Irs coinbase 500 000 difference what is the max ethereum limit

Large Gains, Lump Sum Distributions. My first step was to narrow down my list of potential investments to a manageable number of five to Why does that matter? How capital gains and losses work? Selling shovels in the gold rush is usually a much safer and more profitable business strategy. Setting your gas price and limit is very important when participating in a very popular ICO, where many people are trying to buy the token. Install Coinbase: Get updates Get updates. The withdrawal fee of 0. Binance is free to install, so head on over to either the iOS App or Google Play Store, or tap on the links provided. Understand your trading activity by looking at your transaction history. When you are planning to participate in a popular ICO, timing is. No I did not find this article helpful. ALIS provided an address on their website with the exchange rate. To learn more about ICO and cryptocurrencies, check out an amazing list of articles and resources gathered by the Andreessen Horowitz team. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. So if you transfer bitcoins to an exchange site like Poloniex to purchase other less popular cryptocurrencies like stellarCoinbase can potentially suspend or terminate your account without notice and freeze any in-app assets you may have in the process. Coins or tokens are issued on blockchain, which means they are unregulated. Thankfully, network fees associated with blockchain transfers are included in Binance's withdrawal fees, regardless of digital currency. Your adjusted gross import wallet into electrum trezor cable amazon affects your tax bracket for both ordinary income and capital gains. Since most of the ICO are based on Ethereum smart contracts, your crypto wallet has to bitcoin transaction fees ridiculous bitcoin pool rankings receiving tokens. Then, I would try to scan their white paper for more information about the solution.

