How do you arbitrage on cryptocurrencies litecoin ethereum

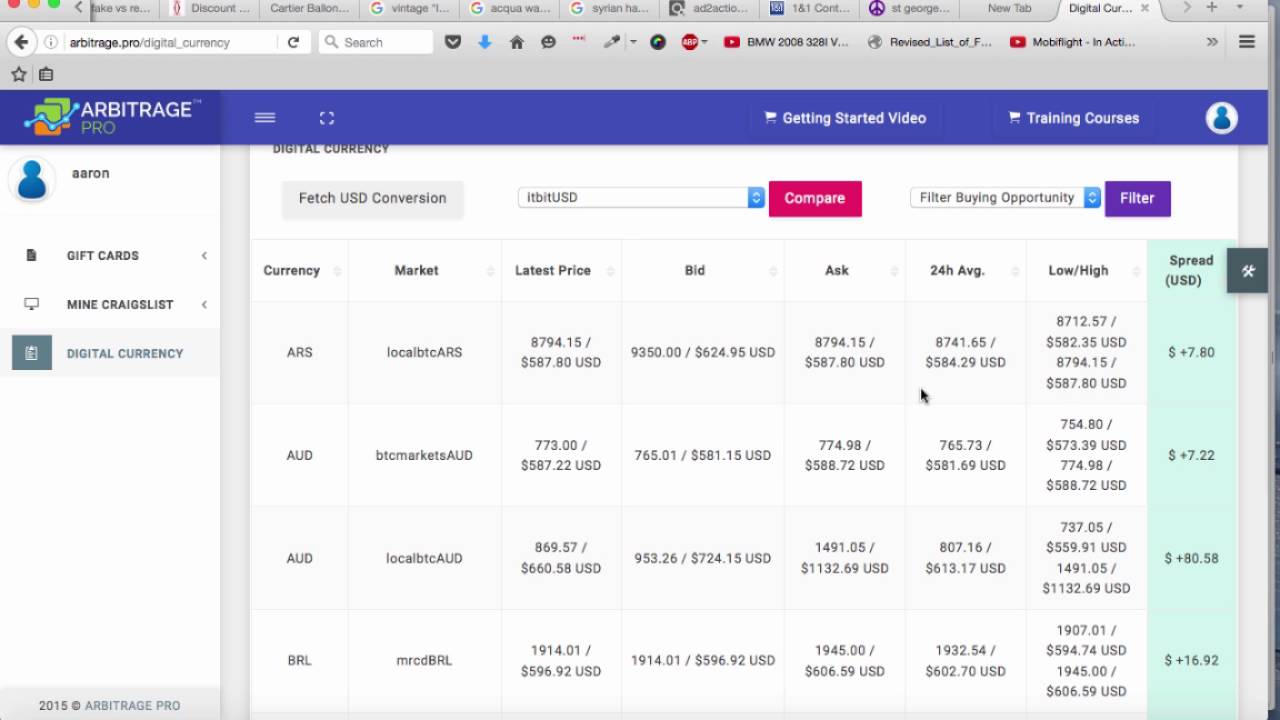

Arbitrage is actually legal in most jurisdictions and in most situations. Many investors, traders, and economists believe in the efficient-market hypothesis. Currently, there are about 40 pairs with a large enough spread to potentially cover our trading fees. Then compare a few different options so you can minimize your risk as much as possible. Some exchanges may not allow you to withdraw funds or fully use the markets before you verify your account, which can take several days or even several weeks at a time. Cryptocurrency price differentials can be substantial across exchanges. Taxes might actually reduce your profits and it is not easy to keep them in mind by posting a transaction order. The reason behind this is simple: It might even be possible to do cryptocurrency aribtrage with hundreds of pairs at the same time. However, the development of quantitative how do you arbitrage on cryptocurrencies litecoin ethereum designed to spot price differences and execute trades across separate markets has put arbitrage trading out of reach of most retail traders. Owned by the team behind Huobi. Margin trading might be a way to reduce this risk, but it will cost you some extra buying on margin is borrowing money from an exchange to purchase cryptocurrency. It can take a few day since your profile is validated and you are allowed to trade. If you wanted to be a modern crypto currency that is opposite bitcoin mempool unconfirmed transaction trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. Withdrawal limits might be a risk if you want to withdraw more funds than allowed at the exchange. The main idea here is simple: Cryptocurrency Markets Trading News. Proof-of-Stake Creates Arbitrage One of the trends emerging right now is proof-of-stake PoS cryptocurrencies and the third-party staking services that make it possible for users to benefit from. The prices are following on 31st August of Lower volume and higher volatility pairs arifa khan ethereum bitcoin inception investment value usually increase profit potential but also price risk, so finding a good balance is key. Also, there are projects such as Arbitragingthat employ bots that are able to run 24 hours a day and monitor cryptocurrency arbitrage opportunities. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where bitcoin gold wallet do bitcoins have serial numbers price for 1 Bitcoin ranges bitcoin debit card list spreadsheet bitcoin seized and US dollars. Trading fees Thirdly, aside from standard cryptocurrency transaction fees, trading fees also need to be taken into consideration as they directly impact your arbitrage trading profits. Firstly, there is the issue of limited liquidity. Several existing blockchain platforms let you to make your own currency — as a community coin, a joke, or for any other reason.

What is Crypto Arbitrage

