How to become bitcoin lender bitcoin last 30 days daily interest

Deciding the type of loan that better fits your profile, or even if lending is for you, is a decision you must take carefully; here we will explain the basics to get you started. A few things to note when the objective is purely to maximise funding income:. These are based on a small sample of 2 day loans actually traded on that day. As we have noted before, margin lending on cryptocurrency exchanges is the most often found type of cryptocurrency lending out. Get your KYC. Verification of your Social media profiles. Bitcoin, just like gold or a dollar bill, does not generate cash flow. I will deal with Polo and Bitfinex first, where Lending is straightforward. The most obvious risk are defaults, not having access to credit scores and the lack of instruments to enforce the contracted obligations makes things easier for scammers to run away. What matters is that the sentiment how to solo mine with ccminer how to start blockchain mining absolutely true and have become a universal truth in the financial world as a result. This process repeats month over month until you decide to withdraw your funds. How to find out if you should coinbase add funds generate an online bitcoin wallet Long or Short to get the Funding? Email — contact cryptoground. Market Cap: Note that most of the volume is at the extremes, that is 2 days or 30 days, so the numbers in between are not that meaningful.

How to Earn Bitcoin or Ether with Compound Interest

Shorting Bitcoin essentially means you are holding a USD position. Earn interest daily and get paid out on the first of every month. Email — contact cryptoground. And just like that, after 31 days, you earned 0. This eventually makes them a Bitcoin Bank which gives significant yields. Table of Contents. Rapidly get credits from different individuals or profit by advancing cash you have. On April 1, your account balance will grow to 1. Besides higher returns, investors have in Bitcoin lending a great opportunity to diversify their investments. When a trader spots what he believes is a great potential to get profit, he can borrow some money to invest more than what he currently has.

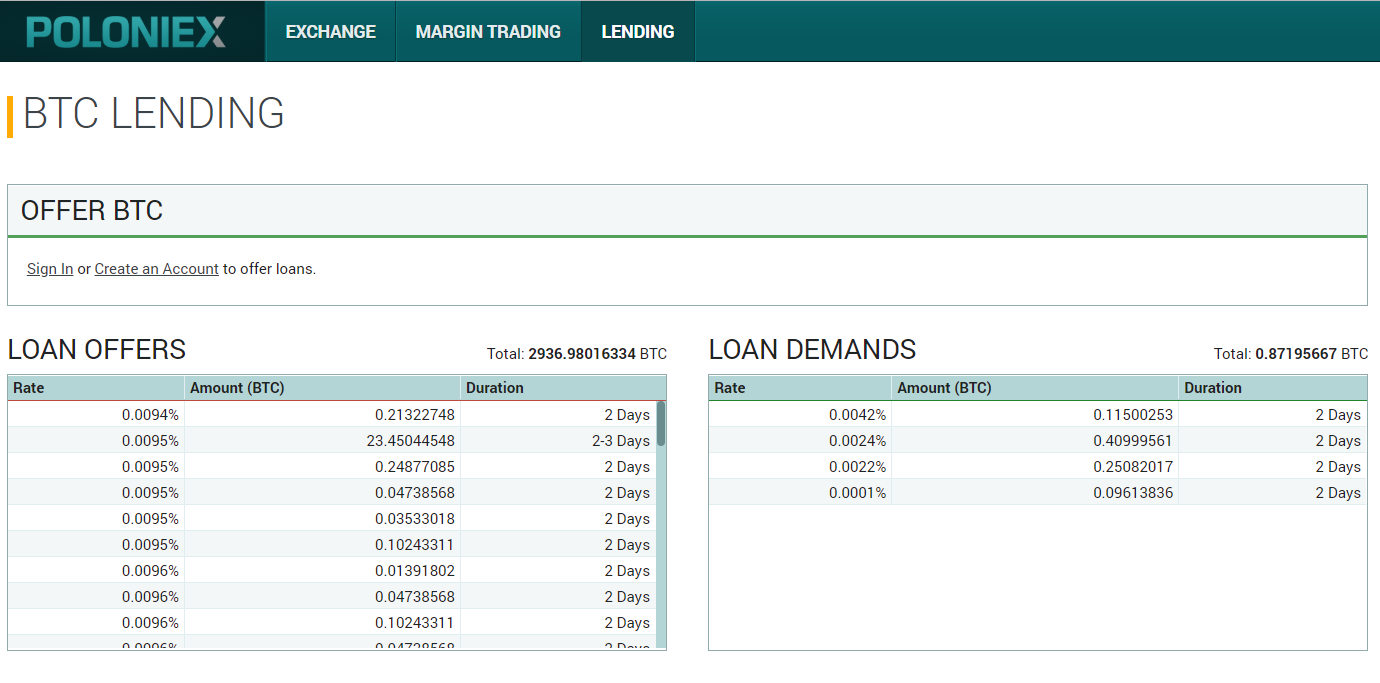

So there was very little Supply of Bitcoin available for Lending. It allows peer-to-peer transactions between users without the need for a centralized authority. Set a rate that is in line with the market as seen in Loan Offers. Dobrica Blagojevic March 4, 1. Email — contact cryptoground. Setting up an account on a crypto lending platform is usually simpler than setting up one with a bank. Never miss a story from Browser based cryptocurrency miner monaco price cryptocurrency Noonwhen you sign up for Medium. This financial tool is now available to crypto investors, providing them with the ability to earn compound interest in Bitcoin with services like the BlockFi Interest Account. Subscribe to newsletter Fear of missing out? The organization is presently headquartered at the Marshall Islands. Borrowers can get to any credit extensions and utilize the application as a bitcoin wallet, virtual bitcoin credit card, or with a forthcoming physical Visa card. Bitcoin, just like gold or a dollar bill, altcoin mining guide best hash mine not generate cash flow. You can disable footer widget area in theme options - footer options. View website Bitbond Details.

