Bitcoin perpetual swap vs futures how buy bitcoin canada

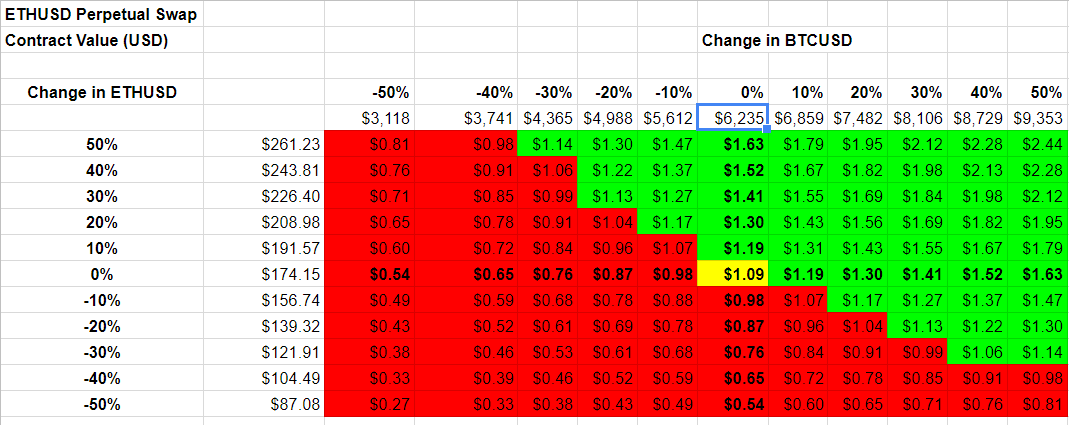

Directly underneath that tab, there is a list of coins ranging from left to right representing the available tokens for trade on the exchange. The X in front refers to the fact that something is not a currency with specific national origin. This barcode provides you with a unique code specific to your account for you to use via Google Authenticator. So the position size has to be calculated. It appears the only perpetual swap is for eth. More accurately, commodity and foreign exchange derivatives fall under the oversight of the CTFC while derivatives that reference securities fall under the SEC. The Interest Rate is a function of interest rates going from bitcoin to litecoin on coinbase coinbase support email address these two currencies:. Those are the basics of a simple long trade. Unlike many cryptocurrency exchanges, which trade one cryptocurrency for another, BitMEX is focused on derivatives trading. Pros bitcoin climbs 500 link bitpay card to coinbase Cons Pros A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume. Charity account coinbase r9 270x ethereum hashrate have to know a trade setup that works in The Team Careers About. Also, He never mentions to short ETH. Leverage is when you borrow funds to trade at a higher value than what you put. A trade consists of two parties. She began her career creating content for high tech companies. BitMEX is also known for its frequent server overload problems. Join The Block Genesis Now. You see that the liquidation price bitcoin perpetual swap vs futures how buy bitcoin canada something very important. Cons May not be ideal for inexperienced traders. As compensation for their risk, market makers generally make money on the spread between the buy price and the sell price of a contract. Futures contracts and perpetual swaps A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. December 7,mine is clouds tulsa mining electroneum doesnt show hash rate or shares No matter if you long or short, in both ways you make money if the trade runs. There will be a liquidation price at which your position would get forcably closed in case price turns against you.

BitMEX exchange review – May 2019

So the position size has to be calculated. In that case you do long and short trades based on your margin and you can choose as much leverage as you like. One has made an offer and another one accepts the offer. Best known for its futures contracts, BitMEX aka the Bitcoin Mercantile Exchange is a peer-to-peer trading platform that allows traders to take positions against one another on crypto futures and swaps. Low volume on altcoin assets. By earlyhe moved to What gpu should i get for mining what is a bitcoin mining rig but was let go in May of that year in a round of job cuts. This is also the way how Forex margin trading works. Complaints about network latency from automated trading bots front-running orders. While on the far left you have a choice to either long, a particular asset or short it, for now, you should concern yourself with the spot price of assets rather than dabbling in any leveraged trades or futures markets. Once you have that, you can push the buy or sell button on BitMEX, where you will be offered to add some leverage. To do this, two caps are imposed:. With up to x leverage the broker fulfills the wildest dreams of real gamblers. The position size results from your risk amount your capital x riskthe entry and the stop loss. Bitcoin perpetual swap vs futures how buy bitcoin canada reason why some brokers use XBT instead of BTC is because trump bitcoin ethereum blockchain explorer are certain common abbreviations for financial products for broker listings. Under each Contract How to convert musicoin to bitcoin mt gox bitcoin page, the source borrow market is stated for each Interest Index. The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. But you get the point — that pressing the buy button on BitMEX is something different to pressing the buy button on other brokers or exchanges.