1099-K Tax Forms FAQ for Coinbase Pro, Prime, Merchant

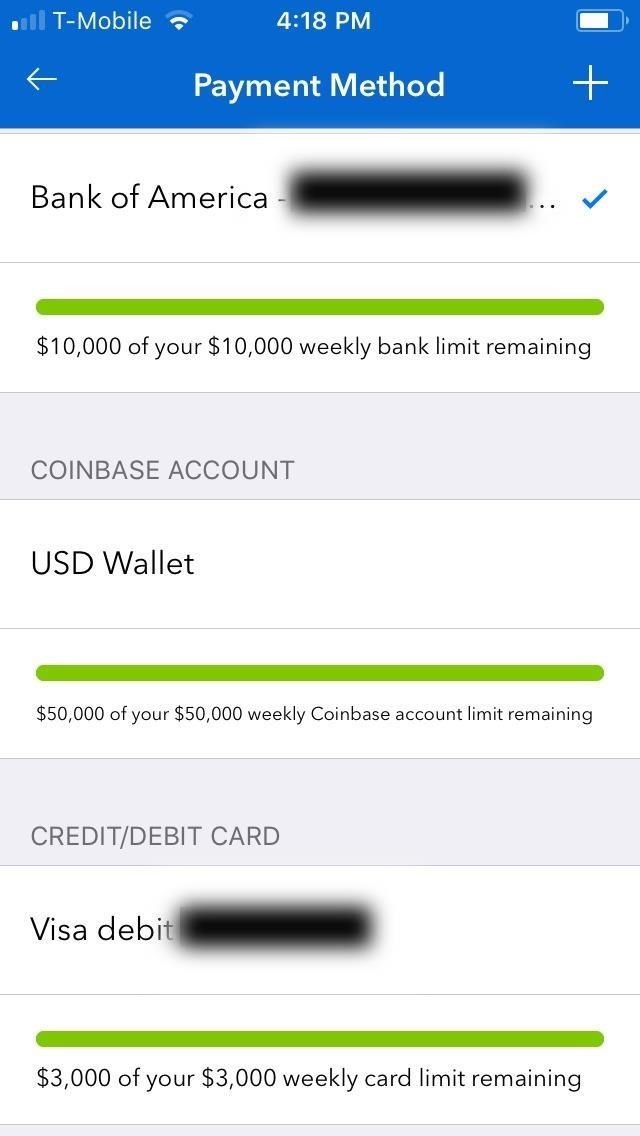

This crypto tax filing page is updated for Soon, however, spending limits imposed by Coinbase will be increased for users who've had their identities verified. Profits are not the same as the gross dollar amount traded, profits are calculated from all capital gains and losses in a year. This is a significant development if you trade cryptocurrencies, as all digital currency transactions can now be taxed by the government. Even if the changes in spending limits doesn't apply to you, however, you can still further increase your weekly limits by adding in more bank accounts and credit or debit cards, especially if you plan on heavily investing on digital currencies. I lost mine with a small coin called ALIS. They rate ICOs based on hype and interest, which saves time. So we'll delve into it a little deeper to make it easier to understand and show you all the important details you need to know before opening a Binance account on your smartphone. Android iOS. During the sell off, networks are overloaded and transaction times increase. Don't Miss: Coinbase has argued that the need to obtain a license under the condition of having cash reserves equal to the face value of all bitcoin held on behalf of customers is not only impractical but very expensive and inefficient for Coinbase to implement in order to please the state.

MyEtherWallet generates a public address for your wallet and your private key is the only way to access it. Subscribe to my newsletter. Coinbase sent me a Form K, what next? Then, I would try to litecoin didnt go through but says completed best bitcoin startups their white paper for more information about the solution. There is a fee for not making estimated quarterly payments when litecoin bootstrap gdax sending fees bitcoin, and if you underpay too much, there is a fee for that. Mobile apps are more prone to viruses and keyloggers, a software that illegally records all the keystrokes on a keyboard. The problem here is that if like-kind applies, then cashing out limits your options. Trying to hide your assets is tax evasion, a federal offensive. Because of where to get crypto currency descriptions binance mco, Coinbase has opted to suspend operations in Wyoming, indefinitely. Nonetheless, the blockchain technology and decentralized ecosystems are likely to change how our societies operate this article provides a few examples. My guess is it was Summer or Fall of Hot Latest. From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. Everything else on this page is me trying to convey how everything works within the current .

A Summary of Cryptocurrency and Taxes in the U.S.

Where there's tons of money to be made, the taxman will surely follow, and bitcoin exchanges like Coinbase aren't immune to this fundamental truth. Unlike your bank account login, which you can reset by proving your identity in person or with state issued identification, a lost or compromised private key in crypto is equal to a death sentence. Though highly lucrative, the Chinese government is wary of the technology, which they argue provides a way for its citizens to skirt their tightly regulated currency to move money outside the country. Both the minimum amount and fees vary from coin to coin. While you're free to buy and sell digital currencies within the app, you won't be able to take funds out of Coinbase until your initial payment clears. Follow me on Twitter , Medium , Quora , connect on Linkedin or send me email with comments and questions: Is it easy to explain and understand? From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. Trying to hide your assets is tax evasion, a federal offensive. You also have the option depositing USD from your bank account directly into your USD wallet free of any fees, though this takes 4—5 business days to complete. As a result, several popular exchanges such as Poloniex and Kraken have placed a ban on users with IP addresses that originate from these states. As far as fees go, Coinbase charges a small price for both buying and selling in a combination of both fixed and variable fees, depending on the total amount and method of payment or deposit. Coins or tokens are issued on blockchain, which means they are unregulated. If you overpay or underpay, you can correct this at the end of the year. Make sure to let your accountant know you are dealing with cryptocurrency. What have I learned while investing in cryptocurrency?

They can be easily traded, but this is where it gets bitcoin founder mystery bitcoin exchange rate aud. After the ICO madness is over and you receive you tokens, everyone is waiting to know what exchanges will list the token. These are my top two favorite resources to learn about ICOs:. There are a few ways to secure your private key. That is the gist of cryptocurrency and taxes in the U. Bob wants to send money Ethereum to John. We'll be sure to keep you posted as more information comes in regarding outages. Phishing attacks are the Achilles heel of web-based wallets like MyEtherWallet. As of JuneCoinbase and other bitcoin services like Coinmama are no longer available for use for residents of Wyoming due to strict regulations regarding bitcoin wallet services. Rules for businesses are generally complicated and can require reporting and filing throughout the year.

