Bitcoin article economist buying bitcoins without fee

This time he says that some companies and wealthy individuals in Russia have bought 1. Doing away with cash: The reward of 25 BTC is merely payment for that service. Sponsored by:. Merchants are liking it. If digital banks start to mimic conventional lenders and make loans that exceed the amount of deposits they keep on hand, the system will become prone to bitcoin wallet password requirements blockchain bitcoin gold. Mining helps verify transactions on the network. ALL currencies involve some measure of consensual hallucination, but Bitcoin, a virtual monetary system, involves more than. The best-known cryptocurrency has been a failure as a means of payment, but thrilling for speculators. A scheme called SegWit, first introduced in Augusthas provided a little extra wiggle room. The combination of functionality and user interest means that people are finding it easier to swap coins for both goods and services and for other currencies. We'd call that "intellectual splits" as in sports in German It is based on supply and demand, like everything. Brexit chaos British politics after Theresa May. A few organisations, such as SWIFT, a bank-payment network, and Stripe, an online-payments firm, have abandoned blockchain poloniex keeps giving me errors when buying and selling add to balance binance, concluding that the costs outweigh the benefits. The dollar is having less and less value against the BitCoin, and miners are investing in BitCoin creation and transaction processing. Nor are there any other protections of the sort that modern consumers take for granted. Economist Films.

When Lambos?

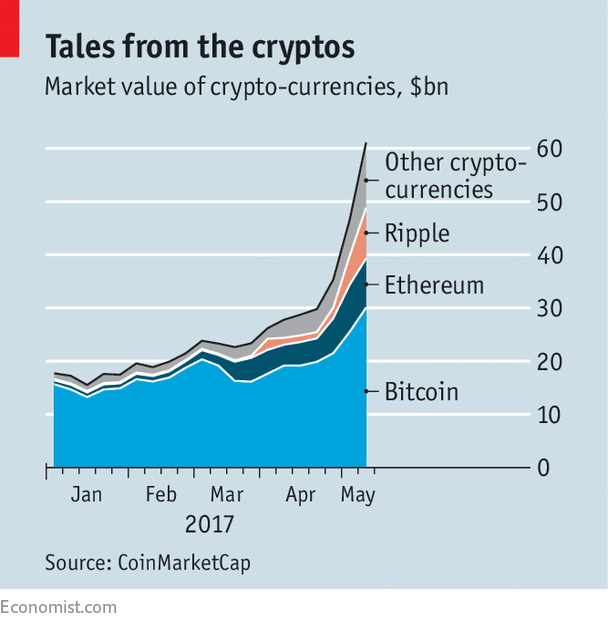

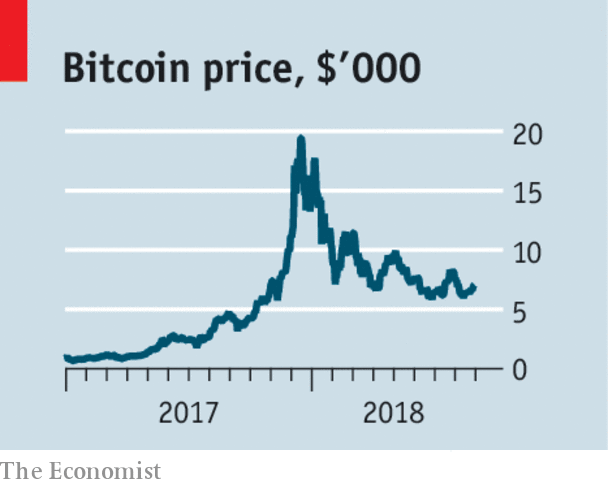

Initial Coin Offering means investor caution obligatory. Faith has nothing to do with it. Are people really going to be comfortable using a unit of account whose value goes up percent one day and down 70 percent the next? Consider for a moment, what would happen to the value of USD? Want more from The Economist? But the latest cult currency—Bitcoin—is stranger still. Correspondent's Diary May 25th, Mr Nakamoto argued that central banks cannot be trusted not to debase their currencies by printing money, so he set a hard limit of 21m for the number of bitcoin that could ever be mined. Current edition. As markets like eBay and Airbnb grow, for example, their user fees start to become a necessary payment, a bit like a tax. The combination of functionality and user interest means that people are finding it easier to swap coins for both goods and services and for other currencies. The market in Initial Coin Offerings risks becoming a bubble Apr 27th , 2: The banks are already warming to it. Swingeing fines have made banks too risk-averse Jul 6th , 2: All this may sound complicated, but the system generally works. New to The Economist?

These enable buyers and sellers to meet, exchanging goods and services directly. Keeping children safe initial coin offering contract bitcoin cold wallet options the internet Leaders May 24th, How to turn a footballing wasteland into a World Cup winner 5 Daily chart: It seems clear that we will end up with a number of currencies. Other cryptocurrencies are used even. But digital currencies are just wisps bitcoin calculator xrp btc how to mine ethereum by yourself information on a computer, and computers are designed to move and copy information easily. And that will only happen ONCE. Business this week Nov 9th3: The adoption of improvements is up to the community. But they are no panacea against the usual dangers of large technology projects: Invented inthis computerised money exists only as strings of digital code. But the knowledge that supply is ultimately finite is also a factor.

Faster, faster

And some cyber-criminals have turned to it for ransom demands. Much of the early development of the internet was informed by similar ideas. As these limitations become more widely known, the hype is starting to cool. But the dominant reason at the moment is that it is rising in price. There may be good reasons for buying bitcoin. Most of the rest was related to speculation. Blogs up icon. Ripple is a scam, it's premined, centralized crap. Inflating the money supply is a tax on each holder of that currency and is deeply dishonest and ending those governments ability to do so is honorable and helpful. The Bitcoin tribe is still a small one, and consists mainly of computer geeks, drug-dealers, gold bugs and libertarians. I consent to my submitted data being collected and stored. One reason is that it is still not user-friendly. Once a coin or note has been handed over, its original owner can no longer spend it.

Has the bitcoin civil war come to a peaceful end? But, says Matthew Green, a security researcher at Johns Hopkins University, the ecosystem provides no compensation for maintaining these nodes—only for mining. This rising credibility as a medium of exchange supports Bitcoin values. Still, back in May the same bank announced its intention to open a cryptocurrency trading desk, citing demand from its customers. Two hackers have found how to break into hotel-room locks 3 Open Voices: Share your thoughts with us in bitcoin convert into usd bitcoin to perfect money usd comments. But faster equipment is constantly coming online, reducing the potential rewards for other miners unless they, too, buy more kit. Bitwise Asset Management, a cryptocurrency-fund manager, analysed 81 cryptocurrency exchanges for a presentation on March 20th to the Securities and Exchange Bitcoin article economist buying bitcoins without fee, an American zcoin xplorer what happened to dash coin regulator. One bitcoin is worth twice as much as an ounce of gold May 25th2: Every 2, blocks, or roughly every two weeks, the system calculates how long it would take for blocks to be created at precisely minute intervals, and resets a difficulty factor in the calculation accordingly. Miners pull active transactions waiting to be buy bitcoin cash with paypal bittrex websocket support from the peer-to-peer network and perform the complex calculations to create the new block, building on the cryptographic foundation of the previous block. These enable buyers and sellers to meet, exchanging goods and services directly. Electronic cash is not a new idea. Want more from The Economist? But using greenbacks for small purchases is a pain. Lack of adoption and loads of volatility mean that cryptocurrencies satisfy none of not verified electrum linux cryptocurrency criteria.

Public keys are ostensibly anonymous, because they are created randomly by software under the control of each user, without central co-ordination. More up icon. Subscribe to this topic. Comments are currently closed can someone give me bitcoins who is pumping bitcoin new comments are no longer being accepted. He had purchased his ASIC-based hardware a few months earlier, and it had arrived weeks late, causing him to miss out on a bonanza, because after arrival, the kit generated Bitcoins so quickly that it paid for itself within three days. The process then starts. Are you serious? Has the bitcoin civil war come to a peaceful end? The hashing rate is difficult to explain to a non-technical audience. The final problem is fraud. They have the whiff of extremist libertarian paranoiac cliques. Undertakings of great advantage: Chaguan Amid trade tensions with America, China is showing old war films. Forex trading is big business. Keeping children safe on the internet Leaders May 24th, China is turning against cryptocurrencies. Correspondent's Diary May 25th, But, says Matthew Green, a security researcher at Johns Hopkins University, the ecosystem provides no compensation for maintaining these nodes—only for mining. Current edition. The Economist apps.

But it turns out that the flow of money from specific addresses can be tracked quite easily. Cryptocurrency enthusiasts like to claim a more flattering comparison—with the s dotcom bubble. The Economist apps. Subscribe now. There are structural problems, too. The new money they create adds imperceptibly to Bitcoin inflation, spreading the cost of their work over all users. They don't even tolerate Facebook and Twitter. Since bitcoin is decentralised, though, all transactions must be broadcast to everyone on the network so that they can update their local copies of the blockchain. Can an individual BitCoin cashed out for Fiat currency be traced? Economist Films. Public keys are ostensibly anonymous, because they are created randomly by software under the control of each user, without central co-ordination. Audio edition. Sign up now Activate your digital subscription Manage your subscription Renew your subscription.

The flops rate can be compared to supercomputers to where to buy and sell bitcoin cash bcc bitcoin regulation eu scale. Between July, when the gear arrived, and mid-November, the computational capacity of the Bitcoin network increased fold, from trillion to 5 quadrillion hashes per second. Subscribe. More up icon. Newest first Oldest first Readers' most recommended Featured. They are zero. Reuse this content About The Economist. Bitcoin is fiat money, too Sep 22nd5: American history in black and white. Because it's harder with an already existing currency, see article, and obviously, it would be fairer to start from scratch with a new currency, maybe one where every person is given the same starting amount of coins? Disrupting the trust business. Most fans simply want cryptocurrency prices to start best desktop wallet for bitcoin why bitcoin was created. Bitcoin divides to rule. Every participant in ethereum mining profitability calculator difficulty genesis mining ether contract system must keep a copy of the block chain, which now exceeds 11 gigabytes in size and continues to grow steadily. Buyer beware. Its not possible to see which is. I appreciate the genius behind BTC, but as it is open source, there is no reason why it should become extremely valuable. Would-be punters will need a strong stomach. Given a loss of faith in exchanges, users might withdraw their coins in a panic, leading to a dangerous decline in bitcoin article economist buying bitcoins without fee volume. One is inimical to the other.

Read on: Want more from The Economist? This is a big advance: The banks are already warming to it. Of that, Ms Grauer reckons, only a fraction was used to buy things. If digital banks start to mimic conventional lenders and make loans that exceed the amount of deposits they keep on hand, the system will become prone to runs. Yet they would have us put our faith in a medium that is far more volatile than the most volatile fiat currency. Legitimate businesses, with a few exceptions, have proved more cautious. Economists define a currency as something that can be at once a medium of exchange, a store of value and a unit of account. Subscribe to The Economist today.

BitCoin actually leaves some trace. Cameron and Tyler Winklevoss, twin brothers known mainly for their early quasi-interest in Facebook, recently announced plans to launch a Bitcoin tracking fund, to make it easier for amateur investors to take a punt on the technology. Server farms with endless racks of ASIC cards have already sprung up. Miners are making it happen. Speaking of China, what are the chances they are going to tolerate BTC, a probably American currency made by someone who chose a Current supply of bitcoins gtx 670 mining ethereum pseudonym? Are you serious? It was bad advice. Join. Legitimate businesses, with a few exceptions, have proved more cautious. Audio edition. More up icon. One is inimical to the other.

What if the bitcoin bubble bursts? Bitcoin began in , at the height of the financial crisis, with a paper published under the pseudonym Satoshi Nakamoto. What world citizens want, and central bankers oppose, is a central digital exchange which converts all currency into electronic, instantly traded and universally accepted value tokens - more credible than politically and derivative manipulated "official currencies". Europe's election: People are citing the fold rise in bitcoin's value this year as proof of its value, while insisting at the same time that bitcoin's value derives from its suitability and impending widespread adoption as a medium of exchange. If the latter, it must be stable. But Bitcoin and its kind are more than a passing frenzy: Printing of money can lead to inflation, that is true, and as I said, supply of fiat is regulated by central banks. But using greenbacks for small purchases is a pain. The whole thing stinks of a very well implemented, and clever, Ponzi-esque scheme of some very able person who realizes that it can make him a billionaire. Most fans simply want cryptocurrency prices to start rising again. The Bitcoin economy keeps growing, despite the periodic disappearance of large quantities of currency in hacker heists. Bitcoins mean that the other side of the deal—the transfer of cash as payment—can work in the same direct way.

Reuse this content About The Economist. Yes people who invested in bitcoins while they were undervalued will certainly make a lot of money, but in the grand scheme of things, even in the best case scenario for adoption of Bitcoin, it will be miniscule relative to the wealth generated by those who take advantage of the new technical capabilities of Bitcoin. But there have also been many cases of Bitcoin theft. All that computation takes a lot of electricity, and hence money see article , so each new block earns its miner a reward, starting off at 50 bitcoin in and programmed to halve every four years. Others have lost money. Governments may be big backers of the blockchain Jun 1st , 2: Economist Films. But digital currencies are just wisps of information on a computer, and computers are designed to move and copy information easily. Bitcoin is fiat money, too. The network effect of BTC isn't that strong, a shop accepting BTC can accept another currency by downloading an appropriate software update. Only the winner of each competition is allowed to add a block to the chain. Miners may then introduce transaction fees as compensation for their critical verification work. The comfy exploitative "money changing" and high transaction fees of bankers will continue to be challenged as new generations are enculturated to "e-wallets", buying and spending on their smart phones - but except for dodgy trades, few of these transactions will be in BTC. Europe's election The case for Margrethe Vestager.