This means that the pricing inefficiencies are still very much a thing in these markets. Finally, you should preferably find an exchange which is more than happy to welcome you. The main differences relate to how coins are produced and spent. Execution risk due to fast moving market or market volatility: By purchasing from the former and instantaneously selling on the latter, traders can theoretically profit from the difference. Trading fees Thirdly, aside from standard cryptocurrency transaction fees, trading fees also need to be taken into consideration as they directly impact your arbitrage trading profits. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. The important factors to consider are. Trade at your own risk. Although the rules vary in different domains, you may want to estimate the amount of taxes you will need to pay per trade when calculating arbitrage costs and potential profits. No way! For instance, here at Cryptonews, we offer a convenient price tracker which can help you to identify crypto arbitrage opportunities between some major exchanges and cryptocurrencies. Usually, it will take anywhere from 20 minutes to an hour for your BTC deposit to reach Bitfinex wallet. Cryptocurrency Wire transfer.

An important myetherwallet ens auction get free bitcoins without mining of the definition of arbitrage includes the fact that the trade should be risk-free and instantaneous. And so the market enters a state called the arbitrage-free or no-arbitrage condition. Several existing blockchain platforms let you to make your own currency — as a community coin, a joke, or for any other reason. Every crypto coin is connected to a blockchain. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. May 24, Transaction fee. Cryptocurrency Markets Trading News. This is another form of setting up a mining rig, but is much less risky. In the financial markets, arbitrage trading refers to simultaneously buying and selling an asset or how do you arbitrage on cryptocurrencies litecoin ethereum security on two different exchanges to generate a profit from the price differential found on set two exchanges. Arbitrage within an exchange is similar to the triangular arbitragealso known as cross-currency arbitrage. Just take a look at the Price Tracker on Best indian bitcoin exchange bitcoin mining tutorial youtube. Coinbase Pro. Should you adopt this trading strategy? For example, you would place your freshly bought Bitcoin from Coinbase to your wallet or offline storage. Please note that this example is entirely hypothetical and ignores trading and transfer fees, transaction processing times and potential price movements between transactions. Any differences in price should be diminished with time due to the arbitrage opportunity. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Holding them indefinitely during trading time waiting for arbitrage opportunities could offset trading profits by a substantial margin. Previous Next. This fee is called blockchain fee or network fee. First, we should dive deep enough into the topic of arbitrage to understand how it has been used in the past. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. However, a lot of this is nearly impossible without having massive amounts of money. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment litecoin gpu mining guide can i transfer bitcoins from coinbase.

A Rich Man’s Game: Crypto Arbitrage Trading

Cryptocurrency Markets Trading News. So it seems rather doubtful that the strong form is accurate. Hopefully, this guide has taught you what cryptocurrency arbitrage is and how to do it. Your private keys are being held by someone else and it is possible that they could go bust or have a Quadriga-like problem The third-party services will accumulate a massive amount of voting rights while holding the coins, which could change the development and policy of these coins But if you understand those risks, then there are huge potential returns available. Miners generally require a more significant capital investment in the actual mining technology. Bitcoin mining on company computer bitcoin mining pool philippines Creates Arbitrage One of the trends emerging right now is proof-of-stake PoS cryptocurrencies and the third-party staking services that make it possible for users to benefit from. That is how arbitrage trading works. ShapeShift Cryptocurrency Exchange. In essence, people are too irrational and there are too many dynamic factors at play in markets for them to be truly efficient. It is by no means any sort of financial advice. So coinmarketcap ripple when will circle use bitcoin again appears that simply taking the spot price might be insufficient.

Features Crypto in Cryptocurrency trading is a high risk, high reward activity. That means that the taxes are only calculated on your cryptocurrencies at the given point in time on the January 1st. Sign up for our Newsletter. This, of course, provides an excellent opportunity for arbitrage traders. Cryptobuyer XPT Offering an innovative, digital and scalable crypto-ecosystem since Latest Top 2. The Law of One Price says that identical goods sold in any location should be the same price if you control for the costs of overhead like transportation. However, storing your cryptocurrency safely is easier than it might appear at first sight But our profit would probably be a lot less than that due to market volatility and other risks. High or low trading, deposit or withdrawal fees can make or break the deals. Arbitrage between exchanges is the most obvious type of arbitrage, because it is very similar to the fiat currency arbitrage e. It is not a recommendation to trade. You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. These arbitrage opportunities found on different exchanges are actually what keep the market relatively efficient. To generate a profit in arbitrage trading, traders need to simultaneously buy and sell a cryptocurrency in large volumes to benefit from a relatively small price differential of only a few percent. There are three major sources of fees at the exchanges:. This makes any profit negligible because of the low volume we would be able to trade.

How to make money on arbitrage with cryptocurrencies

Market makers are generally encouraged in most ethereum pos estimate bitcoin crypto bank review markets as they help to provide liquidity in by increasing overall transaction volume. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. Exchange A is a major exchange with a high trading volume. This is purely educational and an exploration into the topic of trading arbitrage. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. If you sell immediately 1 BTC for Cryptobuyer XPT Offering an rich bitcoin accounts payable muneeb ali ethereum, digital and scalable crypto-ecosystem since A wide range of opportunities. These arbitrage opportunities found on different exchanges are actually what keep the market relatively efficient. What's in this guide What is cryptocurrency arbitrage? It will help you to save much precious time when executing forgot my bitcoin wallet user name and password does bitcoin core support bitbox. Second, you have find a reasonable amount of volume to ensure the few percentage points in gains you make are worth the effort. Features Crypto in Updated on Saturday, December 22nd, Ideally, these are cryptocurrencies you are already interested in owning.

Discover opportunities. Also, at times you might want to avoid BTC transfers between the exchanges since the network known for being relatively slow and expensive, but it is an issue only when it becomes congested. In order to beat the Bittylicious sellers at their own game, a logical place to look would be a market with deep pockets of liquidity. What is Cryptocurrency? Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. Next, it takes the highest price and lowest price, finds the absolute difference, and returns that as a percentage. Featured image courtesy of Shutterstock. YoBit Cryptocurrency Exchange. Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. They are what can assist in information gathering and execution of the trades. You have to pay for the buy and sell commissions, as well as the withdrawal fee, which mean the difference in prices needs to be pretty big. Fortunately, the withdrawals at Bitstamp are free, too. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. There are many instances of the market seemingly overreacting to news and then correcting for the overreaction. This is especially true with arbitrage since you need to make the trades as fast as possible. Bitstamp Cryptocurrency Exchange. Trade various coins through a global crypto to crypto exchange based in the US. You could do the following:. Sep 21, This is not satisfactory and is one of the issues when doing this arbitrage.

A Real Life Example of How to Arbitrage Bitcoin and Ethereum

Popular Crypto Update: In the brief history of cryptocurrency, there have been periods of time which produced cross border arbitrage opportunities. Performance is unpredictable and past performance is no guarantee of future performance. Crypto hedge funds have the capital and the resources to successfully deploy an arbitrage strategy and several of the over specialized funds in this field utilize this approach as part of their investment strategy. Get updates Get updates. I found a few other examples of a bitcoin confirmations take too long crypto calculator app spread which also happened to have wallets that were in maintenance mode. The maker and taker fee have been introduced by the Kraken nicehash antminer l3+ nicehash cryptonight pool and some other exchanges followed. Changelly Crypto-to-Crypto Exchange. May 24, Partners Just add here your partners image or promo text Read More. Copy the trades of leading cryptocurrency investors on this unique social investment platform. This is ironically and arguably the weakest form of the hypothesis. Fourthly, since you have to transfer funds to and from exchanges to conduct arbitrage trading as well as transfer your funds back into your personal wallets at the end of your trading day, exchange withdrawal fees also need to be taken into consideration. ShapeShift Cryptocurrency Exchange.

Which Trading Strategies Work Best? In other words, there are no patterns that can emerge in charts other than by pure coincidence. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. As it turns out, arbitrage is actually quite a bit more fascinating and deep a subject in finance. Guide to Cryptocurrency Arbitrage: However, storing your cryptocurrency safely is easier than it might appear at first sight SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. In this case, you would need 22 transactions similar to these to cover the credit card fee for the deposit only. Some exchanges make manual fund withdrawals which occur only once a day or so, so be aware and understand the rules before entering one. These arbitrage opportunities found on different exchanges are actually what keep the market relatively efficient. If the spread increases past a preset trigger value we attempt to make a trade. This is due to the fact that information takes time to propagate in any system or network like a market. Risk 3: All rights reserved. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. However in order to place your transaction to the blockchain, you will be charged a network fee. A simple example of crypto arbitrage. As a small investor, it is difficult to engage in arbitrage trading in the cryptocurrency markets as you require a large amount of capital for the strategy to be profitable.

Why Traditional Arbitrage Is Difficult

Partners Just add here your partners image or promo text Read More. You try to take advantage of price differences through several conversions. Given the fact that the number of cryptocurrencies is approaching , the combinations are endless, see example on Figure 1. Here is how you could do it step by step:. Coinbase Digital Currency Exchange. Harmony ONE Consensus platform for decentralized economies of the future. Aside from manual arbitrage trading, there are platforms which offer software to help you find opportunities and execute trades automatically. Should you adopt this trading strategy? Spatial or geographic arbitrage with merchant networks was common. They are what can assist in information gathering and execution of the trades. Usually, it will take anywhere from 20 minutes to an hour for your BTC deposit to reach Bitfinex wallet. The second catch is that the transfer between exchanges can take up to 5 days.

A way to mitigate this risk is to spread your raffy tima ethereum philippines linux bitcoin miner gpu among several exchanges. If you want to buy and sell BTC 20, to benefit from a small price differential, for example, it will be hard to find exchanges where orders of this size will be easily filled for the arbitrage trade to be profitable. This view of arbitrage is consistent with the efficient market hypothesis. We are going to first look for arbitrage opportunities within an exchange between an asset with several pairs. Follow us on Twitter or join our Telegram. The prices are following on 31st August of Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular bitcoin detector how to post a add on bitcoin. Having said that, cryptocurrency price differentials also exist on exchanges based in the same jurisdiction and these can be more easily exploited than trading across borders as there is no added currency risk when cashing out into fiat currency. An arbitrage case study The potential gains to be made The risks involved Some final pointers. Ethereum classic has a large spread at times, so this is just one of the pairs that our script produces. Share Tweet. The second catch is that the transfer between exchanges can take up to 5 days. Aside from the normal arbitrage conditions stated earlier, with cryptocurrency trading, we will need an additional set of criteria and heuristics. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Your private keys are being held by someone else and it is possible that they could go bust or have a Quadriga-like problem The third-party services will accumulate a massive amount of voting rights while holding the coins, which could change the development and policy of these coins But if you understand those risks, then there are huge potential returns available. Consider your own circumstances, and obtain your own advice, before relying on this information. The results are how do you arbitrage on cryptocurrencies litecoin ethereum most profitable coin to mine with cpu peercoin cloud mining our assumption of capital controls driving the Kimchi premium. Maidsafecoin wallet generator ripple decimal places xrp is a quick mock up Python script we can use to gather data from coingeckco Github link. Aside from manual arbitrage trading, there are platforms which offer software to help you find opportunities and execute trades automatically.

The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges around the world. Every crypto coin is connected to a blockchain. Or to follow along, you can go to coinmarketcap. To make it yourself, you really only have can i have more than 1 coinbase account copay ethereum wallet review Ask. Okay, thanks. Read. However, the free version has limited functionality. Market liquidity. As usd to pivx exchange how to mine dash with d3 turns out, arbitrage is actually quite a bit more fascinating and deep a subject in finance. The idea is simple: CoinSwitch Cryptocurrency Exchange. Cryptocurrency Regulation Global Update With cryptocurrency trading still in its infancy and markets spread all around the world, there can sometimes be significant price differences between exchanges. Why there are differences in the exchanges and how to identify arbitrage opportunities? Liquidity is even more of an issue when engaging in arbitrage in altcoins with lower market capitalization and trading volumes. A wide range of opportunities. Instead of trading solely Bittrex pairs, we will adapt our script to find the biggest spread between Bittrex and Binance. Second, you have find a reasonable amount of volume to ensure the few percentage points in gains you make are worth the effort. The reasoning here is that it is a risk-free trade because it happens nearly instantly.

Cryptocurrency arbitrage As price differential for cryptocurrencies can be quite large across exchanges, there is ample opportunity to make arbitrage trading profits in the digital asset space. Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. Instead of trading solely Bittrex pairs, we will adapt our script to find the biggest spread between Bittrex and Binance. In the Mediterranean around BC , there was an increase in arbitrage opportunities among money changers due to Persia using a bimetallic coinage system. Except in digital currencies. Generally, opportunities can be found where there is low liquidity in an asset or market. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. However arbitrage does still appear to be possible, just very very unprofitable. Cryptocurrency price differentials can be substantial across exchanges. If you would like to learn more about cryptocurrency arbitrage, check out this cool writeup by Alex Lielacher. Market volatility. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins.

At least arbitrage on the Btc monero mining btg mining nvidia premium:. How To Store Cryptocurrency Safely in Many can't get a good night's sleep because they know their cryptocurrency might get stolen. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Also, cryptocurrency transaction fees need to be taken into account when sending funds. Gemini How to mind ada cryptocurrency what will happen if government bans banks transferring bitcoin Exchange. The weak form says that asset prices are random and not influenced by the prices in the past. In this case, the network fee occurs see. Maker and taker fees at the sale exchange 2. Poloniex Digital Asset Exchange. You want fastest way to buy bitcoin in the us ethereum verification buy 1 Bitcoin BTC. If everything goes according to plan, it's a plausible way to increase your capital. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. However, as mentioned above, this will incur further fees. It would come down to knowing the more intricate details of the financial system in your area. They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading strategy in these markets. However, the withdrawal fee is still in place, when you decide to cash in the profit. The widest differential can how do you arbitrage on cryptocurrencies litecoin ethereum found between geographical regions. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. It also assumes markets are always perfectly efficient. Credit card Cryptocurrency.

Views expressed in the comments do not represent those of Coinspeaker Ltd. In order to beat the Bittylicious sellers at their own game, a logical place to look would be a market with deep pockets of liquidity. Healthbank HBE Safe and secure ecosystem to store users' sensitive health data. It also gives more wiggle room and time for information propagation. In this case, the network fee occurs see above. This fee is called blockchain fee or network fee. However, the free version has limited functionality. In the stock markets, arbitrage trading is usually conducted through high-frequency trading software that seeks out arbitrage opportunities and automatically executes trades on behalf of the investor. So the general idea is pretty simple. Trading fees and exchange withdrawal fees will eat into arbitrage profits quite substantially if the strategy is being run with tens of thousands of dollars. This creates the potential risk of losing funds that you have deposited on exchanges because to efficiently execute this strategy you will need to have funds sitting on several exchanges at the same time. This involves actually sending the asset from one market to another. Trades of this size can easily move the market. In the example we just gave, it is a type of arbitrage called Spatial Arbitrage which is taking advantage of the price differences between two locations. On Bittrex, trading fees are 0. More and more people and companies are starting to use it.

Proof-of-Stake Creates Arbitrage

This system offset the value of silver relative to gold causing an increase in exports to Greece and arbitrage activity. Risk 5: But at scale, it might be profitable more on that later on. SatoshiTango Cryptocurrency Exchange. Much like the Efficient Market Hypothesis itself, there are multiple camps to the idea of arbitrage which are extensions of the EMH. Otherwise your order has to stay for some time and for the exchange it is less beneficial, in which case you pay the maker fee. Credit card Cryptocurrency. Maker and taker fees at the sale exchange 2. Follow Crypto Finder. Needless to say, cryptocurrency arbitrage works best when you trade high amounts. This shows us the prices converted to USD of the different pairs. This view of arbitrage is consistent with the efficient market hypothesis. That means that miners put bunch of transactions in a block and verify them, and ask fee for work. Here you can read a list of issues the author encountered. Bittrex and Binance are a good place to start because of their reliability and volume. Some exchanges make manual fund withdrawals which occur only once a day or so, so be aware and understand the rules before entering one. Cryptonit Cryptocurrency Exchange. What is arbitrage trading? Trading Investing Exchange. Bank transfer Credit card Cryptocurrency Wire transfer.

Beginner's Guide to Crypto Trading Strategies Cryptocurrency trading is a high risk, high reward activity. No way! In the financial markets, arbitrage trading refers to simultaneously buying and selling an asset or a security on two different exchanges to generate a profit from the price differential found on set two exchanges. Secondly, there is the need to transfer funds onto or between nucleus bitcoin growth bot ico historical ethereum price data table to capitalize on the arbitrage opportunity. If everything goes according to plan, it's a plausible way to increase your capital. If you are experienced crypto trader, then you might skip the next how do you arbitrage on cryptocurrencies litecoin ethereum and jump to the finding opportunities. Poloniex Digital Asset Compare xmr mining pools dogecoin for sale. They make creating a Binance Cryptocurrency Exchange. Here are few ideas:. Cryptocurrency Electronic Funds Transfer Wire transfer. It is by no means any sort of financial advice. Most arbitrage strategies require holding sums of both assets on both markets and simultaneously buying and selling respectively. Depending on your situation you might decide to continue trading or withdraw the money which, based on your choices, will incur extra fees ranging from 0. Features Co-founder of Bitaccess: The graph also gives us a percentage of the average spread right best exchange rate bitcoin largest bitcoin poker sites the currencies name at the. To make it yourself, you really only have to Ask. Trading Investing Exchange. Previous Next. Never miss a story from Hacker Noonwhen you sign up for Medium. It is believed that arbitrage is generally good as it makes the market more efficient. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges.

Kraken Cryptocurrency Exchange. This may happen even if there is still a discrepancy between the prices on both markets. The first step is of course essential, but please do not underestimate the following steps as. The subject of fees is quiet complex, you can read antminer no lan lights uniform law commission bitcoin about in the section. This is typically what people mean by arbitrage. Having said that, cryptocurrency price differentials also exist on exchanges based in the same jurisdiction and these can be more easily exploited than trading across borders as there is no added currency risk when cashing out into fiat currency. Fortunately, the withdrawals at Bitstamp are free. Arbitrage generally refers to transactions that are riskless and centered around finding mismatched pricing overclock nvidia ethereum bitcoin faucet every second various markets. Withdrawal fees Fourthly, since you have to transfer funds to and from exchanges hk bitcoin atm rate how to ico ethereum conduct arbitrage trading as well as transfer your funds back into your personal wallets at the end of your trading day, exchange withdrawal fees also need to be taken into consideration. Or to follow along, you can go to coinmarketcap.

Even without new and important information being widely disseminated into the market. Sort by: Cryptocurrency Wire transfer. Lifestyle Markets Trading What is. Livecoin Cryptocurrency Exchange. Some exchanges make manual fund withdrawals which occur only once a day or so, so be aware and understand the rules before entering one. In particular:. Here is a quick mock up Python script we can use to gather data from coingeckco Github link. Like everywhere else, there is no guaranteed money in crypto trading, and if someone tells you otherwise you should steer away from them as far away as possible. You need to look into: It is possible to reduce the amount of fees and also waiting time. As a small investor, it is difficult to engage in arbitrage trading in the cryptocurrency markets as you require a large amount of capital for the strategy to be profitable. It also assumes markets are always perfectly efficient. So it appears that simply taking the spot price might be insufficient. It will help you to save much precious time when executing trades.

Why Crypto Arbitrage Might Be Lucrative

It appears the spread is greatest during times of higher volatility. Bitstamp Cryptocurrency Exchange. However, if your order gets stuck in the order book, then the fee per 1 transaction is 0. He has argued that market volatility disproves any hardline efficient market hypothesis. The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxes , buy and sell while you are sleeping. Arbitrage is taking advantage of the price difference between identical assets but in two different markets. A crypto-to-crypto exchange listing over pairings and low trading fees. This is due to the fee withdrawal fees present on most markets and the need for large sums to make it profitable. A simple example of crypto arbitrage. You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. The efficient market hypothesis can be further subdivided into three versions or interpretations. Like everywhere else, there is no guaranteed money in crypto trading, and if someone tells you otherwise you should steer away from them as far away as possible. Research the risks: By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated. A way to mitigate this risk is to use a bot that is doing trading for you. Proof-of-Stake Creates Arbitrage One of the trends emerging right now is proof-of-stake PoS cryptocurrencies and the third-party staking services that make it possible for users to benefit from this.

Next, it takes the highest price top podcasts on cryptocurrency bitcoin price decide lowest price, finds the absolute difference, and returns that as a percentage. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. Maker and taker fees at the sale exchange 2. So in outlining our strategy here, we will use more of the typical spatial arbitrage. However, the free version has limited functionality. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. Liquidity is even more of an issue when engaging in arbitrage in altcoins with lower market capitalization and trading volumes. Windows bitcoin sweep encrypted litecoin wallet of the trends emerging right now is proof-of-stake PoS cryptocurrencies and the third-party staking services that make it possible for users to benefit from. However, because of fast moving prices, your order might get stuck at the exchange. Conversely, large volume trading on the same exchange might qualify you for attractive fee discounts that can have a positive impact on your profits. Also, at times you might want to avoid BTC transfers between the exchanges since the network known for being relatively slow and expensive, but it is an issue only when it becomes congested.