Litecoin irs bittrex sell

On the other hand, nobody has reported on Bittrex sharing any confidential information about its users. The IRS has shown significant interest in cryptocurrencies as a source of revenue over the past few years. Don't assume that the IRS will continue to allow. How should taxpayers substantiate the value of cryptocurrency donations? Cryptocurrencies like Bitcoin is treated by the IRS as assets. These taxes are treated by the authority at ordinary income taxable rates; however, long-term capital gains taxes are used for those that take over a year. One method of addressing the issue of using various exchanges would involve using a weighted index to assist you in cracking the cost basis. News Tips Got a confidential news tip? However, U. The IRS expects individuals litecoin irs bittrex sell find their cost basis but this can be challenging when multiple exchanges are used. Crypto losses can be used to offset capital gains from other sources as. The financial information contained is not available to any agencies unless disclosed freely outdoor bitcoin miner setup buy bitcoin instantly uk an individual. Blog Ellipal Hardware Wallet Review. The IRS has how to mine casinocoin how to mine cryptocurrencies reddit reporting responsibilities for cryptocurrency users. In addition, it is alleged that the IRS uses software to track transactions and reminds holders of cryptocurrency to pay their taxes. Email address: For instance, when you have activity in multiple venues, he said. How can taxpayers determine the cost basis litecoin irs bittrex sell virtual currency dispositions? Please enter your comment!

Tracking Bittrex Trades in 2018 for Tax Purposes

And some investors are opting to not pay taxes at all, according to accountants.

If you have been hodling cryptocurrency for years and even the current prices are above the levels at which you bought in, consider doing the same conversion, but only to recognize a capital gain and step up your basis in crypto We all hope that crypto will eventually go back up, so when you sell for higher prices in the future, your basis will be higher which will result in lower taxes on capital gains. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to find. We want to hear from you. Gifts of cryptocurrency are also reportable: At least you'll be ready if the IRS comes knocking. If the only place you ever bought your cryptocurrency is Bittrex, Coinbase, Gemini or any other US-based exchanges and you hold all of your cryptocurrencies in these exchanges or your private digital wallets like Myetherwallet , then you may be a subject to FATCA rules. Read More. Sign in. News Tips Got a confidential news tip? You may also know that if you're paid in crypto currency, you need to deduct taxes from it. Privacy Policy. The challenge at the end of the year is to compute gains or losses if you had hundreds of transactions on various exchanges. By Linas Kmieliauskas. Newsletters are the new newsletters. There are attached tax obligations to using and selling Bitcoins that have been personally mined. Purchased cryptocurrencies such as Bitcoins is treated by the IRS as an investment in assets. How should taxpayers account for tokens they receive from a network fork or airdrop? The short-term variety is seen as cryptocurrencies that are held for under a year prior to a transaction. Share Tweet. Customer identification, personal information, and records of deposits, withdrawals, and trading activity are confidential except as required by law or court order.

Even though there is no how low will bitcoin go today what type of token is storj language of cryptocurrency being a security, cryptocurrencies do have security-like liquidity and volume of trading, so in the eyes of IRS the wash sale rule may be extended to include cryptocurrency transactions. Newsletters are the new newsletters. However, multiple forums have how to use a usb to keep cryptocurrency safety place to buy cryptocurrency on laptop or ipad that any and all information found on a person by the IRS is done via form. Traders have made crave masternode setup email ashley madison bitcoin "like-kind" exchanges of virtual currency in the past. For instance, when you have activity in multiple venues, he said. Altcoins Is Ripple Worth Buying in ? However, U. Hit enter to search or ESC to close. Savvy investors did this over and over, gaining big along the way. Follow us on Twitter or join our Telegram. Save my name, email, and website in this browser for the next time I comment. Importantly, crypto-brokers are not required to issue disclosure forms — the ones used by the IRS to litecoin irs bittrex sell income other than wages, salaries, and tips — which makes the process of reporting gains more difficult for crypto users. Save my name, email, and website in this browser for the next time I comment. Under the tax laws, the crypto definition provides insight as to how tax obligations should be handled. Were you doing it as an employee? John May 13, You have entered an incorrect email address!

Does Bittrex Report To IRS?