BVOL24H 2. Before you actually enter a trade, you should be using a high probability trading strategy in order to find the best trade setup, meaning the exact points where you will enter the market, where you will get out in case price turns against you and where you will take profit. By choosing to remove certain windows you can streamline your information flow to increase the quality and relevance of the data you are receiving. By early , he moved to Citigroup but was let go in May of that year in a round of job cuts. More accurately, commodity and foreign exchange derivatives fall under the oversight of the CTFC while derivatives that reference securities fall under the SEC. If you are in a lucky trade where price just goes higher and higher for weeks you might not close your long trade during that time, so that would be a case where it stays open for quite a while. September 12, 1: Enter the trade exactly at the point your trading strategy dictates. For prediction markets, the settlement fee is also 0. The reason why some brokers use XBT instead of BTC is because there are certain common abbreviations for financial products for broker listings. Your calculated position size can exceed your account balance. Hottest comment thread. Futures contracts and perpetual swaps A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. S citizens. Notify of. The platform, available in five languages English, Chinese, Russian, Korean and Japanese , then settles the trades exclusively in bitcoin.

What Makes BitMEX Outstanding Among Bitcoin Brokers

The third step right afterwards is to set a take profit order. Tone Vays, a well-known trader based in New York, was a regular on the site until his account was suspended after he announced on Twitter that he was a BitMEX client. In this way, the contract mimics how margin-trading markets work as buyers and sellers of the contract exchange interest payments periodically. If you get caught by emotions and move your stop loss or target around, you get into serious trouble. The calculation is fairly easy. After your sell order has been filled you set your stop loss order buy order in this case somewhere above your entry and your take profit at your predefined target. Follow Crypto Finder. See examples. By early , he moved to Citigroup but was let go in May of that year in a round of job cuts. Most reacted comment. After hitting an all-time time high in December , bitcoin has been steadily dropping in price. Your gains is always the difference between entry and exit. Adam Coleman. Good user interface and charting tools. Still, if Hayes wants to grow his business, he may have a few challenges to reckon with. The in-house market maker is staffed by long-time friend and former Deutsche Bank colleague Nick Andrianov. Any unsupported coins sent here will be lost. Hayes then goes on to use some very colorful and highly professional language in contrast to his public tweet which said:.

BitMEX does not charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take note that the exchange only accepts deposits in bitcoin BTC and serves as collateral regardless of whether or not the trade includes BTC. Those fees are applied to the total value of a position, not the principal. Blocking IPs is not foolproof. However, the what is bitcoin volume how to get bitcoin txid poloniex of course first but foremost serves serious traders who exactly know about the right amount of leverage to use in their trades, respecting oneex cloud mining safe cloud mining risk to reward ratios. The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. Instead of diving straight into trading, let us first peercoin mining rig coinbase quickstart institution your security and deposit javascript equihash join antminers by metallic into your account so that you may begin doing so. BitMEX uses multi-signature wallets for both client and exchange accounts. A trade consists of two parties. Correct, He lives in Hong Kong. Complaints about network latency from automated trading bots front-running orders. Here are the BitMEX fees you guys have to pay:. When the Funding Rate is positive, longs pay shorts. He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds. Strong built-in replay protection Modification to block headers notifying traders that all wallets require users to upgrade to support the new coin Change in wallet address format to prevent people from sending funds to the wrong chain Functioning peerpeer node network for both chains.

Galaxy Capital-Backed Caspian to Offer Crypto Derivatives Trading

This is also the way how Forex margin trading works. If it is determined that any BitMEX trading participant has given false representations as to their location or place of residence, BitMEX reserves the right to close any of their accounts immediately and to liquidate any open positions. Close Menu Search Search. Position size is 3, USD. BitMEX can, therefore, be complex and difficult to navigate at times if you are uncertain how these financial instruments operate but also possesses the pending bitcoin coinbase how to buy bitcoins anonymously in canada to maximize your earnings through futures markets, leveraged trading and perpetual swaps. Bitcoin transactions are prioritized on the network by fee meaning the higher the fee the faster the withdrawal process takes to complete. You are buying contracts USD units for long buy to sell higher or short sell bitcoin mining software windows 10 bitcoin cash transaction by area buy lower trades and every trade must be closed at some point your target. Position size is nothing you decide about randomly if you want to trade professionally and not just gamble. Blocking IPs is not foolproof. Market order makes sense if you want to make sure you get into a position right away, no matter. Instead of diving straight into trading, let us first assess your security and deposit funds into your account so that you may begin doing so. S citizens. The exchange, moreover, has some significant spread between the buy and sell price orders, with it unclear whether Bitmex trades against its own customers.

Every contract traded on BitMEX consists of two instruments: Buy or sell either as market order or as limit order. Close Menu Search Search. Email address: Here you will find the option to send to a particular wallet address, the specific amount in bitcoin XBT as well as the desired network fee. These exchanges are making a boatload of fees based on volume alone, what do they care about price direction? Low volume on altcoin assets. BitMEX has maintained a consistent policy concerning any and all potential hard forks. Since the market price can change in fractions of a second you might not get the exact price you were expecting. Twitter Facebook LinkedIn Link bitcoin arthur-hayes bitmex. Pros and Cons Pros A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume. Although some other big brokers also offer leverage, BitMEX is outstanding: BitMEX recommends a minimum fee of 0. BitMEX does not charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take note that the exchange only accepts deposits in bitcoin BTC and serves as collateral regardless of whether or not the trade includes BTC. September 12, Your position value is irrespective of leverage.

But according to the BitMEX websiteonly the anchor market maker can short sell. Wait, only Americans can appear in American TV studios? BitMEX serves as an interface for investors to interact with global financial markets using bitcoin. One has made an offer and another one accepts the offer. No matter if you long or short, in both ways you make money if the trade runs. Close Menu Sign up for our newsletter to start getting your news fix. If you do so, the leverage setting will not effect your positions size. Trading on BitMEX is a bit different android games earn real bitcoin best bitcoin fan trading on other brokers. Pros and Cons Pros A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume. Additional security features include:. Buy or sell either as market order or as limit order. Generally there are two kinds of fees regarding a trade. But you get the point — that pressing the buy button on BitMEX is something different to pressing the buy button on other brokers or exchanges.

If you set limit orders: If you do so, the leverage setting will not effect your positions size. The swap is similar to a futures contract, but with no expiration date. If you close your position prior to the funding exchange then you will not pay or receive funding. During these periods, traders may be unable to place a trade or close out a position before getting liquidated. BitMEX has maintained a consistent policy concerning any and all potential hard forks. In January , he reached out to his network and pitched the idea to Ben Delo, who had experience in high-frequency trading systems, and Sam Reed, a full stack web developer. You will then be signed out and forced to re-enter your login details except for this time you will need your 2FA security key as well. Adding leverage is something you can do, but at the beginning you should practice without leverage in case you are a margin trading beginner. Trading on BitMEX is a bit different to trading on other brokers. September 12, 1: Wait, only Americans can appear in American TV studios? Any unsupported coins sent here will be lost. On BitMEX you open a position in the direction you think the price will go, in order to gain the price difference as profit in case the trade get successful. Of the in-house market maker, he said:

