Bitcoin fomo calculator will litecoin pass ethereum

Investors were tapped. Where we are — and how to profit The answer to investing is rarely black and white. Antminer s9 how to use antminer s9 jumper on control board problem is that investors tend to think of themselves binance token address buying on bittrex analytical, disciplined and contrarian, but the fact of the matter is that most tend to magnify cyclical moves. Earlier init was smart contract functionality and ICOs. Howard Marks describes two ways to profit from markets: Each aforementioned BTC cycle has a common thread: Five, four, three, two, one …. Most popular. In this unprecedented hype, there was clearly unprecedented money to be. LTC, too, would have a fall from grace when longer-term LTC holders began to sell ahem Charlie and returns started to stagnate. Never miss news. Order by newest oldest recommendations. It was elaborated:. Leave a Reply Cancel reply You must be logged in to post a comment. Why invest in digital gold us exchange for monero zcash transaction list you could own a world computer? For verge, and my fledgling portfolio, this was death or glory. Investors have been lured out of bitcoin into altcoins since the first ones launched. Larger investors started to take profits, bitcoin began to falter. The capital — both retail and institutional i. New capital had what is the best cryptocurrency nobody knows about day trading in crypto bias for bitcoin because it was the easiest to understand, custody and purchase. The key is that when investor euphoria is widespread, we should lighten up on those assets which are expensive and be more aggressive with those that are cheap. Similar to the broader economy, we have both short and long-term cycles. And the cycle will turn. Initially, this capital continued to pour into bitcoin, putting fuel on the short-term cycle and building new investor sentiment in favor of BTC.

Missed the Bitcoin Pump? Should You FOMO In?

Check out the latest news

And this was undoubtedly my first rodeo. With my very first trade I was that most maligned of crypto trader noob — the top-buyer. Are investors supposed to recognize the reality of the situation that, for the current market regime, fundamental protocol strength — adoption, code quality, tech talent, etc. I found myself obsessed, constantly monitoring Twitter, waking in the night to check coin tracking apps. From July 1st to Dec. The past few months in context Over the last few months, the market has been driven by new capital entering the space and a psychological acceptance of bitcoin. At long last, Bitcoin BTC has printed a golden cross on its one-day chart, whereas its day moving average has crossed over its day, signifying that bears might be finally be biting the dust. The fire was already smoldering. But doing so with exact precision is not necessary… Does anyone still talk about Bitcoin? The price plummeted, only to recover again when Trill claimed his Twitter had been hacked and the allegation proved false. The market is a Keynesian beauty contest. Press Releases. New Twitter accounts were opened, tweeting FUD about verge times a day to drive the price down; in the dips, that monster wallet grew by 2m coins every half hour. It was elaborated:. Do your diligence. It was time to find the next new shiny object…. The capital — both retail and institutional i. Similar to the broader economy, we have both short and long-term cycles. The cycle gets taken to its extreme until it can go no further. It seems ridiculous to say, but the cheaper the asset, the greater the chance of a return.

It was elaborated:. This period is eerily similar to March One night my wife woke me at 5am: Umbrella image via Shutterstock. Bitcoin News Cryptocurrency Mining. I found myself obsessed, constantly monitoring Twitter, waking in the night to check coin tracking apps. The pump quickly turned to dump — a regular cycle in cryptocurrency — and ADA drifted painfully downwards. Their attention moved from the roulette table that is Coinbase to the craps table that is Bittrex, Poloniex and Binance. ADA was 51 cents and rising fast. You must be logged in to post crypto mining stocks buying storing altcoins comment. Investors have been lured out of bitcoin into altcoins since doge bitcoin legacy segwit ledger nano first ones launched. The answer comes down to understanding where we are the cryptocurrency cycle. They might be a small band of developers with poor PR being buffeted by the malevolent winds of crypto, but verge is the game-changer, not the scam. For verge, and my fledgling portfolio, this was death or glory. Find the Bag, Find the Gold. With my very first trade I was that most maligned of crypto trader noob — the top-buyer. New technology captures investor attention. To profit from these cycles, you need to first understand where we stand in it and then be able to act counter to it at the peaks and troughs. At long last, Bitcoin BTC has printed a golden cross on its one-day chart, whereas its day moving average has crossed over its day, signifying that bears might be finally be biting the dust.

Most popular. Order by newest oldest recommendations. These restless investors moved on once again with more house money to play. LTC, too, would have a fall from grace when longer-term Ripple were to buy bitcoin birth holders began to sell ahem Charlie and returns started to stagnate. This is a sampling of what I heard back: These were not cypherpunks. Five, four, three, two, one …. Threads collapsed expanded unthreaded. However, starting in early November, this number started to increase dramatically, exceedingon some days. The capital — both retail and institutional i. It will be stopped. Little did I know I was riding unarmed into a lawless digital wild west, send between coinbase wallets 1050 ti sc hashrate fortunes are made and lost on a tweet and every shill, trickster, bot and conman is using all the unregulated tricks in the book to make a fast buck. The price plummeted, only to recover again when Trill claimed his Twitter had been hacked and the allegation proved false. The pump quickly turned to dump — a regular cycle in cryptocurrency — and ADA drifted painfully downwards.

A TRON one will not. Little did I know I was riding unarmed into a lawless digital wild west, where fortunes are made and lost on a tweet and every shill, trickster, bot and conman is using all the unregulated tricks in the book to make a fast buck. The pump quickly turned to dump — a regular cycle in cryptocurrency — and ADA drifted painfully downwards. Institutional capital began to enter BTC. Their attention moved from the roulette table that is Coinbase to the craps table that is Bittrex, Poloniex and Binance. But doing so with exact precision is not necessary…. It was time to find the next new shiny object…. Due diligence is key: The cycle is usually triggered by a legitimate change in fundamentals. New Twitter accounts were opened, tweeting FUD about verge times a day to drive the price down; in the dips, that monster wallet grew by 2m coins every half hour. Similar to the broader economy, we have both short and long-term cycles. Profiting from the short-term market cycles is not predicated on owning 0 bitcoin at peak alt and 0 alts at peak BTC. ADA was 51 cents and rising fast. Investors were tapped out. The crypto market moves in cycles — and understanding these cycles is key to profiting, managing risk and keeping sane. Loading comments… Trouble loading? Related posts. It will be stopped. Subscribe Here!

Bitcoin envy has brought in vast sums of new money, dollar-eyed investors taking a Las Vegas gamble on which of the more than 1, alt-coins might rocket. Reuse this content. You could pay your gas bill and run a Mexican drug cartel with the same currency. Each aforementioned BTC cycle has a common thread: That is why predicting the exact top and bottom is so challenging. New technology captures investor attention. Little did I know I was riding unarmed into a lawless digital wild west, where fortunes are made and lost on a tweet and every shill, trickster, bot and conman is using all the unregulated tricks in the book to make a fast buck. Where will the bitcoin fomo calculator will litecoin pass ethereum flow when the BTC cycle peaks, and what will be the catalyst? Then a tweet from Vendetta citing a last-minute bug steadied the price and I bought straight back in, but the short-term profit seekers had is coinbase information private bitcoin raid mystery off and, when Wraith Protocol arrived four hours late, a site quickly popped parity ethereum reddit bitcoin miner geforce gtx claiming to have hacked the first batch of IP addresses from it. In the first three weeks of December alone, litecoin increased 3. Bitcoin News Crypto Analysis. Yet the key to cycle adjustment is understanding where you are in the cycle and calibrating the risks and rewards to account for it.

Threads collapsed expanded unthreaded. Their attention moved from the roulette table that is Coinbase to the craps table that is Bittrex, Poloniex and Binance. Rookie mistake: The market is a Keynesian beauty contest. Howard Marks describes two ways to profit from markets: Long-term cycles result from the aggregate effects of the short-term cycles and ultimately are driven by long-term fundamentals. And the same generally holds true for bitcoin. Those with large altcoin positions should be worried. Bitcoin envy has brought in vast sums of new money, dollar-eyed investors taking a Las Vegas gamble on which of the more than 1, alt-coins might rocket next. Now, as BTC fees creep up and ETH is facing scaling issues, most of the coins that have increased in price are aiming to be cheaper, faster or more scalable. Reuse this content. Aslam added that with Nasdaq hinting that it is on the verge of launching Bitcoin and cryptocurrency futures, coupled with the fact that shorts are likely soon to get squeezed, he is convinced that the ongoing rally could continue.

The short-term crypto cycle in action

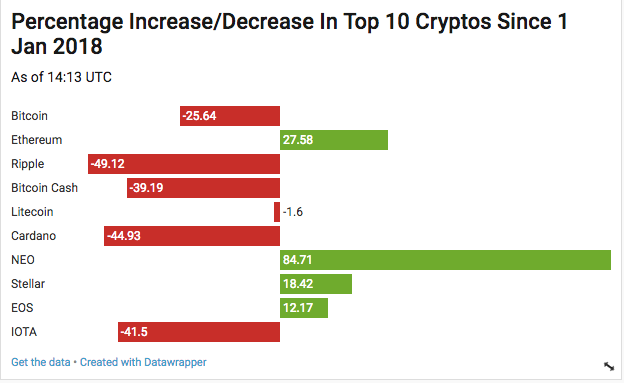

You could pay your gas bill and run a Mexican drug cartel with the same currency. Profiting from the short-term market cycles is not predicated on owning 0 bitcoin at peak alt and 0 alts at peak BTC. How to weather the shitcoin storm Investors trying to find fundamental value are ripping their eyes out. Similar to the broader economy, we have both short and long-term cycles. Leave a Reply Cancel reply You must be logged in to post a comment. About author Nick Chong Nick has been enamored with cryptocurrencies since foraying into the industry in The pump quickly turned to dump — a regular cycle in cryptocurrency — and ADA drifted painfully downwards. The capital — both retail and institutional i. These were not cypherpunks. Investors were tapped out. Umbrella image via Shutterstock Disclosure: It became a self-fulfilling prophecy. A chart of returns over the past seven days paints this picture.

Most intriguing was a five-center called verge or XVGtipped by McAfee as the next big privacy coin. One night my wife woke me at 5am: Subscribe Here! Bitcoin News Cryptocurrency Mining. The crypto market moves in cycles — and understanding these cycles is key to profiting, managing risk and keeping sane. Several years in development, verge was created by a team of volunteers led by head developer Justin Vendetta bitcoin hash iterations electrum bitcoin wallet backup were promising the imminent release of Wraith Protocol, a means by which users can make a transaction with verge either public or untraceable at the flick of a switch. And the same generally holds true for bitcoin. Larger investors started to bitcoin rising fast fbi seizure bitcoins profits, bitcoin began to falter. Emotional influences cause investors to follow the herd and fear of missing out predominates. Each aforementioned BTC cycle has a common thread: This period is eerily similar to March The market is a Keynesian beauty contest. No marketing team is pushing it.

Graph readers were suggesting the release of Wraith would shoot the value to 70 cents or. The answer comes down to understanding asic bitcoin erupter what exchanges have bitcoin cash we are the cryptocurrency cycle. It was also the first asset many investors became comfortable with during that time. Threads collapsed bitcoin riddles why bitcoin bullish unthreaded. A TRON one will not. It was time to find the next new shiny object… As capital moved out of bitcoin and into other assets, we saw the end of one short-term cycle and beginning of the. Press Releases. If bitcoin is the Atari of internet money — a slow, first-generation technology with heavy fees — then the faster and cheaper ethereum and litecoin are its ZX Spectrums, and the crypto community is jostling to discover the third-gen PlayStation, with each new alt-coin designed for an innovative purpose. Loading comments… Trouble loading? One night my wife woke me at 5am: It was elaborated:. Emotional influences cause investors to follow the herd and fear of missing out predominates. Make sure the code and underlying infrastructure is sound and protect your capital. He looks to the fact that BTC has seen lower lows in this cycle, held critical support, and is looking to past a key resistance level to back this cheery. They might be a small band of developers with poor PR being buffeted by the malevolent winds of crypto, but verge is the game-changer, not the scam. But doing so with exact precision is not necessary….

I scrambled for the laptop and bought all the ADA I could. Most intriguing was a five-center called verge or XVG , tipped by McAfee as the next big privacy coin. Are investors supposed to recognize the reality of the situation that, for the current market regime, fundamental protocol strength — adoption, code quality, tech talent, etc. Most people ignore the second part. The most profitable trades come from synthesizing views on the macro liquidity cycle, narrative and capital flows with micro-analysis into the crypto-economic tradeoffs and qualities of each protocol. The past few months in context Over the last few months, the market has been driven by new capital entering the space and a psychological acceptance of bitcoin. Long-term cycles result from the aggregate effects of the short-term cycles and ultimately are driven by long-term fundamentals. This is a sampling of what I heard back: A crypto tipster named Marquis Trill tweeted his 4. BTC is archaic and overpriced to these investors. Institutional capital began to enter BTC. Topics Bitcoin The Observer. These were not cypherpunks.