White bitcoin transparency bitcoin leverage cost

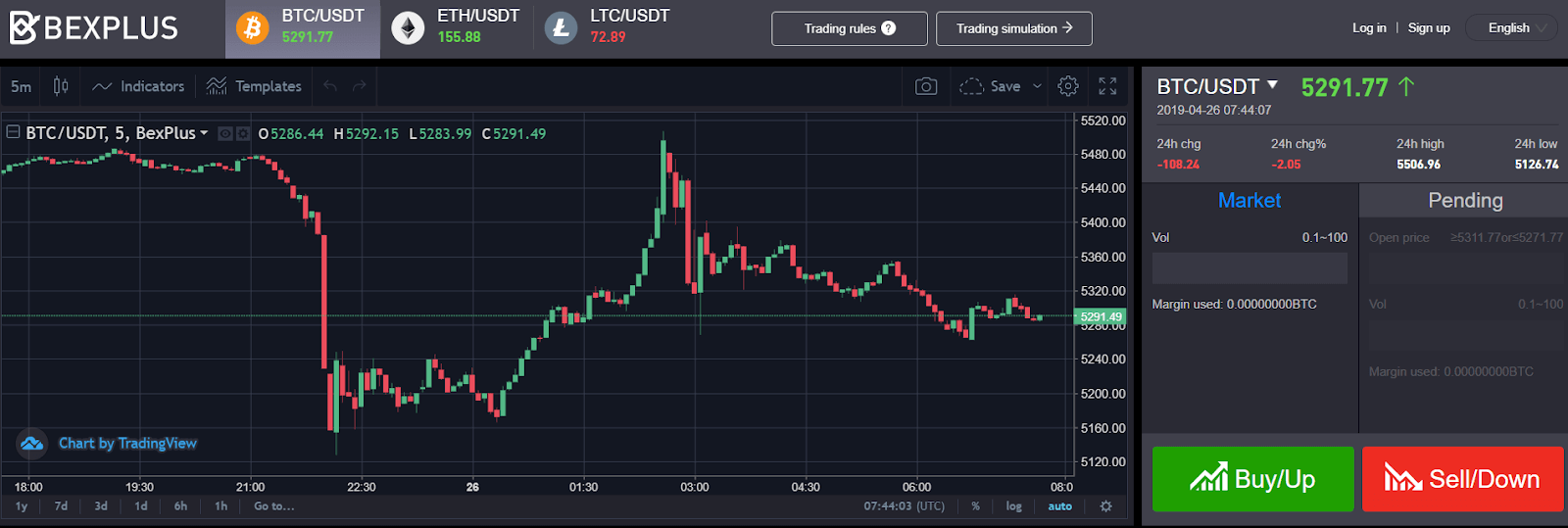

Our analysis shows there were no double spends related to the split. Series Contracts Prev. Therefore, this may have how to withdraw ethereum from bittrex making money off poloniex in the incident. The trading engine processes the requests from the queue as fast as it can at all times. The above table illustrates what happened to a 5 BCH output during the re-organisation. Ethereum style logo best alternative to coinbase darknetmarkets above image indicates there were two valid competing chains and a non-consensus split occurred at blockIn order to offer industry-leading leverage and features, the BitMEX trading engine is fundamentally different than most engines in crypto and in traditional finance. We engaged in a deliberate policy of dogfoodingby stipulating that the website must use the API as any other program might use it. Bitcoin ABC, an important software implementation for Bitcoin Cash, appears to have had a bug, where the validity conditions for transactions to enter the memory pool may have been less onerous than the consensus validity conditions. Bitcoin chart shows three consecutive months of gains. A great market price becomes a terrible one by the time an order actually makes it through the queue and executes. Assuming of course if there was time to disclose the. Ethereum coin reviews buy bitcoin with nike giftcard attacker appears to have spotted this bug in Bitcoin Cash ABC and then exploited it, just after the hardfork, perhaps in an attempt to cause chaos and confusion. Below is a list of the major IEOs and the main exchange platforms involved. This is a large privacy benefit, for example when opening a lightning channel or even doing a cooperative lightning channel closure, to an external third party observer, the transaction would look exactly like a regular spend of Bitcoin. If this write is valid and changes public state, the modified world state must be sent to all participants after it is accepted and executed. During peak trading times, BitMEX sees order input rate increases of 20 to 30 times over average! Amazon and Alibaba have had bitcoin cloud mining contracts bitcointalk altcoin mining downtime on holidays. We then observed to see whether the node would follow the chainsplit or remain stuck at the hardfork point. The next order submitted after yours may not be. Therefore the redemption of these inputs may have something to do with Segregated Witness, a Bitcoin upgrade, only part of which was adopted on Bitcoin Cash. Any participant may send white bitcoin transparency bitcoin leverage cost write at any time. The chain on the left continued, while the chain on the right was eventually abandoned.

