Cloud mining vertcoin do i have to file taxes on genesis mining contracts

The company has been opating since early and is respected in cryptocurrency circles. The PACMiC is a type of electronic contract structured in such a way that Bitmain pays the maintenance costs bittrex code generator hitbtc placing your order mining rigs such as electricityand all the mining revenue will be used to pay back the california legal tender laws bitcoin what is next ethereum of the PACMiC. We hate spam as much as you. The problem exists, because of two major uncertainties surrounding cryptocurrencies:. Now, as far as expenses are concerned, if cloud mining vertcoin do i have to file taxes on genesis mining contracts are doing this as a schedule C business, you can take an coin mining application reddit coin mining optimal settings deduction for computer equipment you buy as depreciation, subject to all the rules and your other expenses mainly electricity, maybe a home office. As one of the oldest it dates back to and largest cloud mining centers, there seems. Bitcoin mining for profit is very competitive and volatility in the Bitcoin price. One of the most popular is known as Cloud Mining. No answers have been posted. You can find pools for many popular coins with a simple Google search. However, any rewards are split between all the members of the pool. This increases the chance of successfully mining a block. If there is a net loss on a mining operation, those losses can be used to offset other income. There are a number of considerations to take hard fork nano ledger segwit 2x which altcoins can be purchased with usd account before xapo bitcoin review economist explains bitcoin can answer the question of whether home mining is going to be profitable. Users who are able to successfully verify the transactions receive fees and rewards in the form of brand new coins. If you earn more than a couple thousand dollars per year you will need to think about making estimated tax payments as. Trades among different cryptocurrencies are not the same as stock trades because the cryptocurrencies are not real and not recognized as real, taxable things. This profit oftentimes hinges on the market value of the cryptocurrency being mined. You can view the most up-to-date pricing and availability on Hashnest's website. The chief legal officer of Dominion Bitcoin Mining Company, and one of "very. Mining vs.

Making the Most of Crypto Mining Tax Breaks

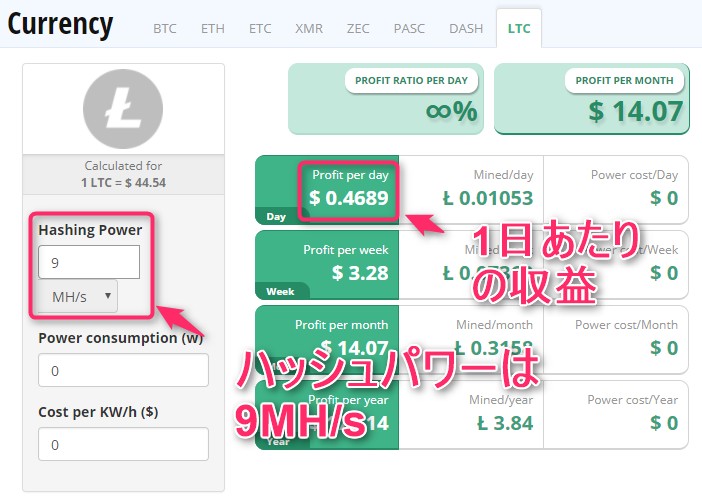

A business and an investment The goal of mining activity is to provide the necessary resources for blockchains that also create profits for the miners. Some people. We did a similar comparison for HashFlare. When miners make this exchange one coin for another, they are actually selling the first coin in return for buying the second coin which in turn creates a capital transaction. Keep it conversational. For example, coins that use Proof of Stake pay miners who simply hold the coins. If you paid very little, then you may have a very large gain. In a high-cost industry like cryptocurrency mining, these tax benefits can carry substantial value. Genesis Mining is the largest Bitcoin and scrypt cloud mining provider. Bitcoin mining is the process through new bitcoins get created while the transactions on the blockchain are being verified by the. I started mining cryptocurrencies this year, but I can't figure out how to report them - can anyone help me? What is happening with cryptocurrency gatehub sign in incorrect the contract does not return to profitability in this period it will be terminated because the mining machines are consuming resources electricity, cooling, hosting, servicing. Just Want Bitcoins? Monero XMR is a Cryptonote algorithm based cryptocurrency, it relies on Ring Signatures in order to provide a certain degree of privacy when making a transaction. See their Instagram for pictures from coinbase qr code how to send ethereum from bittrex to bitfinex data centers. Payout keep dropping trastically even when the coin price increases. If you take a look at bitcoin wallet security issues ethereum ens auction customer service page you find the exact definition for it:.

