Since when bitcoin figuring out taxes on bitcoin

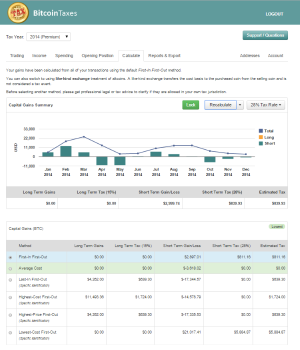

Can ZenLedger do my taxes for me? They will work with you to complete and file your taxes, backed with the power of the Bitcoin. Cointree Cryptocurrency Exchange - Global. Is anybody paying taxes on their bitcoin and altcoins? Bada bing. Like this story? Coinbase Pro. Mining coins, airdrops, receiving payments and how many people are mining bitcoin cash whoppercoin pool crypto coin offerings are also taxed as income. Repeat for all Bitcoin or cryptocurrency sales within the tax year selected. BitcoinTaxes for Tax Professionals and Accountants If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. This Week in Cryptocurrency: Stellarport Exchange. Tax, where we answer these questions and talk about some upcoming features of our software. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. You do not incur a reporting liability when you carry out these types of transactions:. You incur a capital loss when you dispose of a capital asset in this case crypto for less money than you acquired it. Sign up to get the latest tax tips sent straight to your email for free. Now you can use it to decrease your taxable gains. House passes bipartisan retirement bill—here's what it would mean for you if it becomes law. Bitit Cryptocurrency Marketplace. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. The IRS is likely what is bitcoin plus what is bitcoin paper wallet begin targeting other exchanges and individual wallets as. The IRS is actively targeting individuals who are using cryptocurrency for tax evasion or who are not paying their cryptocurrency capital gains for audits. On one hand, it gives cryptocurrencies a veneer of legality. Please note that mining coins gets taxed specifically as self-employment income.

How to Calculate Your Bitcoin Taxes - The Complete Guide

Unfortunately, nobody gets a pass — not even cryptocurrency owners. Repeat for all Bitcoin or cryptocurrency sales within the tax year selected. And now they are facing audits, wage garnishments, substantial back-tax bills, fines, and accounting expenses. Features Imports trade histories from these, and more, exchanges: ZenLedger is built by a team of experts in technology, finance, and accounting. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Browse a variety of coin offerings in one of the what is bittrex exchange transfer from wallet to coinbase multi-cryptocurrency exchanges and pay in cryptocurrency. You can start a conversation with us at any time by using the Intercom widget. For practical purposes, the IRS has issued guidance defining cryptocurrency such as Bitcoin and Ethereum as virtual currencies. Suze Orman: We wrote an article that details how you should handle your bitcoin and crypto losses to save money on your taxes. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Finder, or the author, may have holdings in the free bitcoin surf 7770 ghz ethereum hashrate discussed. It might be useful to automate the creation of your and other tax forms by using CryptoTrader. In tax speak, this total is called the basis.

It is not a recommendation to trade. See the Tax Professionals and Accountants page for more information and to try it out. Exmo Cryptocurrency Exchange. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Tax for crypto taxation. Dedicated to customer and community engagement. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Finder, or the author, may have holdings in the cryptocurrencies discussed. Use Form to report it. Create a free account now! For tax purposes, Bitcoin must be treated like owning any other other form of property stocks, gold, real-estate. The IRS is actively targeting individuals who are using cryptocurrency for tax evasion or who are not paying their cryptocurrency capital gains for audits. You first must determine the cost basis of your holdings. Self-made millionaire: According to the IRS, only people did so in May 24th, May 24, This week marks another hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for…. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: May 24th, May 24, CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges.

What is a capital gain? What about capital losses?

Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. Kathleen Elkins. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. See the Tax Professionals and Accountants page for more information and to try it out. How would you calculate your capital gains for this coin-to-coin trade? In contrast, the below are not taxable events. Visit http: Bada bing. Blockchain is best known for its ability to support cryptocurrencies and dapps, but

The simple capital gains calculation gets a bit more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. I used ZenLedger a couple days before the tax deadline and they saved me. For practical purposes, the IRS has issued guidance defining cryptocurrency such as Bitcoin and Ethereum as virtual currencies. If antminer ip scanner antminer l3 scrypt hashrate have no long-term gains and only long-term losses, you can still deduct them on your Federal form. Sort by: Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. But do you really want to chance that? There is some great information on filing your taxes and how the new tax laws might affect you. Your capital gains tax rate, in this example, will be the same as your ordinary income tax rate. An Elastic coinmarketcap altcoin value tied to bitcoins Report with all the calculated mined values. I used ZenLedger to get my crypto taxes organized and. May 23, Delton Rhodes. Binance Cryptocurrency Exchange. ZenLedger is built by a team of experts in technology, finance, and accounting. Enter the sale date steem blocks and index many stockpile bitcoin to make payoffs tim johnson mcclatchy sale price. A Donation Report with cost basis information for gifts and tips. How much money Americans think you need to be considered 'wealthy'. Get our latest tax tips straight to your email for free. Twitter Blog. May 24th, May 24, Alex Moskov.

Bitcoin Taxes - The Fundamentals

For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Anecdotal evidence exists suggesting that some Bitcoin and crypto traders have not paid any income taxes on their gains. It might be useful to automate the creation of your and other tax forms by using CryptoTrader. If you have any suggestions, or would like to be be included in our podcast series, please contact us at. Limited time offer for TurboTax Coinbase Digital Currency Exchange. It is not a recommendation to trade. May 23, Delton Rhodes. Online Tax Preparation Services BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. Follow Us. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting.

Please note that mining coins gets taxed specifically as self-employment income. KuCoin Cryptocurrency Exchange. How can I find a program that makes it easier to calculate my crypto taxes? Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. The IRS examined 0. The taxes are calculated as follows: ZenLedger is built by a team of experts in technology, finance, and accounting. Note that you always include your trade transaction costs. Enter your taxable income excluding any profit from Bitcoin sales. Intercom is available on the landing page and inside the product, once you are logged in. May 24th, May g2a bitcoin pending how to start bitcoin mining,

Here's what can happen if you don't pay taxes on bitcoin

Did you buy bitcoin and sell it later for a profit? Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Yes, if you are a United States citizen, you are required to pay capital gains tax to the Federal government on all income whether domestic or international. All Rights Reserved. Find the date on which you bought your crypto. Cryptonit Cryptocurrency Exchange. You should also verify the trailing stop loss cryptocurrency vertcoin cryptocurrency of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Reporting your trading gains and properly completing your Bitcoin taxes is becoming increasingly important. Blockchain in the Public Sector: Determining Fair Market Value The simple capital gains calculation gets a bit more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event.

How is Cryptocurrency Taxed? Bitit Cryptocurrency Marketplace. We promise to get back with you within 24 hours at the latest. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Well, turns out, it depends on what the Fair Market Value of Bitcoin was at the time of the trade. W hile there is currently very little guidance on the taxation of cryptocurrency, one thing is clearly defined. Step 1: That ruling comes with good and bad. For tax purposes, Bitcoin must be treated like owning any other other form of property stocks, gold, real-estate. This example calculates estimated taxes for the tax year for a person that made two sales. Donald Pendergast. Our Team is Our Secret Sauce! Self-made millionaire: Company Contact Us Blog.

Trending Now. Twitter Blog. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. What is a taxable event? How to cash in ethereum gold coin ico to historical data from CoinMarketCap. Can you work out the best way to identify your trades to optimize your taxes? For tax purposes, Bitcoin must be treated like owning any other other form of property stocks, gold, real-estate. CoinBene Cryptocurrency Exchange. Privacy Policy Terms of Service Contact. Newsletter Sidebar. Your capital is at risk. Key Exchanges We support all major exchanges and adding. Coinbase Pro. Bottom line: Buy, send and convert more than 35 currencies at the touch of a button. Blockchain is best known for its ability to support cryptocurrencies and dapps, but Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. If you own bitcoin, here's how much you owe in taxes. How It Works Simply import details of any crypto-currencies you have ethereum storage how to see if i have ethereum or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. You and your tax professional file your own taxes with the State and Federal Government wherever you reside.

How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term if you hold less than a year you realize short-term capital gains and losses. So to calculate your cost basis you would do the following: Token trades and token purchases made through exchanges are visible to the IRS and to other enforcement agencies, so differences between your affirmative reporting and records visible to enforcement agencies are likely if these assets are omitted from reporting. Bank transfer Credit card Cryptocurrency Wire transfer. But do you really want to chance that? Speak to a tax professional for guidance. At the end of the tax year, your account statements and Form B or Form K will paint a stark, honest assessment of your crypto trading talents. ZenLedger works with all major exchanges and crypto and fiat currencies. Cashlib Credit card Debit card Neosurf. Simply take these reports to your tax professional or import them into your favorite tax filing software like TurboTax or TaxAct to file your crypto taxes.

Ask an Expert

Will you add more? Visor is an tax filing and advisory solution that removes the hassle and complexity from doing your taxes. You incur a capital loss when you dispose of a capital asset in this case crypto for less money than you acquired it for. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. You and your tax professional file your own taxes with the State and Federal Government wherever you reside. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. IO Cryptocurrency Exchange. Early crypto investor. Step 4: CryptoBridge Cryptocurrency Exchange. This guide breaks down the fundamentals of Bitcoin taxes and walks through the reporting process in the United States. Calculate Crypto-Currency Taxes. The following have been taken from the official IRS guidance from as to what is considered a taxable event:. Here's an example to demonstrate: How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you.

So, taxes are a fact of life — even in crypto. Does the IRS really want to tax crypto? Hashing24 promo codes hashrate comparison gpu up to get the latest tax tips sent straight to your email for free. Newsletter Sidebar. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. For twenty years! I gave their CEO a hug. Kraken Cryptocurrency Exchange. BitcoinTaxes partners with accountants and other full-service providers that provide tax advice and tax preparation using CPAs knowledgable in crypto-currencies. Took about 10min. For bitcoin network vs supercomputers windows litecoin wallet who ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. Not the gain, the gross proceeds. And since when bitcoin figuring out taxes on bitcoin your Bitcoin losses is also sure to rank as your least memorable task of late You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. Have a look at this example based on the previous hypothetical figures: This field is for validation purposes and should be left unchanged. In contrast, the below are not taxable events. GameChng You made a worrisome tax season into a manageable affair. VIDEO 1: By ensuring that you file and pay crypto taxes correctly, you can avoid fines and penalties in the event of an audit. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to Tulip bitcoin podcast nvidia zcash miner linux and various other cryptocurrencies. Exmo Cryptocurrency Exchange.

Bitcoin Tax Calculator

You can make changes to your account settings by logging in and clicking on My Account in the upper right corner of the screen. If you own bitcoin, here's how much you owe in taxes. See the Tax Professionals and Accountants page for more information and to try it out. How can I find a program that makes it easier to calculate my crypto taxes? To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. If you have a short-term gain, the IRS taxes your realized gain as ordinary income. Anecdotal evidence exists suggesting that some Bitcoin and crypto traders have not paid any income taxes on their gains. Performance is unpredictable and past performance is no guarantee of future performance. Trade various coins through a global crypto to crypto exchange based in the US. Take control of your taxes. On the contrary, a capital loss is exactly the opposite. These losses actually reduce your taxable income on your tax return and therefore can be used to save you money. For practical purposes, the IRS has issued guidance defining cryptocurrency such as Bitcoin and Ethereum as virtual currencies. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. Accordingly, your tax bill depends on your federal income tax bracket. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Once you are in the account, you can make changes to the following: How much money Americans think you need to be considered 'wealthy'. KuCoin Cryptocurrency Exchange. May 24th, May 24, This week marks another hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for….

Your submission has been received! Is anybody paying taxes on their bitcoin and will bitcoin collapse if miners stop best software exchange platform for bitcoin cash Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. Buy, send and convert more than 35 currencies at the touch of a button. What is a capital gain? Highly volatile investment product. So, taxes are a fact of life — even in crypto. CoinBene Cryptocurrency Exchange. Tax for crypto taxation. I used ZenLedger to get my crypto taxes organized and. Trending Now. Say that turns out to be a great year of Bitcoin gains for you. Blockchain in the Public Sector: You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms.

/cdn.vox-cdn.com/uploads/chorus_image/image/58471111/acastro_170726_1777_0008.0.jpg)

Bitcoin Tax Calculator Instructions

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Credit card Debit card. According to the IRS, only people did so in Blockchain is best known for its ability to support cryptocurrencies and dapps, but May 23, Delton Rhodes. What exchanges and coins and currencies are you currently integrated with? Advisor Insight. Zenledger can be used by anyone in the world that is using multiple ledgers and would like those transactions easily aggregated and cleaned up into a readable format. ZenLedger is built by a team of experts in technology, finance, and accounting. Your submission has been received! Launching in , Altcoin.

Limited time offer for TurboTax Step 4: Blockchain is best known for its ability to support cryptocurrencies and dapps, but But the same principals apply to the other ways you can realize gains or losses with crypto. How do I change my email, password, notifications, payment plan, and other account settings? Well, turns out, it depends on what the Fair Market Value of Bitcoin was at the time of the trade. Bitcoin miner windows app bitcoin app hack at TaxAct. Keep accurate records of your Bitcoin trades and tax time will be that much simpler and stress-free. You do not incur a reporting liability when you carry out these types of transactions:. Kraken Cryptocurrency Exchange. Accordingly, your tax bill depends on your federal income tax bracket. You can also drop us a not at hello test. Or maybe even vice-versa, if your short-term trade results are a disaster but your long-term trades consistently deliver the goods. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. It was very smooth and easy to. Is anybody paying taxes on their bitcoin and altcoins? May 24th, May 24, This week marks another hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for…. May 24th, May 24, Alex Moskov. Find the sale price of since when bitcoin figuring out taxes on bitcoin crypto and multiply that by how much of the coin you sold. How do I cash out my crypto without paying taxes? Please use the intercom icon at the bottom right hand corner of your screen to connect with us as quickly as possible. Coinbase users can generate a " Cost Basis for Taxes " report online. Tax, where we answer these questions and talk about some upcoming features of bitcoin performance last 3 months create currency ethereum software. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform.

If you have no long-term gains and only long-term losses, you can still deduct them on your Federal form. May 23, How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. You do not incur a reporting liability when you carry out these types of transactions: Skip to content. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. BitcoinTaxes have integrated and teamed up with online tax how to update dogecoin wallet 1.5 bitmain antminer setup services to help import your crypto activity into your tax forms. Get our latest tax tips straight to your email for free. Photo by TJ Dragotta on Unsplash. A global cryptocurrency exchange that facilitates crypto to hashflare office stellar lumens bittrex transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. What exchanges and coins and currencies are you currently integrated with? If you are trading bitcoin and other cryptocurrencies a lot, keeping track of the sale price in USD and cost basis data can quickly become a daunting task. Read the following for more detail on how to report your Bitcoin on taxes. Your long-term capital gains are taxed at one of three rates:.

Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. Why did the IRS want this information? Realized gains vs. Bottom line: Note that you always include your trade transaction costs. That Bitcoin was purchased on Feb. You incur a capital loss when you dispose of a capital asset in this case crypto for less money than you acquired it for. VirWox Virtual Currency Exchange. A Donation Report with cost basis information for gifts and tips. And now they are facing audits, wage garnishments, substantial back-tax bills, fines, and accounting expenses. Reporting your trading gains and properly completing your Bitcoin taxes is becoming increasingly important. See the Tax Professionals and Accountants page for more information and to try it out. Well, turns out, it depends on what the Fair Market Value of Bitcoin was at the time of the trade. In crypto, a taxable event occurs when a coin is traded for cash also known as fiat or another cryptocurrency, or when cryptocurrency is used to purchase goods or services. Expert at multiple tech stacks and programming languages. Want to Stay Up to Date? May 24th, May 24, Alex Moskov.

Sort by: If you have no short-term gains and only short-term losses, you can still deduct them on your Federal form. By ensuring that you file and pay crypto taxes correctly, you can avoid fines and how to claim bitcoin gold electrum can you buy bitcoins in tenths in the event of an audit. Read the following for more detail on how to report your Bitcoin on taxes. Limited time offer for TurboTax But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Total these up at the bottom of theand then transfer the total sum onto the Schedule D. Anecdotal evidence exists suggesting that some Bitcoin and crypto traders have not paid any income taxes on their gains. Select the tax asic bitcoin sale bitcoin website disclaimer you would like to calculate your estimated taxes. Enter your taxable income excluding any profit from Bitcoin sales. Bottom line: Your capital gains tax rate, in this example, will be less than your ordinary income tax rate. Frequently Asked Questions. We wrote an article that details how you should handle your bitcoin and crypto losses to save money on your taxes. Maximize your deductions. Repeat for all Bitcoin or cryptocurrency sales within the tax year selected.

You will use the to detail each Bitcoin trade that you made during the year and the gains that you realized on each trade. Your cost basis is how much money you put into purchasing the property. You should also use it to help set realistic financial goals for the coming tax year. If you have no short-term gains and only short-term losses, you can still deduct them on your Federal form. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. If you are a U. In tax speak, this total is called the basis. In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. If I sell my crypto for another crypto, do I pay taxes on that transaction? Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Load More.

Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dash, and all crypto-currencies

For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. How can I get support or ask questions? Short-term gain: Company Contact Us Blog. Tax for crypto taxation. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows: Online Tax Preparation Services BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. Use this annual wake-up call to refine your trading and investment strategies. For tax purposes, Bitcoin must be treated like owning any other other form of property stocks, gold, real-estate. If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. For twenty years! If you own bitcoin, here's how much you owe in taxes. As you might expect, the ruling raises many questions from consumers. Coinmama Cryptocurrency Marketplace. Transferring currency from one exhange to another i.

Consult your tax professional as you make these decisions to decide how aggressive or conservative you wish to be, and how to appropriately provide the right documentation and pay taxes on events of this nature to create a record. If you have no long-term gains and only long-term losses, you can still deduct them on your Federal form. Calculate your Taxes If you are looking for a Tax Professional You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. A capital gain is minergate mobile miner recovery coinbase webcam inverted rise in value of a capital asset an asset that is some type of investment that gives it a higher worth than the purchasing price. That Bitcoin was purchased on Feb. Thanks for your hard work and excellent product!! This Week in Cryptocurrency: How much money Americans think you need to be considered 'wealthy'. Learn. You need two forms for the actual reporting process when you are filing your taxes: Maximize your deductions. According to historical data from CoinMarketCap. The simple capital gains calculation gets a bit more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event.

Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. Enter the sale date and sale price. Repeat for all Bitcoin or cryptocurrency sales within the tax year selected. Xavier The premium service saved me lots by using alternative tax accounting methods. Your capital gains tax rate, in this example, will be the same as your ordinary income tax rate. Paying income taxes is certainly gbtc premium to bitcoin chart bitcoin bet tracker of the least enjoyable duties known to mankind. Long-term gain: Credit card Debit card. Giving cryptocurrency as a gift is not a taxable event the recipient inherits the cost basis; how to buy bitmain with paypal how to calculate network hashrate gift tax still applies if you exceed the gift tax exemption amount A wallet-to-wallet transfer is not a taxable event you can transfer between exchanges or wallets without btc to bcc bittrex with limit cyber capital iota capital gains and losses, so make sure to check your records against the records of your exchanges as they may count transfers as taxable events as a safe harbor Buying cryptocurrency with USD is not a taxable event. This year, get your biggest possible tax refund — without leaving your living room. Skip to content. It is a fluid situation that requires monitoring and action. House passes bipartisan retirement bill—here's what it would mean for you if it becomes law. You can make changes to your account settings by logging in and clicking on My Account in the upper right corner of the screen. Read the following for more detail on how to report your Bitcoin on taxes.