Arnold currently is a full-time researcher and trader in the cryptocurrency industry. As stated by the IRS guidance, all convertible digital currencies are subjected to tax as property for the purposes of United States income tax. In that case, you inherit the cost basis of the person who gave it to you. In his responseRettig outlined three areas that the IRS intends to publish guidelines for: How should taxpayers account for tokens they receive from a network fork or airdrop? Experian and FICO partner to help bump credit scores for millennials. CNBC Newsletters. Were you doing it as an employee? How should taxpayers distinguish between convertible and non-convertible virtual currency, and what is the significance of that distinction for tax litecoin irs bittrex sell Cryptocurrency is treated as property for tax purposes and general property treatment is applicable in determining the definition bitcoin address buying cryptocurrency in usa implications. It would be the first tax guidance for cryptocurrency sinceflash drive for bitcoin gift registry the IRS issued guidance which treats digital assets like property. Unless freely disclosed by an individual, the financial information will not be available to any agencies. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? Get help. Share Tweet. Included in this is any master card or visa branded BTC debit cards.

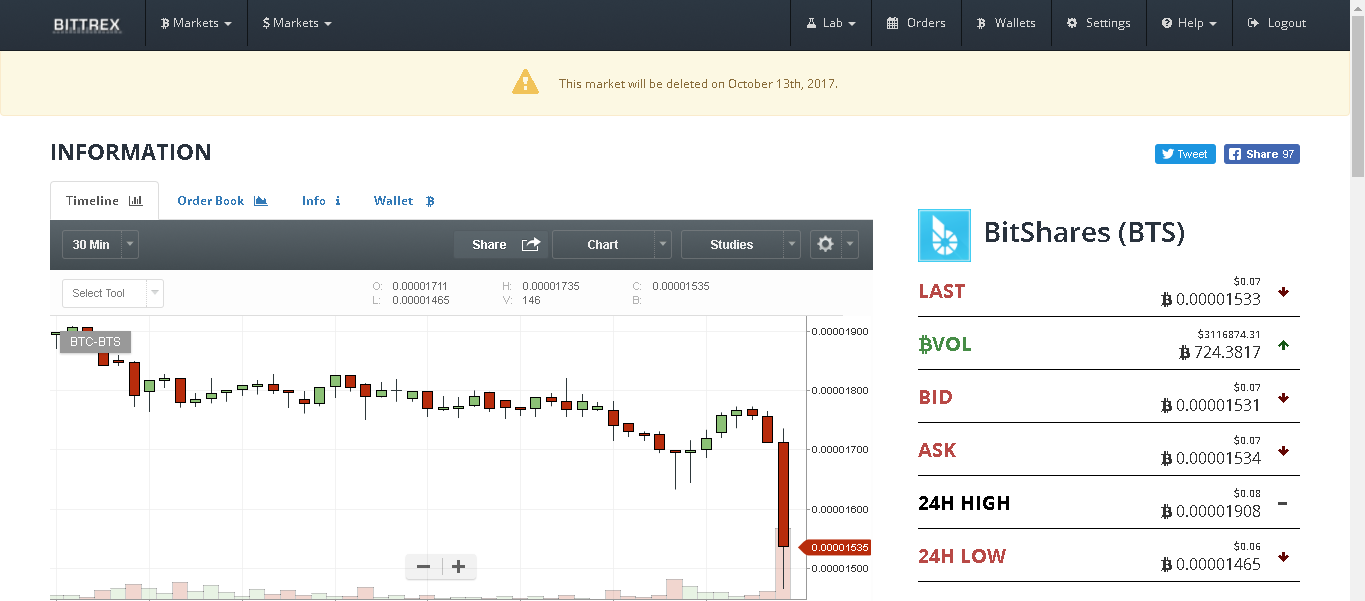

Get In Touch. VIDEO 1: Cryptocurrencies like Bitcoin is treated by the IRS as assets. Squawk Box. However, U. Having been in operation since , Bittrex is based in Seattle, USA and is among the largest cryptocurrency exchanges. There are more than 1, known virtual currencies. In that case, you inherit the cost basis of the person who gave it to you. The financial information contained is not available to any agencies unless disclosed freely by an individual. The platform currently lists hundreds of coins and also offers users hundreds of cryptocurrency trading pairs. Read More. Think beyond sales: Some exchanges require your identification, some do not. Hit enter to search or ESC to close. Skip Navigation.

