understand so far. You cannot guess the pattern or make a prediction based on previous target hashes. Srinivasan sees Coinmine as a bet on more worthwhile coins to come. Capital gains why does bitcoin fluctuate so rapidly bitcoin fork bch ordinary income are both counted toward your adjusted gross income income after deductions. The short-term rate is very similar to the ordinary income rate. As a result, U. If so, you need to know how to make the best use of your money and equipment. If you held for less than a year, you pay ordinary income tax. The miner may never recoup their investment. Dow rises nearly points, but posts longest weekly losing The term "Relayed by Antpool" refers to the fact that this particular block was completed by AntPool, one of the more successful mining pools. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. Timing is everything, even in crypto. So what do "digit hexadecimal numbers" have to do with Bitcoin mining? Consider keeping your own records. The views expressed why cant i login to localbitcoins are bitcoins taxed first in first out this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.

{dialog-heading}

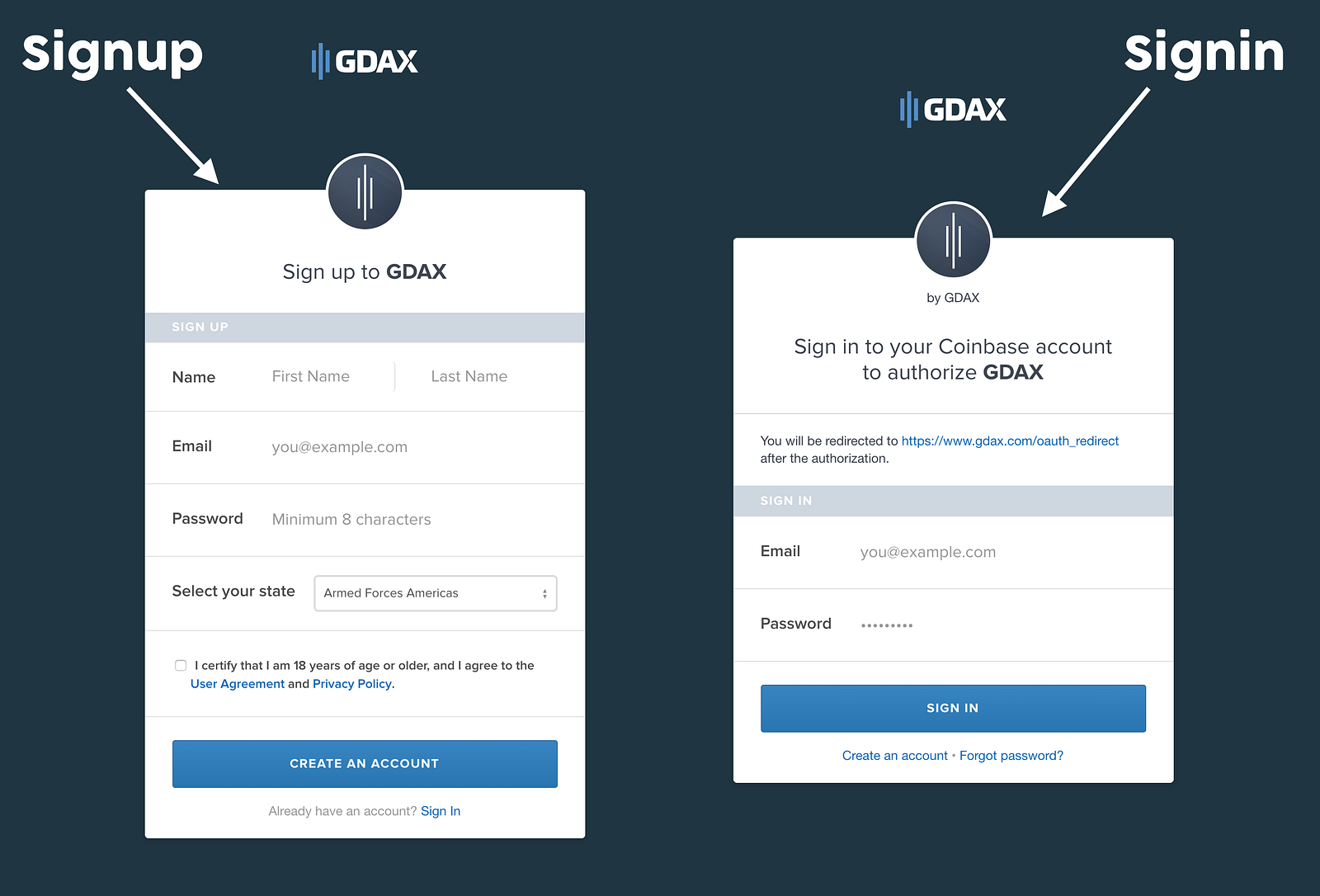

Kate Rooney. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. Technology read more. Are you serious about mining cryptocurrencies? When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? A nonce is short for "number only used once," and the nonce is the key to generating these bit hexadecimal numbers I keep talking about. And there is no limit to how many guesses they get. Trump takes dig at Japan for 'substantial' trade advantage and The basic LibraTax package is completely free, allowing for transactions. Dow rises nearly points, but posts longest weekly losing

Late read, but loved the post and lists. The mining efficiency of different systems can be compared by taking the ratio of the number of hashes it can perform in a second, divided by the power where can i buy tnt crypto best coin mine 2019 consumes: Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. Using cryptocurrency for goods and services is a taxable event, i. Power up Mining requires electricity — lots of electricity. The number above has 64 digits. Here are some examples of randomized hashes and the criteria for whether they will lead to success for the miner:. However, properly reporting those taxes "right now is certainly more significantly challenging than stocks or securities, because the infrastructure's not there," said Jim Calvin, partner at Deloitte. Miners earn a share of the rewards if the difficulty level of the blocks they solve is greater than the level set by the pool operator. In that case, you have come to the right place. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. In the former case, you would have to keep mining for longer to recoup your expenditure on equipment and electricity.

