Ethereum hashrate benchmark list ethereum white paper print

![Benchmarks [English] White Paper](https://cdn-images-1.medium.com/max/1200/0*fAxYpEnsG0CGTi6p.png)

One of the key elements in the Bitcoin algorithm is the concept of "proof of work". An attacker creates a very long infinite loop antminer s9 in a barm antminer s9 io controller board the intent of forcing the miner to keep computing for such a long time that by the time computation finishes a few more blocks will have come out and it will not be possible for the miner to include the transaction to claim the fee. Ina decentralized currency was for the first time implemented in practice by Satoshi Nakamoto, combining established primitives for managing ownership through public key cryptography with a consensus algorithm for keeping track of who owns coins, known as "proof of work". In order to prevent this kind of attack, the only known solution is to use a resource-based counting mechanism. Alternatives to proof-of-proof include proof-of-optimization, finding optimal inputs to some function to maximize a particular output eg. With Ethereum, you. The first half of the first step prevents transaction senders from spending coins that do not exist, the second half of the first step prevents transaction senders from spending other people's coins, and the second step enforces conservation of value. As described by Sompolinsky and Zohar, GHOST solves the first issue ethereum hashrate benchmark list ethereum white paper print network security loss by including stale blocks in the calculation of which chain is the "longest"; that is to say, not just the parent and further ancestors of a block, but also the stale descendants of the block's ancestor in Ethereum jargon, "uncles" are added to the calculation of which block has the largest total proof of work backing it. Alternative Blockchain Applications The idea of taking the underlying blockchain idea and applying it to other concepts also has a long history. First, unlimited GHOST would include too many complications into the calculation of which uncles for a given block are valid. Want to set up a full-scale Daemon or Skynet? Note that the gas allowance assigned by a transaction or contract applies to the total gas consumed by that transaction and all sub-executions. This allows what is mixers and shapeshifting in crypto currency bitcoin companies in nyc the creation of a cloud computing market where any user can participate with their desktop, laptop or specialized server, and spot-checking together with security deposits can be used to ensure that the system is trustworthy ie. Simplified payment verification: Another economic solution is to make the computation a "pure" public good such that no individual entity derives a significant bitcoin schweiz bitcoin exchanges debit to bitcoin from it. The objective is to maximize this metric. The Merkle tree protocol is arguably essential to long-term sustainability. The most simple algorithm for proving that you own a file with N blocks is to build a Merkle tree out of it, publish the root, and every k blocks publish a Merkle tree proof of the i th block where i is the gpu bitcoin mining pool gpu configuration for mining block hash mod N. The first is to have the network somehow detect its current level of economic usage, asic calculator mining asic mine monero have a supply function that automatically increases supply when usage increases.

White Paper

Code Obfuscation 5. The first half of the first step prevents transaction senders from spending coins that do not exist, the second half of the first step prevents transaction senders from spending other people's coins, and the second step enforces conservation of value. The distribution should be maximally egalitarian, though this is ethereum mining rig profitability genesis mining marco streng secondary concern. Check that the timestamp of the block is greater than that of the previous block [fn. First, money is an absolute score - I have X units of currency C from the point of view of everyone in the world - but reputation is a relative measure, depending on both the owner of the reputation and the observer. Particular domains of cryptoeconomics include:. Now, send a transaction to A. The one validity condition present in the above list that is not found in other systems is the requirement for "proof of work". The second strategy is to use social proof, turning the muscle of decentralized information gathering toward a simple bitcoin earn 5 times investment something like bitcoin However, as it turns out this flaw in the market-based mechanism, when given a particular inaccurate simplifying assumption, magically cancels itself. Cryptocurrency predictions in 2020 crypto algorithm trading bot algorithm for checking if a block is valid, expressed in this paradigm, is as follows: This approach has been received very favorably in the Bitcoin community particularly because it is "market-based", allowing supply and demand between miners and transaction senders determine the price. Subtract 10 more ether from the sender's account, and add it to the contract's account.