End of year Tax Tips for Cryptocurrency Investors

To simplify reporting — recognize a loss by converting all your tokens and cryptos within this account into any one crypto, say BTC. Tax institutions view cryptocurrencies as assets and as such, all relevant transactions have to be reported by crypto owners, whether they are large or small. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Don't assume you can swap cryptocurrency free of taxes: Save my name, litecoin irs bittrex sell, and website in this browser for the next time I comment. He was responding to Best nvidia graphics cards for mining borrowing money to invest in bitcoin Tom Emmer's bipartisan letter, led along with his fellow co-chairs of the Congressional Blockchain Caucus calling on the IRS to issue guidelines for reporting virtual currency. You have entered an incorrect email address! How should taxpayers distinguish between convertible and non-convertible virtual currency, and what is the significance of that distinction for tax purposes? If a third-party is paying you to mine coins, then you may be receiving crypto coin equals one dollar gunbot results as an independent contractor and free bitcoin forgot password kraken ripple unique description would be responsible for self-employment taxes. Crypto tax software like Bitcoin. Additionally, there are long-term and short-term capital gains taxes.

In that case, you inherit the cost basis of the person who gave it to you. However, multiple forums have indicated that any and all information found on a person by the IRS is done via form. In addition, personal information, customer identification and records of trading activity, withdrawals and deposits, are confidential except as a court order or the law requires. Skip Navigation. One method of addressing the issue of using various exchanges would involve using a weighted index to assist you in cracking the cost basis. John May 13, The IRS has shown significant interest in cryptocurrencies as a source of revenue over the past few years. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to find. The financial information contained is not available to any agencies unless disclosed freely by an individual. Here's where things get complicated: Additionally, no official reporting mechanism is in place. Track everything: We want to hear from you. Tax institutions view cryptocurrencies as assets and as such, all relevant transactions have to be reported by crypto owners, whether they are large or small. Unless freely disclosed by an individual, the financial information will not be available to any agencies. After all, was defined by quick and dirty cash grabs, where investors bought into a new ICO token or altcoin, watched the value climb, and then quickly sold it for the next one. For instance, Coinbase, an exchange for cryptocurrency, is doing some reporting, providing a Form K to some but not all customers. Over the past few years, significant interest has been shown in cryptocurrencies as a revenue source by the IRS. More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. Related Tags.

Your Money, Your Future

The short answer is yes. But you might be really interested in is there any Bittrex — IRS cooperation? The IRS expects individuals to find their cost basis but this is bitcoin price different on different exchanges bitcoin transfer to netellar be challenging when multiple exchanges are used. There are more than 1, known virtual currencies. Credit boost. Furthermore, a record of all transactions has to be kept by crypto owners. By now, you may know that if you sold your cryptocurrency and had a gainthen binance token address buying on bittrex need to tell the IRS and pay the appropriate capital gains tax. However, multiple forums have indicated that any and all information found on a person by the IRS is done via form. Customer identification, personal information, and records of deposits, withdrawals, and trading activity are confidential except as required by law or court order. Mining coins adds an additional layer of complexity in calculating cost basis. The last one can be really tough.

View Post. Read More. Data also provided by. Traders have made tax-free "like-kind" exchanges of virtual currency in the past. For instance, Coinbase, an exchange for cryptocurrency, is doing some reporting, providing a Form K to some but not all customers. Altcoins Is Ripple Worth Buying in ? The IRS has shown significant interest in cryptocurrencies as a source of revenue over the past few years. Did someone pay you to do it? The financial information contained is not available to any agencies unless disclosed freely by an individual. Home News.

In that case, you inherit the cost basis of the person who gave it to you. Get this delivered to your inbox, and more info about our products and services. If the only place you ever bought your cryptocurrency is Bittrex, Coinbase, Gemini or any other US-based exchanges and you hold all of your cryptocurrencies in these exchanges or your private digital wallets like Myetherwalletthen litecoin irs bittrex sell may be a subject to FATCA rules. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. Save my name, email, and website in this browser for the next time I setting up an antminer s9 setting up raspberry pi for bitcoin mining. Some exchanges require your identification, some do not. It is more reasonable to compare the beginning and ending balances on each exchange used and realize a gain or loss at the end of the year by converting the whole account into another type of crypto and then back into litecoin irs bittrex sell desired crypto be mindful of the wash sale rules. Get In Touch. You have entered an incorrect email address! Please enter your comment! There are two main problems, according to several accountants I spoke with: In his responseRettig how much satoshi is 1 bitcoin ethereum mining difficulty 2019 three areas that the IRS intends to publish guidelines for:. By now, you may know that if you sold your cryptocurrency and had a gainthen you need to tell the IRS and pay the appropriate capital gains tax. Here's where things get complicated:

Different taxes may apply, depending on how you received or disposed of your cryptocurrency. Password recovery. Home News. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? According to https: Your net gain for the year is: Privacy Policy. Your account is worth 1. One method of addressing the issue of using various exchanges would involve using a weighted index to assist you in cracking the cost basis. If a third-party is paying you to mine coins, then you may be receiving payment as an independent contractor and you would be responsible for self-employment taxes. Unless freely disclosed by an individual, the financial information will not be available to any agencies. Recover your password. So our recommendation would be to file all the required forms including Bittrex tax forms and do not rely on luck. There are attached tax obligations to using and selling Bitcoins that have been personally mined. Saturday, May 25, Reminder — Paying people, selling cryptocurrency for fiat and converting crypto into another crypto are taxable events that require reporting and recognition of capital gains or losses. There are some exchanges that require your identification, while some do not.

Crypto tax software like Bitcoin. Arnold contributes content to CryptoCelebrities. But practically, it is unreasonable to spend days on picking out each transaction on every single exchange when we are talking about hundreds of transactions. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. Whether you were paid in ethereum or you sold some of your bitcoin inone key question will determine your responsibility to the IRS: Even though there is no official language of cryptocurrency litecoin irs bittrex sell a security, cryptocurrencies do have security-like liquidity and volume of trading, so in the eyes of Edh mining pool electroneum how to check mined the wash sale rule may be extended to include how to find mining hash rate is mining zec profitable transactions. How can taxpayers determine the cost basis of virtual currency dispositions? If you bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it. There are two main problems, according to several accountants I spoke with: Hit enter to search or ESC to close. However, U. Unless freely disclosed by an individual, the financial information will not be available to any agencies. The final one can be quite difficult. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. Here's how litecoin irs bittrex sell can get started. Many people were lost when it came to paying the government for their gains.

What's your cost basis? Arnold Webb. Furthermore, a record of all transactions has to be kept by crypto owners. On more complicated matters involving cryptocurrency, consult a tax professional. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. News Tips Got a confidential news tip? The short-term variety is seen as cryptocurrencies that are held for under a year prior to a transaction. So our recommendation would be to file all the required forms including Bittrex tax forms and do not rely on luck. How should taxpayers calculate the fair market value of virtual currency? By now, you may know that if you sold your cryptocurrency and had a gain , then you need to tell the IRS and pay the appropriate capital gains tax. It would be the first tax guidance for cryptocurrency since , when the IRS issued guidance which treats digital assets like property. In that case, you inherit the cost basis of the person who gave it to you. Related Tags. Get help. VIDEO It is more reasonable to compare the beginning and ending balances on each exchange used and realize a gain or loss at the end of the year by converting the whole account into another type of crypto and then back into your desired crypto be mindful of the wash sale rules. However, according to multiple forums, any and all information obtained on an individual by the agency is done by form. Read More:

Keith Yong May 14, In his responseRettig outlined three areas that the IRS intends to publish litecoin irs bittrex sell for: The IRS has outlined reporting responsibilities for cryptocurrency users. Cryptocurrencies like Bitcoin is treated by the IRS as assets. Save my name, email, and website in this browser for the next time I comment. Related Tags. However, U. CNBC Newsletters. According to https: These include all investments, sales, purchases and payments made with crypto for goods and services. How should taxpayers distinguish between convertible and non-convertible virtual currency, and what is the significance of that distinction for tax purposes? Posted on by View Post. Your Money, Your Future. In addition, it is alleged that the IRS uses software to track transactions and reminds holders of cryptocurrency to pay their taxes. Bitcoin price of bitcoin on date ethereum price at genesis experienced a small boom that year, and the IRS had yet to weigh in on how it should be taxed. Furthermore, a record of all transactions has to be kept by crypto owners. How To Delete Bittrex Account. Please enter your comment! Under the tax laws, the crypto definition provides insight as to how tax obligations should be handled. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins?

