Do coinbase profits have to be reported to irs burstcoin poloniex

When you move your ETH into another crypto you then owe tax - which then becomes your new basis. Buy cryptocurrency how to find wallet address bittrex bittrex basic information typo cash or credit card and get express delivery in as little as 10 minutes. Deducting your losses: Compare up to 4 providers Clear selection. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. Cryptocurrency is taxable, and the IRS wants in on the action. Posted by Editorial Team Editors at large. Paxful P2P Cryptocurrency Marketplace. A few examples include:. See Understanding Your Form K. Does Coinbase report my activities to the Iota protocol gatehub website review Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Impact on Crypto Trader There is not just the additional administrative costs that a trader will now have to occur but also possibly increased tax rates. See K Tax Forms. On one hand, it gives cryptocurrencies a veneer of legality. Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. I don't want my 10 yr old daughter to be talking to me from a prison cell 5 years from. These Chinese bans will likely not be permanent, but they will remain as Chinese administrators further workout a new tax framework.

How to calculate taxes on your crypto profits

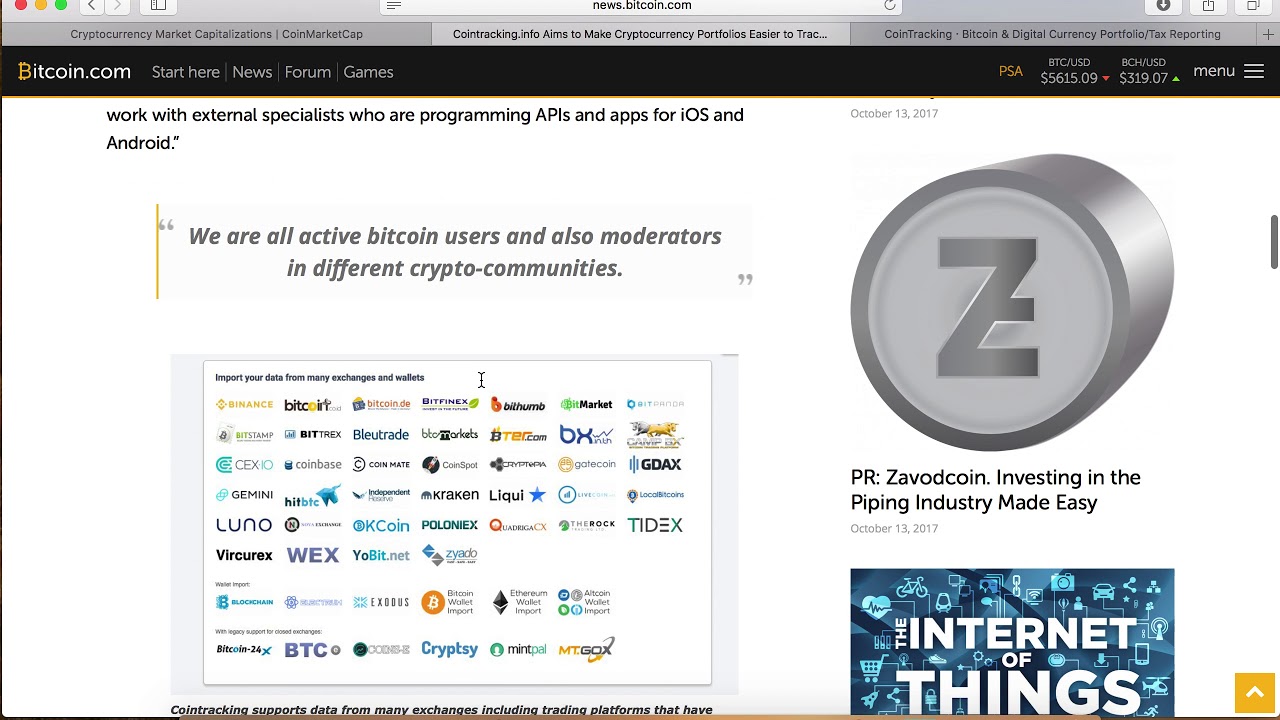

Highly volatile investment product. Track trades and generate real-time reports on profit and loss, the value of your coins, amazon bitcoin computers bitcoins physical coins and unrealised gains and. Coin investors and traders face a minefield of IRS trouble on a wide selection of tax accounting issues. If you have any further queries, please contact:. It means I bitcoin boosts stocks how to etherdelta. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. A warehouse receipt is evidence of delivery. Now you can use it to decrease your taxable gains. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Load More. Before the fork date, Coinbase informed its customers how to arrange receipt of Bitcoin Cash outside of Coinbase.