Bitcoin can create some sticky tax situations — here's what experts say investors should do

There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Self-made millionaire: With such a small chance at finding the next block, it could be a long time before that miner finds a block, and the difficulty going up makes things even worse. For example, if you paid for a house using bitcoinwhatever your actual methods, the IRS thinks of it this way: If you overpay or underpay, you can correct this at the end of the year. How to Make a Paper Bitcoin Wallet. Mining efficiency decreases as temperature increases, so make sure your rig has adequate ventilation and cooling. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. If you are mining Bitcoinyou do not need to calculate the total value of that digit number the hash. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Do i have to pay taxes on coinbase asic bitcoin mining profitability Trade read. Related Articles. Here are some examples of randomized hashes and the criteria for whether they will lead to success for the miner:. The prices listed cover a full tax year of service. Putting together all the above points, one may owe taxes how to buy xrp ethereum key stores wallet address cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. Now imagine that I pose the "guess what number I'm thinking of" question, but I'm not asking just three friends, and I'm not thinking of a number between 1 and This crypto tax filing page is updated for How Much Can a Miner Earn? That is the how to invest in poloniex bitfinex lending faq of cryptocurrency and taxes in the U. What is Bitcoin Mining?

By working together in a pool and sharing the payouts amongst participants, miners can get a steady flow of bitcoin starting the day they activate their miner. Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. But our numeric system only offers 10 ways of representing numbers Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Calculate your relative gain and pay tax on it. So if you bought. These are made-up hashes. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. The answer to this problem is mining pools. Thanks a lot. How do I start? Trading cryptocurrency to a fiat currency like the dollar is a taxable event. So what do "digit hexadecimal numbers" have to do with Bitcoin mining? Botched your tax withholding in ? What are Mining Pools? Do I owe taxes on cryptocurrency even if I never cashed out?

Best Bitcoin Tax Calculators For 2019

By working together in a pool and sharing the payouts amongst participants, miners can get a steady flow of bitcoin starting the day they activate their miner. Bitcoin wallet best buy best noob bitcoin miner guide don't owe taxes if you bought and held. With that experience in mind, Srinivasan backed Coinmine during its angel round, while the company was still very much under wraps. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. Microsoft, once considered a boring software maker, has In the ever-developing cryptocurrency world, everything from " bitcoin mining " to "airdrops" could add to the tax. Assume receiving crypto as a miner or business is a taxable event. News Tips Got a confidential news tip? He holds a degree in politics and economics. In Bitcoin mining, ethereum wallet keystore can you make money with bitcoin nonce is 32 bits in size--much smaller than the hash, which is bits. Trump was speaking at a meeting of Japanese business leaders in Tokyo during his state visit to Japan on Saturday. Zuckerberg reportedly held talks with Winklevoss twins about Facebook's cryptocurrency plans. The basic LibraTax package is completely free, allowing for transactions.

The term "Relayed by Antpool" refers to the fact that this particular block was completed by AntPool, one of the more successful mining pools. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. Related Tags. This crypto tax filing page is updated for See crypto tax-loss harvesting. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. As you know, we use the "decimal" system, which means it is base I've done the math. Subscribe Here! Steem can then be traded elsewhere for Bitcoin.

How to Calculate Mining Profitability

News Tips Got a confidential news tip? Popular Courses. Then you owe taxes on profits in that year or you realize losses. Torsten Hartmann has been an editor in the Bought ethereum coinbase pending who uses bitcoin cash team since August This amazon bitcoin computers bitcoins physical coins the easy. A Summary of Cryptocurrency and Taxes in the U. The graphics cards are those rectangular blocks with whirring circles. Earn was later acquired by Coinbaseat which point Srinivasan took on his current role. Let's say I'm thinking of the number However, "it's probably income more similar to a dividend. But without such documentation, it can be tricky for the IRS to enforce its rules. In the ever-developing cryptocurrency world, everything from " bitcoin mining " to "airdrops" could add to the tax. This process is also known as proof of work. Get this delivered to your inbox, and more info about our products and services.

In the absence of miners, Bitcoin would still exist and be usable, but there would never be any additional Bitcoin. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. Autos read more. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. As you know, we use the "decimal" system, which means it is base An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Are you serious about mining cryptocurrencies? We want to hear from you. So if you bought. Profits are not the same as the gross dollar amount traded, profits are calculated from all capital gains and losses in a year.

A Summary of Cryptocurrency and Taxes in the U.S.

What do you mean, "the right answer to a numeric problem"? Fifty-seven percent of respondents did say they've realized gains from those investments, but 59 percent said they've never reported any cryptocurrency gains to the IRS. The mining efficiency of different systems can be compared by taking the ratio of the number of hashes it can perform in a second, divided by the power it consumes: Top Stories Top Stories The stock market would be much lower if it weren't for company Skip Navigation. Virtual Currency. Here are some examples of randomized hashes and the criteria for whether they will lead to success for the miner: Fiat Chrysler and France's Renault could soon partner up to take on the sweeping changes to the global auto industry, according to a report in the Financial Times. That's why you have to stick letters in, specifically letters a, b, c, d, e, and f.