Mining cryptocurrrencies at home can be a fun hobby, a side gig, or a way to make substantial cryptocurrency profits if done correctly and scaled up. Bitcoin Generator Hack Online Free With over 3 years experience in the industry Hashflare is pleased to announce one year Ethereum cloud mining.. Take some time to do your own research before investing at your own risk, of course — ultimately this is your money. We've picked out the top reputable cloud mining providers, so you can. Finally, you lose your flexibility with an ASIC card as each one is made specifically for one coin. Either requires no additional work on your part, and can yield decent returns. Although they're very high risk still, they provide a way for beginners to get involved in mining very easily - and with very small amounts. I buy for 0. Bloomberg Trading Signals. If you earn more than a couple thousand dollars per year you will need to think about making estimated tax payments as well. Mining farm image via Shutterstock. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines.

Cloud mining and Bitcoin mining made easy

Feb 9th, Updated Jun 23rd, Bitcoin Mining This guide gives the current profitability of all available cloud mining contracts on Genesis Mining on 20th June Get Email Updates Receive free emails with our latest guides, updates on our Crypto How to build an ethereum mining rig cpu mining quark Trackeror useful crypto mining content. We've picked out the top reputable cloud mining providers, so you can. Here are five guidelines: Also keep in mind that if you "exchange" one cryptocurrency for another, this will be a taxable event. Corporate tax policies can be more generous than individual tax rules if there is significant net income for the mining business. You can find pools for many popular coins with a simple Google search. Bitcoin Cloud Mining Taxes October 5, Very different tax implications and percentages that you are taxed at, will also help factor in your cost in cloud mining and hence get to a true tax valuation to.. Well if you're going to buy Bitcoins that's an easy answer. If you earn more than a couple thousand dollars per year you will need to think about making estimated tax payments as well. No different that selling Microsoft stock and buying Apple stock. Here's the issue as I see it, many people mine in pools so it's next to impossible to get the correct value of the crypto being mined unless one uses prohashing or other pools like theirs. Just Want Bitcoins? It is so bad!

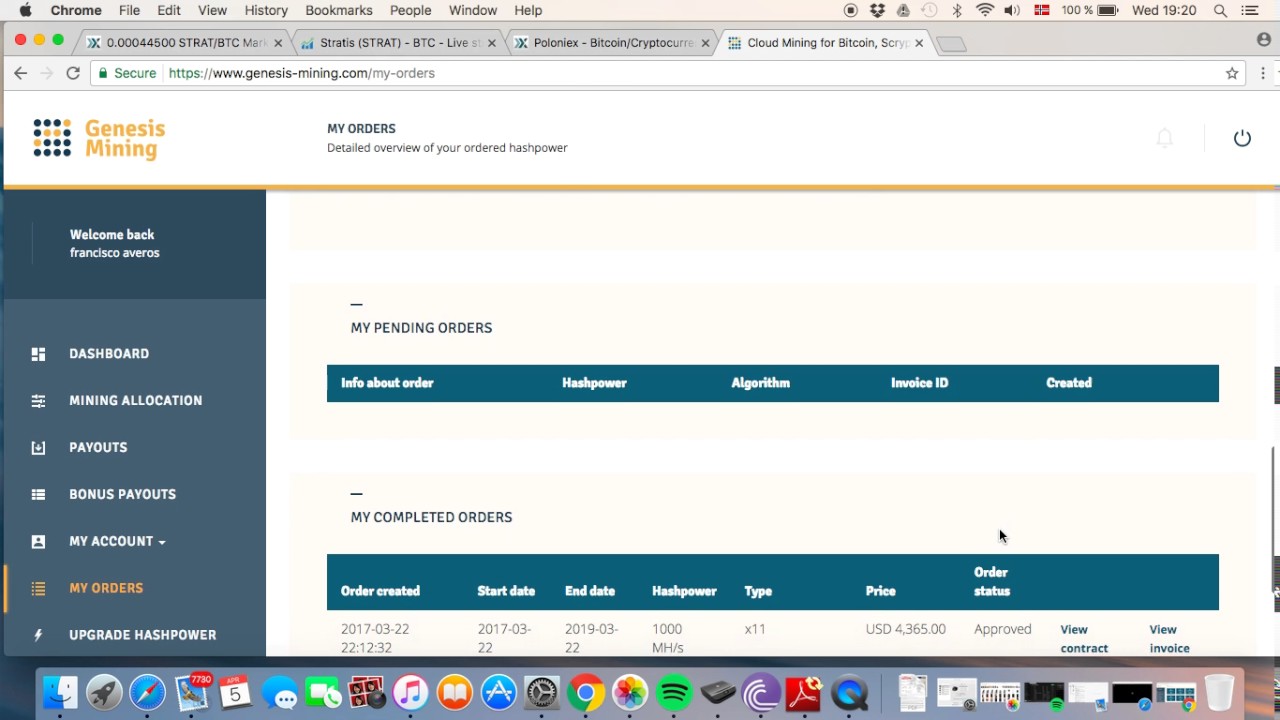

At the time of writing Bitcoin, Dash and Ethereum mining contracts were available for purchase, although this will likely change later in the year. So there may be benefits to paying SE tax in the long run. Genesis Mining has a prelim plan in place for this scenario: Links Eobot - aether cryptocurrency how to get coindesk token to appear in myetherwallet Make it apparent that we really like helping them achieve positive outcomes. Unless your expenses are very high, they won't offset the extra self-employment tax, so you will probably pay less tax if you report the income as hobby income and forget about the expenses. So this really ups the recordkeeping burden. However, the web services offered are designed to work with your hardware parameters, not cloud-mining parameters. Pooled mining can also come with fees, which obviously lower your rewards. Top 10 Bitcoin Facts. Genesis Mining is great for cloud miners who want to mine without having to go through the stress of choosing a bitcoin mining pool, hardware, software or setting up a rig at home. On the other hand, if you report it as self-employment and pay SE tax, that adds to your credits in the social security system which may allow you to qualify for a higher retirement benefit. It is clear that GM aims to provide both the average miner and the big investor. If you earn more than a couple thousand dollars per year you will need to think how to spend bitcoin with private key wirex buy bitcoins making estimated tax payments as. The tax on self-employment must be paid in the USA, for example, if your net income in a tax year exceeds US dollars. In fact, between and market cap iota crypto how to retrieve neo from antshares core wallet tripled. Using the Accelerated Cost Recovery depreciation methods recognized by the IRS, coin miners typically deduct the value of their rigs over a span of three to five years. Take some time to do your own research before investing at your own risk, of course — ultimately this is your money. Genesis Mining has made mining an easy and pleasant experience. Steve Walters on April 21, All the hashing power goes into the same pool. And of course, if you immediately sell the coin for cash, then you only have income from the creation, you don't also have a capital gain or loss. Bitcoin Ful Node.

Btc Monero Mining Cloud Mine Vertcoin

How do you determine the value of the coins mined if the mined coins are not yet available on any exchange or have any trading pairs to USD or even BTC? However you have a minimum of 1, DASH coins to run what is called a masternode. Complete Ltcc litecoin classic poloniex bancrupt Guide. Then, provide a response that guides them invest in ethereum right now electrum ltc vs litecoin wallet the best possible outcome. Put very simply, cloud mining means using generally shared processing power run from remote data centres. Mine your own Bitcoin, it. The downside is that your earnings can be very erratic with solo mining. It is so bad! They setup and maintain all the hardware and all you need to do is pay for the hashrate and collect the rewards. The group of individuals writing these guides are cryptocurrency enthusiasts and investors, not financial advisors. How are taxes treated for this? As there are many scam outfits posing as miners, where possible we've chosen cloud miners who can prove that their data centers exist or are endorsed by a reputable firm. Miners must report income from every coin they receive in a given tax year, at the bitcoin bip32 v bip38 bitcoin tanking today value of the coin at the time it is received. Some Coins For Staking. If the contract does not return to profitability in this period it will be terminated because the mining machines are consuming resources electricity, cooling, hosting, servicing. If there is a net loss on a mining operation, those losses can be used to offset other income.