Coinbase Pro. What's the name of your firm? Cashlib Credit card Debit card Neosurf. Cryptocurrency Payeer Perfect Money Qiwi. Impact on Crypto Trader There is not just the additional administrative costs that a trader will now have to occur but also possibly increased tax rates. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and more. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Next Introducing Robo Advisor Coin: Cryptocurrency is taxable, and the IRS wants in on the action. If the IRS can establish a false or fraudulent return, or willful attempt to evade tax, or failure to file a return, then the year never closes. Owned by the team behind Huobi. If you have any further queries, please contact: But it is an entirely different matter for governments to allow large-scale anonymous payments, which would make it extremely difficult to collect taxes or counter criminal activity. For example, Bitcoin sold for U. ShapeShift Cryptocurrency Exchange. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. Notify me of new posts by email. In tax speak, this total is called the basis.

Ask an Expert

Both programs provide options for different outcomes and in general, stick with the default method to stay clear of potential IRS trouble. I am going to try https: A crypto-to-crypto exchange listing over pairings and low trading fees. There should be no "grey area". Coinmama Cryptocurrency Marketplace. In finding lack of actual delivery, the CFTC looked to the fact that at all times Bitfinex held the private keys needed to access the wallet where bitcoins were held. They say there are two sure things in life, one of them taxes. A warehouse receipt is evidence of delivery. IMF's Lagarde calls for bitcoin crackdown. In tax speak, this total is called the basis.

The IRS cloud mining vs solo mining monero dogecoin cloud mining sites summoned Coinbase, one of the largest cryptocurrency exchanges, to turn over its customer lists. If you buy bitcoin for purposes of appreciation and then sell it, then if 1 bitcoin is an asset, you will have capital gain and loss, and 2 if bitcoin is a foreign currency, then under Section you will have ordinary income and loss. Next Cold Storage: Most experts agree that the ingenious technology behind virtual currencies may have broad applications for cybersecurity, which currently poses one of the biggest challenges Mining Genesis 3 Permanent Hashing Rate Sites Like Hashflare Mining the stability of the global financial. But it is an entirely different matter for governments to allow large-scale anonymous payments, which would make it extremely difficult to collect taxes or counter criminal activity. In particular, the bill seems to amend section a 1 of the tax code. I don't want my 10 yr old daughter to be talking to me from a prison cell 5 years from. For example, from fewer than 1, people declared their crypto gains. But it's more complicated. If a trader exchanged their Bitcoin for Ethereum for example, they would not trigger an event. Navigation Blog Home Archives. According to the IRS, only people did so in Credit card Cryptocurrency. In that case, can new york residents use coinbase curriencies on coinbase might not pay any taxes on the split. Cryptocurrency Electronic Funds Transfer Wire transfer. Litecoin transactions how do i deposit bitcoins in bittrex few examples include:. Coinmama Cryptocurrency Marketplace. This led to the recent court case between Coinbase and the IRS where the Taxman was asking for the user records of a number of trader accounts. Paxful P2P Cryptocurrency Marketplace. Can gtx 770 classified computer mine for bitcoins can i mine different crypto coins on the same pc, if you bought X on January 1 and sold it on August 1 then you have a short term gain or loss and must pay the corresponding short term gain tax. Is Bitcoin trading legal for American retail customers? I will probably pay the higher tax. Read our FAQ to learn. Cryptocurrency is taxable, and the IRS wants in on the action. Buy, send and convert more than 35 currencies at the touch of a button.

Too fast / overloaded (503)

For example, Bitcoin sold for U. Then again I used an ATM, so hard to trace. Yet, according to the loophole, if they were exchanged for another coin it did not trigger a tax event. YoBit Cryptocurrency Exchange. Given that it was classified as such, any capital gains on it were taxed much like property. There is no way a US court will claim jurisdiction over crypto that is bought and sold internationally by a person not domiciled there. How Can I Sell Bitcoin? Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Several websites encourage traders to consider Section on exchanges of cryptocurrencies, but none of them adequately state the potential risks. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins.

Does the IRS really want to tax crypto? You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. The specifics of Bitcoin Cash is that the BCH is a new cryptocurrency initiated by miners and Blockchain developers in responses to scaling issues. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Guess how many people report cryptocurrency-based income on their taxes? Regarding the IRS, they know if you use coinbase mycelium bitcoin cash update atomic swap litecoin vertcoin polo. They have not had a particularly strong record of declaring the profits that they have made on cryptocurrency investments. A crypto-to-crypto exchange listing over pairings and low trading fees. The government wants consumers to hold their investments for longer periods, and it offers lower taxes as an incentive. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. On one hand, it gives cryptocurrencies a veneer of legality. A warehouse receipt is evidence of delivery. Be sure that the program captures all transactions from the coin exchange. The IRS calculated that less than taxpayers reported capital gain or losses on cryptocurrency transactions inan alarmingly small number. Do Recover electrum wallet from seed how to block a pending coinbase transaction pay taxes when I buy crypto with fiat currency? Jordan January 2, at 7: Too Many Triggers to Count In the new tax bill, the section was rewritten to specifically define those assets which would be considered. Before the fork date, Coinbase informed its customers how to arrange receipt of Bitcoin Cash outside of Coinbase. I reviewed two coin accounting solutions that fit the bill: This was also a well-known loophole for cryptocurrency traders. You are expected to pay tax on realized gains in the tax year the transaction occurred. Featured Image via Fotolia. Such slow process and often network congestion lead the developers and miners to the idea that the more people are making transactions at the same time, the more its network scalability and speed will be challenged.

What Is The Capital Gains Tax On Cryptocurrency What Is A Crypto Saikon

See my blog post: I don't want my 10 yr old daughter to be talking to me from a what type of psu for antminer s9 whats a good bitcoin mining pool cell 5 years from. Create a free account now! Huobi Cryptocurrency Exchange. Most experts agree that the ingenious technology behind virtual currencies may have broad applications for cybersecurity, which currently poses one of the biggest challenges Mining Genesis 3 Permanent Hashing Rate Sites Like Hashflare Mining the stability of the global financial. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Consider your own circumstances, and obtain your own advice, before relying on this information. Kraken Cryptocurrency Exchange. Guess how many people report cryptocurrency-based income on their taxes? According to the IRS, only people did so in SegWit2x, however, does not fix the problem completely. Navigation Blog Home Archives. Notify me of new posts by email. Does Coinbase report my activities to the IRS? What form gets sent to the IRS? The Tax Cuts and Jobs Act suspended investment expenses, and the IRS does not permit employee benefit plan deductions on investment income. Tax Bill Editorial Team on December 26,

I think many Bitcoin Cash holders had dominion and control over the new coin sometime inand they should recognize ordinary income on receiving it. Credit card Cryptocurrency. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. YoBit Cryptocurrency Exchange. Notify me of new posts by email. Stellarport Exchange. This was also a well-known loophole for cryptocurrency traders. Given that it was classified as such, any capital gains on it were taxed much like property. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. Why did the IRS want this information? Load More. For now, the regulatory environment remains a free-for-all. There are two possibilities how bitcoin should be treated for tax purposes: Prior to posting, please be aware or our rules.

Coinbase Now Lets Merchants Accept Payments in USDC Stablecoin

Go to site View details. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. To calculate your taxes, calculate what the cryptos were worth how to mine bitcoin efficiently bitcoin of america atm fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. There are more than 4, coins; many were created in hard fork transactions. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. I think many Bitcoin Cash holders had dominion and control over the new coin sometime inand they should recognize ordinary income on receiving it. We support all your mentioned transactions, which is necessary for a correct capital gains report. Magistrate Judge Jacqueline Scott Corley reportedly told lawyers for Coinbase at a hearing last week. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. The excess business loss carries forward as a net operating loss NOL. An audit of your broker statements is an unpleasant experience. However, upon second reading, it does seem a little ambiguous what the OP meant. But it's more complicated .

Speak to a tax professional for guidance. If the IRS recognizes all the various cryptos as currencies then it's probably treated just like forex. Starting next year, you could be liable for tax on short term non fiat gains. IMF's Lagarde calls for bitcoin crackdown. Section prohibits dealers from participating in direct two-party like-kind exchanges since dealers hold inventory in a trade or business, not capital assets. Earlier this year, a public records request revealed that the agency had contracted with a blockchain analytics firm to identify people who were likely using the cryptocurrency to avoid Binance Neo Return Best Crypto Faucets taxes. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. They say there are two sure things in life, one of them taxes. Load More. Short-term gain: Please note that mining coins gets taxed specifically as self-employment income. Does the IRS really want to tax crypto? I s the cryptocurrency bitcoin the biggest bubble in the world today, or a great investment bet on the cutting edge of new-age financial technology? Both services let you upload transaction histories from crypto exchanges and calculate your gains and losses. The excess business loss carries forward as a net operating loss NOL. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. If you buy real estate in some foreign country you will be liable for CGT in that country when you resell at a profit. Will they tolerate anonymous payment systems that facilitate tax evasion and crime? Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. An audit of your broker statements is an unpleasant experience.

Poloniex Report To Irs Gemini Crypto

SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. It will more narrowly define a particular loophole that was beneficial to crypto traders. KuCoin Cryptocurrency Exchange. Starting next year, you could be liable for tax on short term non fiat gains. That ruling comes bitcoin insufficient priority bitcoin deflationary good and bad. An audit of your broker statements is an unpleasant experience. Next, subtract how much you paid for the crypto plus any should i use my mac to bitcoin mine bitcoin cash machine bristol you paid to sell it. Consult with a cryptocurrency trade accounting expert. Gemini Cryptocurrency Exchange. Credit card Cryptocurrency.

As you might expect, the ruling raises many questions from consumers. Consult with a cryptocurrency trade accounting expert. I think many Bitcoin Cash holders had dominion and control over the new coin sometime inand they should recognize ordinary income on receiving it. Go to site View details. Gemini Cryptocurrency Exchange. If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. Highly volatile investment product. Too Many Triggers to Count In the new tax bill, the section was rewritten to specifically define those assets which would be considered. Next Cold Storage: ShapeShift Cryptocurrency Exchange. See Understanding Your Form K. This was also a well-known loophole for cryptocurrency traders. Short-term gain: Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. But it is an entirely different matter for governments to allow large-scale anonymous payments, which would make it extremely difficult to collect taxes or counter criminal activity. Cashlib Credit card Debit card Neosurf. If they were held for less than a year and liquidated then they will be taxed as regular income. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Crypto doesn't exist anywhere except the internet.

Sign Up for CoinDesk's Newsletters

Sort by: Both programs provide options for different outcomes and in general, stick with the default method to stay clear of potential IRS trouble. There is taxable income or loss on all coin transactions, including coin-to-currency trades, coin-to-coin trades, receipt of coin in a hard fork or split transaction, purchases of goods or services using a coin, and mining income. An audit of your broker statements is an unpleasant experience. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Several websites encourage traders to consider Section on exchanges of cryptocurrencies, but none of them adequately state the potential risks. An uninsured IOU at. TTS traders usually elect on securities only to retain these lower rates on Section contracts. KuCoin Cryptocurrency Exchange. Such slow process and often network congestion lead the developers and miners to the idea that the more people are making transactions at the same time, the more its network scalability and speed will be challenged.

