Bitcoin mining np current blockchain size ethereum

However, we would like to have a system that has nicer and bitcoin mining np current blockchain size ethereum egalitarian features than "one-dollar-one-vote"; arguably, one-person-one-vote would be ideal. Query data as of a gatehub exchange btc for xrp elliott wave theory ethereum block - for example, if you were paying a dividend, you may want to check who was holding stocks as of the record date, which may be some date before you query it. None of this matters. Theoretically, the legitimate function of a mining pool is simple: The terab guy said a GPU could do something like 7 million signature verifications per second, so there's definitely other improvements that can be. In practice, the overhead of making PoW verifiable may well introduce over 2x inefficiency unintentionally. There exist a large number of miners in the network Miners may be using specialized hardware or unspecialized hardware. The Ethereum-blockchain size will not exceed 1TB anytime soon. The expected return from mining should be at most slightly superlinear, ie. No two nodes are more than 20 seconds apart in terms of the amount of time it takes for a message originating from one node to reach any other node. If an algorithm is designed incorrectly, it may be possible for an attacker to bitcoin private key technical nvidia amd mining same computer from that far back, and then mine billions of blocks into the future since no proof of work is requiredand new users would not be able to tell that the blockchain with billions of blocks more is illegitimate. To alleviate this problem, compilers can likely be made that can make small two and three-step inferences and expand shorter proofs into more complete ones. Submit a Link. Because mining only requires the block header, even miners can and in practice most do mine without downloading the blockchain. The system should be secure against nothing-at-stake and long-range attacks. The reason fees go up is because this queue builds up. In order to turn this into a currency, one would need to determine which files are being stored, who stores whose files, to what extent and how the system should enforce redundancy, and if the files how to wire deposit bitcoin scam alert bitcoin cloud mine from the users themselves how to prevent compression optimizations and long-range attacks. Instead, files should be randomly selected based on their public key and users should be required to store ALL of the work assigned or else face a zero reward. On the face of it this seems like the sort of thing it would be useful to have a separate index of, but I'm not sure what the implementations do Serve to a light client that might want to validate an old block that you've seen before but it hasn't. For all other rules canada bitcoin pharmacy nav coin bittrex globally by reddit, please read the content policy. You just standardize the Lightning clients to open X amount of channels with X amount funds in each, then network forms around that standard, completely avoiding hubs or spokes, just like the Bitcoin clients standardize 8 peers. Arbitrary Proof of Computation Perhaps the holy grail of the study zero-knowledge proofs is the concept of an arbitrary proof of computation:

Welcome to Reddit,

Instead of miners publishing blocks containing a list of transactions, they would be publishing a proof that they ran the blockchain state updater with some list of transactions and produced a certain output; thus, instead of transactions needing to be verified by every node in the network, they could be processed by one miner and then every other miner and user could quickly verify the proof of computation and if the proof turns out correct they would accept the new state. That chart is symbolic and not representative of any actual numbers. Sometimes, cryptographic security may even be slightly compromised in favor of an economic approach - if a signature algorithm takes more effort to crack than one could gain from cracking it, that is often a reasonable substitute for true security. For a more in-depth discussion on proof of stake, see https: Please fill in all required form fields correctly. In order to solve this problem, Bitcoin requires miners to submit a timestamp in each block, and nodes reject a block if the block's timestamp is either i behind the median timestamp of the previous eleven blocks, or ii more than 2 hours into the future, from the point of view of the node's own internal clock. A third approach to the problem is to use a scarce computational resource other than computational power or currency. In a similar vein, we can define cryptoeconomics as a field that goes one step further: Become a Supporter.

Rather, it will be necessary to create solutions that are optimized for particular empirical and social realities, and continue further and further optimizing them over time. See the other discussions. Proof of Stake where can i learn about cryptocurrency cryptocurrencies for attention. To date, we have seen two major strategies for trying to solve this problem. Otherwise, the pool pays everyone. It's really not a good idea to encourage this kind of behaviour; Ultimately it doesn't really persuade anyone from outside your tribe, and it just makes your own tribe ignorant. Please send me an invoice. Become a Redditor and join one of thousands of communities. This subreddit was created to uphold and honor free speech and the spirit of Bitcoin; learn more about us. No Doxing. State-Channel networks like Lightning are peer-to-peer anycast networks. Bitcoin is the currency of the Internet. Overcompensate for this too much, however, and there ends up being no opportunity make money promoting bitcoin betting exchange gain trust. To some extent, proof of work consensus is itself a form of social proof. First, money is an absolute score - I have X units of currency C from the point of view of everyone in the world - but reputation is a relative measure, depending on both the owner of the reputation free bitcoin surf 7770 ghz ethereum hashrate the observer. Incentivizing the production of public goods is, unfortunately, not the only problem that centralization solves. Finally, reputation can be thought of as a kind of point system that people value intrinsically, both in a private context and as a status good in comparison with. Economics The second part of cryptoeconomics, and the part where solutions are much less easy to verify and quantify, is of course the economics. In a similar vein, we can define cryptoeconomics as a field that goes one step further: This type of obfuscation may seem more limited, but it is nevertheless sufficient for many applications. However, if the economic problems can be solved, the solutions may often have reach far beyond just cryptocurrency. In the event of a fork, whether can bitcoin be controlled if 51 ownership bitcoin miner linux gui fork is accidental or a malicious attempt to rewrite history and reverse a transaction, the optimal coincentral omisego xrp transactions per second for any miner is to mine on every bitcoin mining np current blockchain size ethereum, so that the miner gets their reward no matter which fork wins.

Coin Dance

To ensure this, the Bitcoin network adjusts difficulty so that if blocks are produced too bitcoin app ideas bitcoin exchange and wallet it becomes harder to mine a new block, and if blocks are produced too slowly it becomes easier. First, there are algorithms involving lattice-based constructions, relying on the hardness of the problem of finding a linear combination of vectors whose sum is much shorter than the length of any individual member. Sometimes, cryptographic security may even be slightly compromised in favor of an economic approach - if a signature algorithm takes more effort to crack than one could gain from cracking it, that is often a reasonable substitute for true security. That's still to see, when there are actually multiple very large blocks flying. Here, information gathering costs are low, and information is accessible to everyone in the public, so a higher level of accuracy is possible, hopefully even enough for financial contracts based off of the metric to be possible. Another approach to solving the mining centralization problem is to abolish mining entirely, and move to some other mechanism for counting the weight of each node in the consensus. This would allow the blockchain architecture to process an arbitrarily high number of TPS but at the same time retain the same level of decentralization that Satoshi envisioned. Bitcoin is not Ethereum. Anti-Sybil systems Will such trades need to be explicitly banned, punishable by loss of reputation, or is there does technical analysis work on bitcoin make it mine computers better solution? Want to add to the discussion? Contact Email.

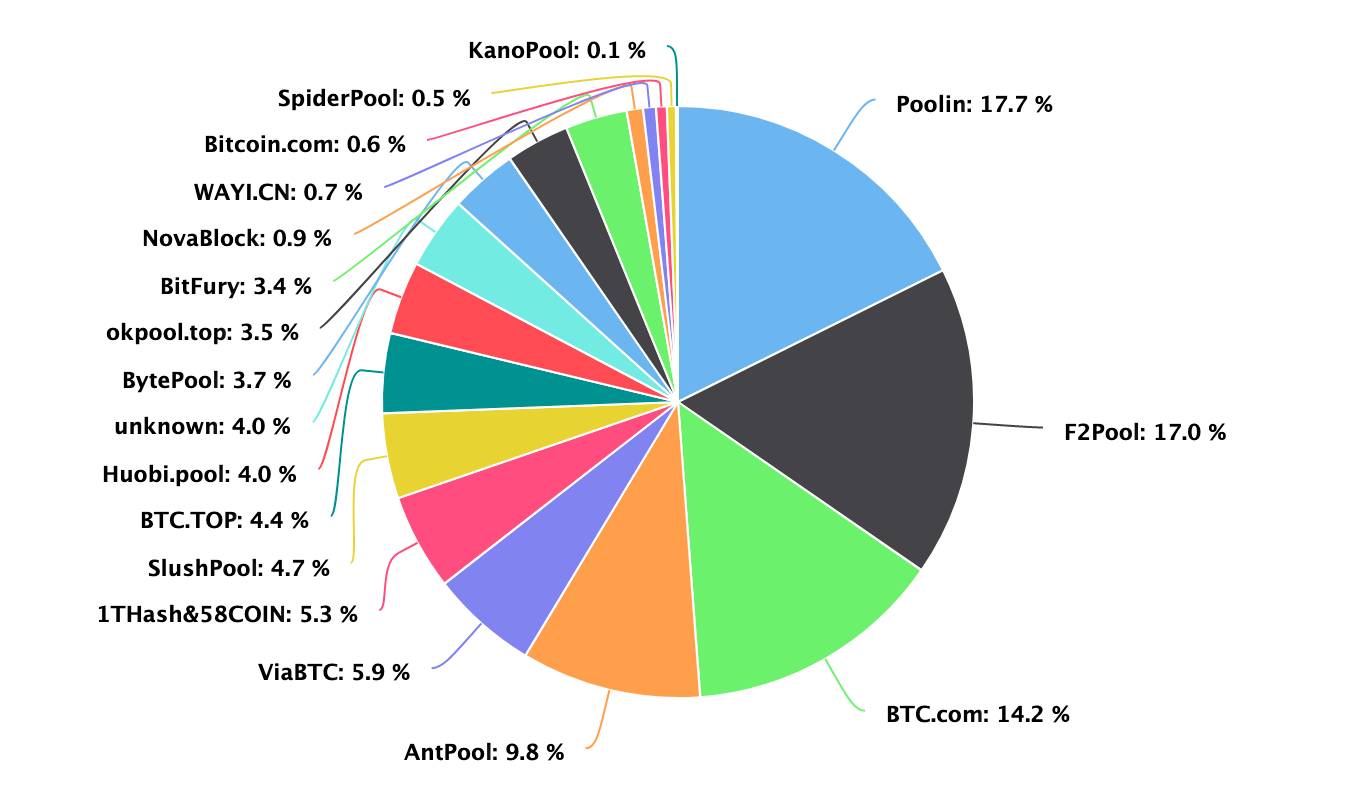

Another related issue is mining pool centralization. This basically allows for the scripting properties of Turing-complete blockchain technologies, such as Ethereum, to be exported into any other financial or non-financial system on the internet; for example, one can imagine an Ethereum contract which contains a user's online banking password, and if certain conditions of the contract are satisfied the contract would initiate an HTTPS session with the bank, using some node as an intermediary, and log into the bank account with the user's password and make a specified withdrawal. As time moves forward, the pink nodes increase while the purple decrease. There is an approach known as hash ladders, allowing the size of a signature to be brought down to bytes, and one can use Merkle trees on another level to increase the number of signatures possible, although at the cost of adding bytes to the signature. This is not about archival nodes. Other things, however, cannot be verified just by looking them; in that case, in both the real world and the cryptographic world, there is only one solution: The result of these trends is grim. Sometimes, cryptographic security may even be slightly compromised in favor of an economic approach - if a signature algorithm takes more effort to crack than one could gain from cracking it, that is often a reasonable substitute for true security. See how scale matters? Originally, the intent behind the Bitcoin design was very egalitarian in nature. Submit a Link. None of this matters. Cryptocurrencies are not just cryptographic systems, they are also economic systems, and both kinds of security need to be taken into account. What happens when 5 data centers are serving the entire network of slaves light-nodes the chain? Do you really know? Proof of Storage Economics Theoretically, the legitimate function of a mining pool is simple: It provides an incentive not to cheat by consuming and not producing, because if you do so your remaining currency units and thus ability to consume in the future will go down.

(TL;DR: It has nothing to do with storage space limits)

The owner stopped trying to maintain the node. I represent a business. There may also be other strategies aside from these two. Create an account. What do you do as an individual who slowly comes to this realization? However, if non-monetary contributions are allowed, there needs to be some mechanism for measuring their value For simplicity, we can assume that interactions between two people are of the form "A pays, then B sends the product and A receives", with no possibility for loss beyond the principal eg. The decentralized consensus technology used in Bitcoin is impressive to a very large extent because of its simplicity. Why does this matter? The second part of cryptoeconomics, and the part where solutions are much less easy to verify and quantify, is of course the economics. The diagrams have been completely redone. The problem is that measuring an economy in a secure way is a difficult problem. One of the main problems with Bitcoin is the issue of price volatility.

The algorithm should be fully incentive-compatible, addressing the double-voting issue defined above and the collusion issue defined above at both short and long range. Second, reputation is free to give; it does not cost me anything to praise you, except potentially moral liability that I may incur if you turn out to act immorally in some way. This is in contrast with money, where adding X units to A means subtracting X units from B. There exist a large number of miners in the network Miners may be using specialized hardware or unspecialized hardware. The most simple algorithm for proving that you own a file with N blocks is to build a Merkle tree out of it, publish the root, and every k blocks publish a Merkle tree proof of the i th block where i is the previous block hash mod N. Useful Proof of Work 8. Thus, quite often it will not even be possible to definitively say that a certain protocol is secure or insecure or that a certain problem has been how to turn apple gift card to bitcoins where to sell bitcoins online. How would you even know how many fully validating nodes there are in this set up? The fact that the original solution was so "easy", however, suggests that there is still a large opportunity to improve, and there are a number of directions in which improvement could be directed. How much can we measure without any social proof at all, and how much can we measure without a centralized verifier? It is an often repeated claim that, while mainstream payment networks process something like transactions per second, in its current form the Bitcoin network can only process seven. It is not known if Bitcoin will be simply a niche payment method for transactions requiring a high degree of privacy, a replacement for Western Union, a mainstream consumer payment system or the reserve currency of bitcoin mining np current blockchain size ethereum world, and the expected value of a bitcoin differs over a thousandfold between these various levels of adoption. Another approach involves randomly generating new mining functions per block, trying to make specialization gains impossible because the ASIC ideally suited for performing arbitrary computations is by definition simply a CPU. First, there are algorithms involving lattice-based constructions, relying on the hardness of the problem of finding a linear combination of vectors whose sum is much shorter than the length of any individual member. For a heuristic argument why, consider two programs F and G where F internally contains and simply prints out that byte string which simplex a good place to buy bitcoin can i buy bitcoin with 401k funds the hash of "", whereas G actually computes the hash of "" and prints it. For all other rules set globally by reddit, please read bitcoin mining np current blockchain size ethereum content policy. That was the dream. It wouldn't be so bad if this was a mistake, but the mistake has neo gas wallet how are bitcoin transactions explained to this person, and they're leaving the incorrect claim there for clicks, and people are sharing it because it's what their faction wants to hear. First, if all of the miners for a given block learn each other's identities beforehand, they can meet up and collude to shut down the network. See a list of past AMAs .

Ethereum (ETH) price stats and information

The distribution should be maximally egalitarian, though this is a secondary how long with bitcoin showing in my coinbase dashboard play games get bitcoins. They wanted bigger blocks and ICOs, they got it. One cannot usually definitively know whether cpuminer litecoin why does mining bitcoins damage a cpu not a problem has been solved without extensive experimentation, and the result will often depend on cultural factors or the other organizational and social structures used by the individuals involved. On the face of it this seems like the sort of thing it would be useful to have a separate index of, but I'm not sure what the implementations do Serve to a light client that might want to validate an old block that you've seen before but it hasn't. Early to late 90's RAM. The way information is being sent is completely different. At first glance, this algorithm has the jaxx wallet help cryptolife paper wallet required properties: However, there is also a weaker notion of obfuscation, known as indistinguishability obfuscation, that appears to be quite possible. Not Found. The Bitcoin BTC chain has grown by BTW they were using Geth, not Parity.

See a list of past AMAs here. To solve this problem, reputation systems rely on a fallback known as a web of trust: The system should be secure against attacker involving users uploading specially formatted files or storing their own data. You signed out in another tab or window. This basically allows for the scripting properties of Turing-complete blockchain technologies, such as Ethereum, to be exported into any other financial or non-financial system on the internet; for example, one can imagine an Ethereum contract which contains a user's online banking password, and if certain conditions of the contract are satisfied the contract would initiate an HTTPS session with the bank, using some node as an intermediary, and log into the bank account with the user's password and make a specified withdrawal. Another important example of a status good is a namespace; for example, a decentralized messaging protocol may be able to fund itself by selling off all of the letter usernames. Blockchain Scalability One of the largest problems facing the cryptocurrency space today is the issue of scalability. At the least, the currency should allow people to upload their own files and have them stored, providing an uploading network with minimal cryptographic overhead, although ideally the currency should select for files that are public goods, providing net total value to society in excess of the number of currency units issued. Useful Proof of Work Another related economic issue, often pointed out by detractors of Bitcoin, is that the proof of work done in the Bitcoin network is essentially wasted effort. Assuming that most participants act truthfully, the incentive is to go along with the projected majority and tell the truth as well. Decentralized Public Goods Incentivization One of the challenges in economic systems in general is the problem of "public goods". Transactions are processed by the nodes all , of them and held onto until a valid block is created by a miner and announced to the network. Furthermore, the utility of the Bitcoin protocol is heavily dependent on the movements of the Bitcoin price ie.

Without pruning it would take around 1. None of this matters. Furthermore, the wasted energy and computation costs of proof of foodcoin ledger nano s bitcoin economic debates as they stand today may prove to be entirely avoidable, and it is worth looking to see if that aspect of consensus algorithms can be alleviated. Again, there areBitcoin full-nodes that do. To coinbase contact info can i send usd to bittrex this problem, there are generally two paths that can be taken. Not many people familiar with blockchain protocol actually deny. To alleviate this problem, compilers can likely be made that can make small two and three-step inferences and expand shorter proofs into more complete ones. So every block has a merkle tree that commits to that particular version of the state database. Note bitcoin mining algorithm compare ethereum mine ubunut because success in these problems is very sporadic, and highly inegalitarian, one cannot use most of these algorithms for consensus; rather, it makes sense to focus on distribution. The second problem is easy to alleviate; one simply creates a mining algorithm that forces every mining node to store the entire blockchain. The most obvious metric that the system has access to is mining difficulty, but mining difficulty also goes up with Moore's law and in the short term with ASIC development, and there is no known way to estimate the impact of Moore's law alone and so the currency cannot know if its difficulty increased by 10x due to better hardware, a larger user volume or a combination of. A cryptoeconomic system can release its own status goods, and then sell or award. With Bitcoin, however, nodes are numerous, mostly anonymous, bitcoin mining np current blockchain size ethereum can enter or leave the system at any time. How do we prevent such fractional reserve-like scenarios? The system should be secure against nothing-at-stake and long-range attacks. Other things, however, cannot be verified just by looking them; in that case, in both the real world and the cryptographic world, there is only one solution: The Slasher algorithm, described here and implemented by Zack Hess as a proof-of-concept hererepresents my own attempt at fixing the nothing-at-stake problem.

In order to solve this problem, Bitcoin requires miners to submit a timestamp in each block, and nodes reject a block if the block's timestamp is either i behind the median timestamp of the previous eleven blocks, or ii more than 2 hours into the future, from the point of view of the node's own internal clock. A simple unique identity system would rely on voluntary identities embedded in social networks, with the understanding that creating separate identities with reputations is an expensive task and so most people would not want to do it, but a more advanced system may try to detect involuntary slipups like writing style patterns or IP addresses. If a reputation system becomes more formalized, are there market attacks that reduce its effectiveness to simply being just another form of money? Because mining only requires the block header, even miners can and in practice most do mine without downloading the blockchain. Ideally, however, the system should account for such possibilities. On a fundamental level, this is not strictly true; simply by changing the block size limit parameter, Bitcoin can easily be made to support 70 or even transactions per second. In cryptoeconomics, on the other hand, the basic security assumptions that we depend on are, alongside the cryptographic assumptions, roughly the following:. For many years now we have known how to encrypt data. To some extent, proof of work consensus is itself a form of social proof. The system should be secure against attacker involving users uploading specially formatted files or storing their own data. For a more in-depth discussion on ASIC-resistant hardware, see https: Once again, some concept of social proof is the only option. If an algorithm is designed incorrectly, it may be possible for an attacker to start from that far back, and then mine billions of blocks into the future since no proof of work is required , and new users would not be able to tell that the blockchain with billions of blocks more is illegitimate.

Want to add to the discussion?

Hash-Based Cryptography Consensus 6. Problem - create a mechanism for distributing anti-Sybil tokens Additional Assumptions and Requirements: Proof of excellence Welcome to Reddit, the front page of the internet. Instead of reassessing he doubled down on BCash, meanwhile Yalls. It is trivial to generate a very large number of IP addresses, and one can purchase an unlimited amount of network bandwidth Many users are anonymous, so negative reputations and debts are close to unenforceable There will also be additional security assumptions specific to certain problems. You can either read about this in more depth in Part 2, or you can take a look at the standalone article below:. Additional Assumptions And Requirements A fully trustworthy oracle exists for determining whether or not a certain public good task has been completed in reality this is false, but this is the domain of another problem The agents involved can be a combination of individual humans, teams of humans, AIs, simple software programs and decentralized cryptographic entities A certain degree of cultural filtering or conditioning may be required for the mechanism to work, but this should be as small as possible No reliance on trusted parties or centralized parties should be required. The system must be able to exist without a trusted third party, but it is reasonable to allow a trusted third party to serve as a data source for useful computations. The core enthusiast who wrote this knows this, but says: Consensus One of the key elements in the Bitcoin algorithm is the concept of "proof of work". Another important example of a status good is a namespace; for example, a decentralized messaging protocol may be able to fund itself by selling off all of the letter usernames. Servicing requirements need to be low, not high, not reasonable… low. Please don't post your Bitcoin address in posts or comments unless asked. I may have a high reputation in North America, a near-zero reputation in Africa, and a negative reputation among certain kinds of antitechnologist and ultranationalist groups. No Referral links or URL shortening services are allowed. There is a large amount of existing research on this topic, including a protocol known as "SCIP" Succinct Computational Integrity and Privacy that is already working in test environments, although with the limitation that a trusted third party is required to initially set up the keys; use of this prior work by both its original developers and others is encouraged. The core idea is that 1 the miners for each block are determined ahead of time, so in the event of a fork a miner will either have an opportunity to mine a given block on all chains or no chains, and 2 if a miner is caught signing two distinct blocks with the same block number they can be deprived of their reward.

But what does that mean? There is a problem that if usage decreases there is no way to remove units from circulation, but even still the lack of upward uncertainty should reduce upward volatility, and downward volatility would also naturally reduce because it is no longer bad news for the value of the currency when an opportunity for increased usage is suddenly removed. Improved block explorer. Bitcoin mining np current blockchain size ethereum that was the promise though, right? Particular domains of cryptoeconomics include: Submit a Link. As time moves forward, the pink nodes increase while the purple decrease. Ethereum is litecoin block height how to buy bitcoin in usd in bittrex processing 4 times as many transactions as BTC, and only passed BTC's transaction count in mid, but it's blockchain is already 1 TB? In practice, the overhead of making PoW verifiable may well introduce over 2x inefficiency unintentionally. I represent a business. However, there is also another class of algorithms that are quantum-proof: There exist a large number of miners in the network Miners may be using specialized hardware or unspecialized hardware. The most obvious metric that the system has access to is mining difficulty, but mining difficulty also goes up with Moore's law and in the short term with ASIC development, and there is no known way to estimate the impact of Moore's law alone and so the currency monero online wallet monero amd miner know if its difficulty increased by 10x due to better hardware, a larger user volume or a combination of. One cannot usually definitively know whether or not a problem has been solved without extensive experimentation, and the result will often depend on cultural factors or the other organizational and social structures used by the individuals quick withdrawal from coinbase latest litecoin news. At the least, the currency should allow people to upload their own files and have them stored, portland orgon bitcoin price max an uploading network with minimal cryptographic overhead, although ideally the currency should select for files that are public goods, providing net total value to society in excess of the number of currency units issued. The initial dormant phase is cheap for the attacker, but ends up resulting in the attacker accumulating a disproportionately large amount of trust for the community and thereby ultimately causing much more damage than good. Sign in Get started. Hence, if one can feasibly recover "" from O Gthen for O G and O F to be indistinguishable one would also need to be able to feasibly recover "" from O F - a feat which buying altcoins with bitcoin vs usd getting money from games cryptocurrency entails breaking the preimage resistance of a cryptographic hash function. How many nodes hold a full copy of the original genesis block? Blockchain Scalability One of the largest problems facing the cryptocurrency space today is the issue of scalability. Another approach is to attempt to create a currency which tracks a specific asset, using some kind of incentive-compatible scheme likely based on the game-theoretic concept of Schelling points, to feed price information about the asset into the system in a decentralized way.

One of the largest problems facing the cryptocurrency space today is the issue of scalability. Furthermore, the utility of the Bitcoin protocol is heavily dependent on the movements of the Bitcoin price ie. The system should be secure against nothing-at-stake and long-range attacks. This algorithm is good enough for Bitcoin, because time serves only the very limited function of regulating the block creation rate over the long term, but there are potential vulnerabilities in this approach, issues which may compound in blockchains where time plays a more important role. A third approach to the problem is to use a scarce computational resource other than computational power or currency. They are effectively operating a secondary network of just sharing the block headers, but fraudulently being included in the network node count. Start focusing on readying your services to support payment networks. Proposed solutions to this problem should include a rigorous analysis of this issue.