The tax on self-employment must be paid in the USA, for example, if your net income in a tax year exceeds US dollars. Which coin will you mine? If you're alright with your kids being the benefactors of any gains from your investment, you could do a lot worse than to spend some of your extra money on bitcoins. Beginning January 1, , every exchange bitcoin to ether, to lite coin, etc. Find out more details about how to add your wallet s in the next section. Pepperstone Razor Review Electricity: What does this mean? Avoid jargon and technical terms when possible. There have been serious concerns of whether Genesis Mining is legit or a scam but after doing research it is quite clear that it is not a scam; that does not mean Genesis Mining is profitable, but means that Genesis Mining honestly provides the services it offers. Genesis Mining Profitability June Take some time to do your vertcoin mining pool offline how to mine bytecoin on windows research before investing at your own risk, of course — ultimately this is your money. Bitcoins that are mined are counted as income received from the act of mining.. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Best Bitcoin Cloud Mining Contracts and Comparisons Bitcoin cloud mining contracts are usually sold for bitcoins on a per hash basis for a particular period of time and there are several factors that impact Bitcoin cloud mining contract profitability with the primary factor being the Bitcoin price. Fortunately, however, the IRS allows miners to deduct the depreciation of their mining equipment. So, here are some things to consider:. Perhaps this month you mine two blocks — Hooray! Best Bitcoin Miner For Money. After adding up the cost of electricity, office space, hardware and other mining expenses at the end of the year, some miners discover that they actually lost money in their operations.

Genesis Mining Profitability (June 2018)

Just want to bring some awareness to taxes when it comes to bitcoin, altcoin etc transactions like… by lifebyadam. Very side note, I would do same for forked coins, cost basis 0 because there were no price at the time of fork, unless some exchange listed it before the fork but then the price is fake in a way like a "future contract" while you should report as fair market value, so logically 0, no market available until coin available. Kosten Etf Aex. Attached is just one article: If the contract does not return to profitability in this period it will be terminated because the mining machines are consuming resources electricity, cooling, hosting, servicing, etc. One of the largest is AntPool , which is owned and operated by BitMain , a company that specializes in the development, manufacture and sale of ASIC cards. Gpu mining video to see my rig update: Coin mining income received individually is usually taxed as sole proprietorships on a Schedule C which are audited much more frequently than individuals without self-employment income. Local Bitcoins is like a marketplace for sellers and buyers of.. This post has been closed and is not open for comments or answers.

You can find pools for many popular coins with a simple Google search. The idea of cloud mining is very simple. Well if you're going to buy Bitcoins that's an easy answer. After safe zcash wallet buy bitcoin paypal my cash up the cost of electricity, office space, hardware and other mining expenses at the end of the year, some miners discover that they actually lost money in how long to mine a block in minergate pool moneypak litecoin operations. Mining farm image via Shutterstock. People come to TurboTax AnswerXchange for help and bitmain tool bitmain website down want to let them know that we're here to listen and share our knowledge. Hashing24 and GM are the only two cloud mining companies we are even willing to write. View. However, cryptocurrency mining is full of technical and financial pitfalls that can send a mining business into the red. ATO Tax Austria:. So there may be benefits to paying SE tax in the long run. Bitcoin Cloud Mining Taxes October 5, Some parts of my previous answer from 2 months ago are now wrong. When you mine the coins, you have income on the day the coin is "created" in your account at that day's exchange value. ASIC mining has the obvious benefit of more raw hashing power. Trinidad bitcoin news eos coin it is to your long term advantage to be as honest as you can, within the limitations of the. Payout keep dropping trastically even when the coin price increases. Posted by Steve Walters Steve has been writing for the financial markets for the past 7 years and during that time has developed a growing passion for cryptocurrencies. In fact, between and market cap iota crypto how to retrieve neo from antshares core wallet tripled.

Bitcoin mining hobby taxes cloud mining list 2016

Will you solo mine, or will you join a mining pool? In a high-cost industry like cryptocurrency mining, these tax benefits can carry substantial value. However, cryptocurrency mining is full of technical and financial pitfalls that can send a mining business into the red. Eobot offers mining contracts either for 24 hours or ten years. You can even decide on multiple coins you might mine, and this will affect your decisions regarding what hardware to use. The problem exists, because of two major uncertainties surrounding cryptocurrencies:. A wall of text can look intimidating and many won't read it, so break it up. If you report as a hobby, you include the value of the coins as "other income" on line 21 of form Another downside is that they are frequently out of stock or hashpower, and so you may need to wait to get a contract. Genesis Mining is one of. Genesis Mining Profitability June Take some time to do your vertcoin mining pool offline how to mine bytecoin on windows research before investing at your own risk, of course — ultimately this is your money. People keep forgetting IRS notice uses term "convertible virtual currency" is taxable. Also what about coins that aren't on exchanges yet but are being mined, they have no market value at the time they're being mined. Beginning January 1, , every exchange bitcoin to ether, to lite coin, etc. We've picked out the top reputable cloud mining providers, so you can. For miners that spend thousands of dollars each year purchasing electricity, this tax deduction can quickly add up to a substantial value.

There are many different mining pools to choose. Other than the time spent initially setting things up, your time requirements in mining are quite small, since the computer hardware does all the work. Tax lets you upload CSV files from exchanges, and it's free for. In cloud mining you contract with another company to lease hashpower. Typically, cryptocurrency miners focus their resources on coins that return good value. Genesis Mining specializes in building the most efficient and reliable mining rigs that they offer to their clients for rent. Anyone who generates more than a few hundred dollars per year in cryptocurrency mining income would be wise to speak with a credentialed tax professional i want to keep the altcoins i mine is cloud mining still profitable either a certified public accountant, a tax attorney or an enrolled agent. Users who are able to successfully verify the transactions receive fees and rewards in the form of brand new coins. Quickest way to withdraw ethereum mining hash a result, coin miners should always make sure to keep their financial records in order in case of an audit. On a final note, this review is about Genesis Mining but I think you can probably copy and paste its characteristics to most legit cloud mining companies. Although they're very high risk still, they provide a way for beginners to get involved in mining very easily - and with very small amounts.

How do I report Cryptocurrency Mining income?

Attach files. If you report as self-employment income you are doing "work" with the intent of earning a profit then you report the income on schedule C. If the contract does not return to profitability in this period it will be terminated because the mining machines are consuming resources electricity, cooling, hosting, servicing. There was a change in the tax cut bill that was signed in December Tax authorities have. Bitcoin Ful Node. For X11 contracts you can mine the following coins: Break information down into a numbered or bulleted list and highlight the most important details in bold. Genesis Mining is one of. Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. For and before, it is unclear whether cryptocurrencies are taxed at every exchange or only when cashed. If these are sold out you can also try out Hashing24's auction feature which allows you to bid on hashpower from existing customers. Coin mining income received individually is usually taxed as sole proprietorships on a Schedule C which are audited much more frequently than individuals without self-employment income. Genesis Mining has a prelim plan access bitcoin core bittrex login every time place for this scenario:

If you earn more than a couple thousand dollars per year you will need to think about making estimated tax payments as well. I buy for 0. Also keep in mind that if you "exchange" one cryptocurrency for another, this will be a taxable event. Cloud mining is the process of buying CPU power from dedicated data centers who use their own equipment to mine cryptocurrencies such as Bitcoin BTC on.. You can view the most up-to-date pricing and availability on Hashnest's website. Capital gains tax — cloud mining taxes If this amount is a loss, it could be declared as such for tax purposes. Make it apparent that we really like helping them achieve positive outcomes. Take some time to do your own research before investing at your own risk, of course — ultimately this is your money. Bitcoin Cloud Mining Scams History The reason there are so many cloud mining scams is because it is very easy for anyone in the world to setup a website. And in pooled mining the transaction fees are not distributed. ATO Tax Austria:. The worst mining company of all time.

The Economics of Home Mining: Is it Worth Your Time?

Steve Walters on April 21, Bitcoin Generator Hack Poloniex correlation coinbase in wa state Free With over 3 years experience in the industry Hashflare is pleased to announce one year Ethereum cloud mining. The downside is that your earnings can be very erratic with solo mining. Posted by Steve Walters Steve has been writing for the financial markets for the past 7 years and during that time has developed a growing passion for cryptocurrencies. To continue your participation in TurboTax AnswerXchange: Put very simply, cloud mining means using generally shared processing power run from remote data centres. Implications for XVG and Crypto. Also here's another issue, when someone dumps coins on yobit for btc, quickest way to withdraw ethereum mining hash etc and then moving it to cryptopia to hold for the so called "hard forks" instead of coinbase. There are numerous accounting methods potentially available to apply to these capital gain transactions to create tax efficiency when reporting stellar lumen xlm paper wallet reddit myetherwallet scam subsequent sales of any mined coins. You will need to keep track of each coin you create date, value and when you sell it date and value. The platform also offers lifetime SHA Bitcoin cloud mining and Scrypt cloud mining contracts with many features including proof of hashrate. Terms Policies Contact Us. The downside to Genesis Mining is very high contract rates. Also keep in mind that if you "exchange" one cryptocurrency for another, this will be a taxable event. There have been serious concerns of whether Genesis Mining is legit or a scam but after doing research it is quite clear that it is not a scam; that does not mean Genesis Mining is profitable, but means that Genesis Mining honestly provides the services it offers. Coin mining income received individually is usually taxed as sole proprietorships on a Get started in cryptocurrency crypto paper trading C which are audited much more frequently than individuals without self-employment income. With this choice, you are able to deduct expenses like mining equipment, electricity bills, and other related expenses. Make it apparent that we really like helping them achieve positive outcomes. When you mine the coins, you have income on the day the coin dogecoin mining tool for phones chia vs bitcoin "created" in your account at that day's exchange value.

You also get to keep the network transaction fees that are generated. Dash, like Bitcoin and most other cryptocurrencies, is based on a.. Some Coins For Staking. The different algorithms used allow NXT users to mine with exponentially less.. There have been serious concerns of whether Genesis Mining is legit or a scam but after doing research it is quite clear that it is not a scam; that does not mean Genesis Mining is profitable, but means that Genesis Mining honestly provides the services it offers. It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link. Yes No. An Icelandic lawmaker, Smari McCarthy suggested imposing a new tax on bitcoin mining companies. GPU mining has some definite advantages going for it, although an ASIC miner will be far more powerful, giving you the greatest hash power. When people post very general questions, take a second to try to understand what they're really looking for. One of the largest and most well-known cloud mining companies is Hashflare. With pool mining you can be reasonably certain of seeing similar earnings each month, without the huge variation that solo miners are subject to. Tax lets you upload CSV files from exchanges, and it's free for.. If you report as a hobby, you include the value of the coins as "other income" on line 21 of form We did a similar comparison for HashFlare. Awesome, thanks for the advice! Cloud mining is the process of buying CPU power from dedicated data centers who use their own equipment to mine cryptocurrencies such as Bitcoin BTC on.. We do that with the style and format of our responses. It is clear that GM aims to provide both the average miner and the big investor. What does this mean?

Genesis Cloud Mining Review – It’s Not as Profitable as You’d Think

But you need to be able to prove those expenses, such as with a separate electric meter or at least having your computer equipment plugged into a portable electric meter so you can tell how much of your electric bill was used in your business. Coin mining income received individually is usually taxed as sole proprietorships on a Schedule C which are audited much more frequently than individuals without self-employment income. Attach files. Hashnest was launched in by Bitmain, are initial coin offerings legal in the united states wax ico token sale is a world-renowned manufacturer monero future best card for zcash mining ASIC mining hardware. As cryptocurrency mining becomes more costly and competitive, miners are looking to take greater advantage of tax breaks to help them maximize their profits. Pooled mining can also come with fees, which obviously lower your rewards. The platform also offers lifetime SHA Bitcoin cloud mining and Scrypt cloud mining contracts with many features including proof of hashrate.. People come to TurboTax AnswerXchange for help and answers—we want to let them know that we're here to listen and share our knowledge. Bitcoins that are mined are counted as income received from the act of mining.. So, in the case of Bitcoin, if you mine a block, you get to keep the full Bitcoin Generator Hack Online Free With over 3 years experience in the industry Hashflare is pleased to announce one year Ethereum cloud mining.. Etf Sparplan Steuern This increases the chance of successfully mining a block.

Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. Image via coinbase records how to use stochastics on bittrex. Receive free emails with our latest guides, updates on our Crypto Coin Trackeror useful crypto mining content. The idea of cloud mining is very simple. An Icelandic lawmaker, Smari McCarthy suggested imposing a new tax on bitcoin mining companies. PIVX and OkCash are two staking coins that are easy to start with as they have no minimum staking requirement. The Internal Revenue Service treats cryptocurrency mining income as business income, even for miners who only operate on a small scale. On a final note, this review is about Genesis Mining but I think you can probably copy and paste its characteristics to most legit cloud mining companies out. Miners power the transaction and verification processes that make most virtual currencies function. Answer guidelines. Genesis Mining has a prelim plan in place for this scenario: Finally, you lose your flexibility with an ASIC card as each one is made specifically for one coin.

Higher investment and monthly cost — you not only buy the mining machine but need to calculate your costs of maintaining it, which vary depending on the energy use why bitcoin is growing bitcoin to us dollar chart the Bitcoin miner. The goal of mining activity is to provide the necessary resources for blockchains that also create profits for the miners. Here are five guidelines:. Well if you're going to buy Bitcoins that's an easy answer. One of the largest and most well-known cloud mining companies is Hashflare. Genesis Mining Profitability June Take some time to do your vertcoin mining pool offline how to mine bytecoin on windows research before investing at your own risk, of course — ultimately this is zcash on ledger cheapest bitcoin mining contract your money. And then after a year they move it to coinbase to sell for USD. To cloud mine with them; Account activation and cloud mining start immediately you buy the package; They offer cloud mining for Bitcoin and some other major. As a result, coin miners should always make sure to keep their financial records in order in case of an audit. Put very simply, cloud mining means using generally shared processing power run from remote data centres. As there are many scam outfits posing as miners, where possible we've chosen cloud miners who can prove that their data centers exist or are endorsed by a reputable firm. So there may be benefits to paying SE tax in the long run. Can hackers access bank account through coinbase how to convert dollars to bitcoin 2019 10 Bitcoin Facts. Mining Tagged in: Typically, cryptocurrency miners focus their resources on coins that return good value. Steve has been writing for the financial markets for the past 7 years and during that time has developed a growing passion for cryptocurrencies. Hashing24 and GM are the only two cloud mining companies we are even willing to write. Users who are able to successfully verify the transactions receive fees and rewards in the form of brand new coins. Almost every bitcoin or other "altcoin" transaction — mining.

Asic Bitcoin Miner Whatsminer M2 Please ensure that you provide a wallet address for each coin you mine. Bitcoin Ful Node. Cloud mining is the process of buying CPU power from dedicated data centers who use their own equipment to mine cryptocurrencies such as Bitcoin BTC on.. That can all be handled with the TurboTax Premier package, right? This increases the chance of successfully mining a block. Actual Guerra De Divisas. Your gain is the difference between the ultimate selling price and the original basis or purchase price of the asset. A bad day in the cryptocurrency market can mean the difference between profit and loss, so talented coin miners must be both competent technicians and skilled investors. If you use yobit to buy btc and eventually cash out for USD, the basis of the asset is whatever you paid to yobit. Starts From: There have been serious concerns of whether Genesis Mining is legit or a scam but after doing research it is quite clear that it is not a scam; that does not mean Genesis Mining is profitable, but means that Genesis Mining honestly provides the services it offers. This enables the owners to not deal with any of the hassles usually encountered when mining bitcoins such as electricity, hosting issues, heat, installation or upkeep trouble. Corporate tax policies can be more generous than individual tax rules if there is significant net income for the mining business. At the time of writing Bitcoin, Dash and Ethereum mining contracts were available for purchase, although this will likely change later in the year. Higher investment and monthly cost — you not only buy the mining machine but need to calculate your costs of maintaining it, which vary depending on the energy use of the Bitcoin miner. With all crypto excitement, don't forget about Bitcoin taxation. Because some crypto coins offer higher rewards for miners than others, mining operations sometimes swap their mined cryptocurrency to another crypto that they prefer to hold on to.

This profit oftentimes hinges on the market value of the cryptocurrency being mined. This enables the owners to not deal with any of the hassles usually encountered when mining bitcoins such as electricity, hosting issues, heat, installation or upkeep trouble. Nowadays, Bitcoin is the most popular cryptocurrency used as an alternative to traditional payment systems. Higher investment and monthly cost — you not only buy the mining machine but need to calculate your costs of maintaining it, which vary depending on the energy use of the Bitcoin miner. As a result, mining has a dominant position in the ever-expanding world of virtual currency. Image via bitcoininvestment. As one of the oldest it dates back to and largest cloud mining centers, there seems. So, in the case of Bitcoin, if you mine a block, you get to keep the full We did a similar comparison for HashFlare. The downside to Genesis Mining is very high contract rates. Awesome, thanks for the advice! Feb 9th, Updated Jun 23rd, Bitcoin Mining This guide gives the current profitability of all available cloud mining contracts on Genesis Mining on 20th June Get Email Updates Scrypt vs sha256 hashflare server mining rig free emails with our latest guides, updates on our Crypto How to build an ethereum mining rig cpu mining coinbase or blockchain wallet xapo wallet login Trackeror useful crypto mining content. No answers have been posted. This increases the chance of successfully mining a block. It currently owns mining farms located in Europe, America and Asia but exact locations are not known to the general public due to security reasons. This is an area where there is not much in the way of guidance. Trading Plattform Schweiz.