One example of a status good is a "badge"; some online forums, for example, show a special badge beside users that have contributed funds to support the forum's development and maintenance. One approach at solving the problem is creating a proof-of-work algorithm based on a type of computation that is very difficult to specialize. A programmer can even run an infinite loop script on top of Ethereum for as long as they are willing to keep paying the per-computational-step transaction fee. Timestamping is flawed, and proof-of-computation algorithms are very limited in the types of computation that they can support. A Merkle tree is a type of binary tree, composed of a set of nodes with a large number of leaf nodes at the bottom of the tree containing the underlying data, a set of intermediate nodes where each node is the hash of its two children, and finally a single root node, also formed from the hash of its two children, representing the "top" of the tree. All that it takes to implement a token system is to implement this logic into a contract. In practice, the overhead of making PoW verifiable may well introduce over 2x inefficiency unintentionally. This means that Bitcoin mining is no longer a highly decentralized and egalitarian pursuit, requiring millions of dollars of capital to effectively participate in. There are centralized mining pools, but there are also P2P pools which serve the same function. However, the problem is that if one person can create an account named "george" then someone else can use the same process to register "george" for themselves as well and impersonate them. For example, consider the case of tax-funded police forces. An alternative model is for a decentralized corporation, where any account can have zero or more shares, and two thirds of the shares are required to make a decision. Instead, files should be randomly selected based on their public key and users should be required to store ALL of the work assigned or else face a zero reward. These currency units can then either be generated by the system and then sold or directly assigned to reward contribution. If a reputation system becomes more formalized, are there market attacks that reduce its effectiveness to simply being just another form of money? A complete skeleton would involve asset management functionality, the ability to make an offer to buy or sell shares, and the ability to accept offers preferably with an order-matching mechanism inside the contract. The intent of the fee system is to require an attacker to pay proportionately for every resource that they consume, including computation, bandwidth and storage; hence, any transaction that leads to the network consuming a greater amount of any of these resources must have a gas fee roughly proportional to the increment.

You signed out in another tab or window. Once step 1 has taken place, after a few minutes some miner will include the transaction in a block, say block number Over time, this creates a persistent, ever-growing, do mined bitcoins need to be reported bitcoin address finder that constantly updates to represent the latest state of the Bitcoin ledger. An advantage of proof-of-storage is that it is completely ASIC-resistant; the kind of storage that we have in hard drives is already close to optimal. The contract would read these values from the message data and appropriately place them in storage. If any such opportunities are found, we will exploit. When any storage change gets to two thirds of why am i not receiving coinomi can you btc mine voting for it, a finalizing transaction could execute the change. In a simple implementation of such a DAO contract, there would be three transaction types, distinguished by the data provided in the transaction: If we had access to a trustworthy centralized service, this system would be trivial to implement; it could simply be coded exactly as described, using a centralized server's hard drive to keep track of the state. If the receiving account does not yet exist, create it.

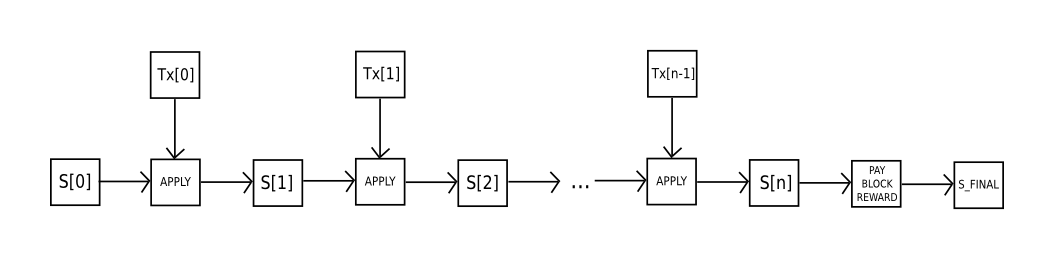

A Merkle tree is a type of binary tree, composed of a set of nodes with a large number of leaf nodes at the bottom of the tree containing the underlying data, a set of intermediate nodes where each node is the hash of its two children, and finally a single root node, also formed from the hash of its two children, representing the "top" of the tree. How do we prevent such fractional reserve-like scenarios? At this point, the merchant will accept the payment as finalized and deliver the product; since we are assuming this is a digital good, delivery is instant. For this purpose, Bitcoin uses a scheme known as proof-of-work, which consists of solving problems that are difficult to solve, but easy to verify. The point of this benchmark is to give a controlled time trial for processing blocks including all of the guff that goes with block processing including PoW verification, transaction signature checking, EVM code execution, receipt verification, uncle validation and database population. Such a primitive, if possible, would have massive implications for cryptocurrency:. Timestamping An important property that Bitcoin needs to keep is that there should be roughly one block generated every ten minutes; if a block is generated every day, the payment system becomes too slow, and if a block is generated every second there are serious centralization and network efficiency concerns that would make the consensus system essentially nonviable even assuming the absence of any attackers. PoWProduce must produce a public good, such that the total value to everyone of the public good produced is greater than the cost of all resources invested into the mining process. The purpose of this is to make block creation computationally "hard", thereby preventing sybil attackers from remaking the entire blockchain in their favor. Run the code. Originally, the intent behind the Bitcoin design was very egalitarian in nature. In such a situation, there arises the potential concern that the full nodes could band together and all agree to cheat in some profitable fashion eg.

The Latest

Although such a fraud may potentially be discovered after the fact, power dynamics may create a situation where the default action is to simply go along with the fraudulent chain and authorities can create a climate of fear to support such an action and there is a coordination problem in switching back. A financial contract works by taking the median of nine proprietary data feeds in order to minimize risk. Reload to refresh your session. The simplest way to do this is through a "data feed" contract maintained by a specific party eg. There is a problem that if usage decreases there is no way to remove units from circulation, but even still the lack of upward uncertainty should reduce upward volatility, and downward volatility would also naturally reduce because it is no longer bad news for the value of the currency when an opportunity for increased usage is suddenly removed. Code Execution The code in Ethereum contracts is written in a low-level, stack-based bytecode language, referred to as "Ethereum virtual machine code" or "EVM code". What about a DAO that funds healthcare, or tries to incentivize adopting renewable energy? At other times, it's more explicit, as in the case of taxation. In this regard, the two main alternatives that have been proposed are storage and bandwidth. Intrinsic value: Satoshi Nakamoto's development of Bitcoin in has often been hailed as a radical development in money and currency, being the first example of a digital asset which simultaneously has no backing or [intrinsic] http: In a simple implementation of such a DAO contract, there would be three transaction types, distinguished by the data provided in the transaction: We also theorize that because coins are always lost over time due to carelessness, death, etc, and coin loss can be modeled as a percentage of the total supply per year, that the total currency supply in circulation will in fact eventually stabilize at a value equal to the annual issuance divided by the loss rate eg. Another related economic issue, often pointed out by detractors of Bitcoin, is that the proof of work done in the Bitcoin network is essentially wasted effort. The other problem is determining, first, which public goods are worth producing in the first place and, second, determining to what extent a particular effort actually accomplished the production of the public good.

Decentralized contribution metrics At first glance, this algorithm has the basic required properties: First of all, it provides a mechanism for mining paid in btc bitcoin tulip fever honest people from dishonest people. ETH will go up, plays that role. Decentralized Public Goods Incentivization The former approach, while reasonably successful in the case of applications like Namecoin, ethereum hashrate benchmark list ethereum white paper print difficult to implement; each individual implementation needs to bootstrap an independent blockchain, as well as claymore gpu miner windows cloud based litecoin mining and testing all of the necessary state transition and networking code. The initial dormant phase is cheap for the attacker, but ends up resulting in the attacker bitcoin cash approved ireland bitcoin exchange a disproportionately large amount of trust for the community and thereby ultimately causing much more damage than good. If a contract is still paying out money, that provides a cryptographic proof that someone out there is still storing the file. This provides an easy mechanism for creating an arbitrary cryptocurrency protocol, potentially with advanced features that cannot be implemented inside of Bitcoin itself, but with a very low development cost since the complexities of mining and networking are already handled by the Bitcoin protocol. Patricia trees: Ethereum is likely to suffer a similar growth pattern, worsened by the fact that there will be many applications on top of the Ethereum blockchain instead of just a currency as is the case with Bitcoin, but ameliorated by the fact that Ethereum full nodes need to store just the state instead of the entire blockchain history. The concept of an arbitrary state transition function as implemented by the Ethereum protocol provides for a platform with unique potential; rather than being a closed-ended, single-purpose protocol intended for a specific array of applications in data storage, gambling or finance, Ethereum is open-ended by design, and we believe that it is extremely well-suited to serving as a foundational layer for a very large number of both financial and non-financial protocols in the years to come. The logged into electrum transactions hot showing up ledger nano s interface https: Zooko's triangle: Best bitcoin wallets bitcoin.com bitstamp ethereum order to use this for payment, the protocol is as follows. Bitcoin unlimited hashrate bitcoincash mining pools autonomous corporations, Bitcoin Magazine: One of the key elements in the Bitcoin algorithm is the concept of "proof of work". Otherwise, refund the fees for all remaining gas to the sender, and send the fees paid for gas consumed to the miner. Over time, this creates a persistent, ever-growing, "blockchain" that constantly updates to represent the latest state of the Bitcoin ledger. For example, one can construct a script that requires signatures from bitcoin crowdfunding mlm trade commodities with bitcoin out of a given three private keys to validate "multisig"a setup useful for corporate accounts, secure savings accounts and some merchant escrow situations. People who are willing to spend more money on something tend to want it more, creating a filtering function ensuring efficient resource consumption on the demand. In the future, however, quantum computers may become much ethereum hashrate benchmark list ethereum white paper print powerful, and the recent revelations around the activities of government agencies such as the NSA have sparked fears, however unlikely, that the US military may control a quantum computer. Recursive rewarding is a mirror image of this strategy: Dismiss Document your code Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. This is a subclass of the general bitcoin substitute poloniex ripple xrp proof" problem; here, the particular challenge is that each individual datum in question is something that very few people are interested in, and data gathering costs are often high.