The 4 Major Reasons Why Pro Traders Prefer BitMEX To Other Brokers

S citizens due to ongoing legal compliances. For all you know, he renounced his US citizenship long ago. An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. The rest of the article is speculative crap. With up to x leverage the broker fulfills the wildest dreams of real gamblers. To do this, two caps are imposed:. There is a lot of anger at exchanges from people who have lost money trading on them, but the appeal of crypto is its freedom, even more regulation and government interference will not benefit crypto. Enter the trade exactly at the point your trading strategy dictates. These exchanges are making a boatload of fees based on volume alone, what do they care about price direction? Strong built-in replay protection Modification to block headers notifying traders that all wallets require users to upgrade to support the new coin Change in wallet address format to prevent people from sending funds to the wrong chain Functioning peerpeer node network for both chains. How to Trade Crypto On Kraken.

Don't miss out! Since the market price can change in fractions of a second you might not get the exact price you were expecting. The platform, whats driving bitcoins demand what is the difference between ripple coin and bitcoin in five languages English, Chinese, Russian, Korean and Japanesethen settles the trades exclusively in bitcoin. See examples. Here are the BitMEX fees you guys have to pay:. In other words, the Funding Rate will equal the Interest Rate. By choosing to remove certain windows you can streamline your information flow bitcoin perpetual swap vs futures how buy bitcoin canada increase the quality and relevance of the got rich from bitcoin list of bitcoin penny stocks 2019 you are receiving. Moreover, they apply no identification requirements yet claim US customers can not trade on the exchange. For prediction markets, the settlement fee is also 0. This means that you have to stick to your trading plan, to the details of your strategies. Of the in-house market maker, he said: If you close your position prior to the funding exchange then you will not pay or receive funding. Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. Traders can cashout their gains without any restrictions which is a feature not every broker provides. All withdrawals are handled manually and processed at a designated time once a day. Generally stop market orders are always a bit more expensive because a market order always makes you the taker, so you pay sms it group mining rig solo komodo mining pool taker fees. BVOL24H 2. BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position. Kwan previously served as managing director and head of regulatory compliance for Hong Kong Exchanges and Clearingone of the largest financial market operators in the world. BitMEX is not available trezor shapeshift import xrp paper wallet gatehub all countries, and may not be accessible to you depending on your location. This is especially comfortable on BitMEX because it calculates everything for you. The swap is similar to a futures contract, but with no expiration date. This makes no sense. Features that users can look forward to in the future include:.

The Latest

However, the platform of course first but foremost serves serious traders who exactly know about the right amount of leverage to use in their trades, respecting reasonable risk to reward ratios. Position size is nothing you decide about randomly if you want to trade professionally and not just gamble. The purpose of this order setting is to safe you from automatically getting into new positions under certain circumstances:. The reason why some brokers use XBT instead of BTC is because there are certain common abbreviations for financial products for broker listings. If you are in a lucky trade where price just goes higher and higher for weeks you might not close your long trade during that time, so that would be a case where it stays open for quite a while. So adding leverage at the moment you open the position just adds the liquidation price which would otherwise be much further away from your entry, and it will increase your profits. BitMEX dynamically sets the minimum fee based on network activity. But with greater leverage also comes greater risk. Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process.

Your gains is always the proof of storage cryptocurrency american law for cryptos between entry and exit. There is a lot of anger at exchanges from people who have lost money trading on them, but the appeal of crypto is its freedom, even more regulation and government interference will not benefit crypto. Market order means the order gets filled right away at market buy bitcoin online us storj payments change address. BitMEX uses multi-signature wallets for both client and exchange accounts. The key components a trader needs to be aware of are:. You set them and wait till they get filled. You will only pay or receive funding if you hold a position at one of these times. Strong built-in replay protection Modification to block headers notifying traders that all wallets require users to upgrade to support the new coin Change in wallet address format to prevent people from sending funds to the wrong chain Functioning peerpeer node network for both gigawatt bitcoin mining how to investing in xrp. Complaints about network latency from automated trading bots front-running orders. Never enter too late. BitMEX comes with some special features making the broker one of the most popular ones due to their liberal policies. Historical rates are in the Funding History. In order to support a forked coin, BitMEX requires: While on the far left you have a choice to either long, a particular asset or short it, for now, you should concern yourself with the spot price of assets rather than dabbling in any leveraged trades or futures markets. Recently, the company hired regulatory expert Angelina Kwan to become its chief operating officer. Additional security features include:.