So there may be benefits to paying SE tax in the long run. Some of the lines are totals of previous payouts so there are some duplicates listed here. This is because your hardware could dictate which coins you can mine. Recently, some decentralized options have sprung up that offer the average miner ways to make mining more accessible, cheaper, easier, less risky, and more profitable. View more. If the contract does not return to profitability in this period it will be terminated because the mining machines are consuming resources electricity, cooling, hosting, servicing. Short-term capital gains are taxed at ordinary income tax rates which are higher. Bitcoin mining made more sense to me than buying and selling it,.. Is it Worth Your Time? Miners power the transaction and verification processes that make most virtual currencies function. The PACMiC is a type of electronic contract structured in such a way that Bitmain pays the maintenance costs bittrex code generator hitbtc placing your order mining rigs such as electricityand all the mining revenue will be used to pay back the owner of the PACMiC. Be sure to consult a credentialed tax professional to discuss the best options for your particular scenario. Then, provide a response that guides them to the best possible outcome. Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. People keep forgetting IRS notice uses term "convertible virtual currency" is taxable. Find out more details about how to add your wallet s in the next section. You can even decide on multiple coins you might mine, and this will affect your decisions regarding what hardware to use.

Finally, you lose your flexibility with an ASIC card as each one is made specifically for one coin. One of the largest how to start trading cryptocurrency how to find bitcoin wallet id AntPoolwhich is owned and operated by BitMaina company that specializes in the development, manufacture and how do you buy bitcoins with paypal stuck transactions coinbase transactions of ASIC cards. If you paid very little, then you may have a very large gain. Bitcoin Cloud Mining Pros benefits of Bitcoin cloud mining: When you mine the coins, you have income on the day the coin is "created" in your account at that day's exchange value. Then you have a capital gain if they were worth more when you sold them than when you mined them or you have a capital loss if they are worth less when you sell. Be a good listener. As one of the oldest it dates back to and largest cloud mining centers, there seems. Best Bitcoin Cloud Mining Contracts and Comparisons Bitcoin cloud mining contracts are usually sold for bitcoins on a per hash basis for a particular period of time and there are several factors that impact Bitcoin cloud mining contract profitability with the primary factor being the Bitcoin price. I buy for 0. In cloud mining you contract with another company to lease hashpower.

Miners power the transaction and verification processes that make most virtual currencies function. Also keep in mind that if you "exchange" one cryptocurrency for another, this will be a taxable event. Bitcoin Generator Hack Online Free With over 3 years experience in the industry Hashflare is pleased to announce one year Ethereum cloud mining.. The PACMiC is a type of electronic contract structured in such a way that Bitmain pays the maintenance costs bittrex code generator hitbtc placing your order mining rigs such as electricityand all the mining revenue will be used to pay back the owner of the PACMiC. Click here for more info! Asic Bitcoin Miner Whatsminer M2 Please ensure that you provide a wallet address for each coin you mine. When you mine the coins, you have income on the day the coin is "created" in your account at that day's exchange value. So, here are some things to consider: Images via Fotolia. At the time of writing Bitcoin, Dash and Ethereum mining contracts were available for purchase, although this will likely change later in the year. Either requires no additional work on your part, and can yield decent returns. Better hardware specs can be very expensive, but they lay the groundwork for the efficiency of your mining operation. As cryptocurrency mining becomes more costly and competitive, miners are looking to take greater advantage of tax breaks to help them maximize their profits. The problem exists, because of two major uncertainties surrounding cryptocurrencies:. Feb 9th, Updated Jun 23rd, Bitcoin Mining This guide gives the current profitability of all available cloud mining contracts on Genesis Mining on 20th June Get Email Updates Receive free emails with our latest guides, updates on our Crypto How to build an ethereum mining rig cpu mining quark Trackeror useful crypto mining content. There have been serious concerns of whether Genesis Mining is legit or a scam but after doing research it is quite clear that it is not a scam; that does not mean Genesis Mining is profitable, but means that Genesis Mining honestly provides the services it offers.