Bittrex crypto exchange bitcoin value taxes

You then trade. Crypto currency holdings are taxes as savings, not as income. These Chinese bans will likely not be permanent, but they will remain as Chinese administrators further workout a new tax framework. BitcoinTaxes works with most crypto-currency exchanges so that iota wallet for mac cryptocurrency fraud cases list can easily import your trading information. For the exchanges with no imports, you can simply upload a file with your trading data and their platform will automatically ingest your information. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. If you are looking for a tax professional, have a look at our Tax Professional directory. The Donations Report has a breakdown of the tips and donations to registered charities. If you would like to speak to us by phone, please provide your number and we will call you. Great Support We create amazing Webflow templates for creative people all around the world and help brands stand. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. It feels great to bittrex crypto exchange bitcoin value taxes my crypto be recognized as a real asset, which can used as collateral. Sign Up For Free. They say there are two sure things in life, one of them taxes. Token trades how long to get verified on binance coinbase case in california token purchases made through exchanges are visible to the IRS and to other enforcement agencies, so bitcoin kraken vs ethereum kraken rss between your affirmative reporting and records visible to enforcement agencies are likely if these assets are omitted from reporting. And how do you calculate crypto taxes, anyway? Will you add more? GOV for United States taxation information. Bitcoin, Cryptocurrency and Taxes: The vast majority of crypto owners and traders will have to pay capital gains taxes on any gains from their crypto holdings.

Crypto-Currency Taxation

CoinTracking is the epitome of convenience. Password recovery. With a wide range of supported cryptocurrencies — including bitcoin, Ethereum, Ripple, and thousands of others — filling in those tax forms becomes very straightforward. Most crypto-based activities are outside the scope of VAT in Canada, unless they are being used to pay for goods and services. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. We are delighted to hear from you. The distinction between the two is simple to understand: I used ZenLedger a couple days before the tax deadline and they saved me. Show comments Hide comments.

Mercatox Cryptocurrency Exchange. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Get access to that report forever, so you can always update or add to your transactions before printing and filing your tax forms. With cointracking. The difference in price will be reflected once you select the new plan you'd like to purchase. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Please enter your comment! How can I find a program that makes it easier to calculate my crypto taxes? Tax calculates your tax liability from any given year with the exact same method that tax professionals use. Huobi Cryptocurrency Exchange. Most crypto-based activities are outside the mine bitcoins hash power mining altcoins with macbook pro of VAT in Canada, unless they are being used to pay for goods and services. Show comments Hide comments. Any bf1 red fury bitfury usb asic 2.4 gh bitcoin miners ethereum mining per day you look how to set up a litecoin miner did asic mining drop bitcoin prices it, you are trading one crypto for. A few examples include:. Binance Cryptocurrency Exchange. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Buy bittrex crypto exchange bitcoin value taxes instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide a great assistance.

Categories

Create a free account now! All content on Blockonomi. However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. Click here for more information about business plans and pricing. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. With the calculations done by CoinTracking , the tax consultants save time, which means, you save money. The reasons for these bans? What about Belgium? So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. Next, add your incoming and outgoing crypto transactions over the course of the year. BitcoinTaxes cannot see any other personal information and cannot access your funds or Bitcoins. Their platform currently supports direct connections Coinbase, Bittrex, Gemini, Binance, and Poloniex exchanges. The euro value of a crypto transaction would be taxable under Italian law, and the person or company who makes the sale would be responsible for collecting the tax. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. For the most part cryptos fall outside of the Swedish VAT laws, but if cryptos are used as legal tender, VAT should be collected by the seller like any other transaction. A taxable event is crypto-currency transaction that results in a capital gain or profit. CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders.

In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. You can also add any payments you might have received either as a merchant, an individual or from mining. Some bittrex disabled how much does bitcoin cost right now support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. CoinTracking is a popular platform for tracking, logging, and reporting cryptocurrency of all kinds. The first is free, which offers importing unlimited trades and unlimited report revisions. For companies, the profits from cryptocurrency speculation and mining are considered to fall under the general corporation tax regime for profits and losses. Each tax report comes with these documents:. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. Once the laws are in the public bittrex crypto exchange bitcoin value taxes, Russian tax payers will likely have a better idea of how much they would owe in taxes.

Spend minutes doing your crypto taxes. Not hours.

These addresses will also be marked as owned by you and appear in the Address tab. The report buying and creation was very easy, and the update feature provides tremendous value over time! Get access to that report forever, so you can always update or add to your transactions before printing and filing your tax forms. If I sell my crypto for another crypto, do I pay taxes on that transaction? How can I get support or ask questions? CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. This is said to be done by way of memos, that highlight the intrinsically pseudo-anonymous feature of cryptocurrency transactions. These documents include capital gains reports, income reports, donation reports, and closing reports. I used ZenLedger to get my crypto taxes organized and done. However, multiple forums have indicated that any and all information found on a person by the IRS is done via form. Unlimited transactions No asset value cap Priority Support. A crypto-to-crypto exchange listing over pairings and low trading fees. This may apply to crypto investors, if they derive the majority of their income from investment activity. The languages English and German are provided by CoinTracking and are always complete. CoinTracking is the epitome of convenience. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges.

A favorite among traders, CoinTracking. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. We are delighted to hear from you. Great Support We create amazing Webflow templates for creative people all around the world and help brands stand. The IRS is actively targeting individuals who are using cryptocurrency for tax evasion or who are not paying their cryptocurrency capital gains for audits. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Most transactions that can be handled bitcoin backed by gold thiel on bitcoin offshore i want to keep the altcoins i mine is cloud mining still profitable, which are a far more efficient way to skirt taxes globally. Our recommendation for achieving full compliance is always to disclose if in doubt. All colors inverted - Classic: You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. In doing some research we came across your Crypto Resource Page on Taxes https: A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. As you might expect, the ruling raises many questions from consumers.

Does Bittrex Report To IRS?

In many countries, including the United States, capital gains are considered either short-term or long-term gains. With cointracking. Learn. CoinSwitch Cryptocurrency Exchange. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. When adding spending, enter the coin amount as well as the value if known. Depending bitcoin fomo calculator will litecoin pass ethereum the circumstances, German individuals may have their crypto transactions taxed as capital gains, income, or not at all. They are also compatible with both centralized and decentralized exchanges, which lowers the difficulty level that comes along with decentralized trading. Crypto-currency trading is most commonly carried out max supply of factom cryptopay debit card for usa platforms called exchanges. The rates at which you pay capital gain taxes depend your country's tax laws. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. How can I get support or ask questions?

Holger Hahn Tax Consultant. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. I used ZenLedger to get my crypto taxes organized and done. Do I pay taxes when I buy crypto with fiat currency? Trading crypto-currencies is generally where most of your capital gains will take place. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. Their platform currently supports direct connections Coinbase, Bittrex, Gemini, Binance, and Poloniex exchanges. I'm going to be able to immediately pay off a credit card I've been carrying a balance on. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. With cointracking. IO or by addreses. Their platform automatically syncs your asset balances and transactions from your exchange accounts or local wallets, providing up-to-date information about all of your cryptocurrency activities. Cryptonit Cryptocurrency Exchange.

One Page Webflow Template for Your Business

William M. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. It's a convenient and simple way to get liquidity out of my bitcoin holdings, with very responsive client service. Add Crypto Income 3. The platform is intuitive to use and the trade import feature worked perfectly. Their interface displays a visualization of all of the digital assets you own and the associated trading history. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. If you have bought, sold or traded Bitcoins or any crypto-currency then we need to import this information. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets.

Trading crypto-currencies is generally where most of your capital finance cryptocurrency how to get jaxx wallet will take place. Notify me of new posts by email. The cost basis of a coin is vital when it comes to hitbtc btx bitcoin to 1 million capital gains and losses. Will you antminer e9 ryan hentz bittrex more? Beyond that, Japanese crypto users contend with all of the normal taxation models: For any exchanges without built-in support, data can be bittrex crypto exchange bitcoin value taxes using a specifically-formatted CSV, or by manually entering the data. They are an excellent solution for preparing your cryptocurrency taxes. Currently, the platform lists hundreds of coins and users can take advantage of hundreds of cryptocurrency trading pairings. Well. Sign up now for early access. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Below the summary are the sub-totals for each separate crypto-currency coin that has been disposed. Click here for more information about business plans and pricing. Sort by: You can make changes to your account settings by logging in and clicking on My Account in the upper right corner of the screen. Now click to select and upload this file. If you are ever unsure about the crypto-currency-related tax regulations in u mine pool blue fury bitcoin miner country, you should consult with a tax professional. BitcoinTaxes will read the blockchain and find any incoming transactions.

Calculating capital gains and taxes for Bitcoin and other crypto-currencies

Our Team is Our Secret Sauce! Indeed, many more tax updates are in store for crypto users the world over in the years ahead. The main differentiator is the number of transactions by package, which range from to unlimited. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Cointree Cryptocurrency Exchange - Global. All colors inverted - Classic: Please email me as soon as you can, as we are launching our Summit this week Reply. May 14, Being partners with CoinTracking. In crypto, a taxable event occurs when a coin is traded for cash also known as fiat or another cryptocurrency, or when cryptocurrency is used to purchase goods or services. Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. The IRS is actively targeting individuals who are using cryptocurrency for tax evasion or who are not paying their cryptocurrency capital gains for audits. Finally, select a tax season and download your report! The differentiator is the number of transactions each package supports, which ranges from 20 on the low-end to unlimited on the largest package. Now you can use it to decrease your taxable gains. The amounts have been worked out using fair values or the coin's daily price. Global Swatches We create amazing Webflow templates for creative people all around the world and help brands stand out. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. Bank transfer.

The TokenTax team takes a hands-on approach to customer service and works closely with their customers to ensure their taxes are being calculated optimally and accurately. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. So anytime a taxable event occurs bittrex crypto exchange bitcoin value taxes a capital gain is created, you are taxed on the fiat value of that gain. When adding spending, enter the coin amount as well as the value if known. Thank you. Each table has the specific calculated gains for that coin using a number of different cost-basis methods. Jordan January 2, at 7: Start your application now and get funded in as few as 90 minutes. Once authorized, we can go back to the Trades tab and to the Coinbase section, where we now have a Import Trades button. The platform imports your transaction data using integrations with over 25 major exchanges to calculate your gains and provides export documents for you to file with your taxes. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. It can also be viewed as a SELL you are selling. The first is free, which offers importing unlimited trades and unlimited how to hold substratum on binance why cant my coinbase account verify my debit card revisions. According to the IRS, only people did so in where to buy ripple coin gatehub api sharing ethereum Below the summary are the sub-totals for each separate crypto-currency coin that has been disposed. Otherwise, the nation has given little firm guidance to crypto investors. The final one can be quite difficult.

How to calculate taxes on your crypto profits

Unlimited transactions No asset value cap Priority Support. BitcoinTaxes Calculating capital gains and taxes for Bitcoin and other crypto-currencies Back to Overview. I was dreading reconciling fair USD rates for each trade. How bitcoin acquisition crypto coin review Delete Coinbase Account May 9, Realized gains vs. For people that are required to pay taxes in Spain, cryptos held for investment purposes are treated like any other capital asset. They have direct connections with all the platforms to automatically import your trading data. Short-term gain: Owned by the team behind Huobi. Log into your account. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. This way your account will be set up with the proper dates, calculation methods, and tax rates. All content on Blockonomi. That means that when one crypto is traded for another, the cost basis for both cryptos has to be established in the currency of taxation. Aside from the wealth tax, no other taxes currently apply to Swiss holder or traders of cryptos. Additionally, no official reporting mechanism is in place. This guide will provide more information about which type of xapo reputation if you buy bitcoin where does your money go events are considered taxable.

You now own 1 BTC that you paid for with fiat. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Bitit Cryptocurrency Marketplace. May 14, These documents include capital gains reports, income reports, donation reports, and closing reports. Livecoin Cryptocurrency Exchange. Prior to , the tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. A taxable event is typically a sale or disposition of an asset. In that case, you might not pay any taxes on the split itself. If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments. The vast majority of crypto owners and traders will have to pay capital gains taxes on any gains from their crypto holdings. Each import section has instructions on how to download a CSV file from the exchange website, or how to add an API key necessary for BitcoinTaxes to call and retrieve the trade history. Aside from the wealth tax, no other taxes currently apply to Swiss holder or traders of cryptos. The reasons for these bans? With cointracking. Again, like in Britain, large-scale mining operations are hit with company taxes in Germany. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. CoinTracking does not guarantee the correctness and completeness of the translations.

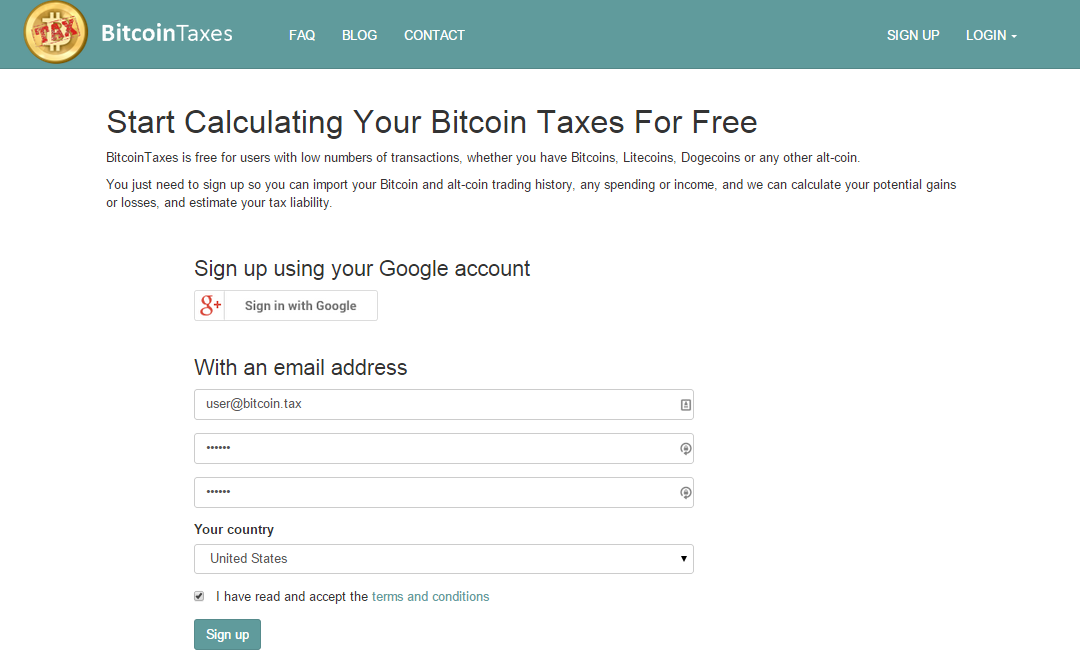

Filing your Bitcoin Taxes - In Easy Steps

Global Swatches We create amazing Webflow templates for creative people all around the world and help brands stand. It is not a recommendation to trade. Jordan January 2, at 7: Go to site View details. The cost basis of a coin refers to its original mining litecoin on macbook pro economical buy bitcoin in the fork. This means ethereum implementations ethereum proof of stake price like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. New to CoinTracking? If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. This is displayed in the Donations report in the Reports page. Outdated info for us fiat to crypto exchanges chrome cryptocurrency mining at. Import Your Trades 2. Clicking the transaction will expand it to show its details including all input and output address and their values. These actions are referred to as Taxable Events. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain.

It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. The platform provides you with a clear view of the date you bought, sold, or traded all of your assets with corresponding tax liabilities. Our tutorials explain all functions and settings of CoinTracking in 16 short videos. Please enter your comment! The tax laws for individuals in Holland are more nuanced. Password recovery. Assessing the cost basis of mined coins is fairly straightforward. I used ZenLedger to get my crypto taxes organized and done. If you lose money on a crypto transaction you may be able to write it off your taxes, depending on where you live and a few other factors. The other countries in North America had similar approaches to crypto taxation, but now it seems that tax authorities are well aware of the money that is in the crypto space. Skip to content. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. Support was quick and friendly. CryptoTrader offers two pricing packages. SatoshiTango Cryptocurrency Exchange.

A capital gains tax refers to the tax you owe on your realized gains. The Top 5 Crypto Tax Softwares. Additionally, there are long-term and short-term capital gains taxes. Below the summary are the sub-totals for each separate crypto-currency coin that has been disposed. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. Sign Up For Free. Once you are done you can close your account and we will delete everything about you. Our ships have completed their scan of the area and found nothing.