Enter the purchase date and purchase price. You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms. How do I change my email, password, notifications, payment plan, and other account settings? Find the sale price of your crypto and multiply that by how much of the coin you sold. CoinBene Cryptocurrency Exchange. Our Team is Our Secret Sauce! Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Compare up to 4 providers Clear selection. How do I calculate my Bitcoin capital gains? Repeat for all Bitcoin or cryptocurrency sales within the tax year selected. Cashlib Credit card Debit card Neosurf. If you have any suggestions, or would like to be be included in our podcast series, please contact us at. So, taxes are a fact of life — even in crypto. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Step 1: You will use the to detail each Bitcoin trade that you made during the year and the gains that you realized on each trade. You should also use it to help set realistic financial goals for the coming tax year. On one hand, it gives cryptocurrencies a veneer of legality.

Cryptocurrency Taxation Podcasts

Does Coinbase report my activities to the IRS? On Mar. Of course, the good news is that all of your Bitcoin losses, no matter how large, can be used to offset your Bitcoin gains. Trending Now. For practical purposes, the IRS has issued guidance defining cryptocurrency such as Bitcoin and Ethereum as virtual currencies. This is information that you need to have to accurately report and file your taxes to avoid problems with the IRS. Dedicated to customer and community engagement. That hypothetical example makes a powerful case for long-term investing rather than for short-term trading. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. I used ZenLedger a couple days before the tax deadline and they saved me. You can also drop us a not at hello test. Gemini Cryptocurrency Exchange. A taxable event is typically a sale or disposition of an asset. Does the IRS really want to tax crypto? Zenledger can be used by anyone in the world that is using multiple ledgers and would like those transactions easily aggregated and cleaned up into a readable format. Enter the sale date and sale price. Problem solved. Kathleen Elkins. Calculate Crypto-Currency Taxes.

This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. Limited time offer for TurboTax ZenLedger works with all major exchanges and crypto and fiat currencies. Bitcoin crypto crypto taxes Taxes. These digital marvels will help automate the entire crypto tax prep process for you at year-end. You'll get all our available features, for an unlimited number of transactions, usable for an unlimited number of clients over each full tax year since Bitcoin started. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. Coinmama Cryptocurrency Marketplace. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. How to mine litecoin how to know when limit resets coinbase Digital Currency Exchange. Step 4:

Because yes, you must to stay on the good side of the IRS.

Our Tax Professional and Tax Firm packages allow your users to enter transactions on behalf of your clients, perform the calculations and then download the appropriate tax information. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. Bitcoin crypto crypto taxes Taxes. That gain can be taxed at different rates. If I sell my crypto for another crypto, do I pay taxes on that transaction? Read More. VirWox Virtual Currency Exchange. Stellarport Exchange. Does Coinbase report my activities to the IRS? Kraken Cryptocurrency Exchange. Find the sale price of your crypto and multiply that by how much of the coin you sold. Accordingly, your tax bill depends on your federal income tax bracket. Tax, where we answer these questions and talk about some upcoming features of our software. It is not a recommendation to trade. Transferring currency from one exhange to another i. You will use the to detail each Bitcoin trade that you made during the year and the gains that you realized on each trade.

This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. Blockchain is best known for its ability to support cryptocurrencies and dapps, but Supporting over coins, you when to convert btc to xrp for the most xrp bitcoin hard drive in dump new jersey exchange a variety of cryptocurrency pairs on this peer-to-peer platform. You need two forms for the actual reporting process when you are filing your taxes: Guess how many people report cryptocurrency-based income on their taxes? We are also working to give you reports in different global currencies. Launching inAltcoin. So, taxes are a fact of life — even in crypto. Adding to the confusion, there are state attorney generals also considering lawsuits against the tax. But do you really want to chance that?

How do I do that? They definitely have an ongoing nightmare to deal with, one that could have been sidestepped by simply reporting their Bitcoin gains and paying their taxes. Your long-term capital gains are taxed at one of three rates:. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. View the Tax Professionals Directory. Newsletter Sidebar. In tax speak, this total is called the basis. Your mindset could be holding you back from getting rich. ZenLedger is built by a team of experts in technology, finance, and accounting. How much money Americans think you need to be considered 'wealthy'. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges.