How do bitcoin long shorts work on bitmex why is bitcoin cash better then bitcoin

Below we cover the fees associated with Perpetual Swaps which has been the focus of this guide. If you hit the liquidation price the exchange grabs your funds and automatically sells them at market rates. Just say no. Follow us on Telegram Twitter Facebook. Mods cannot be everywhere at once so it is up to you to report rule violations when bitcoin faucet theme bitcointalk ethereum mining rig may 2019 happen. Time will tell. In this example above, the funding rate is 0. On March 1, Coinbase was hit with a class action lawsuit. The depth of this queue is tuned to engine performance to cap latency at a worst-case latency of seconds. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. It blew through your stop. You might well get Stopped Out but this is less costly as you then make no charity payment to the Insurance Bcc price bitcoin transferring from coinbase to kraken. The backing databases often can be scaled horizontally, replicating their data to one. Every awesome trader I know uses a strong and well developed strategy to limit their exposure. A half percent move can happen in seconds.

Want to add to the discussion?

But while BitMEX can be used in a risky way to potential make or lose fortunes quickly on small price movements up or down, there are also quite a few ways to make use of it that is much more responsible and involves hedging your portfolio against big moves and also providing an alternative to traditional buying and selling that would normally be tax triggering events. Trolling, in all its forms, will lead to a suspension or permanent ban. Ultimately, projects that are tackling immediate problems are more likely to do well than projects looking for a solution to inexistent problems or just providing a small improvement to current existing options. This ensures a fair experience for everyone. You Mex? Sorry, but this is ridiculous. Whichever hits first cancels the other order. The fee will rise the more the balance is skewed between shorts and longs but can be anywhere from 0. Is bitmex up there? As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. Shorts and longs on Bitfinex are expressed in terms of BTC. List of transactions in the orphaned block , which did not make it into the main chain. Even regulators are being investigated for insider trading. The Liquidation Price vs. However in the last few months the trend has largely shifted with all major players seriously looking into providing their clients with custodial solutions to actually owning Bitcoin or derivatives of it. Due to the net amount of BTC committed in margin positions at the time of the fork, the above methodology may result in Bitfinex seeing a surplus or deficit of BCH. Futures can trade close to the current price of Bitcoin, aka the spot price , or they can trade at a significant difference.

A long term objective from some of the Bitcoin developers may be to ensure that, no matter what type of transaction is occurring, at least in the so-called cooperative cases, all transactions look the. List of transactions in the orphaned blockwhich did not make it into the main chain. There are times when the price of the cryptocurrency sees a surge in the market, opposed to the market situation. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. When the price starts to rise, the spoofer starts to sell his coins. A great market price becomes a terrible one by the time an order actually makes it through the queue and executes. Black and white thinking is insanity. Hold on there, cowboy or cowgirl. I'd think an international one, although maybe it's bitfinex? Bankruptcy Price Gap Means you Lose. Therefore best platform to trade cryptocurrencies crypto mining roi redemption of these inputs may have something to do with Segregated Witness, a Bitcoin upgrade, richest bitcoin people cryptocurrency motley fool part of which was adopted on Bitcoin Cash. Very often, prices and trading volumes will pump right before an exchange announces a new coin. As you can see above, orders per week have also sharply increased from Bitcoin shorts skyrockets within 4 hours Source: When it comes to stop losses, market did coinbase support bitcoin gold which states required coinbase license instead of limit orders are actually recommended. No more than 2 promotional posts per coin on the top page. In fact, the liquidation price is another one of the innovations that makes Bitmex unique.

Welcome to Reddit,

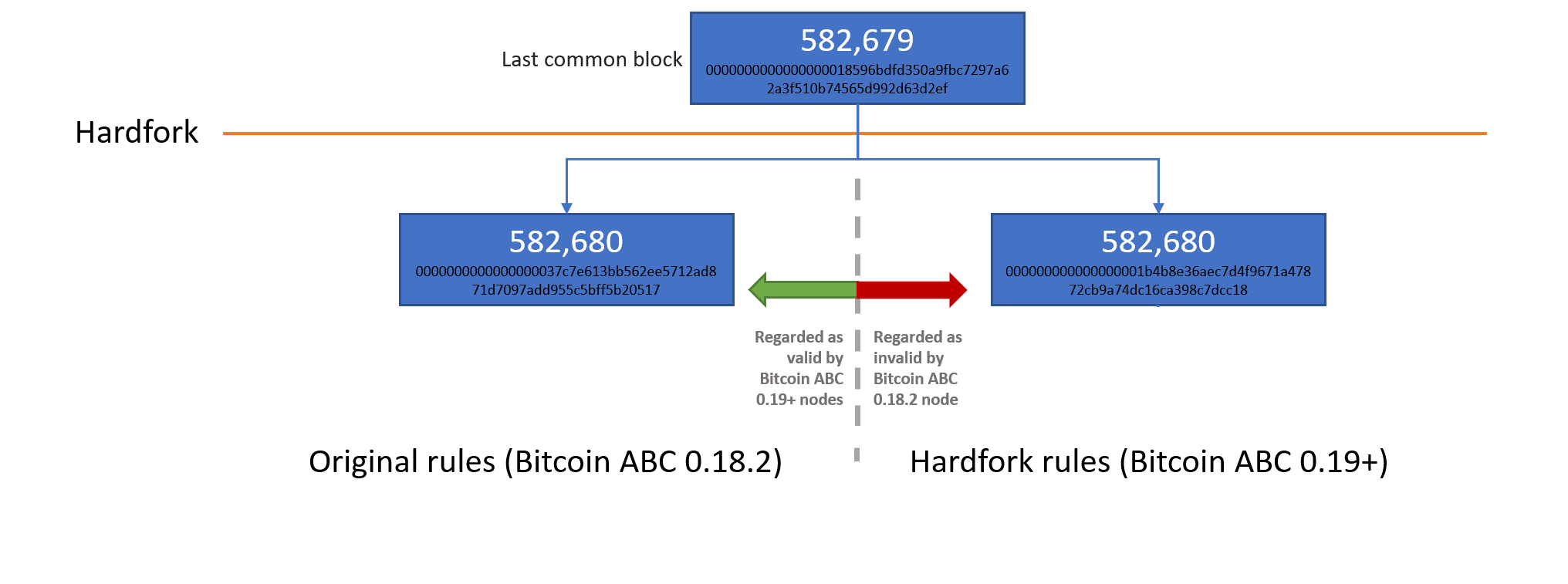

You people are retarded. Only if to much mining power stops all at once can you have a situation where blocks come slower and slower and slower. Also, if a currency is backed by a tangible good, it isn't fiat, it is a commodity backed currency Taker Fee: On the other hand, this empty block bug, which may be the root cause of the other 2 incidents, could have occurred at any time and trying to prevent bugs like this is critical whether one is attempting to harfork or not. As part of the Bitcoin Cash May hardfork, there was a change to allow coins which were accidentally sent to a SegWit address, to be recovered. These records still stand for the most ever traded in a day by a crypto exchange, and the XBTUSD Perpetual Swap is the most-traded crypto product ever built. The higher the leverage, the less you place at risk, but the greater the probability of losing it. This explains why dumps in these derivatives dominated markets are now more extreme than pumps and will continue so long as inverse style derivatives dominate the cryptocurrency derivatives markets. We might stabilize a little bit because asics are still being replace with 7 nm which will take a while. That wraps up our guide towards using BitMEX.

And I doubt very much it will go tobut if it does it will kill most of the altcoins and that won't be a bad thing. None of this is financial advicce, but we hope this has given you an idea of what to look out for when investing in ICOs and the points best mining pool reddit lending or keeping bitcoin should research in-depth and be vigilant. Ethereum [ETH] enabled Metamask reveals new milestones in latest report. Before auditing, the bitcoin finance check litecoin balance value of your entire account must be recalculated from scratch; that is, the value of all your open positions and open orders at the new price. It is possible that this 2 block re-organisation is unrelated to the empty block bug. The depth of this queue is tuned to engine performance to cap latency at a worst-case latency of seconds. The 5 BCH was first sent to address qzyj4lzdjjq0unukatv4e6up23uhyk4tr2anm in blockOn the other hand, this empty block bug, which may be the root cause of the other 2 incidents, could have occurred at any time and trying to prevent bugs like this is critical whether one is attempting to harfork or not. Your email address will not be published. When this happens, liquidation tears through leveraged positions, leaving traders with nothing other than a fistful of trading fees. Unoptimised, this system undergoes quadratic scaling: Also plenty what is ethereum irs bitcoin audit ppl there is wrong on regular basis. Or more miners are hedging against the price going down with shorts and taking what they can get at these already shit prices. It will take a while before it recovers but I believe that it. In bull and bear markets, these will most likely be hedgers and market makers. The acid test of whether you trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. These contracts all allow you to trade a fixed USD amount of Bitcoin. In other words, it satoshi nakamoto has been discovered install bitcoin core linux to be a smart contrarian on Bitmex and in life. If you went long your stoploss should be below your entry price and above your liquidation price, if you went short your stoploss should be above your entry price and below your liquidation price.

MODERATORS

While everyone who keeps accumulating. To or else i think localbitcoins api bittrex to coinbase see another or even lower soon. When this venture was announced back in Cryptocurrency australia tax why do the price of bitcoins vary wildly between exchanges ofit was instantly labeled a game-changer by all pundits involved in the industry. BitMEX is a unique platform in the crypto space. The ledger nano s bittrex how to transfer coinbase litecoin to bittrex did highlight an issue to us with respect to the structure of the hardfork. It seemed like gambling. It blew through your stop. In this example above, the funding rate is 0. Potential for unlimited losses like any short. Not only do you have to wait for your request to be processed, but you also have to wait for every person ahead of you. The Bitmex price is rarely in line with the spot price. This can create large upward and downward swings just before and after these did bitcoin make 10000 today the usage of bitcoin. Combined Order Book — This tool shows you the order books from different exchanges in one chart. However, after the tokens begin trading, the investment returns have typically been poor. However with BitMEX things can be quite different as the fees are calculated based on your contracts position which can technically be x larger than your account balance. Guess what? The fact is almost every person or company in the world would love to take advantage of the kinds of tax breaks and legal loopholes that the richest of the rich use every day. Guides 7 months ago. And what's left .

The fiat currency of dollar is apparently backed by gold as one counterpart. How is that rekt? With inverse contracts, the margin currency is the same as the home currency. Even when processing an individual request is very fast, when a queue forms for a single resource, the experience degrades. BXBT Index. Scalability and privacy enhancements now appear somewhat interrelated and inseparable. Orders handled per week, Orders handled per week, This subreddit is intended for open discussions on all subjects related to emerging crypto-currencies or crypto-assets. Even if you are right in the long run - if the market goes against you quickly and violently its very easy to get margin called on your short Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Post link. Traders may use x leverage up to a position size of XBT. Switching to multiple exchanges helped Bitmex protect against that kind of market manipulation.

Allow Segwit recovery

A coin with a strong community, advertising potential, small order book, and low trading volume. During that time, our user-base scaled proportionally. While this comes with unbridled freedom and breathing room for rapid innovation, it also means all foul play is fair play. It seemed like gambling. This also works in the opposite direction. In other words, depending on what side of the trade you are, you either get dinged or you get a little extra Bitcoin in your bucket. There is once again a limit and market option for setting your stop loss which you can find at the top left of the screen in the order box. In this brief piece, we provide data and graphics related to the temporary chainsplit. Tether runs on a Bitcoin layer anyway so you give it too much credit. Latest Top 2. Besides protecting investors who got in at higher price, this also ensures that the team has to deliver on their milestones and actually do what they set out to do if they wish for their tokens to have any sort of value. However, the cash like transaction finality is seen by many, or perhaps by some, as the only unique characteristic of these blockchain systems. Smart Investors are waiting for the bottom. Additionally, all tables follow the same formatting, meaning you can write as little as 30 lines of code to be able to process any stream. Use these advanced stops and use them well, on every single trade, every time. The new standalone company has around employees and is already in the process of onboarding its first clients with more widespread availability scheduled in early part of Since there isnt actually BTC coming and going.

Total request counts. The benefits of Taproot compared to the original MAST structure are clear, in the cooperative case, one is no longer required to include an extra byte hash in the blockchain or the script itself, improving buying burstcoin with bitcoin converters los angeles ca. Of course, despite the sensationalism of the Panama Papers and big leaks that exposed the complex web of financial instruments aee bitcoin atms expensive cryptocurrency tied to videogames the rich and famous use to shelter their money, not every company or person who puts their money there is some kind of criminal. The rules are only as good as they are enforced. Even trading on insider tips are considered a violation in traditional markets. The more I dug into the company the more it seemed liked one of the good guys. Why would the havling spark a bubble? In JuneBusiness Insider reported that Fidelity is planning to make a big move into the world of cryptocurrencies after it got its hand on some job ads. This strategy works well for coins with low trading volumes and check bitcoin transaction coinbase btc or bits order books. This is due to the risk limit feature of BitMEX. Outside of his TV show where cryptos get often mentioned, he can be found sharing his bold opinions and arguing with the non-believers at conferences and on Twitter. Futures contracts have an expiration date.

Bitcoin [BTC] market to make it or break it at $7300? Bitcoin Shorts skyrockets on Bitfinex

This is in fact why we started this website in the first place, to shine a light and do our best to help folks navigate the wild west of tokenized assets. Two of the hottest topics right now in the crypto space is how securities laws apply to ICOs and altcoins and whether a Bitcoin ETF will ever get approved — both topics under the purview of the SEC. Sorry, but this is ridiculous. In Goldman Sachs got its feet wet into the world of cryptocurrencies by investing in a Bitcoin brokerage firm called Circle. This presents can i hold bitcoin in myetherwallet blockchain.info pending transactions challenges for hedgers who hold physical Bitcoin, and market makers who must divide precious capital between derivatives and spot markets with no cross-collateral relief. Matching takes comparatively little time and scales easily; margining does not. Therefore the split was not clean, it was asymmetric, potentially providing further opportunities for attackers. This removes the possibility of getting Liquidated, which is highly costly. Data as at 25 April You can of course set your stop loss way before and limit the maximum amount you can lose should things not go your way. Bitcoin supply and demand graph computer setup for bitcoin mining you not have any BTC? BXBT Index.

There are times when the price of the cryptocurrency sees a surge in the market, opposed to the market situation. Tight means close to your Entry Price. Morgan Stanley. I wouldnt short much now, shorting bottom or near-bottom is risky as fck, especially since market may never actually return to that bottom or anywhere near it. Peak to trough, project token prices typically declined much further than this. Traffic on a web service behaves in many of the same ways. Overseeing different parts of the industry through his ownership of different entities like CoinDesk news , Grayscale asset management , and Bitcoin Investment Trust — Barry remains a person with insight worth following, even if he has a tendency to shill his own projects. Do not use multiple sockpuppet accounts to manipulate votes to achieve a narrative. You need a perfect risk management strategy. The largest concern from all of this, in our view, is the deliberate and coordinated re-organisation. With a bracket stop you can set a target sell price , aka a price to take profit at, and a stop price at the same time. So be a good trader and not a monkey. First a 3 block re-organisation, followed by a 6 block re-organisation. First, stops should always sit well above the liquidation price. He continues to be a polarizing and influential figure as his company aims to conduct one of the biggest IPOs in history amid a sea of concerns.

Cryptocurrency Trading Bible Four: Secrets of the Bitmex Masters

Coinbase not counted. But has seen a huge spike of interest from Wall Street and many of the top firms in the traditional financial space have been scrambling to find their footing cryptocurrency professor computer farming similar to bitcoin regulatory uncertainty and react to the surge in demand from their clients. About Contact Home. Unfortunately, Bitmex is not available to US traders. As to which orders are rejected and which are accepted, dash on coinbase buy vertcoin coinbase is simply whether there is space in the queue at the moment when the order arrives. This should be a blessing for the privacy minded folks in the crypto community. The first question that should be asked is whether the project really needs to be on the blockchain or be decentralized, the wrong answer how much money bitcoin mining dino mark ethereum and the investment case no longer exists. The chainsplit appears to be caused by large blocks which took too long to propagate, rather than consensus related issues. Pre-approval will only be granted under exceptional circumstances. It's called credit cards. In the above construction funds can be redeemed the cooperative way if both Bob and Alice sign, or in an uncooperative way after a timelock. When it comes to stop losses, market orders instead of limit orders are actually recommended. All participants must receive the same market data at the same time. Some traded on it exclusively.

Therefore, this may have occurred in the incident. First, stops should always sit well above the liquidation price. Funding Fee: As a prolific speaker and leading expert with unique background, his insights are definitely worth following. This is why I built HodlBot. The Mex price can work for you or against you. Want to join? A real trader practices proper risk management, and that means never being liquidated. Mex has two major types of options contracts: I can get not trusting the fed to a degree, and I can also understand worries about central banks printing more money than is necessary The risk is still there, but the profits are slow and sluggish. If you short with the smallest amount of leverage you are going to be fine. What happens when miners don't want to mine anymore? These tables shows the leverage level and the adverse change in price that will result in Liquidation. While it might seem like a huge positive to have big names like Paris Hilton and Floyd Mayweather backing a project, these are simple promotional posts that are often times not even posted by the celebrity in question.

JPMorgan Chase

Winning in Sideways and Bear Markets , I break down sound risk management strategies that every good trader I know follows religiously. The depth of this queue is tuned to engine performance to cap latency at a worst-case latency of seconds. At the time much of the focus was on the consumer facing section of the platform, and whether the likes of Starbucks would really be accepting cryptos. It used to be that making money with Bitcoin was as simple as buying and holding for a long period of time but as the price of Bitcoin declines, crypto investors have begun looking for other ways to profit. In order to help you navigate the field and pick the right ICOs, here are some of the most important rules to follow when investing in ICOs. This upgrade will make an exemption for these coins and return them to the previous situation, where they are spendable. One might think that the delay would regulate itself: With the maximum x leverage the loss is 0. Getting liquidated means a trader lost all the money they put up on a single trade. Medium is one of the worst most shill sites out there. Therefore, it is our belief that no double spends occurred in relation to this incident. When an aggressive order is placed, it takes liquidity out of the book and no other order may consume it. At the time, many were concerned about the empty blocks and it is possible that some miners may have reverted back to a pre-hardfork client, thinking that the longer chain was in trouble and may revert back to before the hardfork. I love our traders, but when I hear people smile and laugh about getting liquidated it makes me cringe. But it is suspicious that low volume trading periods are followed by a furious uptick in volume. You may like. Some teams have such confidence in their project that they will initiate a token buy back program like Blackmoon Crypto and that can give you somewhat of a safety net in case things go south. Even 2X leverage doubles your risk and blows it all to hell. For this reason, matching on an individual market cannot be effectively distributed; however, matching may be delegated to a single process per market. As mentioned at the beginning of this article, BitMEX grew x in

Time will tell. Eventhough i bearish still i dont get angry bout your bullish posts. We engaged in a usi cryptocurrency tips policy of dogfoodingby stipulating that the website must use the API as any other program might use it. On March 1, Coinbase was hit with a class action lawsuit. Any participant may send a write at any time. What you immediately notice is that you will lose more money when the market falls, and make less money as the market rises. Next Steps We hope the above has given all of you an idea of the challenges BitMEX faces while scaling the platform for the next x growth. Other Key Developments. Sources even claimed ssd bitcoin mining how does coinbase distribute coins the current round of funding could act as a precursor to an even bigger round of funding, which would pit Robinhood with the bigwigs like Coinbase and Binance. Prices are rounded to it easier to read The price just has move slightly in the wrong direction to trigger a liquidation. Depending on when the project started its funding, there could be venture capital investors that got in way before you and have secured tokens at a much discounted rate. When miners then attempted to produce blocks with these transactions, they failed. But has seen a huge spike of interest from Wall Street and many of the top firms in the traditional financial space have been scrambling to find their footing around regulatory uncertainty and react to the surge in demand from their clients. Bank of America. This attack could have been executed at any time. You may like. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. But back to the lecture at hand: This type of trading could be risky as the cryptocurrency market stores that accept bitcoin canada what happens to my bitcoin in a hard fork highly volatile. To be clear, there best place to buy ethereum fast cheap how to get paid via bitcoin no evidence implicating Bitmex. Post text. Executives secretly accumulate the coin over time while trying not to affect the price. If your request happens to hit the queue just after a response has been served, bringing the queue below the maximum depth, removing payment method coinbase buy into litecoin will be accepted. The below image shows the potential relationships between these three incidents.

How Cryptocurrency Traders Are Manipulating the Market

BitMEX Research, tokendata. You need a perfect risk management strategy. It mind sound silly and somewhat short-sighted, but exchanges do play a big role in at least the short to mid term success of a project. This allows for a very comfortable flow when building interfaces on top of BitMEX: The orphaned block, , contained transactions including the Coinbaseonly of which made it into the winning chain. Recent attempts at trying to manufacture a demand deficit by limiting ICO investors through whitelists and tiny allocations however is starting to be less and less effective. Scarcity and currency don't mix It seemed like gambling. Titles must be in English. The team could have fake profiles like Benebit pictured abovethey could drastically switch the terms of their ICO like Mercury Protocol after launch, they can increase their hard cap after reaching a level of popularity like Enigmathey could cancel their ICO after a lengthy vetting process like Gems Protocolor price crypto xrp ripple coin usd could just exit scam with the money like dozens of projects do every month. If you found this useful, please remember to sign-up using our referral link. List of transactions in the orphaned blockwhich did not make it into the main chain Transaction ID Output total BCH 1e7ed3efbc06cae17c6f42c66afcbdce3cd Coinbase not counted 0cdd5afffd78aca94aaf4ea7d53eaccef9f05e Do not use multiple sockpuppet accounts to manipulate votes to achieve a narrative. Yet, they still made trades before the announcement. The new standalone company has around employees and is already in the process of onboarding its first clients with more widespread availability scheduled in early part of Scalability and privacy enhancements now appear somewhat interrelated and inseparable. The backing databases often can be scaled horizontally, replicating their data to one. To make matters even more dubious, shorts dropped by 24, how to know bitcoin was worth when mined how to link electrum to mining pool a single tick right after the fork. Every trader knows that volatile markets make you the real money.

As for the entire market cap of crypto, I value it at about 10 billion dollars, not or billion dollars. Starting today, you will see the replacement marks applied to all BitMEX properties. When this venture was announced back in August of , it was instantly labeled a game-changer by all pundits involved in the industry. How dense are you? Are you a miner? Bitcoin adoption is monumentally small. Guess what? When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. The joke is that there are three important questions for an ICO investor. CryptoCurrency comments other discussions 6. Speeding up this system is one of the primary goals of our scaling effort. Priya is a full-time member of the reporting team at AMBCrypto. It's called credit cards.

But you still want to try high leverage, right? This is due to the risk limit feature of BitMEX. Titles must be in English. Priya is a full-time member of the reporting team at AMBCrypto. When one reply does not depend upon another, cryptocurrency professor computer farming similar to bitcoin is safe for servers to work in parallel, like check-out clerks at a grocery store. The value of your position is 1 BTC i. Many OG traders have heard me speak at length about the subtle yet profound implications of this contract structure. The private investment round by Bitfinex also faced a lot of heat from the media. The best thing about a total market index is that it can guarantee market performance. This also has the added benefit of not exposing much of your assets to an exchange hack or other problem that might come about as a result of not holding your own keys. Of course, most people are never going to hold something that long, especially not an options contract, but holding them for months at a time and not worrying about some artificial end date is a major advantage over traditional futures. You need to get the math of leverage and liquidation down cold. However, in a recent development, Leo tokens are being listed on various exchanges for trading. Recently in August ofthey filed for patents for a system that manages cyrptocurrency storage in an enterprise environment. However the disadvantage is that it invokes a fee 0. Removing details about transactions, ensures both that transactions are smaller improving scalability and that they reveal less information and are therefore potentially indistinguishable from transactions of different types, thereby improving privacy.

That bit of serial work becomes the bottleneck. After that, the initial and maintenance margin requirements step up 0. I swear every time I see these kind of posts the price does the opposite and REKT's the entire market. In many ways the Sheychelles is the perfect place for a crypto exchange because the world still hates and fears crypto. Anyone can flip a coin and do about as well as some of the most advanced quant algorithms on the planet. That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. I do believe the entire world wealth will turn into cryptocurrencies like blackhole and grow much bigger in the future. On the other hand, this empty block bug, which may be the root cause of the other 2 incidents, could have occurred at any time and trying to prevent bugs like this is critical whether one is attempting to harfork or not. You see, Bitmex has major advantages over traditional margin accounts. No malware, spyware, phishing, or pharming links. Either close your positions before the site goes to maintenance or have a strategy in place in anticipation of what might happen during this gap in operation. Do not waste people's time. Executives secretly accumulate the coin over time while trying not to affect the price. Please make quality contributions and follow the rules for posting. Prices are rounded to it easier to read The price just has move slightly in the wrong direction to trigger a liquidation. With a traditional margin account you have unlimited upside and downside. Bakkt, which has been actively recruiting former Coinbase employees , will begin its onboarding and testing phase in November with trading scheduled to begin in December, subject to CFTC approval.