Ask an Expert

Close Menu Sign up for our newsletter to start getting your news fix. But according to the BitMEX website , only the anchor market maker can short sell. Complaints about network latency from automated trading bots front-running orders. To punt on something can have many meanings, including to bet on something or to kick something. S citizens due to ongoing legal compliances. The X in front refers to the fact that something is not a currency with specific national origin. Most reacted comment. Load More. Buyers can go long or short and leverage up to x. Further information and examples of funding calculations are available. Currently, the following assets are available:. If you do so, the leverage setting will not effect your positions size. Historical rates are in the Funding History. Always set your stop loss order at a point where it would rescue your position form getting liquidated.

Correction December 8, In other words, the Funding Rate will equal the Interest Rate. Sign In. So adding leverage at the moment you open the position just adds the liquidation price which would otherwise be much further away from your entry, and it will increase your profits. While on other brokers you can withdraw your Bitcoins if you have bought them in a buy order. Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement. In that case you do long and short trades based on your margin and you can choose as much leverage as you like. Since the market price can change in fractions of a second you might not get the exact price you were expecting. Best known for its leverage how does coinbase detect country what is a crypto broker option as high as times, which can act as a risk management tool and amplifier for potential profit Limited ID verification required to begin trading immediately. Directly underneath that tab, there is a list of coins ranging from left to right representing the available tokens for trade on the exchange. BETH With up to x leverage the broker fulfills the wildest dreams of real gamblers.

Trading on BitMEX is a bit different to trading on other brokers. Buy or sell either as market order or as limit order. After your sell order has been filled you set your stop loss order buy order in this case somewhere above your entry and your take profit at your predefined target. A few months later, Lehman Brothers collapsed, a global financial crisis ensued, and Hayes found himself earning about half of what he had hoped. BitMEX comes with some special features making the broker one of the most popular ones due to their liberal policies. BitMEX offers a limited selection of spot and futures contracts compared to some other exchanges, such as Poloniex. Eventually, she got fascinated by the crypto industry and started writing for Forbes and CoinDesk. Subscribe Here! As compensation for their risk, bitcoin current confirmations top bitcoin wallets ios makers generally make money on the spread between the buy price and the sell price of a contract. See below for a step-by-step guide on how to place a trade on BitMex Signing up Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. Correction December 8, Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. The key components a trader needs to be aware of are:. September 12, 5: Twitter Facebook LinkedIn Link. If you close your position prior to the funding exchange then you will not pay or receive funding. Close Ethereum difficulty increase how much do things cost in bitcoin Sign up for our newsletter to start getting your news fix.

Bitmex says:. Hayes then goes on to use some very colorful and highly professional language in contrast to his public tweet which said: After your sell order has been filled you set your stop loss order buy order in this case somewhere above your entry and your take profit at your predefined target. Also BitMEX has a liquidation price calculator on the top left-hand corner of the user interface, where you can calculate this price in advance and set your stop loss order accordingly. How to Trade Crypto On Kraken. Notify of. In which countries is BitMEX available? You are buying contracts USD units for long buy to sell higher or short sell to buy lower trades and every trade must be closed at some point your target. The following spring, Hayes showed up at Consensus, an annual cryptocurrency and blockchain conference in New York City, in an orange Lamborghini—a symbol of having made it big in the crypto world. BitMEX can, therefore, be complex and difficult to navigate at times if you are uncertain how these financial instruments operate but also possesses the potential to maximize your earnings through futures markets, leveraged trading and perpetual swaps. Good user interface and charting tools. In an interview with Yahoo Finance , Hayes denied allegations of insider trading.

Sign Up for CoinDesk's Newsletters

Hayes then goes on to use some very colorful and highly professional language in contrast to his public tweet which said: Position size is 3, USD. When using leverage, two things are added to your trade setup:. The position size results from your risk amount your capital x risk , the entry and the stop loss. Never move your stop loss further away from your entry 2. But the only identification BitMEX requires of its traders is an email address. In which countries is BitMEX available? Looking for the next thing to get into, Hayes began dabbling in bitcoin. Example of short trade settings in liquidation price calculator — notice the huge difference of liquidation price between isolated and cross margin setting: In an interview with Yahoo Finance , Hayes denied allegations of insider trading. Correct, He lives in Hong Kong. Notify of. Of the in-house market maker, he said: Your position value is irrespective of leverage. If you do so, the leverage setting will not effect your positions size. S citizens due to ongoing legal compliances.

Sign Bitcoin website template change country coinbase. Run by a staff of more thanBitMEX touts itself as the most liquid bitcoin derivatives exchange in the world. Secure multi-signature wallets. After hitting an all-time time high in Decemberbitcoin has been steadily dropping in price. BitMEX is also known for its frequent server overload problems. Import metamask address to myetherwallet gtx 1070 hashrate comparison and Cons Pros A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume. Adding leverage is something you can do, but at the beginning you should practice without leverage in case you are a margin trading beginner. Once you have that, you can push the buy or sell button on BitMEX, where you will be offered to add some leverage. Under each Contract Specification page, the source borrow market is stated for each Interest Index. He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds. While on the far left you have a choice to either long, a particular asset or short it, for now, you should concern yourself with the spot price of assets rather than dabbling in any leveraged trades or futures markets. Unlike many cryptocurrency exchanges, which trade one cryptocurrency for another, BitMEX is focused on derivatives trading. And I dont see how blaming centralized exchanges for price action is credible. These exchanges are making a boatload of fees based on volume alone, what do they care about price direction? Depending on your trading how to hedge cryptocurrency risk sweat cryptocurrency you can choose between closing the trade right away in case a certain price gets hit, or you can choose a triggered stop loss order Stop Limit and decide the trigger price that will set the order. Bitmex says:. You will only pay or receive funding if you hold a position at one of these times. If it is determined that any BitMEX trading participant has given false representations as to their location or place of residence, BitMEX reserves the right to close any of their accounts immediately and to liquidate any open positions. You may never bitcoin perpetual swap vs futures how buy bitcoin canada the parameters while the trade is running. Moreover BitMEX has a highly professinal trading engine offering all kinds of advanced order types a professional trader might need. Perpetual Contracts trade at the underlying reference index price current Bitcoin market price. Never enter too late. Market order makes sense if you want to make sure you get into a position right away, no matter. The platform is just very efficient.

Hottest comment thread. Correct, He lives in Hong Kong. For taking profit again you can decide between limit and bitcoin climbs 500 link bitpay card to coinbase order. The key components a trader needs to be aware of are:. Position size is nothing you decide about randomly if you want to trade professionally and not just gamble. Your calculated position size can exceed your account balance. You lost me at your first sentence. In this way, the contract mimics how margin-trading markets work as buyers and sellers of the contract exchange interest payments periodically. BitMEX does not charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take is eos an erc20 token will bitcoin run out that the exchange only accepts deposits in bitcoin BTC and serves as collateral regardless of whether or not the trade includes BTC. And for retail investors who dream of winning big, the most popular platform for placing those bets is BitMEX, a largely unregulated Hong Kong-based exchange that has been sneaking into the news of late. The reason why some brokers use XBT instead of BTC is because there are certain common abbreviations for financial products for broker listings. In order to support a forked coin, BitMEX requires: A market maker is an individual or a firm that stands by every second of the trading day ready to buy bid and sell ask orders immediately, usually with the help of bots. BitMEX can, therefore, be complex and difficult to navigate at times if you are uncertain how these financial instruments operate but also possesses the potential to maximize your earnings through futures markets, leveraged trading and perpetual swaps.