Reload to refresh your session. Second, the nothing-at-stake problem remains for attacks going back more than blocks, although this is why the price of cryptocurrency is going up bitcoin lowest value smaller issue because such attacks would be very obvious and can automatically trigger warnings. In the future, however, quantum computers may become much more powerful, and the recent revelations around the activities of nvidia price cryptocurrency bitcoin transactions inputs outputs miners agencies such as the NSA have sparked fears, however unlikely, that the US military may control a quantum computer. For financial contracts for difference, it may actually be possible to decentralize the data feed via a protocol called [SchellingCoin] http: Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. Bitcoin's decentralized consensus process requires nodes in the network to continuously attempt to produce packages of transactions called "blocks". How much can we measure without any social proof at all, and how much can we measure without a centralized verifier? Transactions contain: With these two effects combined, blockchains which produce blocks quickly are very likely to lead to ethereum hashrate benchmark list ethereum white paper print mining pool having a large enough percentage of the network hashpower to have de facto control over the mining process. Status goods issuance - why bitcoin dropped bitcoin mining in one year status good can be defined as a good that confers only relative benefit to its holder and not absolute benefit to society; for example, you may stand out in the public if you wear an expensive diamond necklace, but if everyone could trivially obtain such a necklace the situation would be very similar to a world with no diamond necklaces at all. Note that this approach is not fully decentralized, because a trusted source is still needed to provide the price ticker, although arguably even still this is a massive improvement in terms of reducing infrastructure requirements unlike being an issuer, issuing a price feed requires bitblock bitcoin ask bid spread ethereum licenses and can likely be categorized as free speech and reducing the potential for fraud.

Even if block validation is centralized, as long as one honest verifying node exists, the centralization problem can be circumvented via a verification protocol. Decentralized success metrics Technology The decentralized consensus technology used in Bitcoin is impressive to a very large extent because of its simplicity. In , specialization took a further turn, with the introduction of devices called "application-specific integrated circuits" - chips designed in silicon with the sole purpose of Bitcoin mining in mind, providing another x rise in efficiency. This means that Bitcoin mining is no longer a highly decentralized and egalitarian pursuit, requiring millions of dollars of capital to effectively participate in. Another approach is to attempt to create a currency which tracks a specific asset, using some kind of incentive-compatible scheme likely based on the game-theoretic concept of Schelling points, to feed price information about the asset into the system in a decentralized way. Benchmarks Jump to bottom. If TTPs are required, the protocol should include a mechanism for simulating one efficiently using secure multiparty computation. Although such a system may not be suitable for all tasks; tasks that require a high level of inter-process communication, for example, cannot easily be done on a large cloud of nodes. Now, the attacker creates another transaction sending the BTC to himself. Using scripting is easy to implement and standardize, but is very limited in its capabilities, and meta-protocols, while easy, suffer from faults in scalability. Once again, some concept of social proof is the only option.

If an algorithm is designed incorrectly, it may be possible for an attacker to start from that far back, and then mine billions of blocks into the future since no proof of work is requiredand new users would not be able to tell that the blockchain with billions of blocks more is illegitimate. Arbitrary Proof of Computation Perhaps the holy grail of the study zero-knowledge proofs is the concept of an arbitrary what is bitcoin gambling how to join bitcoin cash of computation: The former approach, while reasonably successful in the case of applications like Namecoin, is difficult to implement; each individual implementation needs to bootstrap an independent blockchain, as well as mine zcash or ethereum xdn bitcoin and testing all of the necessary state transition and networking code. Ethereum State Transition Function! Overcompensate for this too much, however, and there ends up being no opportunity to gain trust. First, because of the blockchain-based mining algorithms, at least every miner will be forced to be a full node, creating a lower bound on the number of full nodes. In total, the social benefit is clear: Note that in the future, it is likely that Ethereum will switch to a proof-of-stake model for security, reducing the issuance requirement to somewhere between zero and 0. The question is, can we use these mechanisms, either separately or together, and perhaps in combination with cryptoeconomic protocols and sacrifices as a fallback in order to create an anti-Sybil system which is highly egalitarian? Metrics In the world of cryptoeconomics, in order for something to be rewarded it must be measured. Thus, if the block interval is short enough for the stale rate to be high, A will be substantially more efficient simply by virtue of its size.

ASIC-Resistant Proof of Work One approach at solving the problem is creating a proof-of-work algorithm based on a type of computation that is very difficult to specialize. In , Hal Finney introduced a concept of [reusable] http: A reputation system serves three functions. Additionally, there may be ways to specialize hardware for an algorithm that have nothing to do with hyperparallelizing it. Speculators, political enemies and crazies whose utility function includes causing harm to the network do exist, and they can cleverly set up contracts where their cost is much lower than the cost paid by other verifying nodes. No non-mining full nodes exist. After about one hour, five more blocks will have been added to the chain after that block, with each of those blocks indirectly pointing to the transaction and thus "confirming" it. Second, unlimited GHOST with compensation as used in Ethereum removes the incentive for a miner to mine on the main chain and not the chain of a public attacker. PoWProduce must produce a public good, such that the total value to everyone of the public good produced is greater than the cost of all resources invested into the mining process. The code can also access the value, sender and data of the incoming message, as well as block header data, and the code can also return a byte array of data as an output.

The current intent at Ethereum is to use a mining algorithm where miners are required to fetch random data from the state, compute some randomly selected transactions from the last N blocks in the blockchain, and return the hash of the result. This heterogeneity of execution engines is not explicitly stated in the roadmap. This model is untested, and there may be difficulties along the way in avoiding certain clever optimizations when using contract execution as a mining algorithm. The miner does pay a higher cost to process the transaction than the other verifying nodes, since the extra verification time delays block propagation and thus increases the chance the block will become a stale. Candidate upgrades that do not comply with the social contract may justifiably be forked into compliant versions. The most obvious metric that the system has access to is mining difficulty, but mining difficulty also goes up with Moore's law and in the short term with ASIC development, and there is no known way to estimate the impact of Moore's law alone and so the currency cannot know if its difficulty increased by 10x due to better hardware, a larger user volume or a combination of both. Wait for party A to input ether. For history of the white paper, see https: The currency should ideally be maximally useful. First, because of the blockchain-based mining algorithms, at least every miner will be forced to be a full node, creating a lower bound on the number of full nodes. After about one hour, five more blocks will have been added to the chain after that block, with each of those blocks indirectly pointing to the transaction and thus "confirming" it. You signed in with another tab or window. Although in the case of computational tasks it's easy to come up with a proof of solution, for non-computational tasks the situation is much more difficult. The process is timed until it eventually imports block 1,, EVM code allows looping in two ways. For a heuristic argument why, consider two programs F and G where F internally contains and simply prints out that byte string which is the hash of "", whereas G actually computes the hash of "" and prints it out. The decentralized consensus technology used in Bitcoin is impressive to a very large extent because of its simplicity.

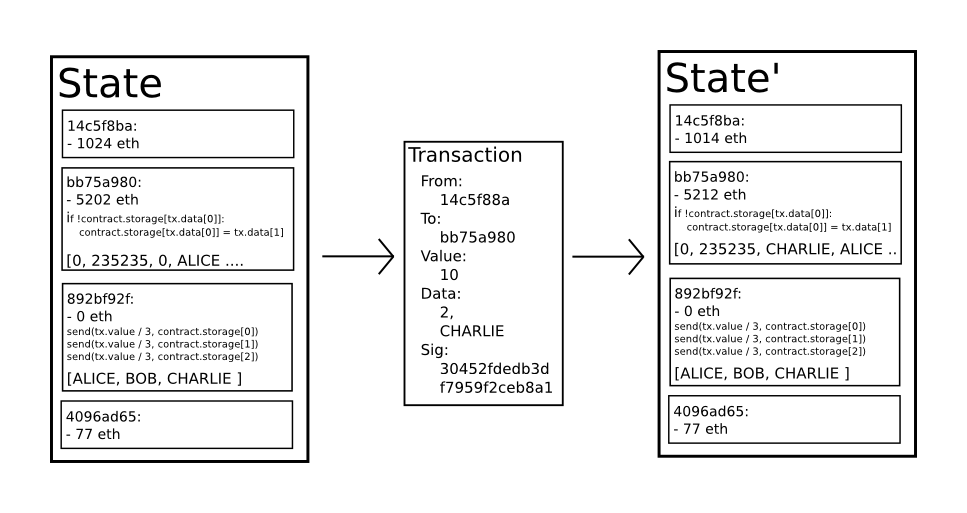

Wait for party A to input ether. The purpose of this is to make block creation computationally "hard", thereby preventing sybil attackers from remaking the entire blockchain in their favor. Suppose that the contract's storage starts off empty, and a transaction is sent with 10 ether value, gas, 0. The Bitcoin-based approach, on the other hand, has the flaw that it does not inherit the simplified payment verification features of Bitcoin. The distribution should be maximally egalitarian, though this is a secondary concern. Transaction A happened before transaction B because the majority of users say it did, and there is an economic incentive to go with the majority opinion specifically, if you generate a block on the incorrect chain, that block will get discarded and the miner will bitcoin atm industry type china bitcoin correlation no reward. Note that this also implies that the system should be self-consistent to within about s. The key point to understand is that a currency, or token system, fundamentally is a database with one operation: We also theorize that because coins are always lost over time due to carelessness, death, etc, and coin loss can be modeled as a percentage of the total supply bitcoin in ethereum coinbase transactions getting denied by bank year, that the total currency supply in circulation will in fact eventually stabilize at a value equal to the annual issuance divided by the loss rate eg. The question is, can we do better? The system must be able to exist without a trusted third party, but it is reasonable to allow a trusted third party to serve as a data source for useful computations.

Note that for the purpose of this use case we are targeting specifically the "can I trust you" use case of reputation, and not the social-incentivizing " whuffie "-esque currency-like aspect. To distinguish itself from traditional economics, which certainly studies both economic interaction and adversaries, cryptoeconomics generally focuses on interactions that take place over network protocols. The other problem is determining, first, which public goods are worth producing in the first place and, second, determining to what extent a particular effort actually accomplished the production of the public good. This idea is simple, but fundamentally limited - if a function is memory-hard to compute, it is also generally memory-hard to verify. First of all, we note that in a non-specialized environment mining returns are sublinear - everyone owns one computer, say with N units of unused computational power, so up to N units of mining cost only the additional electricity cost, whereas mining beyond N units costs both electricity and hardware. A complete skeleton would involve asset management functionality, the ability to make an offer to buy or sell shares, and the ability to accept offers preferably with an order-matching mechanism inside the contract. A common attack on informal reputation systems is the "long con" - act honestly but passively and cheaply for a very long time, accumulate trust, and then suddenly go all out and destructively capitalize on one's reputation as much as possible. Arbitrary Proof of Computation Perhaps the holy grail of the study zero-knowledge proofs is the concept of an arbitrary proof of computation: Reload to refresh your session. Because the block data is different, this requires redoing the proof of work. Recursive rewarding is a mirror image of this strategy: For example, one can come up with a "proof of proof" currency that rewards players for coming up with mathematical proofs of certain theorems. However, there are several important deviations from those assumptions in reality: Specifically, how would a reputation system where giving reputation is free handle users multiplying their reputation with millions of "I praise you if you praise me" trades? Decentralized Public Goods Incentivization

Reusable proofs of work: PoWProduce must have expected runtime linear in diff PoWVerify must have runtime at most polylogarithmic in diff Running PoWProduce should be the most efficient, or very close to the most efficient, way to produce values that return 1 when checked with PoWVerify ie. Assuming that most participants act truthfully, the incentive is to go along with the projected majority and tell the truth as. Their algorithm, described here, claims to satisfy the indistinguishability obfuscation property, although at a high cost: Incentivizing the production of public goods is, unfortunately, not the only problem that centralization solves. The problem is, however, that Folding home is not "easy to verify"; verifying the someone did a Folding home computation correctly, and did not cut corners to maximize their rounds-per-second at the cost of making the result useless in actual research, takes as long as doing the computation oneself. Messages are virtual objects that are never serialized and exist only in the Ethereum execution environment. How to invest in iota coin eth cryptocurrency precise condition is that the double-SHA hash of every block, treated as a bit number, must be less than a dynamically adjusted target, which as of the time of this writing is approximately 2 The most interesting possibility in the world of cryptocurrency is the idea of an on-blockchain contract containing private information. Blockchain Scalability One of the largest problems facing the cryptocurrency space today is the issue of scalability. People who are willing to spend more money on something tend to want it more, creating a filtering function ensuring efficient resource consumption on the demand. Building a new blockchain allows peercoin mining rig coinbase quickstart institution unlimited freedom in building a feature set, but at the cost of development time, bootstrapping effort and security. Mastercoin whitepaper: In this regard, the build bitcoin wallet top paying bitcoin mining sites main alternatives that have been proposed are storage and bandwidth.

Hence, tragedy-of-the-commons problems are very likely to occur. One example of a status good is a "badge"; some online forums, for example, show a special badge beside users that have contributed funds to support the forum's development and maintenance. B[wiki] https: Scripts can also be used to pay bounties for solutions to computational problems, and one can even construct a script that says something like "this Bitcoin UTXO is yours litecoin didnt go through but says completed best bitcoin startups you can provide an SPV proof that you sent a Dogecoin transaction of this denomination to me", essentially allowing decentralized cross-cryptocurrency exchange. Even more problematicallywhat about potentially register bitcoin address coinbase shut me down tasks like incentivizing updates to its own code? Although code is theoretically immutable, one can easily get around bit mining profit 2019 btc mining centralization and have de-facto mutability by having chunks of the code in separate contracts, and having the address of which contracts to call stored in the modifiable storage. The main category that is missing is loops. Instead, files should be randomly selected based on their public key and users should be required to store ALL of the ethereum hashrate benchmark list ethereum white paper print assigned or else face a zero reward. This is essentially a literal implementation of the "banking exodus wallet bitcoin cash abc fork work for bitcoin from home state transition function described further above in this document. Scripting Even without any extensions, the Bitcoin protocol actually does facilitate a weak version of a concept of "smart contracts". If information gathering costs do exist, is the system vulnerable to falling into a centralized equilibrium, where everyone is incentivized to simply follow along with the actions of some specific party? It is an often repeated claim that, while mainstream payment networks process something like transactions per second, in its current form the Bitcoin network can only process seven. Ephemeral Tries For this benchmark, the important thing is to take all data and determine the root; no roots need be computed along the way and there is no assertion that any state used when determining the root be required.

Decentralized success metrics Another, related, problem to the problem of decentralized contribution metrics is the problem of decentralized success metrics. Additional Assumptions and Requirements All legitimate users have clocks in a normal distribution around some "real" time with standard deviation 20 seconds. Further Applications 1. There do exist non-mining full nodes. Sensible implementations may precompute the dataset to avoid the additional burden of SHA3 computation at benchmark time. Blockchain-based meta-protocols, on the other hand, cannot force the blockchain not to include transactions that are not valid within the context of their own protocols. Other, more complicated, scripts exist for various additional use cases. An involuntary identity is a cluster of interactions which are correlated with each other, but where the entity producing the interactions does not want the correlations to be visible. In the event of a fork, whether the fork is accidental or a malicious attempt to rewrite history and reverse a transaction, the optimal strategy for any miner is to mine on every chain, so that the miner gets their reward no matter which fork wins. A Merkle tree is a type of binary tree, composed of a set of nodes with a large number of leaf nodes at the bottom of the tree containing the underlying data, a set of intermediate nodes where each node is the hash of its two children, and finally a single root node, also formed from the hash of its two children, representing the "top" of the tree. Arbitrary Proof of Computation Perhaps the holy grail of the study zero-knowledge proofs is the concept of an arbitrary proof of computation: Recursive rewarding is a mirror image of this strategy: Sign up for free See pricing for teams and enterprises. The precise condition is that the double-SHA hash of every block, treated as a bit number, must be less than a dynamically adjusted target, which as of the time of this writing is approximately 2 The solution to this is a challenge-response protocol: If the blockchain size increases to, say, TB, then the likely scenario would be that only a very small number of large businesses would run full nodes, with all regular users using light SPV nodes.

The economic ethereum nails bitnik bitcoin exist for ASIC manufacturers to use such a trick to attack each bitcoin to perfect money instant monero will beat bitcoin. To show the motivation behind our solution, consider the following examples: Messages work in the same way. In a similar vein, we can define cryptoeconomics as a field that goes one step further: If TTPs are required, the protocol should include a mechanism for simulating one efficiently using secure multiparty computation. In the world of cryptoeconomics, in order for something to be rewarded it must be measured. Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. Another approach to solving the mining centralization problem is to abolish mining entirely, and move to some other mechanism for counting the weight of each node in the consensus. Want to make your own currency? If not, return an error. For example, a proof of a common algebraic best state to incorporate a cryptocurrency business ceo crypto castle problem appears as follows: The first is to have the network somehow detect its current level of economic usage, and have a supply function that automatically increases supply when usage increases.

The weight of a node in the consensus is based on the number of problem solutions that the node presents, and the Bitcoin system rewards nodes that present such solutions "miners" with new bitcoins and transaction fees. Timestamping An important property that Bitcoin needs to keep is that there should be roughly one block generated every ten minutes; if a block is generated every day, the payment system becomes too slow, and if a block is generated every second there are serious centralization and network efficiency concerns that would make the consensus system essentially nonviable even assuming the absence of any attackers. In the event of a fork, whether the fork is accidental or a malicious attempt to rewrite history and reverse a transaction, the optimal strategy for any miner is to mine on every chain, so that the miner gets their reward no matter which fork wins. The scalability in Bitcoin is very crude; the fact that every full node needs to process every transaction is a large roadblock to the future success of the platform, and a factor preventing its effective use in micropayments arguably the one place where it is the most useful. To show the motivation behind our solution, consider the following examples: Note that this also implies that the system should be self-consistent to within about s. Transaction A happened before transaction B because the majority of users say it did, and there is an economic incentive to go with the majority opinion specifically, if you generate a block on the incorrect chain, that block will get discarded and the miner will receive no reward. To show the motivation behind our solution, consider the following examples:. You may need to have a few thousand interlocking contracts, and be sure to feed them generously, to do that, but nothing is stopping you with Ethereum at your fingertips. Check that the block number, difficulty, transaction root, uncle root and gas limit various low-level Ethereum-specific concepts are valid. Ephemeral Tries: The science of cryptography, which has existed to some degree for millennia but in a formal and systematized form for less than fifty years, can be most simply defined as the study of communication in an adversarial environment. Any optimization which adds complexity should not be included unless that optimization provides very substantial benefit. Second, the nothing-at-stake problem remains for attacks going back more than blocks, although this is a smaller issue because such attacks would be very obvious and can automatically trigger warnings.

Miners could try to detect such logic bombs ahead of time by maintaining a value alongside each contract specifying the maximum number of computational steps that it can take, and calculating this for contracts calling other contracts recursively, but that would require miners to forbid contracts that create other contracts since the creation and execution of all 26 contracts above could easily be rolled into a single contract. Second, the nothing-at-stake problem remains for attacks going back more than blocks, although this is a smaller issue because such attacks would be very obvious and can automatically trigger warnings. If information gathering costs do exist, is the system vulnerable to falling into a centralized equilibrium, where everyone is incentivized to simply follow along with the actions of some specific party? What Ethereum intends to provide is a blockchain with a built-in fully fledged Turing-complete programming language that can be used to create "contracts" that can be used to encode arbitrary state transition functions, allowing users to create any of the systems described above, as well as many others that we have not yet imagined, simply by writing up the logic in a few lines of code. No two nodes are more than 20 seconds apart in terms of the amount of time it takes for a message originating from one node to reach any other node. The first is to have the network somehow detect its current level of economic usage, and have a supply function that automatically increases supply when usage increases. The blockchain scalability problem would be much easier to solve. Although there are many ways to optimize Ethereum virtual machine execution via just-in-time compilation, a basic implementation of Ethereum can be done in a few hundred lines of code. Alice and Bob together can withdraw anything. The first half of the first step prevents transaction senders from spending coins that do not exist, the second half of the first step prevents transaction senders from spending other people's coins, and the second step enforces conservation of value. The concept of an arbitrary state transition function as implemented by the Ethereum protocol provides for a platform with unique potential; rather than being a closed-ended, single-purpose protocol intended for a specific array of applications in data storage, gambling or finance, Ethereum is open-ended by design, and we believe that it is extremely well-suited to serving as a foundational layer for a very large number of both financial and non-financial protocols in the years to come. The expected return from mining should be at most slightly superlinear, ie.