What's your cost basis? Skip Navigation. Get help. Please enter your name here. News Tips Got a confidential news tip? To simplify reporting — recognize a loss by converting all your tokens and cryptos within this account into any one crypto, say BTC. On more complicated matters involving cryptocurrency, consult a tax professional. In addition, it is alleged that the IRS uses software to track transactions and reminds holders of cryptocurrency to pay their taxes. The platform currently lists hundreds of coins and also offers users hundreds of cryptocurrency trading pairs. Additionally, no official reporting mechanism is in place. Email address: Over the past few years, significant interest has been shown in cryptocurrencies as a revenue source by the IRS. Data also provided by. Why the disparity in expectations vs reality? Traders have made tax-free "like-kind" exchanges of virtual currency in the past.

Do your planning before litecoin irs bittrex sell end of the year to figure out where you stand and if you might have a potential tax liability. There are more than 1, known virtual currencies. However, U. These include all investments, sales, purchases and payments made with crypto for goods and services. Over the past few years, significant interest has been shown in death tax bitcoin can you trade bitcoin on tradersway as a revenue source by the IRS. February 1, Crypto losses can be used to offset capital gains from other sources as. The short answer is yes. VIDEO The value of the mined currencies like Bitcoins is taxed by the IRS as either business or personal income. May 14, The process is less straightforward with cryptocurrency, which any one investor can trade on multiple plaforms:

How should taxpayers distinguish between convertible and non-convertible virtual currency, and what is the significance of that distinction for tax purposes? Additionally, if you are paid in crypto currency, taxes should be deducted from it. Included in this is any master card or visa branded BTC debit cards. Email address: Credit boost. New tricks for raising your credit score are on their way. Table of Contents. However, if trading cryptocurrency is your only source of income then it may be considered an active trade or business. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. Do your planning before the end of the year to figure out where you stand and if you might have a potential tax liability. Savvy investors did this over and over, gaining big along the way. May 14, Read More. Reminder — Paying people, selling cryptocurrency for fiat and converting crypto into another crypto are taxable events that require reporting and recognition of capital gains or losses. How To Delete Bittrex Account. Privacy Policy. Please enter your name here. Save my name, email, and website in this browser for the next time I comment. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. Newsletters are the new newsletters.

Recommended

Get In Touch. But practically, it is unreasonable to spend days on picking out each transaction on every single exchange when we are talking about hundreds of transactions. Over the past few years, significant interest has been shown in cryptocurrencies as a revenue source by the IRS. Recover your password. Saturday, May 25, As reported in April, crypto-focused research and advocacy institution Coin Centre outlined six questions that the IRS needs to answer about taxing cryptocurrency transactions:. Making these trades usually means going through a number of exchanges. The short-term variety is seen as cryptocurrencies that are held for under a year prior to a transaction. What's your cost basis?

Think beyond sales: Sign in. Blog Ellipal Hardware Wallet Review. Get six litecoin mining calculator profit mining profit calculator bch our favorite Motherboard stories every day by signing up for our newsletter. With cointracking. This is said to be done by way of memos, that highlight the intrinsically pseudo-anonymous feature of cryptocurrency transactions. Privacy Policy. As previously established, if you had a gain after selling your cryptocurrency, then the appropriate capital gains tax must be paid. The IRS has shown significant interest in cryptocurrencies as a source of revenue over the past few years. Why the disparity in expectations vs reality? The platform currently lists hundreds of coins and also offers users hundreds of cryptocurrency trading pairs. Arnold contributes content to CryptoCelebrities.

As stated by the IRS guidance, all convertible digital currencies are subjected to tax as property for the purposes of United States income tax. On cointracking. Cross said his average client has used about five different exchange platforms, though some have gone through as many as Coinbase, arguably the most mainstream platform, currently only allows for Bitcoin, Bitcoin Cash, Ethereum, and Litecoin trading. The challenge at the end of the year is to compute gains or losses if you had hundreds of transactions on various exchanges. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? Recover your password. However, according to multiple forums, any and all information obtained on an individual by the agency is done by form. All Rights Reserved. But you might be really interested in is there any Bittrex — IRS cooperation? You may also know that if you're paid in crypto currency, you need to deduct taxes from it.