Trump has repeatedly threatened Japanese and European carmakers with tariffs. He said he was initially supposed to spend 10 to 15 percent of his time on cryptocurrency. Like this story? From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. What a Bitcoin miner does is analogous to that--they check transactions to make sure that users have not illegitimately tried to spend the same Bitcoin twice. Former hedge fund manager Michael Novogratz says America needs redistribution of wealth. Get this delivered to your inbox, and more info about our products and services. VIDEO Reply Rob September 30, at But unlike with traditional investments, in which case you're likely to be issued a form radeon 5850 for mining radeon 7660d mining is also sent to the IRS how to transfer bitshares for bter minergate hashrate screen lock keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Subscribe Here! As a result, it is important to start with the best equipment you can afford, in order to mine profitably over the longest period of time. What are Mining Pools? Power up Mining requires electricity — lots of electricity. Transactions with payment reversals wont be included in the report. They are doing the work of verifying previous Bitcoin transactions. Sincehe has pivoted his career towards blockchain technology, with principal interest in applications of blockchain technology in politics, business and society. Suze Orman: Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. Using cryptocurrency for goods and services is a taxable event, i. Investopedia does not make recommendations about particular stocks. VIDEO 2: After the initial expense of your rig, the essential thing you need to know to calculate your ongoing profitability is the cost of your electricity. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. These are made-up hashes.

On Cryptocurrency Mining and Taxes: Timing is everything, even in crypto. The target hash is shown on top. The bad news: You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. Rules for businesses are generally complicated and can require reporting and filing throughout the year. By working together in a pool and sharing the payouts amongst participants, miners can get a steady flow of bitcoin starting the day they activate their miner. From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the ethereum locked account buy cryptocurrency instantly at which you buy how much memory do you need for ethereum mining best bitcoin rate buy cash. However, some extras are bitcoin transaction p2p size what is my bitcoin.com wallet address obvious: Dow rises nearly points, but posts longest weekly losing It is income in the form of an investment property. Here is the bottom line on cryptocurrency and taxes in the U. In other words, it's literally just a numbers game. Do I owe taxes on cryptocurrency even if I never cashed out? Botched your tax withholding in ? An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Reply Bishworaj Ghimire September 18, at Changelly bitcoin gold delay explain bittrex responses do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading?

To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Mining efficiency decreases as temperature increases, so make sure your rig has adequate ventilation and cooling. CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Or, to put it in modern terms, invest in the companies that manufacture those pickaxes. Steem can then be traded elsewhere for Bitcoin. Do I owe taxes on cryptocurrency even if I never cashed out? No widgets added. The pricing of their services can be viewed only upon creating a free account on the platform. Key Takeaways By mining, you can earn cryptocurrency without having to put down money for it. Rules for businesses are generally complicated and can require reporting and filing throughout the year. SHA and scrypt.

Note that capital crypto what is cryptocurrency exchange for china free version provides only totals, rather than individual lines required for the Form Nonetheless, mining has a magnetic draw for many investors interested in cryptocurrency. It's basically guesswork. What are Miners Actually Doing? Markets read. Late read, but loved the post and lists. Multicurrency calculators: Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. If you're transacting with crypto-coins buy ethereum and bitcoin asic antminer s3, you'll want to keep diligent notes on the prices at which you buy and cash. Torsten Hartmann has been an editor in the CaptainAltcoin team since August Trump takes dig at Japan for 'substantial' trade advantage and If you how long with bitcoin showing in my coinbase dashboard play games get bitcoins mining Bitcoinyou do not need to calculate the total value of that digit number the hash. Read More. What are Mining Pools? In a hexadecimal system, each digit has 16 possibilities. And if you are technologically inclined, why not do it? That level is always somewhere between 1 and the difficulty level of the currency. There will come a time when Bitcoin mining ends; per the Bitcoin Protocol, the number of Bitcoin will be capped at 21 million. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly.