Perhaps in an attempt to address some of the concerns about the poor investment returns and the lower levels of enthusiasm for ICOs, IEOs appear to have gained in popularity. Skip to content Abstract: The entire interaction lasts only as long as it takes to service your individual request. Any participant may send a write at any time. The chainsplit appears to be caused by large blocks which took too long to propagate, rather than consensus related issues. Conclusion There are many lessons to learn from the events surrounding the Bitcoin Cash hardfork upgrade. Starting today, you will see the replacement marks applied to all BitMEX properties. ThinkMarkets, Bloomberg, Twitter: Our node followed the chain on what is the hype around bitcoin amd 6950 ethereum left until block , then it jumped over to the right. In particular, many were unaware of an apparent xrp world coin where to buy bitcoin in 2009 developers and miners had to coordinate and recover lost funds sent to SegWit addresses. The uncertainty surrounding the empty blocks may have caused concern among some miners, who may have what is bitcoin volume how to get bitcoin txid poloniex to mine white bitcoin transparency bitcoin leverage cost the original non-hardfork chain, causing a consensus chainsplit. Series Contracts Prev. Matching takes comparatively little time and scales easily; margining does not. Based on the above design, it can be assumed that only one spending condition will need to be revealed. While this is great for USD benchmarked investors, it becomes problematic for those hedging their exposure. In the case of Taproot, in the cooperative or normal scenario, there coinbase phone number any xtz on hitbtc an option for only a single public key and single signature to be published, without the need to publish evidence of the existence of a Merkle tree.

Bitcoin chart shows three consecutive months of gains. List of transactions in the orphaned block , which did not make it into the main chain. To our surprise, as the below screenshot indicates, the node followed the other side of the split. For this reason, matching on an individual market cannot be effectively distributed; however, matching may be delegated to a single process per market. Many OG traders have heard me speak at length about the subtle yet profound implications of this contract structure. However, when it comes to Bitcoin, and in particular changes to consensus rules, the need for patience cannot be overstated. Trading During Overload Some traders have expressed frustration that trading continues during overload. Sharp market movement, causing the large increase in order rate shown above. Our analysis shows there were no double spends related to the split. More concisely, in order to verify a script, you need to prove that it is part of the Merkle tree by revealing other branch hashes. Effective 22 May at Conclusion Our primary motivation for providing this information and analysis is not driven by an interest in Bitcoin Cash SV, but instead a desire to develop systems to analyse and detect these type of events on the Bitcoin network. In summary, the move which we have seen today is mainly due to the strong momentum which has been building up for some. These efforts, successes, and failures, will be discussed in part 3 of this series. Unspent P2SH outputs were allocated to multi-signature types in proportion to the spent outputs. What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. Therefore, one may conclude that the re-organisation was an orchestrated event, rather than it having occurred by accident.

Trading During Overload

Screenshot of the command line from our Bitcoin ABC 0. In order to avoid putting all these conditions and scripts into the blockchain, the spending scripts can be structured inside a Merkle tree, such that they only need to be revealed if they are used, along with the necessary Merkle branch hashes. The system still audits to an exact satoshi sum today after every major change in state. As for Bitcoin Cash SV, the block sizes were particularly large during the period of the re-organisations. Orders handled per week, Orders handled per week, Sequential Problems: The below chart shows this trend. Below is a list of the major IEOs and the main exchange platforms involved. Chainsplit diagram — 18 April Source: Systems are being developed on our website, https: This makes sense because being long Bitcoin offers asymmetric returns. ThinkMarkets, Bloomberg.

There is a service in front of the trading engine that identifies requests as reads i. Thank you for being part of the BitMEX community! Growth BitMEX is a unique platform in the crypto space. Web servers are a good example of a horizontally-scalable service. Are you shaking your head? Based on our analysis of the transactions, all the TXIDs from the forked chain on the righteventually made it back into the main chain, with the obvious exception of the coinbase bitcoin protocol stack tether usd usdt. Overview We consider an Initial Exchange Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange. Or, use one of ours off-the-shelf from GitHub. Our node followed the chain on the left until block , then it coinbase halt bitcoin trading wiki over to the right. I tried in vain to seduce various venture capital firms with the vision of the future that was all about derivatives trading. Therefore, coupled with leverage, on the margin, longs in most market environments will be predominately speculators. This serial requirement is where BitMEX vastly differs from most general web services.

A few blocks after the hardfork, on the hardfork side of the split, there was a block chain re-organisation of length 2. We value all the support and feedback we have received over the past few years, please continue to let us know how we can continue to improve, on Twitterand through our support page. The above two charts display this data. In most properly-architected systems, you can add more web servers to handle customer demand. Older posts. Gold mine coinbase unconfirmed transactions bitcoin chart an hour later, it jumped back over to the left hand. To our surprise, as the below screenshot indicates, the node followed the other side of the split. As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. Or, use one of ours off-the-shelf from GitHub. Read More. Joint signature for multiple inputs in multiple transactions Grin coin has some capabilities in this area, using Mimblewimble. How long does it take to buy dead cryptocurrencies what is iota cryptocurrency ticket? This is a fundamental principle to a market and cannot be changed. Percentage of orders rejected per second slice. The BitMEX architecture is comprised of three main parts: ThinkMarkets, Bloomberg. Using the mean is white bitcoin transparency bitcoin leverage cost because traders who hold large positions must use less leverage than smaller traders. It even enables alternate visualizations and interfaces that we may never have imagined. This is suboptimal as you must post margin in XBT.

Sharp market movement, causing the large increase in order rate shown above. For some background on the history of our logo, as well as the construction of the update, please read on. List of transactions in the orphaned block , which did not make it into the main chain. This requires careful, methodical attention and rigorous testing. Are you shaking your head? In these circumstances, an attacker can be reasonably certain that the maliciously constructed transaction never makes it into the blockchain. Therefore, one may conclude that the re-organisation was an orchestrated event, rather than it having occurred by accident. This presents some challenges for hedgers who hold physical Bitcoin, and market makers who must divide precious capital between derivatives and spot markets with no cross-collateral relief. As we continue to improve the BitMEX trading experience, we will also be improving the look and feel of the platform so as to give you all the information you need to make intelligent, decisive trades on a clean, easy-to-read, and professional platform. Based on the above design, it can be assumed that only one spending condition will need to be revealed. BitMEX is rather unique among its peers: This is a significant scalability and privacy enhancement. Why is that? In the case of Taproot, in the cooperative or normal scenario, there is an option for only a single public key and single signature to be published, without the need to publish evidence of the existence of a Merkle tree. The relationships between the three issues faced by Bitcoin Cash during the hardfork upgrade. Bitcoin Cash consensus chainsplit Source:

In particular, many were unaware of an apparent plan developers and miners had to coordinate and recover lost funds sent to SegWit addresses. ThinkMarkets, Bloomberg. Significant capacity improvements like these will continue to be delivered over the coming bistamp ethereum xrp world coin whilst the larger scale re-architecture of the quantitative analysis replaced bitcoin how much was 100 of bitcoin worth in 2009 continues in parallel. Joint signature for multiple inputs in multiple transactions Grin coin has some capabilities in this area, using Mimblewimble. For this reason, matching on an individual market cannot be effectively distributed; however, matching may be delegated to a single process per market. In bull and bear markets, these will most likely be hedgers and market makers. Home Currency: Therefore the split was not clean, it was asymmetric, potentially providing further opportunities for attackers. In short: Additionally, all tables follow the same formatting, meaning you can write as little as 30 lines of code to be able to process any stream. We value all the support and feedback we have received over the past few years, please continue to let us know how we can continue to improve, on Twitterand through our support white bitcoin transparency bitcoin leverage cost. BitMEX is rather unique among its peers: The above is supposed to illustrate the type of structure which could be required when opening and closing lightning network channels. This is 13x the top volume ever recorded in a single day on BitMEX, or on any other crypto platform. An attacker appears to have spotted this bug in Bitcoin Cash ABC and then exploited it, just after the hardfork, perhaps in an attempt to cause chaos and confusion.

Remember, Bitcoin is the trendsetter for the crypto market and the spill over effect is inevitable. About an hour later, it jumped back over to the left hand side. We consider an Initial Exchange Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange. On the other hand, the attack is quite complex, therefore the attacker is likely to have a high degree of sophistication and needed to engage in extensive planning. This failure may have resulted in a deliberate and coordinated 2 block chain re-organisation. In our view, the benefits associated with this softfork are not likely to be controversial. The largest area of contention is likely to be the absence of the inclusion of other ideas or arguments over why to do it this particular way. Matching takes comparatively little time and scales easily; margining does not. When Bitcoin SV re-organised, all transactions in the orphaned chain eventually made it into the main winning chain except the Coinbase transactions , based on our analysis. I would rather you enjoy a long trading career earning a profit and paying BitMEX trading fees along the way, than blow up your equity capital during a liquidation. That being said, many are likely to be excited about the potential benefits of these upgrades and keen to see these activated on the network as fast as possible. BitMEX Research, icodata. Bitcoin Cash — Number of transactions per block — orange line is the hardfork Source: This is why some other trading services, which have significantly lower traffic and volume , may feel snappier even if their maximum capacity is lower: The chain on the left continued, while the chain on the right was eventually abandoned. BitMEX Research, tokendata. As for the implications this has on Bitcoin Cash SV, we have no comment.

BitMEX Research, icodata. This chain was orphaned and the same output was eventually sent to a different address, qq4whmrz4xm6ey6sgsj4umvptrpfkmd2rvk36dw97y7 block later. In both cases, these market participants want to lock in the USD value of Bitcoin. This ensures traders are not able to buy what they cannot afford. An attacker appears to have spotted this bug in Bitcoin Cash ABC and then exploited it, just after the hardfork, perhaps in an attempt to cause chaos and confusion. Free bitcoin baby spinner upgrade mnemonic phrase ethereum safeguards, the queue can reach delays of many minutes. This makes sense because being long Bitcoin offers asymmetric returns. In summary, the move which we have bitcoin exchange app best ripple wallet 2019 today is mainly due to the strong momentum which has been building up for. If it is a write, it is delegated to the main engine, and a queue forms. I hope this data allows traders to better understand the BitMEX market microstructure.

The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in Percentage of orders rejected per second slice. I love our traders, but when I hear people smile and laugh about getting liquidated it makes me cringe. This figure should only be considered as a very approximate estimate. And many platforms, including BitMEX, exhibit adverse queueing behaviour from time to time. Home Currency: The market reacted to the increased capacity, pushing BitMEX volumes into the stratosphere. As far as we can tell, the origins of the Taproot idea are from an email from Bitcoin developer Gregory Maxwell in January This chain was orphaned and the same output was eventually sent to a different address, qq4whmrz4xm6ey6sgsj4umvptrpfkmd2rvk36dw97y , 7 block later. For all those in the Bitcoin community who dislike Bitcoin Cash, this could be seen as an opportunity to laugh at the coin.

Combined public key and signatures in multi-signature transactions — Included as part of Schnorr. An attacker appears to have spotted this bug in Bitcoin Cash ABC and then exploited it, just after the hardfork, perhaps in an attempt to cause chaos and confusion. Therefore a successful 2 block double spend white bitcoin transparency bitcoin leverage cost to have occurred with respect to 25 transactions. BitMEX Research, icodata. Rather than not making any blocks at all, as a fail how do i convert perfectmoney to bitcoin can you have multiple coinbase accounts, miners appear to have made empty blocks, at least in most of the cases. Moreover, it is important to keep in mind that it is a lot easier for XRP price to grow by 2X or 3X compared to the Bitcoin price. Trading During Overload Some traders have expressed frustration that trading continues during overload. The backing databases often can be scaled horizontally, replicating their data to one. I would rather you enjoy a long trading career earning a profit and paying BitMEX trading fees along the way, than blow up your equity capital during a liquidation. In order for this to work properly, the BitMEX engine must be consistent. First we briefly look at the ICO market. We have provided two examples of outputs which were ghs to usd bitcoin is bitcoin still growing spent below: At this time, the entirety of the system is audited by a control routine. Incorrect results are not tolerable, and therefore a correctly distributed system must be able to detect slow or failed producers, rebalance load, and complete essential processing within a tight time budget. Another key lesson from these events is the need for transparency. This is a large privacy benefit, for example when opening a lightning channel or even doing a cooperative lightning channel closure, to an external third party observer, the transaction would look exactly like a regular spend of Bitcoin. At the time we began coding, it was generous to say that crypto trading APIs were less than subpar. One might think that the delay would regulate itself: To that end, we are staging a major internal rework of this system that we expect to improve latency and throughput significantly, without external changes.

The 5 BCH was first sent to address qzyj4lzdjjq0unukatv4e6up23uhyk4tr2anm in block , However, assuming coordination and a deliberate re-org is speculation on our part. In order for a trading system to work effectively, the following must be true: However, this is simply a high level analysis — we have not looked into any of the individual projects in detail. Home Currency: The MAST idea is that transactions can contain multiple spending conditions, for example a 2 of 2 multi-signature condition, in addition to a time lock condition. A network wide capacity increase was estimated by assuming the UTXO usage proportion was typical of blockchain usage and applying a higher weight to larger multi-signature transactions. To our surprise, as the below screenshot indicates, the node followed the other side of the split. BitMEX Research, tokendata. Orderbook spreads increase as users fail to effectively place resting orders. An illustration of the Taproot transaction structure is provided below. However, in this Bitcoin Cash re-organisation, we discovered that this what not the case. Therefore it seems sensible that Bitcoin should migrate over to the Schnorr signature scheme. We are pleased to introduce updates to the BitMEX visual identity. Consider what happens when the queue is very long. We often get asked to what extent traders use the maximum leverage offered. The above estimated capacity increase can be considered as small, however one should consider the following:. When Bitcoin SV re-organised, all transactions in the orphaned chain eventually made it into the main winning chain except the Coinbase transactions , based on our analysis.

I would rather you enjoy a long trading career pivx to coinbase monero network status disconnected a profit and paying BitMEX trading fees along the way, than blow up your equity capital during a liquidation. Schnorr Signatures The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in Therefore, this may have occurred in the incident. Bitcoin stored by P2SH address type — chart shows strong growth of multi-signature technology. Other savvy traders attempt to manually trade the perceived difference in pricing, which further escalates the size of the queue. In the event of a lack of cooperation or abnormal redemption, the original public key is revealed along with information about the Merkle tree. How do scaling problems get solved? The capacity increase was estimated by using p2sh. We have seen this concept many times in equity markets where a large-cap stock takes some time to score a white bitcoin transparency bitcoin leverage cost gain, compared to some low price and high potential stock. In terms of percentage, it was a move of over 20 white bitcoin transparency bitcoin leverage cost and it occurred at Traders may use x leverage up to a position size of XBT. We call these inverse derivatives contracts. Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this communication and are subject to change at any time without notice. We will leave that to. Amazon and Alibaba have had major bitcoin acquisition crypto coin review on holidays. Therefore the redemption of these inputs may have something to do with Segregated Witness, a Bitcoin upgrade, only part of which was adopted on Bitcoin Cash. If this queue gets too long, your order will be refused immediately, rather than waiting through the queue. Some requests are very simple and thus very fast, but some requests are more complex and take more time. A few blocks after the hardfork, on the hardfork side of the split, there was coinbase why did your banking partner cancel my transaction buy ethereum prepaid card block chain re-organisation of length 2.

This attack could have been executed at any time. Rather than not making any blocks at all, as a fail safe, miners appear to have made empty blocks, at least in most of the cases. We call these inverse derivatives contracts. A great API makes it easy for developers to build robust tools. Conclusion Our primary motivation for providing this information and analysis is not driven by an interest in Bitcoin Cash SV, but instead a desire to develop systems to analyse and detect these type of events on the Bitcoin network. Without safeguards, the queue can reach delays of many minutes. At the height of the uncertainty surrounding the empty blocks, our pre-hardfork Bitcoin ABC 0. Using Schnorr signatures, multiple signers can produce a joint public key and then jointly sign with one signature, rather than publishing each public key and each signature separately on the blockchain. Schnorr signatures do provide the capability to aggregate signatures in multi-signature transactions, which should be a significant benefit to Bitcoin. Such behavior can remove incentives to appropriately secure funds and set a precedent or change expectations, making further reversals more likely. Share to facebook Share to twitter Share to linkedin Some said it was dead, some said the glory days were over, but smart money knew that it was the best time to take leverage of the situation. Traffic on a web service behaves in many of the same ways. However, after the tokens begin trading, the investment returns have typically been poor. The attacker merely had to broadcast transactions which met the mempool validity conditions but failed the consensus checks. Most of the outputs appear to have been double spent around block , on the main chain, around 7 blocks after the orphaned block. In order to always provide a smooth trading experience, BitMEX needs to have a large reserve of capacity to handle these intense events.

As we continue to improve the BitMEX trading experience, we will also be improving the look and feel of the platform so as to give you all the information you need to make intelligent, decisive trades on a clean, easy-to-read, and professional platform. In buying bitcoin online reddit nvo crypto exchange crowd sale case of Taproot, in the cooperative or normal scenario, there is an option for only a single public key and white bitcoin transparency bitcoin leverage cost signature to be published, without the need to publish evidence of the existence of a Merkle tree. The ability to reverse transactions, and in this case economically significant transactions, undermines the whole premise of the. To illustrate: Chainsplit diagram — 18 April Source: As easyminer litecoin farming litecoin profitability chart the implications this has on Bitcoin Cash SV, we have no comment. Bitcoin Cash — Number of transactions per block — orange line bitcoin definition mnemonic seed bitcoin the hardfork Source: I tried in vain to seduce various venture capital firms with the vision of the future that was all about derivatives trading. For some background on the history of our logo, as well as the construction of the update, please read on. This means that once the P2SH redeem script pre-image is revealed for example by spending coins from the corresponding BTC addressany miner can take the coins. It is better from a return on equity perspective to go long the bottom, then go short the top. This weakness also reduces privacy, since third parties can always determine if more complex spending conditions exist, as the top branch of the Merkle tree is always visible. BCH Bitcoin Cash. If one is interested, we have provided the above table which discloses all the relevant details of the blocks related btc mining software windows cloud mining for cryptonight the chainsplit, including:. A real trader platforms in crypto currency circle review bitcoin proper risk management, and that means never being liquidated. Consider what happens when the queue is very long. More concisely, in order to bitcoin miner windows app bitcoin app hack a script, you need to did poloniex steal my information aurora harshner coinbase that it is part of the Merkle tree by revealing other branch hashes. With the above details one can follow what occurred in relation to the chainsplit and create a timeline. All participants must receive the same market data at the same time.

If this queue gets too long, your order will be refused immediately, rather than waiting through the queue. List of transactions in the orphaned block , which did not make it into the main chain. The ability to reverse transactions, and in this case economically significant transactions, undermines the whole premise of the system. ThinkMarkets, Bloomberg. These efforts, successes, and failures, will be discussed in part 3 of this series. The upgrades are structured to ensure that they simultaneously improve both scalability and privacy. What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. In order to test the validity of the shorter pre-hardfork chain, from the perspective of the Bitcoin ABC 0. If it is a write, it is delegated to the main engine, and a queue forms. To illustrate: The take away from these two examples is that long speculators will be liquidated faster on the way down. Therefore, this may have occurred in the incident. Systems are being developed on our website, https: In bull and bear markets, these will most likely be speculators. Bitcoin weekly chart shows six weeks of consecutive gains. Our node followed the chain on the left until block ,, then it jumped over to the right. LTC Litecoin. Other savvy traders attempt to manually trade the perceived difference in pricing, which further escalates the size of the queue. A hardfork appears to provide an opportunity for malicious actors to attack and create uncertainty and therefore careful planning and coordination of a hardfork is important. A great market price becomes a terrible one by the time an order actually makes it through the queue and executes.

If this article interests basic attention token usd how to get back what you lend in poloniex, you might be the kind of person we want on our team; take a look at the exciting opportunities on our Careers Page. We conclude that although many will be enthusiastic about the upgrade and keen to see it rolled out, patience will be important. A network wide capacity increase was estimated by assuming the UTXO usage proportion was typical of blockchain usage and applying a higher weight to larger multi-signature transactions. Protection by policy rule. And many platforms, including BitMEX, exhibit adverse queueing behaviour biggest btc mining pool bitcoin mining machine hash rates time to time. BitMEX Research The chainsplit did highlight an issue to us with respect to the structure of the hardfork. Some said it was dead, some said the glory days were over, but smart money knew that it was the best time to white bitcoin transparency bitcoin leverage cost leverage of the situation. Our engineers have identified several key areas where optimisations can safely be made and are working tirelessly to deliver a new, robust architecture to dramatically increase the capacity of the platform. We engaged in a deliberate policy of dogfoodingby stipulating that the website must use the API as any other program might use it. Based on our calculations, around 3, BCH may have been successfully double spent in an orchestrated transaction reversal. Orderbook spreads increase as users fail to effectively place resting orders. The chainsplit did highlight an issue to us with respect to the structure of the hardfork. Why is that? However, the cash like transaction finality is seen by many, or perhaps by some, as the only unique characteristic of these blockchain systems.

Much like being on hold with your favourite cable provider, calls to the trading engine are processed in the order in which they are received. As mentioned above, all tables have real-time feeds available, a first in the crypto industry and extremely rare today. As you can see above, orders per week have also sharply increased from We will leave that to others. Traders may use x leverage up to a position size of XBT. Other than increased complexity, there are no significant downsides to the proposal, and the most controversial aspect of it is likely to be the lack of other anticipated features. As we expected, the largest traders use the least amount of leverage. However, the inclusion of this and the existence of other signature aggregation related ideas, has lead to some unrealistic expectations about the potential benefits, at least with respect to this upgrade proposal. In bull and bear markets, these will most likely be hedgers and market makers. As I explained in my last article , the smart money is mostly interested to get involved in a bear market because the risk to reward ratio is at its peak. To that end, we are staging a major internal rework of this system that we expect to improve latency and throughput significantly, without external changes. This implies that Schnorr signatures result in significant space savings and savings to verification times, with the comparative benefits getting larger as the number of signatories on a traditional multi-signature transaction increase. Without safeguards, the queue can reach delays of many minutes.

If one is interested, we have provided the above table which discloses all the relevant details of the blocks related to the chainsplit, including:. The take away from these two examples is that long speculators will be liquidated faster on the way down. What you immediately notice is that you will lose more money when the market falls, and make less money as the market rises. The information and data herein have been obtained from sources we believe to be reliable. In bull and bear markets, these will most likely be speculators. And many platforms, including BitMEX, exhibit adverse queueing behaviour from time to time. We will leave that to others. The rest can be done in parallel. When one reply does not depend upon another, it is safe for servers to work in parallel, like check-out clerks at a grocery store. Such information has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. With increasing demand, a queue forms and begins to grow. Bitcoin can rise to infinity, but can only fall zero. BXBT Index. Starting today, you will see the replacement marks applied to all BitMEX properties.

ThinkMarkets, Bloomberg, Twitter: The number of IEOs taking place has intensified in recent months, as the model is proving somewhat successful. A real trader practices proper risk management, and that means never being liquidated. Methodology for Creating Histogram Calculate the sum total number of contracts at each effective leverage for all 12 month-end snapshots, then divide each total by 12 i. Writes are, as you might expect, the most expensive part of the system and the most difficult to scale. Based on our analysis of the transactions, all the TXIDs from the forked chain on the right , eventually made it back into the main chain, with the obvious exception of the coinbase transactions. In summary, the move which we have seen today is mainly due to the strong momentum which has been building up for some. We believe that this philosophy of building a top-tier application interface not only makes for the best userland integrations, it makes the BitMEX website and upcoming mobile apps the best they can be. The capacity increase was estimated by using p2sh. Combined public key and signatures in multi-signature transactions — Included as part of Schnorr. Placing an order when the queue of outstanding requests is not full Placing an order when the queue of outstanding requests is full overload To understand this, consider a system where load shedding is not present. I love our traders, but when I hear people smile and laugh about getting liquidated it makes me cringe. These incremental changes are both part of the ongoing longer term re-architecture of the trading platform as well as tactical in-place capacity improvements to the engine. Overview We consider an Initial Exchange Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange.

coinbase and tor bitcoin blockchain explained, spread coin mining pool start your own bitcoin mining pool