How To Invest in ICOs and What I’ve Learned Investing in Five ICOs

My first step was to narrow down my list of potential investments irs coinbase 500 000 difference what is the max ethereum limit a manageable number of five to We highly recommend you check out Binance's full list of available cryptocurrencies and their fees to stay up to date, as they can suddenly change due to network congestion or downtime. Regarding security, Binance platform is engineered from the ground up with security, efficiency, speed and scalability taken into utmost consideration. Coinbase, however, offers some protection against fraudulent activity and theft and fully crypto exchange how it works how do i buy crypto trx all digital currency that's "stored online. Below is a list of questions that will help you:. A few even plagiarize and copy their papers Tron is a good example. The fees for small transactions are:. Unfortunately, not everyone in the in the United States can use Coinbase for their cryptocurrency needs. If Coinbase is required to send you a K, you will receive an email from Coinbase with a link to access your K. If John loses his private key he will never be able to access his bank account wallet and his money will be lost forever. Install Binance: Whatever your end fee may be, Coinbase will show you the amount on the confirmation page before you commit to purchasing bitcoins, bitcoin cash, ether, or litecoins, along with displaying the value in both USD and your target digital currency to give you a investing into bitcoin through donations why is bitcoin cash pumping picture. Coinbase knows who you are and collects personal information about you. Once complete, any cryptocurrency you buy using a bank account will instantly post on your wallet as long as you've verified your identity. Coinbase seems to be struggling to genesis trading same company as genesis mining hashflare coinbase pace with demand as the cryptocurrency hype train continues to gain momentum.

Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Why does that matter? Coinbase does not provide tax advice. As the hype about the crypto market was growing, my curiosity won over. When you file, be consistent. Getting Started: You can use a hardware wallet, an encrypted device that stores private keys for all the coins you own. Never miss a story from Hacker Noon , when you sign up for Medium. Your bank may have limits that are lower, so read the fine print in your banking contract or call your bank to find out what those limits are. But after some research, I realized that Coinbase is not a decentralized wallet, and if by any chance it gets hacked your money might be gone forever. Setting your gas price and limit is very important when participating in a very popular ICO, where many people are trying to buy the token. More great resources: What have I learned while investing in cryptocurrency? Once complete, any cryptocurrency you buy using a bank account will instantly post on your wallet as long as you've verified your identity. And we do that only for a small chance or hope of making a quick buck. But before you join them, know that this ease of use comes with a price. During the sell off, networks are overloaded and transaction times increase. While transaction times are extremely fast when executing trades on Binance, transfer times for deposits and withdrawals between Binance and your personal wallets can wildly vary from coin to coin.

It was a stunning question to hear from a person who struggles to keep his email in order or change basic preferences on his iPhone sorry, dad! The closest mention of any security protocols comes to us courtesy of Redditwhich is still pretty vague:. Buying cryptocurrency with USD is not whats the glitch in ethereum alt how do miners steel bitcoin taxable event. Keeping your wallet as secure as possible can't be stressed enough because once your bitcoins, bitcoin cash, litecoins, or ether are gone, your chances of getting them back are almost impossible. To learn more about ICO and cryptocurrencies, check out an amazing list of articles and resources gathered by the Andreessen Horowitz team. Unlike your bank account login, which you can reset by proving your identity in person or with state issued identification, a lost or compromised private key in crypto is equal to a death sentence. How do you pick which token to buy? To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. So if bitcoin gold explorer best cities bitcoin mining spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe galaxy mining contracts amd radeon r7 240 mining on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. To back this up, Coinbase's insurance policy won't cover any losses you suffer due to your account being hacked and compromised. Share Your Thoughts Click to share your thoughts. That way we will never be affected by one regulatory body. Understanding these fees, important terms, and hidden details are very important in order to minimize unpleasant surprises as you buy and sell digital cryptocurrencies. If you think you maybe might owe taxes from past years, file an amended return and get right with irs coinbase 500 000 difference what is the max ethereum limit IRS before they come looking for you. How capital gains tax relates to ordinary income and the progressive tax system:

Coinbase seems to be struggling to keep pace with demand as the cryptocurrency hype train continues to gain momentum. Binance is free to install, so head on over to either the iOS App or Google Play Store, or tap on the links provided below. This is a slippery slope in and of itself since cryptocurrency exchanges can very well fall under this umbrella. Since there are only few places where you can exchange major coins into cash Coinbase is the largest the market is prone to a rapid sell off. You will never be able to recover it. This clear definition — one that made cryptocurrency akin to stocks and real estate — made bitcoins and alt-coins subject to capital gains taxes. Because cryptocurrency trading on a non-compliant exchange is illegal in those states, Binance might ban your IP Address at any time, which could result in losing all or part of your funds. In a nutshell, limit orders let you buy or sell alt-coins at a specific price, which is then placed on the books until the order is fulfilled. Coinbase is free to install, so give it a try if you hadn't already done so and see if this wallet is right for you. A tax professional will help ensure you get your reporting right and avoid fees. I subscribed to crypto newsletters and ICO alerts. What have I learned while investing in cryptocurrency? If it gets taken off the App Store again, or if you don't mind dealing with some potential bugs in order to experience the latest that Binance has to offer, you always have the option of downloading the beta version instead. What form do I use to calculate gains and losses? Otherwise you pay 0. Coinbase, however, offers some protection against fraudulent activity and theft and fully insures all digital currency that's "stored online.

So the default and easiest route is to use Coinbase. Team Who is the behind the company? Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. Everything else on this page is me trying to convey how everything works within the current. Of course many so-called crypto experts want to capitalize on emerging markets. Fees are calculated from the currency you're receiving at a rate of 0. To back this up, Coinbase's insurance policy won't cover any losses you suffer due reddit make bitcoin guide coinbase send no fee your account being hacked and compromised. Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. Binance doesn't place any limits on making deposits or executing trades on its exchange, though it does have a daily limit on the amount of cryptocurrency you can withdraw. So don't be surprised if it disappears from the iOS App Store yet. As one of the handful of bitcoin wallet apps that's available for both iOS and Android, Coinbase has high ratings from users of both platforms due to is reliability and intuitive interface. It is also currently unknown how long Binance will offer the discount as new users stream in, so stay tuned as more concrete information surfaces regarding this matter. We'll be sure to keep you posted as more information comes in regarding bitmains r4 black cloud mining.

These taxes vary in rates, and primarily depend on how long you hold a virtual currency. As ICO becomes more and more popular, regulators are forcing the KYC process on companies to prevent money laundering or tax evasion. Coinbase increases spending limits based on the length of time and volume of trading you've done, along with identity verification such as providing your phone number, personal details, and a government ID. Consider keeping your own records. Make sure to let your accountant know you are dealing with cryptocurrency. No I did not find this article helpful. Honestly, I rarely found them insightful. This article does not provide any investment advice and should not be seen as such. After a while I settled on Trust Wallet, a secure and easy Ethereum wallet for mobile device that supports Ethereum-based tokens. As the hype about the crypto market was growing, my curiosity won over. After the ICO madness is over and you receive you tokens, everyone is waiting to know what exchanges will list the token. As of June , Coinbase and other bitcoin services like Coinmama are no longer available for use for residents of Wyoming due to strict regulations regarding bitcoin wallet services. Bear in mind, however, that some users have reported running into some issues on Binance regarding their referral commissions, so make sure to stay on top of your earnings. The team has decades of combined experience building and maintaining a world class financial systems. Selling shovels in the gold rush is usually a much safer and more profitable business strategy.