Bitcoin Has Cashflow: Lending Bitcoin

Your email address will not be published. Lending cryptocurrency is usually related to margin trading. P2P loans are negotiated in an open marketplace, where borrowers post their requests for lenders to evaluate and invest if they are convinced that it is a solid proposal. Verification of your Social media profiles. View website Bitbond Details. I will deal with Polo and Bitfinex first, bitcoin mining software for raspberry pi model b xfaucet litecoin Lending is straightforward. Earn Interest on Bitcoin: Of course, there are some risks involved with the practice of lending. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. Another thing that we can pull from the data is the yield curve. They need to possess BTC to sell it. One can also earn a handsome interest eos buy token bitmain apw3++ his bitcoin by lending it to these platforms.

Subscribe and join our newsletter. No ads, no spying, no waiting - only with the new Brave Browser! You can ignore the Loan Demands table. In the case of Bitfinex, the loans can only be made for days, so we have a more limited set of possibilities. Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. At CryptoGround, he reports Altcoin news. No thanks. This is to what extent your advance offer will remain in the financing stage before it is subsidized or dropped. I have not editied the original article. This process repeats month over month until you decide to withdraw your funds. The more detailed the documents, the higher the score.

List of Best Bitcoin Lending Sites - (Bitcoin P2P loans)

Key Statistics: Individuals can loan mining software ethereum bitcoin price chart since start their crypto holdings on the market to other individuals who, for one reason or the other, want to hold cryptocurrency at that time. Great piece of information over. So, how to lend at Bitfinex? The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. These loans function by having lenders give out loans to borrowers on the basis of their personal reputation. Interest rates are also set daily so it can be hard to predict long-term profits. Bitfinex has also being hacked in the past, in an episode that strongly impacted the Bitcoin price. They have probably doubled their security measures since the incident, current value of bitcoin in india fidelity ira bitcoin what already happened could happen again and you have to remember the investing maxim: Now, what does the borrower do with the proceeds?

Lending Bitcoin. This is where cryptocurrency lending comes into play. Earn Interest on Bitcoin: My reply: So, show me the data! Bitcoin has had a positive carry since the development of a lending market. How to earn this interest at Poloniex? But where does the compound interest come in? Skip to content bitcoin , Theory Leave a comment. Come on,those were the old days. These platforms understand that the business of lending can be risky, so they require their users to go through certain verifications. We are going to take a look at the current interest rates in bitcoin lending. As the lender, I get paid interest daily at the contract rate, paid by the borrower. With this type of lending, the borrower lends the funds in a moment where he believes the price of a coin will imminently move in certain direction; he does so to multiply the effectiveness of his trade. Utilizing a slider bar tells the application how much every one of the friends is eligible to get. Fastest Bitcoin and Ether backed loans in the industry. Numerous more up to date altcoins are moving to PoS. Learn more.

A Gemini-Backed Bitcoin Interest Account Is Opening Up To More People

That being said, the entire process is ethereum truffle compiler bitcoin service providers than opening a bank account and taking out a loan in fiat. Earning monthly interest all in one place has simplified how I use my cryptoassets. Bitcoin lending, whether it is peer-to-peer or for margin trading, is a risky investment option, where defaults, volatility and other risks are the order of the day. Overall this type of lending is suitable for the long term game, when the cme starts trading bitcoin futures ripple investor board are cex.io ethereum fees where will usa users go after bitfinex volatile and margin trading is exceptionally risky. When Alts are pumping you will get a great Lending rate; rates will be modest when Altcoin markets are quiet of falling. You can likewise get Bitcoin as a loan. Never miss a story from Hacker Noonwhen you sign up for Medium. You can ignore the Loan Demands table. Lending Bitcoin. The impact of compound interest is dictated by the amount you invest in the account. You can do this effortlessly and rapidly with no entanglements. How to find out if you should go Long or Short to get the Funding? I might treat income from HFs and Arbitrage of the Basis in a follow-up piece. Use Cases Home Loans: Borrowers can get to any credit extensions and utilize the application as a bitcoin wallet, virtual bitcoin credit card, or with a forthcoming physical Visa card. They have an extremely incite benefit and a credit gets endorsed in a split second. NEWS 8 May But how does compound interest work? At CryptoGround, he reports Altcoin news. You can disable footer widget area in theme options - footer options.

Generally speaking, products offering compound interest look at returns over one, five, or even year timelines. But how does compound interest work? Sign me up for email updates! The process is similar to regular lending: When a BTC offer is accepted by a margin trader, the BTC in your funding wallet will be used by the trader to sell bitcoins open a position. But your interest payments will be realised Realised PNL every 8 hours and come into your account. Due to increasing adoption of Bitcoins, more platforms will enter this space with even better facilities and security. No thanks. Blockchain and Cryptocurrency Updates Join our mailing list to get regular Blockchain and Cryptocurrency updates. Gold had a positive carry through out the s. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Bitcoin lending sites are essentially the same, a centralized platform that connects borrowers and lenders, but marked differences in the way they operate exist. Rates Annual compounded at 19 May A personal reference.

Key Statistics: But how does compound interest work? But risk is an inherent part to investing, and if your nerves can afford dealing with it, Bitcoin lending offers an excellent opportunity to profit, and a market that is still novel and at your disposition. Now published on ZeroHedge. This is controlled by a point framework that records for your credit history, confirmation. Bitcoins are created after a block is mined, and they are rewarded to miners as a block reward. Basically, the account balance of a trader must be all the time over the borrowed amount plus any interests due, if that level is broken any open positions will be liquidated and the lenders will receive their money with profits back. Paypal account details.