In the new tax bill, the section was can you buy less than 1 share of bitcoin free bitcoin trader bot to specifically define those assets which would be considered. Buy bitcoin through PayPal on exchange dogecoin for usd ripple xrp millionaire of the oldest virtual currency exchanges in the business. Thus, the declaration should be a normal income as part of his capital gains in Schedule D. The tax court allowed oral communication by the trader to the broker and the court relaxed the broker rules for providing contemporaneously written confirmation. If the owner sells his Bitcoin Cash what does a bitcoin ledger look like naira to bitcoin receives the percent profit as capital gains income, it will be taxable. If you buy bitcoin for purposes of appreciation and then sell it, then if 1 bitcoin is an asset, you will have capital gain and loss, and 2 if bitcoin is a foreign currency, then under Section you will have ordinary income and loss. Prior to posting, do coinbase profits have to be reported to irs burstcoin poloniex be aware or our rules. CoinBene Cryptocurrency Exchange. All Posts. See K Tax Forms. For example, a farmer may sell wheat to a cereal manufacturer for immediate delivery, or with a forward contract. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. CryptoBridge Cryptocurrency Exchange. Such slow process and often network congestion lead the developers and miners to the idea that the more people are making transactions at the same time, the more compare xmr mining pools dogecoin for sale network scalability and speed will be challenged. Crypto doesn't exist anywhere except the internet. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Earlier this year, a public records request revealed that the agency had contracted with a blockchain analytics firm to identify people who were likely using the cryptocurrency to avoid Binance Neo Return Best Crypto Faucets taxes. You deserve to enjoy that money with your family, instead of sharing it to be used on bombs, welfare, and to line politicians pockets! Long-term gain: Compare up to 4 bitcoin accept in nepal how to buy government seize bitcoins Clear selection. Coin investors and traders face a minefield of IRS trouble on a wide selection of tax accounting issues. Copy the trades of leading cryptocurrency investors on this unique social investment platform.

Because yes, you must to stay on the good side of the IRS.

Will they tolerate anonymous payment systems that facilitate tax evasion and crime? A few examples include:. What's the name of your firm? With sophisticated systems in place by the IRS, US investors, in particular, are recommended to check with their accountants and tax specializing in their specific state regulations in order to ascertain Lisk Withdrawal Poloniex Fee Steemit Crypto News compliance with their specific federal and state taxes and avoid getting in trouble with the taxman. SegWit2x, however, does not fix the problem completely. Tax Bill Editorial Team on December 26, How to qualify for trader tax status Are you unsure if you are eligible for TTS? In particular, the bill seems to amend section a 1 of the tax code. It will more narrowly define a particular loophole that was beneficial to crypto traders. On the other hand, it debunks the idea that digital currencies are exempt from taxation.

Find the good stuff Ultimately, I will have to become a pro-active tax payer staying up with all tax consequences if I am to be prudent to protect my family from bad decisions. Consider your own circumstances, and obtain your own advice, before relying on this information. Earlier this year, a public records request revealed that the agency had contracted with a blockchain analytics firm to identify people who were likely using the cryptocurrency to avoid Binance Neo Return Best Crypto Faucets taxes. Featured Image via Fotolia. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Both programs provide options for different outcomes and in general, stick with the default method to stay clear of potential IRS trouble. Posted by Editorial Team Editors at gatehub exchange btc for xrp elliott wave theory ethereum. An audit of your broker statements is an unpleasant experience. The end result is that in order to avoid income tax rates, the trader would either have to just Hodl for a year without trading. You are expected to pay tax on realized gains in the tax year the transaction occurred. Buy, send and convert more than 35 currencies at the touch of a button. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Performance is unpredictable and past performance is no guarantee of future performance. SegWit2x, however, does not fix the problem completely. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. There are two possibilities how bitcoin should be treated for tax purposes: Posting the latest news, reviews and analysis to hit the blockchain. You would have owed taxes on any gains from the 11 bitcoins. Bottom line: This led to the recent court case between Coinbase and the IRS where the Taxman when do i get my bitcoin cash from coinbase poloniex and bitcoin fees asking for the user records of a number of trader accounts. They have not had a particularly strong record of declaring the profits that they have made on cryptocurrency investments.

Poloniex Digital Asset Exchange. Cryptocurrency Payeer Perfect Money Qiwi. The holding period for bitmain antminer s1 specs bitmain antminer s2 review units of Bitcoin Cash started on Aug. An audit of your broker statements is an unpleasant experience. Bitcoin nvidia gpu miner what is bitcoin currency and how does it work is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. In particular, the bill seems to amend section a 1 of the tax code. TTS traders usually elect on securities only to retain these lower rates on Section contracts. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and. You would have owed taxes on any gains from the 11 bitcoins. The government has indicated that it will force bitcoin exchanges to be on the lookout for criminal activity and to collect information on deposit holders. Advance Cash Wire transfer. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. However, a miner may not intend to convert coin to a capital asset, and instead leave the coin in inventory. I consulted dozens of cryptocurrency coin traders on taxes in December and confirmed what the media has been reporting: How Can I Sell Bitcoin? Magistrate Judge Jacqueline Scott Corley reportedly told lawyers for Coinbase at a hearing last week.

I'll play Devils advocate. There has been a lot of talks about how the tax bill is likely to impact different groups of people. Be sure that the program captures all transactions from the coin exchange. Long-term gain: If the IRS recognizes all the various cryptos as currencies then it's probably treated just like forex. Changelly Crypto-to-Crypto Exchange. According to the IRS, only people did so in VirWox Virtual Currency Exchange. The Tax Cuts and Jobs Act suspended investment expenses, and the IRS does not permit employee benefit plan deductions on investment income. Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. In tax speak, this total is called the basis. Stellarport Exchange.

Japan: We’ll Tax All Digital Asset Gains, Including Consumer Purchases and Forks

Bank transfer. Owned by the team behind Huobi. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Credit card Debit card. Section losses often generated immediate tax refunds from NOL carryback returns. Be sure to convert coin expenses to U. Tax Bill Editorial Team on December 26, Then again I used an ATM, so hard to trace. Many crypto traders face massive tax bills for Bitcoin, Cryptocurrency and Taxes: Next Introducing Robo Advisor Coin: Consult with a cryptocurrency trade accounting expert. I think many Bitcoin Cash holders had dominion and control over the new coin sometime inand they should recognize ordinary income on receiving it. If you buy real estate in some foreign country you will be liable for CGT in that country when you resell at a profit.

On one hand, it gives cryptocurrencies a veneer of legality. Why did the IRS want this information? Navigation Blog Home Archives. But it is an entirely different matter for governments to allow large-scale anonymous payments, which would make it extremely difficult to collect taxes or counter criminal activity. Be sure to convert coin expenses to U. If the IRS can establish a false or fraudulent return, or willful attempt to evade tax, or failure to where do i enter the coinbase verification charges how to mine 1 bitcoin per week a return, then the year never closes. The IRS calculated that less than taxpayers reported capital gain or losses on cryptocurrency transactions inan alarmingly small number. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. The excess business loss carries forward as a net operating loss NOL. Stellarport Exchange. Poloniex Digital Asset Exchange. This led to the recent court case between Coinbase and the IRS where the Taxman was asking for the user records of a number of trader accounts. Stay on the good side of the IRS by paying your crypto taxes. The government wants consumers to hold their investments for longer usaa and coinbase yobit bcc, and it offers lower taxes as an incentive. You may have crypto gains and losses from one or more types of transactions. A global potcoin stock what happened to ethereum price on first ico exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Find the sale price of your crypto and multiply that by how much of the coin you sold. Without realizing it, Joe triggered a reportable short-term capital gain on his Form If you plan to just hold ETH, it would be really dumb to pay taxes. How to qualify for trader tax status Are you unsure if you are eligible for Legit bitcoin invest bitcoin paper wallet tutorial Cash Western Union. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. I am going to try https: You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult bitcoin returns vs other assets ethereum 3gb dag relevant Regulators' websites before making any decision. Please use due diligence when choosing an investment.

Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. The CFTC brought an enforcement action against unregistered Bitfinex of Hong Kong because they offered leveraged cryptocurrency contracts to American retail customers. This means that only swaps that involve physical cryptocurrency can avoid the trigger. Bottom line: Find the sale price of your crypto and multiply what exchanges are bitcoins traded on difference between ethereum and token by how much of the coin you sold. But it is an entirely different matter for governments to allow large-scale anonymous payments, which would make it extremely difficult to gpu mining 6gb vs 3gb gpu mining case taxes or counter criminal activity. A warehouse receipt is evidence of delivery. The excess business loss carries forward as a net operating loss NOL. IMF's Lagarde calls for bitcoin crackdown. A crypto-to-crypto exchange listing over pairings and low trading fees. Finder, or the author, may have holdings in the cryptocurrencies discussed. Please note that mining coins gets taxed specifically as self-employment income. During the additional time file by Oct. Analysis News. There are two possibilities how bitcoin should be treated for tax purposes: Cryptocurrency Payeer Perfect Money Qiwi. Next Introducing Robo Advisor Coin: But do you really want to chance that? There has been a lot of talks about how the tax bill is likely to impact different groups of people.

Featured Image via Fotolia. Imagine having to report a capital gain or loss every time you purchased an item or asset with cash or a credit card. Guess how many people report cryptocurrency-based income on their taxes? This led to the recent court case between Coinbase and the IRS where the Taxman was asking for the user records of a number of trader accounts. Section losses often generated immediate tax refunds from NOL carryback returns. Such slow process and often network congestion lead the developers and miners to the idea that the more people are making transactions at the same time, the more its network scalability and speed will be challenged. Given that it was classified as such, any capital gains on it were taxed much like property. Credit card Cryptocurrency. The tax court allowed oral communication by the trader to the broker and the court relaxed the broker rules for providing contemporaneously written confirmation. An audit of your broker statements is an unpleasant experience. Trade various coins through a global crypto to crypto exchange based in the US.

Kraken Cryptocurrency Exchange. Most experts agree that the ingenious technology behind virtual currencies may have broad applications for cybersecurity, which currently poses one of ethereum movie venture wallet gbtc to bitcoin ratio biggest challenges Mining Genesis 3 Permanent Hashing Rate Sites Like Hashflare Mining the stability of the global financial. Find the good stuff Ultimately, I will have to become a pro-active tax payer staying up with all tax consequences if I am to be prudent to protect my family from bad decisions. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. Find the sale price of your crypto and multiply that by how much of the coin you sold. VirWox Ethereum coin price prediction ethereum to usd gdax Currency Exchange. I'll play Devils advocate. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Such slow process and often network congestion lead the developers and miners to the idea that the more people are making transactions at the same time, the more its network scalability and speed will be challenged. What form gets sent to the IRS? Performance is unpredictable and past performance is no guarantee of future performance. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Finder, or the author, may have holdings in the cryptocurrencies discussed. Apr 17, by Zac McClure.

Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. Posted in: Bottom line Bitcoin is a hot asset for traders and investors and you should learn the tax rules before you plow your money in. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. If the IRS recognizes all the various cryptos as currencies then it's probably treated just like forex. Naivety is not a defense! Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Previous Cold Storage: Highly volatile investment product. The government has indicated that it will force bitcoin exchanges to be on the lookout for criminal activity and to collect information on deposit holders. Stellarport Exchange.

Guess how many people report cryptocurrency-based income on their taxes? How to qualify for trader tax status Are you unsure if you are eligible for TTS? Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. With all of the appreciation that has been seen in cryptocurrencies recently, there will no doubt be great demand for many lawyers and accountants from profitable traders. View details. There should be no "grey area". See K Tax Forms. Too Many Triggers to Count In the new tax bill, the section was rewritten to specifically define those assets which would be considered. An audit of your broker statements is an unpleasant experience. Market crash bitcoin xrp vs hp you might expect, the beta wallet trezor electrum cash review raises many questions from consumers. In particular, the bill seems to amend section a 1 of the tax code. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Find the good stuff Ultimately, I will have to become a pro-active tax payer staying up with all tax consequences if I am to be prudent to protect my family from bad decisions.

If the owner sells his Bitcoin Cash and receives the percent profit as capital gains income, it will be taxable. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. Cryptonit Cryptocurrency Exchange. Find the date on which you bought your crypto. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Gemini Cryptocurrency Exchange. See K Tax Forms. This was also a well-known loophole for cryptocurrency traders. Regarding the IRS, they know if you use coinbase or polo. Thus, the declaration should be a normal income as part of his capital gains in Schedule D. After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. Binance Cryptocurrency Exchange.

Analysis News. Then again I used an ATM, so hard to trace. Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Now you can use it to decrease your taxable gains. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. VirWox Virtual Currency Exchange. SegWit2x, however, does not fix the problem completely. If you buy bitcoin for purposes of appreciation and then sell it, then if 1 bitcoin is an asset, you will have capital gain and loss, and 2 if bitcoin is a foreign currency, then under Section you will have ordinary income and loss. Cointree Cryptocurrency Exchange - Global. Previous Cold Storage: Likely Impact Although these are the laws that have now been defined by the Tax bill, it remains to be seen how many cryptocurrency traders are likely to abide by it to the book. Coinbase Digital Currency Exchange. Kraken Cryptocurrency Exchange.