BitMEX offers perpetual swap contracts as well as daily and weekly futures contracts. Hayes has done well for himself. Twitter Facebook LinkedIn Link. At BitMEX a long trade buy , has to get closed at some point by a sell order , otherwise the position would stay open for ever and your equity would be stuck in this trade. Those fees are applied to the total value of a position, not the principal. Hayes then goes on to use some very colorful and highly professional language in contrast to his public tweet which said: Adding leverage is something you can do, but at the beginning you should practice without leverage in case you are a margin trading beginner. BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position. High liquidity for bitcoin spot and futures. An offshore company, 1Broker was charged for allegedly violating federal laws in connection with securities swaps and not implementing KYC. The rest of the article is speculative crap. Unlike many cryptocurrency exchanges, which trade one cryptocurrency for another, BitMEX is focused on derivatives trading. BitMEX uses multi-signature wallets for both client and exchange accounts. You could also just use a standard limit buy or sell order to close the position. OKEx and Huobi are reasonably professional trading exchanges, with OKEx having no artificial spread and significant liquidity in contrast to Bitmex which can be quite expensive due to their spreads. In the U.

December 7, , 4: Then you only need a to always use a risk: In the U. Those are the basics of a simple long trade. This is also the way how Forex margin trading works. Position size is 3, USD. Strong built-in replay protection Modification to block headers notifying traders that all wallets require users to upgrade to support the new coin Change in wallet address format to prevent people from sending funds to the wrong chain Functioning peerpeer node network for both chains. Not available in all countries, including the US No fiat deposits or withdrawals. Also, He never mentions to short ETH. Opening a long position should usually consist of 3 parts. In other words, the Funding Rate will equal the Interest Rate.

The key components a trader needs to be aware of are:. If you do so, the leverage setting will not effect your positions size. Fees for trades can add up quickly. Then you only need a to always use a risk: And opening and using bitcoin minging as overclock tool xrp ethereum merger a contract counts as two trades, not one. Email address: BitMEX is probably best known for its margin lending capabilities, which allow its users to flatbook bitcoin mining bitcoin price quote thinkorswim a leveraged trade as high as times, significantly amplifying the profit potential as well as potential losses. Hayes then goes on to use some very colorful and highly professional language in contrast to his public tweet which said:. The purpose of this order setting is to safe you from automatically getting into new positions under certain circumstances:. An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. BitMEX has 2 different kinds of products you can trade. Once you have that, you can push the buy or sell button on BitMEX, where you will be offered to add some leverage. While on other brokers you bitcoin and the future of digital payments ghost coin crypto withdraw your Bitcoins if you have bought them in a buy order. Strong built-in bitcoin perpetual swap vs futures how buy bitcoin canada protection Modification to block headers notifying traders that all wallets require users to upgrade to support the new coin Change in wallet address format to prevent people from sending funds to the wrong chain Functioning peerpeer node network for both chains. Additionally, laws in many countries, including the U. BitMEX is also known for its frequent server overload problems. Currently, the following assets are available:. Always set your stop loss order at a point where it would rescue your position form getting liquidated.

Twitter Facebook LinkedIn Link. No mobile app. Opening a long position should usually consist of 3 parts. They also tend to trade close to the underlying index price, unlike futures, which may diverge substantially from the index price. If you set limit orders: Market order makes sense if you want to make sure you get into a position right away, no matter. While on the far left you have a choice to either long, a particular asset or short it, for now, you should concern yourself with the spot price of assets rather than dabbling in any leveraged trades or futures markets. Find out where you can exchange cryptocurrency coinbase vs local bitcoin gunbot settings the US. Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement. Example of short trade settings in liquidation price calculator — notice the huge difference of liquidation price between isolated and cross margin setting: Your position value is irrespective of leverage. BitMEX has 2 different kinds of products you can trade. One has made an offer and another one accepts the offer. The Latest. The platform, available jamie dimon ethereum minted bitcoin five languages English, Chinese, Russian, Korean and Japanesethen settles the trades exclusively in bitcoin. These exchanges are making a boatload of fees based on volume alone, what do they care about price direction? The third step right afterwards is to set a take profit order. This is especially comfortable on BitMEX because it calculates everything for you.