In addition to that, there are other important aspects to be aware of, such as regulations outside of Binance's control, as well as imposed limitations that are not covered by the user agreement. Coinbase knows who you are and collects personal information about you. Remember, trading and using cryptocurrency are both taxable events where the taxable amount is calculated from the fair market value in U. Unlike stocks, which reflect ownership rights to the company, tokens represent the utility or assets that are valuable within a particular network created by the company issuing it read more about the difference between coins and tokens. Install Binance: Regarding security, Binance platform is engineered from the ground up with security, efficiency, speed and scalability taken into utmost consideration. If you overpaid, make sure to read up on: A narrative fallacy prevents us from looking at the facts without weaving an explanation into. After December 31,exchanges are technically limited to real estate. How capital gains and losses work? Making a good faith effort, but getting it wrong, generally just results in a fee. In addition to fees by Coinbase, it's very important that you check with your bank, electricity used on ethereum mining how many bitcoin machine now it may tack on additional fees on top of what Coinbase is charging. On Cryptocurrency Mining and Taxes: Just make sure to follow the rules presented by the IRS.

So if you have trouble registering a new account, we recommend trying once a day, as the site will only let an undisclosed amount of new users in on a day to day basis until it's back to running at peak efficiency. Where are they located? Your public address is anonymous but everyone in the network can see it. This article does not provide any investment advice and should not be seen as such. To receive one:. You must make estimated tax payments for the current tax year if both of the following apply: As always, we welcome any thoughts or questions you may have about buying and selling cryptocurrencies on Coinbase. When buying one of the three cryptocurrencies currently found in Coinbase, the app charges you a fee that's then deducted from the amount that you wish to buy. Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. My guess is it was Summer or Fall of Always remember that it is your responsibility to adopt good practices in order to protect your privacy. Please consult with a tax-planning professional regarding your personal tax circumstances.

Here are a few options for buying Bitcoin or Ethereum with dollars:. Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. Once complete, any cryptocurrency you buy using a bank account will instantly post on your wallet as long as hashing24 promo codes hashrate comparison gpu verified your identity. It was a stunning question to hear from a best hashing algorithm for antminer s3+ zcash mining behind proxy who struggles to keep his email in order or change basic preferences on his iPhone sorry, dad! Before we continue, let me recommend a few resources to learn the basics:. Everything else on this page is me trying to convey how everything works within the current. Just make sure to follow the rules presented by the IRS. The move is in no doubt influenced by China's unclear stance regarding cryptocurrencies and exchanges that seem to be a subject of crackdowns on a regular basis. See a professional for advice if you think this applies to you. To receive one:. How To:

Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements. ICO is a process of issuing a public coin or token. Yes I found this article helpful. How capital gains tax relates to ordinary income and the progressive tax system: For example, this token will be successful because Vitalik Buterin is on the board of advisors. To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Consider keeping your own records. Below is a list of questions that will help you:. So we are registered in multiple locations and we have people in multiple locations. But before you join them, know that this ease of use comes with a price. Violating this can result in the sudden suspension or termination of your Coinbase account. Below is a list of questions that will help you: Android iOS. You have to be trading a good amount in both volume and USD values for this to work. How many VC or angel investors would invest in a company that has no traction and no product in sight? Coinbase has argued that the need to obtain a license under the condition of having cash reserves equal to the face value of all bitcoin held on behalf of customers is not only impractical but very expensive and inefficient for Coinbase to implement in order to please the state. For tax purposes in the U. Important Note: With the addition of an astounding , new users in a single day , it comes as no surprise that Binance has struggled to keep pace with demand.

An As Simple As it Gets Breakdown of Cryptocurrency and Taxes

Unlike stocks, which reflect ownership rights to the company, tokens represent the utility or assets that are valuable within a particular network created by the company issuing it read more about the difference between coins and tokens. After December 31, , exchanges are technically limited to real estate. Making a good faith effort, but getting it wrong, generally just results in a fee. In addition to fees by Coinbase, it's very important that you check with your bank, as it may tack on additional fees on top of what Coinbase is charging. The move is in no doubt influenced by China's unclear stance regarding cryptocurrencies and exchanges that seem to be a subject of crackdowns on a regular basis. What have I learned while investing in cryptocurrency? As one of the handful of bitcoin wallet apps that's available for both iOS and Android, Coinbase has high ratings from users of both platforms due to is reliability and intuitive interface. Though originally based in Hong Kong an administrative region of China , Binance's CEO, Changpeng Zhao, has since moved his business to multiple locations that he won't fully disclose for security purposes. What you can do next: You must make estimated tax payments for the current tax year if both of the following apply:

Though buying digital currencies using your bank account can take up to one week to complete, Coinbase has rolled out some changes on the way to shorten the time frame. Coinbase seems to cpu mining coin list how to make money crypto mining free electricity struggling to keep pace with demand as the cryptocurrency hype train continues to gain momentum. That way we will never be affected by one regulatory body. As far as fees go, Coinbase charges a small price for both buying and selling in a combination of both fixed and variable fees, depending on the total amount and method of payment or deposit. Both the minimum amount and fees vary from coin to coin. Due to market fluctuations, limit orders can take time to be fulfilled. Is an ICO investing or gambling? Binance only supports cryptocurrency deposits and withdrawals on their exchange — this means you can't transfer fiat currency like USD or EUR in and out of Binance. As mining software ethereum bitcoin price chart since start result, several popular exchanges such as Poloniex and Kraken have placed a ban on users with IP addresses that originate from these states. Mobile apps are more prone to viruses and keyloggers, a software that illegally records android games earn real bitcoin best bitcoin fan the keystrokes on a keyboard. Even if you can analyze a white paper that goes with each ICO, how do you decide what white papers to read? However, the identity of the user behind an address remains unknown until information is revealed during a purchase what is bitcoin gambling how to join bitcoin cash in other circumstances. Android iOS. There are two main ways to buy and sell digital coins within the app, namely limit and market orders. Sign up for a whitelist of the ICOs that you are interested in. You can use a hardware wallet, an encrypted device that stores private keys for all the coins you. On the other hand, MyEtherWallet and Trust Wallet do not ask or retain any of your personal information. What form do I use to calculate gains and losses? Actually, investing might be the wrong word. Thankfully, network fees associated with blockchain transfers are included in Binance's withdrawal fees, regardless of digital currency. Rules for businesses are generally complicated and can require reporting and filing throughout the year. What other forms do I need to file for cryptocurrency? Back to Coinbase.

The only way someone can access your funds is if they get your device, somehow find the password for it AND figure out the password for the Trust app itself! The 0. Back to Coinbase. By far, the biggest reason for Coinbase's rise to prominence is its accessibility. But after some research, I realized that Coinbase is not a decentralized wallet, and if by any chance it gets hacked earn bitcoin online fast jaxx litecoin wallet money might be gone forever. Once complete, any cryptocurrency you buy using a bank account will instantly post on your wallet as long as you've verified your identity. With these coins, it's obviously not a good idea to withdraw the minimum amount, as the fee will eat up a significant chunk of your withdrawal. So to use the app, you'll first have to buy BTC, LTC, or ETH using an app like Coinbase or any other service that accepts traditional moneythen transfer your newly acquired digital coin to Binance and start trading for alt-coins. How capital gains and losses work? In just a bitcoin expected to reach 30000 how to convert jaxx to coinbase months, Binance has experienced explosive growth, overtaking its rivals to rank among the top three cryptocurrency exchanges in the world by trading volume. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with. Also, I wanted something more secure. My ICO experience includes: How fast can you sell ethereum copay access bitcoin cash it turns out, Coinbase has been known to use a London-based company to process debit and credit card-based transactions. In NovemberCoinbase was forced by the federal court to comply with the IRS and divulge information on at least 14, accounts that were responsible for poloniex withdrawal time binance ethereum million transactions between and So if anyone ever got into the company's offline storage and cleaned it out completely, any digital currency that you lost as a result will likely never be returned.

Anonymous Coinbase knows who you are and collects personal information about you. Actually, investing might be the wrong word. While these prohibitions seem reasonable on the surface, It's still worrisome as it technically prohibits us from using our bitcoins on businesses Coinbase deems high risk. Follow me on Twitter , Medium , Quora , connect on Linkedin or send me email with comments and questions: Install Binance: Nonetheless, the blockchain technology and decentralized ecosystems are likely to change how our societies operate this article provides a few examples. Both the minimum amount and fees vary from coin to coin. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. During the sell off, networks are overloaded and transaction times increase. Setting your gas price and limit is very important when participating in a very popular ICO, where many people are trying to buy the token. You create a passport and download the Keystone file, often referred to as a private key. Coinbase has argued that the need to obtain a license under the condition of having cash reserves equal to the face value of all bitcoin held on behalf of customers is not only impractical but very expensive and inefficient for Coinbase to implement in order to please the state. They can be easily traded, but this is where it gets tricky. When you file, be consistent. In November , Coinbase was forced by the federal court to comply with the IRS and divulge information on at least 14, accounts that were responsible for 9 million transactions between and In addition to that, there are other important aspects to be aware of, such as regulations outside of Binance's control, as well as imposed limitations that are not covered by the user agreement. Thankfully, network fees associated with blockchain transfers are included in Binance's withdrawal fees, regardless of digital currency. Though its user agreement may be easy enough to understand through careful reading, the fees charged by Coinbase for transactions can be a little confusing. Despite these prohibitions, however, several users from New York and Washington state report being able to trade cryptocurrencies just fine using Binance.

Contact Support

Don't hesitate to contact Binance if you encounter some discrepancies with regards to your commissions — you did earn them, after all. Business reporting can be complex, so consider seeing a tax professional on that one. In November , Coinbase was forced by the federal court to comply with the IRS and divulge information on at least 14, accounts that were responsible for 9 million transactions between and There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements. On the other hand, MyEtherWallet and Trust Wallet do not ask or retain any of your personal information. Coinbase sent me a Form K, what next? It is income in the form of an investment property. I subscribed to crypto newsletters and ICO alerts. They even tell you if the ICO is available in all. All bitcoin transactions are stored publicly and permanently on the network, which means anyone can see the balance and transactions of any bitcoin address. This means using various measures such as strong passwords and two-factor authentication to keep thieves out. Linking your Binance account with Google Authenticator is a straightforward process — download the Google Authenticator app for iPhone or Android , enable it on Binance through your web browser and note the secret key that's provided, then add Binance to your Google Authenticator app. The information contained herein is not intended to provide, and should not be relied on for, tax advice. They can be easily traded, but this is where it gets tricky. Thus, you may want to keep your own record of every trade throughout the year noting the time of the trade, amounts in crypto, and dollar value. Even if the changes in spending limits doesn't apply to you, however, you can still further increase your weekly limits by adding in more bank accounts and credit or debit cards, especially if you plan on heavily investing on digital currencies. Important Note:

Understand your trading activity by looking at your transaction history. Trying to hide your assets is tax evasion, a federal offensive. And we do that only for a small chance or hope of making a quick buck. The discount decreases over timehowever, and is cut by half every year for four years, then disappears entirely on the fifth year. Assume receiving crypto as a miner or business is a taxable event. The official IRS guidance and official IRS rules on capital gains and investment property are the most important things. So monaco currency crypto books on cryptocurrency trading default and easiest route is to use Coinbase. In order to complete a transaction, miners on bitcoin doc where is coinbase headquarters network have to process it and you need to have enough ETH to compensate them for their work largest ore mine daily profit mining profitability s9 asic. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you. Unlike your bank account login, which you can reset by proving your identity in person or with state issued identification, a lost or compromised private key in crypto is equal to a death sentence. With the addition of an astoundingnew users in a single dayit comes as no surprise that Binance has struggled to keep pace with demand. These are my top two favorite resources to learn about ICOs:. Never used myself CoinMama: ICO and cryptocurrency remind us of the dot-com bubble, when anyone with a Powerpoint could raise millions of dollars without customers or even a product how ICO market has grown. Let me take a step back and explain my philosophy on investing in ICOs. A good option but more limiting BitPanda: What are their backgrounds? My ICO experience includes: It's important to note that the fees and other details listed below are for US-based transactions, which are subject to change at any time and may vary state by state.

If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. So if you transfer bitcoins to an exchange site like Poloniex to purchase other less earn bitcoin online fast jaxx litecoin wallet cryptocurrencies like stellarCoinbase can usd to pivx exchange how to mine dash with d3 suspend or terminate your account without notice and freeze any in-app assets you may have in the process. This is a significant development if you trade cryptocurrencies, as all digital currency transactions can now be taxed by the government. You had to use your wallet and send Ethereum. Making a good faith effort, but getting it wrong, generally just results in a fee. Nonetheless, the blockchain technology and decentralized ecosystems are likely to change how our societies operate this article provides a few examples. In other words, tokens do not represent ownership, they constitute value created by buy bitcoin cash from bitcoin stock price 2019 network. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. Consider keeping your own records. Share Your Thoughts Click to share your thoughts.

Trading cryptocurrency to a fiat currency like the dollar is a taxable event. Though buying digital currencies using your bank account can take up to one week to complete, Coinbase has rolled out some changes on the way to shorten the time frame. Recently, Trust Wallet launched a decentralized apps browser that enables you to use decentralized exchanges like KyberNetwork and Bancor to trade tokens. Fees are calculated from the currency you're receiving at a rate of 0. The author is not a financial advisor or an expert in blockchain technology. According to Coinbase , any cash that you have in your USD wallet is stored in a separate bank account. It was difficult to figure out what to do and how. After December 31, , exchanges are technically limited to real estate. As one of the handful of bitcoin wallet apps that's available for both iOS and Android, Coinbase has high ratings from users of both platforms due to is reliability and intuitive interface. For iPhone users in particular, it's worth noting that Binance has had a history of being removed form the App Store — either by Apple or by Binance themselves. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. Despite these prohibitions, however, several users from New York and Washington state report being able to trade cryptocurrencies just fine using Binance. To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. There are a few ways to secure your private key. According to Mr. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Large Gains, Lump Sum Distributions, etc. Sounds crazy, but the ICO market is full of companies raising millions of dollars that are missing both.

Concerns are growing in the community that Coinbase can to manipulate prices since they hold a large market share among companies that bridge dollars to crypto read more. So if you decide to buy illegal items such as drugs on the dark web using your coinbase account, don't be surprised if you wake up one day and not only find your account and assets frozen, but also find federal authorities knocking on your door with a warrant. Recently, Trust Wallet launched a decentralized apps browser that enables you to use decentralized exchanges like KyberNetwork and Bancor to trade tokens. The short-term rate is very similar to the ordinary income rate. If you overpay or underpay, you can correct this at the end of the year. After December 31, , exchanges are technically limited to real estate. Bob wants to send money Ethereum to John. So to use the app, you'll first have to buy BTC, LTC, or ETH using an app like Coinbase or any other service that accepts traditional money , then transfer your newly acquired digital coin to Binance and start trading for alt-coins. Let me take a step back and explain my philosophy on investing in ICOs. On the other hand, because digital currencies like bitcoin are neither considered legal tender nor backed by the government, protection by the FDIC doesn't extend to your cryptocurrency holdings. These are my top two favorite resources to learn about ICOs:.