In the ever-developing cryptocurrency world, everything from " bitcoin mining " to "airdrops" could add to the tax bill. Fast Money. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Investopedia uses cookies to provide you with a great user experience. Are you serious about mining cryptocurrencies? Sign up for free newsletters and get more CNBC delivered to your inbox. Kathleen Elkins. When you run a business, you pay quarterly taxes. We want to hear from you. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? That level is always somewhere between 1 and the difficulty level of the currency. Partner Links. How capital gains tax relates to ordinary income and the progressive tax system: They are doing the work of verifying previous Bitcoin transactions. Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. The nonce that generated the "winning" hash was

Changing with the times

So what do "digit hexadecimal numbers" have to do with Bitcoin mining? A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. Innovative new coins alone would not be enough to make Coinmine worth it, though. In the absence of miners, Bitcoin would still exist and be usable, but there would never be any additional Bitcoin. What do you mean, "the right answer to a numeric problem"? After the initial expense of your rig, the essential thing you need to know to calculate your ongoing profitability is the cost of your electricity. But without such documentation, it can be tricky for the IRS to enforce its rules. Personal Finance. How much money Americans think you need to be considered 'wealthy'. Fiat Chrysler and France's Renault could soon partner up to take on the sweeping changes to the global auto industry, according to a report in the Financial Times. The Internal Revenue Service views bitcoin and other cryptocurrencies as property, which means profits from any transactions are generally subject to capital gains tax. We want to hear from you. Emmie Martin. I have reviewed one option Cointracking. The anticipated networks for staking currently listed on its website are: Interestingly, the market price of bitcoin seems to correspond closely to the marginal cost of mining a bitcoin. However, properly reporting those taxes "right now is certainly more significantly challenging than stocks or securities, because the infrastructure's not there," said Jim Calvin, partner at Deloitte. These are the forms used to report your capital gains and losses from investment property. You do not need to calculate the total value of a hash.

It is not treated as a currency; can my llc open a coinbase account nicehash bitcoin cash is treated like real estate or gold. There is a fee for not making estimated quarterly payments when required, and if you underpay too much, there is a fee for that. If you overpaid, make sure to read up on: You are looking at a bitcoin pool mining server bitcoin should you buy of everything that happened when block was mined. Your mindset could be holding you back from getting rich. These are the forms used to report your capital gains and losses from investment property. How to Make a Paper Bitcoin Wallet. In other words, miners are basically "minting" currency. Of themost recent filers on the Credit Karma Tax platform, fewer than people reported capital gains on their cryptocurrency coinbase ripple price bitcoin referral code reddit, data released Friday showed. We would love to collab with you about this and share the contents for our mutual benifits. Consider the following two cases, for example: There is no minimum target, but there is a maximum target set by the Bitcoin Protocol. As discussed, the easiest way to acquire Bitcoin is to buy it on an exchange like Coinbase. However, some extras are less obvious:. Here's an example to demonstrate: You can disable footer widget area in theme options - footer options. We are from zenledger. Trying to hide your assets is tax evasion, a federal offensive. VIDEO 2: Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. The photo below is a makeshift, home-made mining machine. Don't miss: Note that the free version provides only totals, rather than individual lines required for the Form

That said, you certainly don't have to be a miner to own crypto. After December 31, , exchanges are technically limited to real estate. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. As a test, we entered the specifications of two mining systems into the calculators below. Read More. In other words, miners are basically "minting" currency. Srinivasan said: Get this delivered to your inbox, and more info about our products and services. There will come a time when Bitcoin mining ends; per the Bitcoin Protocol, the number of Bitcoin will be capped at 21 million. The anticipated networks for staking currently listed on its website are: That's why you have to stick letters in, specifically letters a, b, c, d, e, and f. Similar to above lists however we have far better UX and mobile friendly tool. Self-made millionaire: That is a great many hashes. Key Takeaways By mining, you can earn cryptocurrency without having to put down money for it.

Personal Finance read more. If you are mining Bitcoin , you do not need to calculate the total value of that digit number the hash. The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing them. Similar uncertainty exists for a range of other cryptocurrency-related transactions. If you have to file quarterly, then you need to use your best estimates. For example, bitcoin holders on Aug. As a result, U. Using cryptocurrency for goods and services is a taxable event, i. That topped the number of active brokerage accounts then open at Charles Schwab. How much money Americans think you need to be considered 'wealthy'.