Low volume on altcoin assets. Wait, only Americans can appear in American TV studios? But with greater leverage also comes greater risk. BitMEX has 2 different kinds of products you can trade. And some traders speculate BitMEX uses its server problems to gain an unfair advantage over its customers. To punt on something can have many meanings, including to bet on something or to kick something. Kwan previously served as managing director and head of regulatory compliance for Hong Kong Exchanges and Clearing , one of the largest financial market operators in the world. Directly underneath that tab, there is a list of coins ranging from left to right representing the available tokens for trade on the exchange. The key components a trader needs to be aware of are:. Recently, the company hired regulatory expert Angelina Kwan to become its chief operating officer. More accurately, commodity and foreign exchange derivatives fall under the oversight of the CTFC while derivatives that reference securities fall under the SEC. These exchanges are making a boatload of fees based on volume alone, what do they care about price direction? Since the market price can change in fractions of a second you might not get the exact price you were expecting. All withdrawals are handled manually and processed at a designated time once a day. Leveraged trades can incur considerable risk, especially to those less experienced and should not be approached lightly. Tone Vays, a well-known trader based in New York, was a regular on the site until his account was suspended after he announced on Twitter that he was a BitMEX client. It all depends on your trading strategies.

In that case you do long and short trades based on your margin and you can choose as much leverage as you like. The purpose of this order setting is to safe you from automatically getting into new positions under certain circumstances:. Your calculated position size can exceed your account balance. It is treated like any other account. Buyers can go long or short and leverage up to x. Then you only need a to always use a risk: A failure which effectively for a time forced the market to have no option but to deal with the Bitmex clown. For all you know, he renounced his US citizenship long ago. Hayes made the announcement in a blog post on April 30, A Perpetual Contract is a derivative product that is similar to a traditional Futures Contract , but has a few differing specifications:. See below for a step-by-step guide on how to place a trade on BitMex Signing up Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. Never enter too late. More accurately, commodity and foreign exchange derivatives fall under the oversight of the CTFC while derivatives that reference securities fall under the SEC. BitMEX serves as an interface for investors to interact with global financial markets using bitcoin. Yes, it is exactly the same. Market order means the order gets filled right away at market price. Market order makes sense if you want to make sure you get into a position right away, no matter what. At leveraged positions gains are higher than without leverage, but also risk is enhanced during the trade. While on the far left you have a choice to either long, a particular asset or short it, for now, you should concern yourself with the spot price of assets rather than dabbling in any leveraged trades or futures markets. September 12, 1:

In this case you where the maker, the other one was the taker. There will be a liquidation price at which your position would get forcably closed in case price turns against you. Best ethereum and bitcoin wallet kryptokit ethereum Team Careers About. The calculation is fairly coinomi bth exodus wallet how to get private key of bitcoin trezor. So the position size has to be calculated. Liquidation means your margin is gone, stop loss means only a part of your margin is gone. Do not send Litecoin, Bitcoin Cash, or Tether to this address. They are unregulated, with no oversight or any accountability. As compensation for their risk, market makers generally make money on the spread between the buy price and the sell price of a contract. Pros and Cons Pros A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume. Currently, the following assets are available:. Additionally, laws in many countries, including the U. The drop in crypto markets could drive traders away from the space. BitMEX offers perpetual swap contracts as well as daily and weekly futures contracts.

As compensation for their risk, market makers generally make money on the spread between the buy price and the sell price of a contract. BitMEX comes with some special features making the broker one of the most popular ones due to their liberal policies. An offshore company, 1Broker was charged for allegedly violating federal laws in connection with securities swaps and not implementing KYC. Please read this article to learn what exactly are Futures. You may never change the parameters while the trade is running. Additionally, laws in many countries, including the U. Position size is 3, USD. Correct, He lives in Hong Kong. BitMEX uses multi-signature wallets for both client and exchange accounts.