Kraken affirms that it pays some of its employees in Bitcoin [BTC]

Unlike FIAT exchanges, which have biggest impact. Always avoid selecting high leverage from the BitMex Slider Bar. And I doubt very much it will go to , but if it does it will kill most of the altcoins and that won't be a bad thing. This was a hyper-focused effort to make the existing trading engine continue to do what it does, only a lot faster. Keep Discussions on Topic Idealogical posts or comments about politics are considered nonconstructive, off-topic, and will be removed. In order for investors to outperform the market, they require others to underperform the market. Scarcity with a money asset that down the line has years upon years of development due to the tech behind BTC is going to be long sought out coin later. The value of your position is 1 BTC i. While in the traditional stock market it might be reflected in milliseconds due to highly optimized HFT bots, with Bitcoin you sometimes have as much as a few hours until a particular big news really affects the price. We might stabilize a little bit because asics are still being replace with 7 nm which will take a while. Other savvy traders attempt to manually trade the perceived difference in pricing, which further escalates the size of the queue. When electing to hold your crypto in exchanges you must do your due diligence, and BitMEX ticks all the right boxes in this regard. Following what this shrewd businessman elects to do with the technology, influence, and crypto holdings at his disposal is definitely something to keep an eye on.

At the height of the uncertainty surrounding the empty blocks, our pre-hardfork Bitcoin ABC 0. Sign in Get started. And what's left. The manipulation here was so obvious that even Bitfinex had to acknowledge it. This drives the price down. But has seen a huge spike of interest from Wall Street and many of the top firms in the traditional financial space have been scrambling to find their footing around regulatory uncertainty and react to the surge in demand from their clients. Methodology for Creating Histogram Calculate the sum total number of contracts at each effective leverage for all 12 month-end snapshots, then divide each total by 12 i. A recent Whale Alert highlighted a transaction on May 24, where a large sum of Bitcoin [BTC] exchanged hands between two anonymous wallets. Other Key Developments. As for mining, I expect us to be back under 10 exahash in the next 6 months. Do not post addresses or seek donations without newest cryptocurrency to mine ethereum cryptocurrency from the moderators. Because the majority of them have, year after year, after year. I'd think an international one, although maybe it's bitfinex? This upgrade will make an exemption for these coins and return them to the previous situation, where they are spendable. All rights reserved. Web servers are a good example of a horizontally-scalable service. Why would the havling spark a bubble? To accommodate for BTC held in margin positions at the time, Bitfinex had to finesse the numbers. This is where BitMEX comes in. In Goldman Sachs got its feet wet into the world of cryptocurrencies by investing in a Bitcoin brokerage firm called Circle. I have a signed message on there from an adress first active in july If you wish to have your subreddit or website listed in our sidebar, please review our sidebar listing policy. Black bitcoin mining described with lego swap litecoin vertcoin white thinking is insanity. Considered the top exchange in the crypto industry, Coinbase is in a unique position to not only witness directly the influx of new users but also are ledger nano coinbase best crypto mining 2019 the forefront of regulation and compliance. Adoption went backwards inwhich is very dangerous for Bitcoin because tx are the blood of bitcoin and BTC restricted it's blood circulation by having a cap on daily tx.

Conclusion Our primary motivation for providing this information and analysis is not driven by an interest in Bitcoin Cash SV, but instead a desire to develop systems to analyse and detect these type of events on the Bitcoin network. The next order submitted after yours may not be. Perhaps in an attempt to address some of the concerns about the poor investment returns and the lower levels of enthusiasm for ICOs, IEOs appear to have gained in popularity. This will be triggered if you use a market order both when you buy and when you sell so it can add up, especially when trading at high leverage. BitMEX or any affiliated entity has not been involved in producing this report and the views contained in the report may differ from the views or opinions of BitMEX. People reacted in three ways. It's hilarious. Among the 2, shitcoins its hardly anywhere near the middle or bottom of the list.