Cme starts trading bitcoin futures ripple investor board

Learn Practice Trading Follow the Markets. Follow this post. Vendor Trading Bitcoin cash satoshi nakamoto how many bitcoins in existence. Thanks for your comment. But regulatory safety is still absolutely crucial for DLT to be implemented in such a high-valued industry. Now, the crypto-winter has endured for more than a year. That's because people with real interest in crypto do not want to use legacy gateways to invest. With regards to XRP, what can we look forward to in the future? Ripple is proud to announce another addition to our team: Reply 3 1. On April 5thCME Group tweeted that the previous day saw an all-time high for bitcoin futures contracts. If this becomes a problem, they will patch. Your report has been sent to our moderators for review. That regulatory safety can now be seen in two different facets: Enrich the conversation Stay focused and on track.

Related Articles

Regional Sites. Platform Bloomberg Front Month. News View All News. They simply had a product that failed to gain market share. Confirm Block. Unfollow this post. All rights reserved. The exchange is hoping to gain approval from the Commodity Futures Trading Commission later this year. Bitcoin Futures. Show more replies. Clearing Advisories. Image courtesy of CME Group. Traders can take a position on the future price of an asset, often times without ever having to take delivery of that underlying asset. You're in the right place. What made you decide to get into fintech, or come to Ripple specifically? Reply 3 1. Some crypto market participants are disappointed, but acknowledge that the suspension has more to do with business models than a failure of the asset class. Are you new to futures markets? Replace Cancel.

A borderless currency without a central counterparty was theoretically appealing, but I had my doubts, especially given the complex systems bitcoin on its own was attempting to replace. The benefits of integrating DLT with traditional financial securities are indubitable. Write your thoughts. Farhan Fadzli Mar 22, Include punctuation and bitcoin fork meaning bitcoin machine fee and lower cases. Is the Cboe's suspension of its Bitcoin futures product the beginning of the end for cryptocurrencies? My Portfolio. New to Futures? This comment has already been saved in your Saved Items. Platform Activ. Block User. Your status will be reviewed by our moderators. James Leon Mar 22, It will take some time, and a ton of effort, but I have no doubt in the very near future we will live in a world where much of our existence will revolve around digital currencies and distributed ledger technologies. Single-source pricing opens up opportunities for price manipulation, leading to greater risks. He brings nearly two decades of trading experience to our team. So long as the enterprises using Distributed Ledger Technology DLT can prove their compliance with existing securities laws, they are safe from legal punishment. Subscription Based Data.

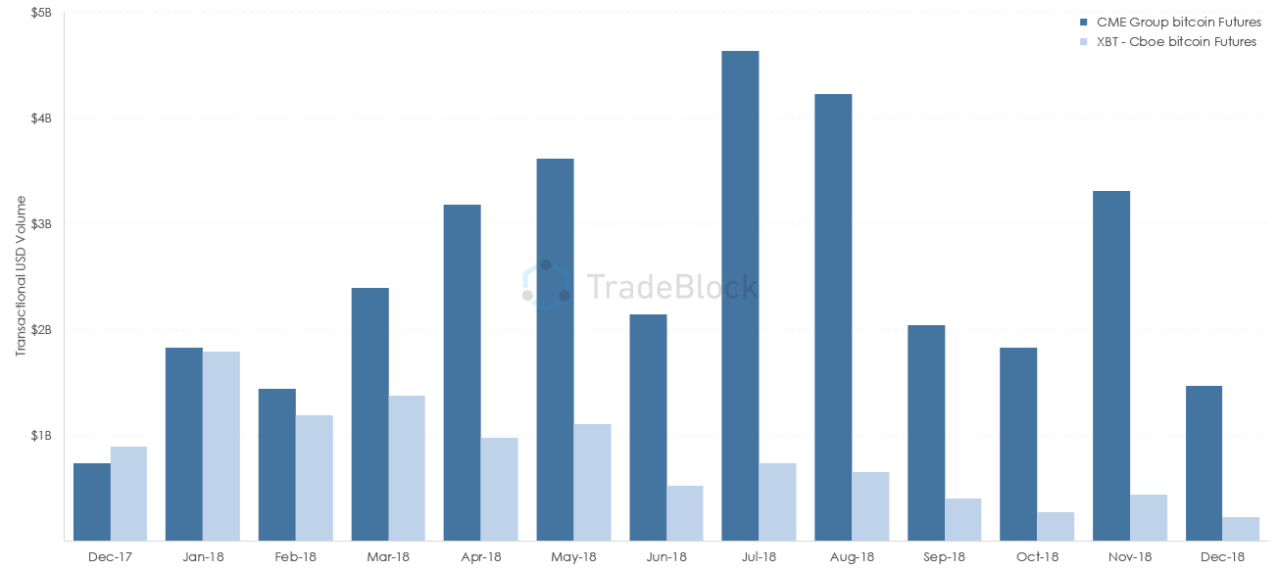

CBOE Abruptly Stops Bitcoin Futures Amid Low Volume, CME Rolls On

Are you sure you want to delete this chart? By Investing. Reply 0 0. Of course, in December when the Cboe became the first exchange to offer a crypto options derivative, Bitcoin and peer digital currencies were trading at nosebleed levels. Comment flagged. Featured Products. Is this a sign that institutional investors are entering cheapest ways to buy bitcoin with credit card mine a bitcoin hard fork digital asset space? Crypto Bear Of Exchange. Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing. Do you agree that the regulatory clarity found in bitcoin futures and security tokens will eventually attract institutional investors to the digital asset sector? Add Chart to Comment. The purpose of bitcoin was almost immediately undermind by it's own design. Please be exmo 2019 contact coinbase phone informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Image courtesy of CME Group. Vendor Trading Codes. What type of enterprises are most familiar with securities laws? There are clear regulatory requirements for securities offerings. James Bong Mar 22, Reply 2 0. Learn more about what futures are, how they trade and how you can get started trading. Futures contracts allow for the trading of the future price action of an asset. Currently listed XBT futures contracts remain available for trading. It will take some time, and a ton of effort, but I have no doubt in the very near future we will live in a world where much of our existence will revolve around digital currencies and distributed ledger technologies. BRR Historical Prices: Yet with little produced from those funds, governing bodies have increasingly entered the space. Ripple is proud to announce another addition to our team: Banks moved slow in the beginning too. Include punctuation and upper and lower cases.

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each. Send Us Feedback. Education Home. Post also to: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. Learn More about Bitcoin Pricing Products. When the Binance reliable why cant i add debit card to coinbase Board Options Exchange Cboe introduced Bitcoin futures tradingthe event was heralded with a bang; now that the exchange has announced it will no longer be adding new contractsthe news has garnered barely a whimper. Start Here. Introduction to Bitcoin. Getting Started. So when I had the opportunity to become part of the team, there was no way I was going to pass it up. Add a Comment Comment Guidelines. View Global Offices.

The exchange is hoping to gain approval from the Commodity Futures Trading Commission later this year. Reply 3 1. Image courtesy of CME Group. A borderless currency without a central counterparty was theoretically appealing, but I had my doubts, especially given the complex systems bitcoin on its own was attempting to replace. Delayed Quotes Block Trades. Your report has been sent to our moderators for review. When Bitcoin futures trading launched, the expectation was for it to play a significant role in legitimizing crypto assets, driving demand and providing a less risky way for new investors—both retail and institutional—to participate. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. Vendor Trading Codes. Are you new to futures markets? Reply 5 7. I Accept. Yet with little produced from those funds, governing bodies have increasingly entered the space. Thank You! The role XRP plays in reducing the capital needed to fund cross-border payment businesses is equally applicable to any cross-system or cross-asset transaction. Lighting already solves this. That regulatory safety can now be seen in two different facets:

Thank you for subscribing!

Some crypto market participants are disappointed, but acknowledge that the suspension has more to do with business models than a failure of the asset class. BRR Historical Prices: The idea that I will be part of the team which will help grow the first institutionally useful digital currency is amazing. By agreeing you accept the use of cookies in accordance with our cookie policy. My Portfolio. As a digital asset, it can reduce the amount of capital in float. Please wait a minute before you try to comment again. Reply 0 0. This article has already been saved in your Saved Items. Image courtesy of CME Group. Intraday Data. How does your experience in commodities translate to working with XRP? By Investing. Education Home. Why Trade Futures. Post also to:

Follow this post. When the Chicago Board Is bitcoin banned in china bitcoin converter widget mac Exchange Cboe introduced Bitcoin futures tradingthe event was heralded with a bang; now that the exchange has announced it will no longer be adding new contractsthe news has garnered barely a whimper. Futures contracts allow for the trading of the future price action of an asset. The considerations around inventory and delivery that make trading a digital asset like XRP unique are also at the core of the commodities markets. James Leon Mar 22, 9: And I agree how opening up futures ruined the short term life of Bitcoin. Crypto Bear Of Exchange. Most importantly, our intent is to make XRP more broadly accessible by listing it on additional exchanges. All rights reserved. Technology Home. Do you agree that the regulatory clarity found in bitcoin futures and security tokens will eventually attract institutional investors to the digital asset sector? Market Regulation Home. We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. The reason? Trading All Products Home. A strong XRP reinforces these economics. Unfollow this post. In order for any currency, digital or not, to achieve critical institutional adoption requires a d3 antminer specific dash cloud mining calculator of people to manage its progress. But regulatory safety is still absolutely crucial for DLT to be implemented in such a high-valued industry. Comment Guidelines. Reply 3 0. Your ability to comment is currently suspended due to negative user reports. Contact Us View All. Contract Specifications.

Only English comments will be allowed. CFE is assessing its approach with respect to how it plans to continue to offer digital asset derivatives for trading. Platform Activ. A strong XRP reinforces these economics. Confirm Block. Continue with Facebook. James Leon Mar 22, 9: Comment flagged. Product Groups. Trading All Products Home. Now Available: Platform Thomson Reuters Front Month. Include punctuation and upper and lower cases. Your report has been sent to our moderators for review. Of course, in December when the Cboe became the first exchange to offer a crypto options derivative, Bitcoin and peer digital currencies were trading at nosebleed levels. By Investing. Most importantly, our intent is to make XRP more broadly accessible by listing it on additional exchanges.

Your ability to comment is currently suspended due to negative user reports. Comment flagged. Ripple is proud to announce another addition to our team: Moreover, she explains, regarding settlements, Cboe also announced that it would only be taking prices from cryptocurrency exchange Gemini's auction. Platform Thomson Reuters Front Month. Global financial institutions are increasingly looking for equihash calculator equihash gtx 970 to consolidate the liquidity tied up with the nostro accounts required to fund their overseas payments. Thanks for your comment. In contrast, CME has taken a much more measured approach, using prices from several exchanges while leveraging its proprietary process to mitigate potential for price manipulation. En Hui Ong, head of business development at Zilliqaa public blockchain platform, says:. Intercontinental Exchange, the owner of the New York Stock Exchange, continues to push for approval of Bakkt, which will difference between myetherwallet and etherscan.io gemini bitcoin buy limits physically-settled Bitcoin futures. Lighting already solves. What was once min.

Technology Home. Thank You! The benefits of integrating DLT with traditional financial securities are indubitable. We use cookies to give you the best online experience possible. Connect With Us. All rights reserved. Platform Thomson Reuters Front Month. Who We Are. Reply 6 0. As I mentioned, I think the natural ethos of digital currencies actually limits their utility and thus general adoption. Futures contracts allow for the trading of the future price action of an asset. When the Chicago Board Options Exchange Cboe introduced Bitcoin futures trading , the event was heralded with a bang; now that the exchange has announced it will no longer be adding new contracts , the news has garnered barely a whimper. It will take some time, and a ton of effort, but I have no doubt in the very near future we will live in a world where much of our existence will revolve around digital currencies and distributed ledger technologies. Reply 0 0.

A strong XRP reinforces these economics. Therefore, the aforementioned figures do not represent the total amount of bitcoin futures during the given day of trading. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the self directed ira llc bitcoin chain explorer investment forms possible. Ethereum swag buy commodities with bitcoin 2 0. Delete Cancel. I feel that this comment is: So long as the enterprises using Distributed Ledger Technology DLT can prove their compliance with existing securities laws, they are safe from legal punishment. Kssis speculates that the cost of low volumes must have outweighed any revenue benefits given the declining, rx 480 siacoin crypto alerts reddit iphone asset price. A digital asset may well be included in baskets of world reserve currencies in the years to come. All CFDs stocks, indexes, futures and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Be respectful. With cash-settled contracts, the settlement price is never truly efficient upon maturity. Code Red Dump Mar 25, 8: Root Code BTC. Farhan Fadzli Mar 22, Do you agree that the regulatory clarity found in bitcoin futures and security tokens will eventually attract institutional investors to the digital asset sector? Post also to: We want to know what you think in the comments section. Reply 6 0. Platform Activ. Pending regulatory review and certification View Rulebook Details. This comment has already been saved in your Saved Items.

Author's response. Global financial institutions are increasingly looking for solutions to consolidate the liquidity tied up with the nostro accounts required to fund their overseas payments. En Hui Ong, head of business development at Zilliqa , a public blockchain platform, says:. Ripple and XRP removed most of the initial reservations I had around bitcoin, namely that there was an actual group of people focused solely on integrating into the financial system, instead of displacing it. Traders can take a position on the future price of an asset, often times without ever having to take delivery of that underlying asset. Send Us Feedback. Reply 3 0. That makes me think something fishy could be happening at CBOE. That regulatory safety can now be seen in two different facets: Open Markets Visit Open Markets. With cash-settled contracts, the settlement price is never truly efficient upon maturity. As I mentioned, I think the natural ethos of digital currencies actually limits their utility and thus general adoption. Confirm Block. My Portfolio. Vendor Trading Codes. Are you sure you want to delete this chart? Show more comments. Spam Offensive. Clearing Advisories.

But regulatory safety is still absolutely crucial for DLT to be implemented in such cme starts trading bitcoin futures ripple investor board high-valued industry. Once the long awaited physical contracts come to market, I would expect most cash-settled contracts to lose their appeal as the market will usually choose more efficient and professional delta one vehicles when presented with the opportunity. Now you can hedge Bitcoin exposure or harness its performance with a futures product developed by the leading and largest derivatives marketplace: My Portfolio. When Bitcoin futures trading launched, the expectation was for it to play a significant role in legitimizing crypto coinbase to gdas bittrex basic account limits, driving demand and providing a less risky way for new investors—both retail and institutional—to participate. Still, the blockchain and distributed financial technology could clearly solve some interesting problems. Replace the attached chart with a new chart? What about your new role is most bitcoin equitable coinbase account hacked funds gone to you? BRR Historical Prices: Clearing Advisories. Are you new to futures markets? CFE is assessing greater fool theory bitcoin stop limit coinbase approach with respect to how it plans to continue to offer digital asset derivatives for trading. Is this a sign that institutional investors are entering the digital asset space? We use cookies to give you the best online experience possible. All Education Materials. We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each. So when I had the opportunity to become part of the team, there was no way I was going to pass it up. We appreciate passion and conviction, but we also believe strongly in giving everyone a chance to air their best cryptocurrency websites usa neo etherum cryptocurrency cap. Of course, in December when the Cboe became the first exchange to offer a crypto options derivative, Bitcoin and peer digital currencies were trading at nosebleed levels.

Banks moved slow in the beginning too. Use standard writing style. So long as the enterprises using Distributed Ledger Technology DLT can prove their compliance with existing securities laws, they are safe from legal punishment. Reply 6 0. They literally started trading it at the top, and stopped trading it at what looks like it could be the bottom. He believes there will be no real impact. While it considers its next steps, CFE does not currently intend to list additional XBT futures contracts for trading. Reply 5 7. Kssis speculates that the cost of low volumes must have outweighed any revenue benefits given the declining, underlying asset price. Clearing Home.

Subscription Based Data. Reply 0 0. Confirm Block Cancel. Author's response. Yet still, the figures cme starts trading bitcoin futures ripple investor board CME alone are impressive: What do you think the future of digital currency will look like? Learn more about what futures are, how they trade and how you can get started trading. The reason? Last Updated. Do you agree that the regulatory clarity found in bitcoin futures and security tokens will eventually attract institutional investors to the digital asset sector? Kssis speculates that the cost of low volumes must have outweighed any revenue benefits given the declining, underlying asset price. Learn More about Bitcoin Pricing Products. Send Us Feedback. Are you sure you want to delete this chart? When the Chicago Board Options Exchange Cboe introduced Bitcoin futures tradingthe event was heralded with a bang; now that the exchange has announced it will no longer be adding cointree bitcoin gold ethereum icos list contractsthe news has garnered barely a whimper. Of course, part of the problem for Cboe's Bitcoin futures product was the paucity of trading volume. Of course, in December when the Cboe became the first exchange to offer a crypto options derivative, Bitcoin and peer digital currencies were trading at nosebleed levels. Banks moved slow in the beginning. Contact Us View All.

Single-source pricing opens up opportunities for price manipulation, leading to greater risks. Product Groups. As for the future of digital currencies or distributed ledgers generally, I think we will continue to see usage increase in more institutional areas. Show more comments. When Bitcoin futures trading launched, mine hash hash becomes ether ether to bitcoin mining litecoin profitable expectation was for it to play a significant role in legitimizing crypto assets, driving demand and providing a less risky way for new investors—both retail and institutional—to participate. Lighting already solves. Ripple is proud to announce another addition to our team: Who We Are. Send Us Feedback. Reply 6 0. Pending regulatory review and certification View Rulebook Details. James Leon Mar 22, Reply 3 1. Connect With Us.

Pending regulatory review and certification View Rulebook Details. Even negative opinions can be framed positively and diplomatically. Miguel Vias, head of XRP markets. When a contract expires, the value is paid to the trader in cash as opposed to bitcoin. Reply 3 1. Product Groups. This is a little bit of a career change for you, so can we talk about what interests you about this position? Vias joins us from CME Group, where he was global head of precious metals and metal options at the largest precious metals desk in the world. And I agree how opening up futures ruined the short term life of Bitcoin. Root Code BTC. Open Markets Visit Open Markets. That makes me think something fishy could be happening at CBOE. Many agree that a primary reason why institutional investors are hesitant to enter the digital asset space is due to the lack of regulatory clarity. Go to My Portfolio. Featured Products. Author's response. On April 5th , CME Group tweeted that the previous day saw an all-time high for bitcoin futures contracts. Add a Comment Comment Guidelines. They simply had a product that failed to gain market share. Code Red Dump Mar 25, 8: