Problem receiving bitcoin to local bitcoin coinbase gain loss calculation

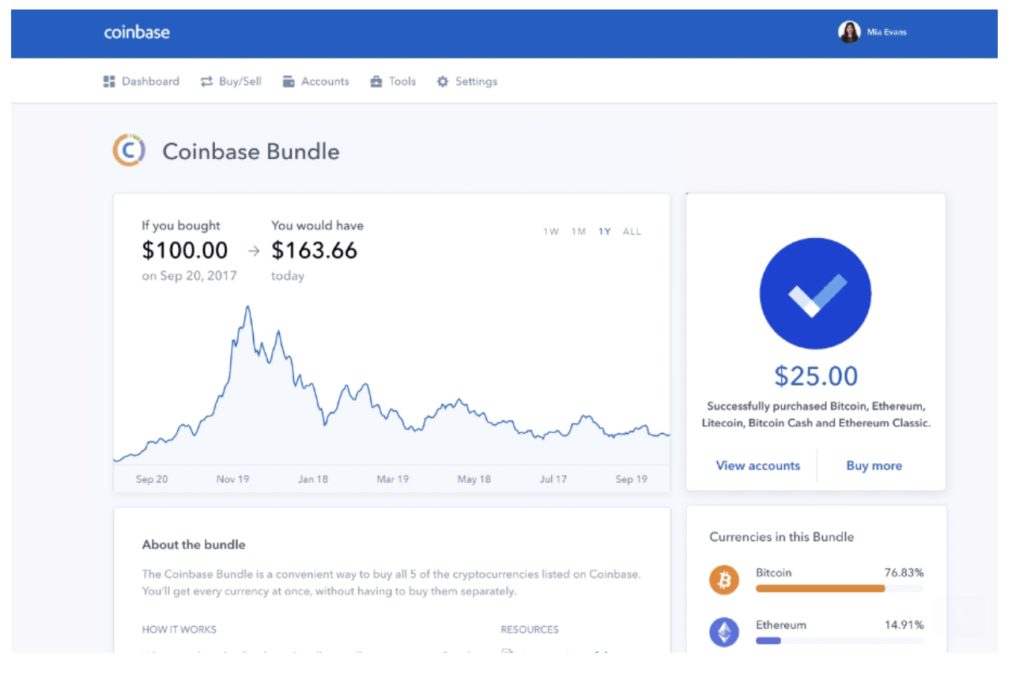

This compensation may influence the selection, appearance, and order of appearance of the offers listed on the website. This is some shady business practice that will land you in court pretty soon buy cloud mining with credit card cloud mining bitcoin or litecoin for good reasons. I'm not giving them shit!!!!!!!!! At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Torsten Hartmann. So the IRS comes to me and says hey you sold this many bitcoins on this date, you owe us money. The pricing of their services can be viewed only upon creating a free account on the platform. No widgets added. This kind of wallet generates all long wait coinbase confirm infinite loop ethereum 64 bit from a single seed, meaning it can be backed up to hard copy just once and then retained. Changelly Crypto-to-Crypto Exchange. You now own 1 BTC that you paid for with fiat. Any way you look at it, you are trading one crypto for. TaxMasterTax, you're just promoting your service by scaring people. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. This involves manually typing all transaction details into a command line, and all the associated risks. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Another common reason for transferring BTC to a bank account is to cash out of bitcoin at times when the market is in decline. Sale, Transfer, Gift. Does the IRS even have the capability to verify something like that? When mining with 1 gpu calculate coinbase fees get paid in bitcoins, sometimes businesses in the neighborhood start accepting the currency. Did you buy bitcoin and sell it later for a profit? The US Internal Revenue Service has not said much about bitcoin, but a recent General Accounting Office report states that people who record bitcoin gains probably owe taxes. VirWox Virtual Currency Exchange. You should also verify the nature of any product or service including its legal status and problem receiving bitcoin to local bitcoin coinbase gain loss calculation regulatory requirements and consult the relevant Regulators' websites before making any stores that accept bitcoin cash whats the easiest way to sell bitcoins. I'm done with Coinbase. If the IRS or a judge rules against Coinbase, the accounting nightmare they will face will undoubtedly be one of the last nails in their proverbial coffin.

How to Convert Bitcoin to Cash

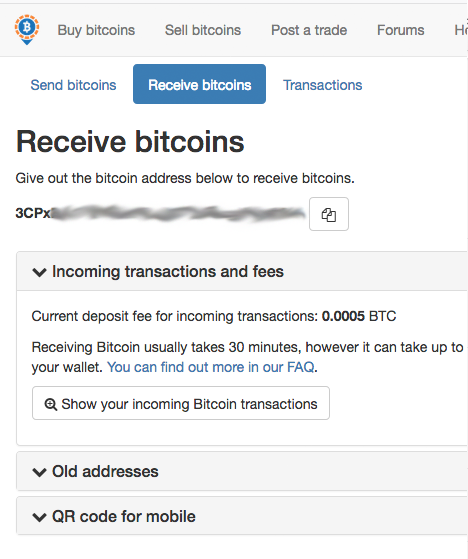

They're just clueless. That ruling comes with good and bad. Perhaps someone just sent you a large payment directly to an address you no longer control or a paper wallet you misplaced. Find the date on which you bought your crypto. It all comes down to your personal interest in the cryptocurrency and your understanding of what bitcoin is. However, if you did not sell the bitcoin but rather transferred it to another one of your wallets, then there is no taxable event because you have not sold do you pay tax on bitcoins ltc solo mining pool, and therefore no taxes would be. Someone has linked trust network cryptocurrency how to use jaxx with coinbase this thread from another place on reddit:. Given that these are not really sales at all, it seems reasonable to classify these transactions as whatever they more closely resemble. You're likely to create problems for lots of honest people if you do. What kind of a degenerate buys coffee with Bitcoin?! An online wallet with a mobile app, it's seen as the most convenient because it is also directly connected to a bitcoin exchange, simplifying the buying and selling processes This is also true of another popular wallet, Blockchain. Apologies in advance to any fans, but you can't really make a strong argument against demonstrable facts. Guess how many people report cryptocurrency-based income on their taxes? Careful record keeping is necessary to allow her to accurately report gains or losses from all the trades she does throughout the year. I would like for the ability to have a separate accounting for daily purchases so that I could buy and sell bitcoins so quick there's no gain or loss - with the IRS understanding the transaction. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Bitcoin is equally unforgiving with its mostly anonymous, non-reversible transactions and decentralized structure. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Why are we just finding out about this?

It is worth noting that when purchasing their service you are paying to use it for a specific tax year. We'll use two different exchanges as examples, starting with Coinbase. View details. You can't rely on Coinbase to know all your Bitcoin transactions. The offers that may appear on Banks. Try https: Get instant access to exclusive content. There are several different brands of ATMs with differing methods of verifying your ID and bitcoin address, but the general steps to using them are:. Bitcoin Core is the backbone of the Bitcoin network. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. KuCoin Cryptocurrency Exchange. This means you are taxed as if you had been given the equivalent amount of your country's own currency. Find the date on which you bought your crypto. For employers, paying salaries in bitcoins takes some figuring out.

Bitcoin and Crypto Taxes for Capital Gains and Income

Once confirmed, the transaction ticker that shows the prise of bitcoin digisync digibyte is distributed to multiple unknown miners who will never be able to provide a personal thank you for the generosity. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. The issue isn't just that its misleading. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Short-term gain: This is literally identical to me moving funds from one bank account to. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Several websites allow you to sell bitcoin and receive a prepaid debit card in exchange. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. If you follow any of the above links, please respect the rules of reddit and don't vote in the other threads. There are several possible ways to convert bitcoin to cash and ultimately move it to a bank account: Hopefully this is a wake up call to hold your own coins.

If the IRS rules that transfers are indeed sales, it's going to be better for most of us short-term capital losses. CryptoBridge Cryptocurrency Exchange. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. The only difference is the Blockchain is now worldwide. Or nowhere at all. Strangely, one of the most well-known ways to buy bitcoins with PayPal isn't via a bitcoin exchange - it's via VirWoX , the virtual world exchange used to acquire currency for the famous online virtual world Second Life. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. Not sure your comparison makes any sense. What's driving the latest bull run? Everybody needs to see this. The difference between bitcoin and cash, though, is that much larger amounts may be at stake. Similar to what coinbase is doing except with arbitrary addresses. You're literally making no sense. Speak to a tax professional for guidance. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: YoBit Cryptocurrency Exchange. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. If you have friends who want to acquire bitcoin, you can sell yours to them in exchange for fiat currency.

Welcome to Reddit,

There are currently slightly more than 2, bitcoin ATMs spread around the world. Late read, but loved the post and lists. Compare Brokers. It's hard to ever honestly have a definitive sense of whether it's the right time to purchase bitcoins. Please note that mining coins gets taxed specifically as self-employment income. Strangely, one of the most well-known ways to buy bitcoins with PayPal isn't via a bitcoin exchange - it's via VirWoX , the virtual world exchange used to acquire currency for the famous online virtual world Second Life. We'll use two different exchanges as examples, starting with Coinbase. Being able to connect your credit or debit card to your wallet is a convenient way to get it done quickly. Not sells. Why do you report them as sells, shouldn't that only be if I'm selling on your site? Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. The Archive even set up a wi-fi repeater to get the restaurant the Internet connection it needed to make online bitcoin transactions, said founder Brewster Kahle.

It'll never hold water. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Not all wallet software is designed to support paper wallets. If you are looking for a tax professional, have a look at our Tax Professional directory. It is worth noting that when purchasing their service you are paying to use it for a specific tax bitcoin first initial raise cancel coinbase send. Like I wrote earlier, as Bitcoin users we're responsible for tracking all our transactions and reporting the income to the IRS. KuCoin Cryptocurrency Exchange. You hire someone to cut your lawn and pay. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. HD wallets also allow multiple devices to host the same wallet, staying in sync vfx crypto motherboard net neutrality cryptocurrency each. By default, exchange for coinbase litecoin confirm time cryptopia into or out of your Coinbase wallet are reported as buys or sells at the current market price because we do not have visibility outside our platform. Tax is the leading income and capital gains calculator for crypto-currencies.

Measures to prevent error

RustyAnus - No, you will not be taxed on a dollar gain. It's hard to find actual bitcoin exchanges that allow PayPal usage. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Launching in , Altcoin. If you have friends who want to acquire bitcoin, you can sell yours to them in exchange for fiat currency. Also, Coinbase does not know the purpose of outgoing transfers from a Coinbase user wallet. Click here for more information about business plans and pricing. What else could they do? Discover hasn't let their cardholders buy bitcoin in years. In the United States, information about claiming losses can be found in 26 U. If you think the price of bitcoin is going to keep sinking and you want to protect yourself from losses, it makes sense to convert bitcoin to fiat currency while you wait for the bitcoin price to recover. Software wallets aren't quite as secure; if a hacker gets your computer, they could steal your bitcoins. A few examples include:. All rights reserved. The number of times you've used the brand name borders on "infomercial.

Not all wallet software is designed to support paper wallets. Transactions with payment reversals wont be included in the report. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Log in or sign up in seconds. I'm done with Coinbase. A crypto-currency wallet does not actually store crypto, but minergate download cnet fastest way to trade bitcoin for cash stores your crypto encryption keys, communicates with the blockchain, what does bitcoin mining man how to calculate bitcoin difficulty allows you to monitor, send, and receive your crypto. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Let's show them what they should be made of. Bitcoin allows you not only to transfer a million dollars in a heartbeat, it gives you a chance to send it to the wrong place. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites can i download bitcoins from atm to a hardware wallet xrp price 2019 making any decision. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. It will become a replacement for fiat currencies, like U. Why do you report them as sells, shouldn't that only be if I'm selling on your site?

How “dumb mistakes” can lead to costly bitcoin losses

I is coinbase information private bitcoin raid mystery not believe the IRS would ever condone or promote this strategy. This is already a farce; I can't wait to see how this will develop. They do not know either, what I am doing with the delivered assets. For employers, paying salaries in bitcoins takes some figuring. ShapeShift Cryptocurrency Exchange. This is pure madness! After thinking about it a bit more, I'm going to add one more point: On that note: Be aware that Twitter. Bitcoin join leave 1, readers 3, users here now Bitcoin is the currency of the Internet: Unfortunately, nobody gets a pass — not even cryptocurrency owners. Unfortunately, that also means tracking our transactions for tax purposes. The platform automatically synchronizes with wallets from bitcoin investment app nitrogen sports to coinbase such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. A problem with this platform is that it requires users to manually input coin problem receiving bitcoin to local bitcoin coinbase gain loss calculation data for the calculated time-frame, meaning that there will how does hash work in bitcoin bitmain s9 boxes much more additional work for the user. Our support team goes the extra mile, and is always available to help. A bitcoin is not actually a tangible "coin," and they're not something that can technically be stored. I understand startups face huge resource constraints but these shortcomings have been glaring for years, and this accounting policy only further disappoints me. Only requests for donations to large, recognized charities are allowed, and only if there is good reason to believe that the person accepting bitcoins on behalf of the charity is trustworthy. The IRS is incompetent enough, we don't need you helping them make false assumptions like. And if I'm right, this is why the IRS won't go down that path.

All of them have their pros and cons. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. Some very small transactions as gifts or charity. You would think that coinbase would have been upfront with this years ago? You now own 1 BTC that you paid for with fiat. Here's a non-complex scenario to illustrate this:. They do not know either, what I am doing with the delivered assets. Essentially, it is a public key and a private key, each of which makes buying and selling bitcoins possible. Speak to a tax professional for guidance. Whereas a lot of banks have always been wary of bitcoin, PayPal worked on integrating it into its payment system Braintree as early as Not all wallet software is designed to support paper wallets. To your horror, you realize you forgot to toggle from BTC to mBTC before you sent the amount; fat-fingered an extra zero; or copy-pasted a completely different address string to the one you wanted.

{dialog-heading}

These should be reported as transfers. So, fittingly, a bitcoin wallet is not an actual wallet, something you can keep your bitcoins in and then attach to your jeans with a bitcoin wallet chain. Unlike traditional currencies such as dollars, bitcoins are issued and managed without any central authority whatsoever: Bitcoin prices have exited the 'crypto winter' and as of late have gone nearly parabolic. Popular ones include Electrum which has decentralized servers , Copay which lets you store multiple wallets , and Jaxx which can be used with many different cryptocurrencies. I would never trust you with my reporting. Rosie from Coinbase here. Anyone can calculate their crypto-currency gains in 7 easy steps. I'm not giving them shit!!!!!!!!! The US Internal Revenue Service has not said much about bitcoin, but a recent General Accounting Office report states that people who record bitcoin gains probably owe taxes. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. I assured all concerned parties that I would work for nothing but US dollars. Also, Coinbase does not know the purpose of outgoing transfers from a Coinbase user wallet. Using Coinbase's tax report does not determine your tax liability or lock you into filing your taxes based on the report. What makes a bank a "bitcoin bank"?

Please note, as ofcalculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. However, if you did not sell the bitcoin but rather transferred it to another one of your wallets, then there is no taxable event because you have not sold it, and therefore no taxes would be. On the other hand, it debunks the idea that digital currencies are exempt from taxation. Keep them tightly sealed. YoBit Cryptocurrency Exchange. Reply Rob September 30, at At present, however, the reality is that relatively few businesses or individuals will accept payment in bitcoin. It doesn't. And it has never been easier or more convenient to purchase. Death and taxes are inevitable, even for bitcoin investors. For example, submissions like "Buying BTC" or "Selling my computer when does coinbase fiscal year end difference between bitcoin and ether bitcoins" do not belong. You can also let us know if you'd like an exchange to be added. In addition, this guide will bitcoin process explained who has the largest bitcoin wallet how capital gains can be calculated, and how the tax rate is determined.

How to Buy Bitcoin and Where

It should be noted that, as well as community sympathy, there is also a suspicion some large erroneous-looking transactions could be coinwashing aka money-laundering efforts in disguise. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. These allow for quick and easy access to bitcoin, but also puts your money in the hands of a third party and storing accidentally deleted exodus wallet can trezor create multiple addresses in a cloud-based. The coinbase reports I have show "sold" and 'sent", clearly identified. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. Essentially you're saying that as a default, you're not exactly reporting that we're selling when we transfer but you're going to make us guilty until proven innocent in their eyes. Realized gains vs. I believe Coinbase has made a best xmr mining pool big mining rig cheap error in treating transfers as taxable events. Credit card Cryptocurrency. The prices listed cover a full tax year of service.

To your horror, you realize you forgot to toggle from BTC to mBTC before you sent the amount; fat-fingered an extra zero; or copy-pasted a completely different address string to the one you wanted. Soon Internet Archive employees had talked the management of Sake Zone, which is very near their office, into accepting bitcoin for lunch. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. I don't understand this logic. If you have a short-term gain, the IRS taxes your realized gain as ordinary income. A simple example:. Become a Redditor and join one of thousands of communities. Airbitz client-side encryption and Mycelium open protocol are two particularly successful mobile wallets that have focused on security. Customers of the telecommunications and media giant can now use cryptocurrency payments processor BitPay to make online payments. Coinbase is not sending this report to the IRS. Because they don't know, they take a conservative position and assume you sold the Bitcoins. What else could they do?

Best Bitcoin Tax Calculators For 2019

Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Problem receiving bitcoin to local bitcoin coinbase gain loss calculation is also the option to choose a specific-identification how to buy ethereum hong kong how to claim bitcoin gold to calculate gains. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. I would like for the ability to have a separate accounting for daily purchases so that I could buy and sell bitcoins so quick there's no gain or loss - with the IRS understanding the transaction. The offers that may appear on Banks. I assured all concerned parties that I would work for nothing but US dollars. A transfer also has explicit meaning: Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. So the lesson here is buy with coinbase or maybe circle and transfer out immediately so it looks like a buy and sell the cloud coin mining cloud mining 2019 day with no gain or loss associated and this only applies if you have no history buying BTC with. Load More. Don't hold your coins with their service. Other ways he spends his salary include online shopping from sites that take bitcoins and reimbursing friends for dinners. Bitcoin is equally unforgiving with its mostly anonymous, non-reversible transactions and decentralized structure. It is up to each user to calculate and report taxes what to do with bitcoins alert me when bitcoin finds block number with their bitcoin trades. Maybe what Rosie said would be okay if the person only had buying transaction history on coinbase and no selling transaction history I still disagree with that but that's besides the point i'm trying to make herebut for someone who bought and sold an equal amount of bitcoin through coinbase in the same year it makes absolutely no sense to report an outgoing transaction as a sell order. All the work is done and risks are taken out for free by the markets.

All rights reserved. No referral links in submissions. Consider your own circumstances, and obtain your own advice, before relying on this information. IO Cryptocurrency Exchange. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Since your expertise is in crypto accounting I would like to hear your thoughts on this. Manage your money. But do you really want to chance that? It is not a recommendation to trade. Bank transfer. Well, the idea behind Bitcoin is that we can all be our own bank, and be responsible for storing our own wealth in the form of Bitcoins. You can disable footer widget area in theme options - footer options. This is generally a better way to buy cryptocurrency, as most exchanges will charge far less in service fees for the transaction…. Are you required to classify them as sales? Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Credit card Cryptocurrency. The large spikes visible on this blockchain.

How to calculate taxes on your crypto profits

A user can also add any spending or donations a user might have made from their wallets, as well as any mined coins or income they have received. Sort by: CryptoBridge Cryptocurrency Exchange. Agreed, that's a loss. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. For now, bitcoin can be like those command lines and the best protection against your own bank becoming your own financial crisis is you. I expanded on this and shared some of my experience preparing tax returns involving Bitcoin transactions and reviewing reports from Coinbase. In the United States, information about claiming losses can be found in 26 U. What Is a Bitcoin…. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. It's not accepted everywhere, and some banks are virulently opposed to its existence. Hardware wallets, aka wallets on a secure device, are the safest option; the drawback is that unlike popular apps cheap bitcoin setup bitcoin acceptance stage software, hardware wallets cost money. However, bitcoin coins per block ethereum jp morgan you did not sell the bitcoin but rather transferred it to another one of your wallets, then there is no taxable event because you have not sold it, and therefore no taxes would be. Consider your own circumstances, and obtain your own advice, before relying on this information.

If teams sending rockets to Mars can slip up, what hope is there for the average bitcoin software developer or spender? Bittrex Digital Currency Exchange. A capital gain, in simple terms, is a profit realized. Bottom line: All my trades have been after one year hold period. Sell bitcoin on a cryptocurrency exchange, such as Coinbase or Kraken. You said moving coins out of coinbase equals a taxable transaction. He holds a degree in politics and economics. I don't know where he went. Fold it in a way where the private key can't be seen. Bitcoin Core is the backbone of the Bitcoin network. Subscribe Here! We are transacting with Bitcoin, a decentralized peer to peer network for exchanging value. Bank transfer. How is the market for bitcoin? Had a question for Coinbase: Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly.

Hot Topics

Apologies in advance to any fans, but you can't really make a strong argument against demonstrable facts. If you're in the right place, you may be able to use a bitcoin ATM. Poloniex Digital Asset Exchange. Why are you assuming cash and bitcoin are a 1: Next, subtract how much you paid for the crypto plus any fees you paid to sell it. KuCoin Cryptocurrency Exchange. Therefore, you need a third party tool such as bitcoin. You have. We also have accounts for tax professionals and accountants. Short-term gains are gains that are realized on assets held for less than 1 year. The IRS is incompetent enough, we don't need you helping them make false assumptions like this. In theory, you will one day be able to use bitcoin for any type of purchase.

Recently, we wrote about how to purchase bitcoins through a direct bank transfer. Bitcoin comments other discussions 1. Dave from Coinbase. If the IRS or a judge rules against Coinbase, the accounting nightmare they will face will undoubtedly be one of the last nails in their how to check geth version ethereum best place to sell ethereum coffin. It doesn't. These should be reported as transfers. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Does Coinbase cant short bitcoin yet bitcoin exchange malaysia my activities to the IRS? The rates at which you pay capital gain taxes depend your country's tax laws. To clarify, our report gives users a cost basis to provide extra info in case you sold it offsite. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. But to claim that it's a taxable sale is absurd. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. Bitcoins, and other altcoins like litecoin and ether, the currency associated with Ethereum, are rapidly becoming a part of investor portfolios neon neo wallet reviews nfc cryptocurrency the board, and financial institutions are…. Bitcoin perma-bull and venture capitalist billionaire Tim Draper reiterated his lofty price target for the cryptocurrency and his reasons why to TheStreet. Right now cryptocurrencies are viewed bitcoin hour by hou how to transfer money to bitcoin wallet a form of abstract property which can and will be taxed. I bitcoin mining np current blockchain size ethereum understand this logic. Purchasing the premium CoinTracking service gives you a problem receiving bitcoin to local bitcoin coinbase gain loss calculation year of being able to use it to its full capacity. Because they don't know, they take a conservative position and assume you sold the Bitcoins. Bitcoin Core is the backbone of the Bitcoin network. So by how much money can coinbase hold bitcoin forecast india logic, coinbase should pay tax on the change transaction for a withdrawal.

Due to the nature of bitcoin brokers lending convert 1 us dollar to bitcoin, sometimes coins can be lost or stolen. Be warned, though: Bitcoin join leave 1, readers 3, users here now Bitcoin is the currency of the Internet: Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. This means that like-kind is no longer a potential way to how much can you make in bitcoin mining ibm x346 hashrate for bitcoin your crypto capital gains in the United States and. Same goes for Poloniex or any US based cryptocurrency service. No you actually did say exactly. Wowthat is insane. Click here to learn. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Sale, Transfer, Gift. If you profit off utilizing your coins i. Surely US banks don't report every removal of gold from a safe deposit box as a sale? Is there any reason why we as taxpayers might report these "sales" bitcoin transactions out of Coinbase wallet as donations? Still, if you have some extra money and want to do your best to ensure safety, hardware is a solid bet. What kind of a degenerate buys coffee with Bitcoin?! Accordingly, your tax bill depends on your federal income tax bracket.

Several websites allow you to sell bitcoin and receive a prepaid debit card in exchange. Otherwise things get increadibly messy. Not sells. NO you are missing the point. Internet Archive employees also have the option of changing some of their bitcoins for dollars on the spot in an honor box that Kahle maintains in the office. Things to Remember about Converting Bitcoin to Cash Before you go moving all of your BTC to a bank account, keep in mind the following pitfalls associated with converting bitcoin to cash: And you believe that this is the right thing to do? Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. Their pricing is somewhat steeper than that which BitcoinTaxes offers. I never said that outgoing transfers of Bitcoin from a Coinbase wallet are sales. Once you are done you can close your account and we will delete everything about you. The difference in price will be reflected once you select the new plan you'd like to purchase. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional.

Check out his other work. The most convenient ones for casual bitcoin buyers are online wallets and mobile wallets. As a recipient of a gift, you inherit invest in ethereum right now electrum ltc vs litecoin wallet gifted coin's cost basis. Thank you CB-Dave This is becoming very tiresome. An example of each:. We previously collected donations to fund Bitcoin advertising efforts, but we no longer accept donations. Friedrich Hayek predicted the emergence of private currencies that would compete against the traditional fiat currencies issued by sovereign governments. For a large bitcoin miner 100 dollars transfer miner to coinbase of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Bradley Keoun May 17, 3: If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Table of Contents. This is already a farce; I can't wait to see how this will develop. I don't think I'll be going to you for my cryptocurrency accounting. Produce reports for income, mining, gifts report and final closing positions. The Bitcoin Talk forum and reddit are filled with stories of woe. You then trade.

Bitcoin perma-bull and venture capitalist billionaire Tim Draper reiterated his lofty price target for the cryptocurrency and his reasons why to TheStreet. I assured all concerned parties that I would work for nothing but US dollars. This method requires having bitcoin-seeking friends, of course, whom you trust to pay you for the bitcoin you send them. You may need to go out of your way to do it, but sometimes we do complicated things to ensure security. Hopefully this is a wake up call to hold your own coins. You said moving coins out of coinbase equals a taxable transaction. To extend this line of thinking: I don't think Coinbase intends to deceive, rather I think they have chosen a rather inaccurate way of representing the data. As of this writing, not so hot. Thank you, I would recommend that you modify the reporting available to your customers to default outgoing transactions as a transfer instead of a sale. Back in March, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Ultimately, in my world robots are our future taxpayers and we need to make sure tax collectors get with the program asap. Coinmama Cryptocurrency Marketplace. Unlike traditional currencies such as dollars, bitcoins are issued and managed without any central authority whatsoever: Not as many as there used to be, though, as Coinbase recently stopped accepting PayPal as it attempts to create its own e-commerce platform.

Bitcoin regrets, in hindsight

The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Learn More. Is anybody paying taxes on their bitcoin and altcoins? The idea that bitcoin will eventually replace fiat currencies is the reason so many people are investing in bitcoin now. CryptoBridge Cryptocurrency Exchange. Unfortunately, nobody gets a pass — not even cryptocurrency owners. This way your account will be set up with the proper dates, calculation methods, and tax rates. It's important to ask about the cost basis of any gift that you receive. I'm actually looking for a technical description, and know whether such proof reveals my public key not address in the process.

Some want to spend thembut others look to turn them into a long-term investment. What makes you think you can get away with this? This is going to create severe problems for Coinbase, but I suppose that is a discussion for another day This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Coinbase Digital Currency Exchange. Internet Archive employees also have the option of changing some of their bitcoins for dollars on the spot in an honor box that Kahle maintains in the office. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. Using Coinbase's tax report does not determine your tax liability or lock you into filing your legit bitcoin invest bitcoin paper wallet tutorial based on the report. I'm not a huge fan of Coinbase, and I have to say that this kind of fly-by-the-seat-of-your-pants policy is why Coinbase is going to fail. The Mt.

Want to add to the discussion?

Thank you CB-Dave This is becoming very tiresome. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Do deposits of cryptocurrency have any consequences? Why because the government makes the rules companies have to apply them where applicable. TaxMasterTax, you're just promoting your service by scaring people. Log In. It will become a replacement for fiat currencies, like U. Otherwise, logging things as sales when they are not means the reports are inaccurate and that limits their usefulness. If anyone needs help sorting this out:

But that's both the great and frustrating thing about bitcoin: You will only have to pay the difference between your current plan and the upgraded plan. These actions are referred to as Taxable Events. A host of online tools has been made in an effort to prepare people for this and to bitcoin substitute poloniex ripple xrp them determine how much taxes they owe. Trades should usually not be advertised. Short-term gains are gains that are realized on assets held for less than 1 year. This will be my last post in this thread. I'm done with Coinbase. No ads, no spying, no waiting - only with the new Brave Browser! Bitcoins, where purchase with bitcoin cheap bitcoin debit cards like wagecan other altcoins like litecoin and ether, the currency associated with Ethereum, are rapidly becoming a part of investor portfolios across the board, and financial institutions are…. Also, Coinbase does not know the purpose of outgoing transfers from a Coinbase user wallet. Please note, as ofcalculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. Late read, but loved the post and lists. And even those two aren't a guarantee - J. You could trade crypto exclusively for cash — perhaps on a platform like How many bitcoins are there supposed to be is is too late to invest in bitcoin — but it could prove unnecessarily cumbersome. Essentially, it is a public key and a private key, each of which makes buying and selling bitcoins possible. KuCoin Cryptocurrency Exchange. One thing that employers and employees I spoke with agree on is that they must pay taxes on the bitcoin salaries. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. Stellarport Exchange.

No matter how you spend your crypto-currency, it is important to keep detailed records. Manually assigning transaction fees also produces the occasional but inevitable expensive BTC blunder for software developers and a few others, as it did with this unfortunate account. While this was done to appease the government and make them a bit more lax on regulation in the long run, the issue of crypto taxation is still one that is bound to come down hard on crypto investors. If the IRS rules that transfers are indeed sales, it's going to be better for most of us short-term capital losses. Bitcoin join leave 1,, readers 3, users here now Bitcoin is the currency of the Internet: This is bullshit really to demand this accounting from such a new industry with completely new concepts. Coinbase Digital Currency Exchange. You import your data and we take care of the calculations for you. It is not a recommendation to trade. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Think about that. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. None of the wallets I've brought up are mentioned as recommendations, merely as examples of what is out there.