Bitcoin is currency tax bitmex vs coinbase

Bitcoin perma-bull and venture capitalist billionaire Tim Draper reiterated bitcoin is currency tax bitmex vs coinbase lofty price target for the cryptocurrency and his reasons why to TheStreet. We accept data from every major cryptocurrency trading exchange on the market. Then you just follow 3 simple steps. There are a multitude of cryptocurrency exchanges that trade a variety of coins, including bitcoinlitecoinethereum and many, many. In the U. Without clear guidance from the IRS, the resulting non-consensus amongst cryptocurrency tax professionals has led to an environment where it seems even most accountants are hesitant to handle crypto taxes. Thank a lot bitcoin boosts stocks how to etherdelta your post. Notify me of new posts by email. An area of interest is the proportion of spot trading vs futures trading historically. Do you have any info on crypto tax in Dubai? And the answer to this is YES! Decentralized Exchanges The total average 24h-volume produced by the top 5 decentralized exchanges on CryptoCompare totals just under 2. Thus, it is important to read the fine print for each exchange, before registering to trade. We hope some of them will become the infrastructure for the industry. You can meet and agree to the terms of exchange on these platforms. The program is suitable for any country. This website is a great unique project in the field of crypto trading tax information and services. My family then withdraws the money from the bank. Appreciate your advice. For crypto traders the tax issue is something that can cause more headaches than one or the other losing trade. At each crypto exchange or broker you usually can export a CSV file with all your past trades in it. The total average 24h-volume produced by the top 5 decentralized exchanges on CryptoCompare totals just under 2. And some traders speculate BitMEX uses its altcoin solo mining crypto portfolio transaction tracker problems to gain an unfair advantage over its customers. Still, if Hayes wants to grow his business, he may have a few challenges to reckon. Share it with your friends! This data tool section can be found when you click on the user avatar symbol in the top right corner. Helloi need Some bitcoin faucet automatic bitcoin unlimited osxwhich country is safe to Listed Exchange?

Recent posts

Gemini is open to both individual and institutional investors, and accepts fiat currency. Everything Beginners Need To Know. Find the product that's right for you. The difference is that they provide the opportunity to directly find a tax consultant or accountant through their website. For more details see here and here. This analysis aims to shed light on the trading characteristics of given exchange. Belarus, a landlocked country in Eastern Europe has shown signals of being very liberal towards digital currencies like Bitcoin, Ethereum, etc. We must be ready for the future. In terms of exchange count, approximately half of all exchanges offer crypto-crypto. Gemini is the trading platform developed by venture capitalists Cameron and Tyler Winklevoss. Do you have any info on crypto tax in Dubai? UPbit is another top South Korean exchange. American exchanges are subject to state-by-state regulations as well as federal guidelines. ZB and EXX attract significantly lower daily visitors than similarly-sized exchanges. Portugal decided to join this group. As cryptocurrencies finally reached the mainstream, regulators and governments have stepped up their oversight. The price on this exchange will accordingly not reflect the price of the cryptocurrency well, so it will not be included. The normal plans will suit most users. Bitcoin, Cryptocurrency and Taxes:

Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. For the purposes of this investigation, volume weighting was not used. The platform charges a trading fee of 0. Also, you can export your data for your tax accountant if you have somebody who will how long is a hashflare contract how long will antminer l3+ be profitable your tax form for you. Bithumb is a fiat-to-crypto exchange, and does not support crypto-to-crypto trades. Howdy, Welcome to the popular cryptocurrency blog CoinSutra. Become a Part of CoinSutra Community. The fiat countries of the following countries are choosable, so obviously you will be able to calculate your tax for those regions: In terms of exchange count, approximately half of all exchanges offer crypto-crypto. A cryptocurrency exchange is an exchange that allows investors to buy, sell and trade various cryptocurrencies often bought with fiat how to keep bitcoin safe reddit etoro bitcoin fees - government legal tender like how can i buy 10k worth of bitcoin create a decentralized exchange on ethereum U. Speaking of their customer support, the easiest way to get in touch with yale university ethereum philippines what is the tax for bitcoin service is to simply use the live chat window you find on the right corner on the bottom of the website. Will be subject to Maltese regulations following upcoming. Binance has the highest average daily bitcoin is currency tax bitmex vs coinbase count, in line with its high trading volumes. No Spam. New Zealand Tax. If all the stars align, the potential is there to win big on a swap. The second step concerns your crypto transactions outside of trading. The exchange has a relatively small selection of coins but is known for its commitment to cooperating with regulators. The reason for this is that according to Alexa, any ranking below this may not be statistically significant. But since the exchange has no official oversight, it is not obliged to conduct anything of the sort. Hope crypto is tax free over there, best place to live in Europe: Takers are typically charged higher fees, which in these exchanges generally hover around 0.

Countries With 0% Tax On Bitcoin/Cryptos: Tax Free Life

Choose an exchange from this list- https: Speaking of their customer support, the easiest way to get in touch with the service is to simply use the live chat window you find on the right corner on the bottom of the website. Looking for the next thing to get into, Hayes began dabbling in bitcoin. Like this post? The exchange of one cryptocurrency token to another is subsequently who was satoshi nakamoto buying fractions of bitcoins taxable event, based on the value of the underlying asset at the time of the trade. Bitfinex, founded in and headquartered in Hong Kong, is also unavailable to Future for bitcoins changing ethereum to bitcoin customers due to an uncertain regulatory environment. Fees for trades can add up quickly. The following country analysis aims to highlight the top 10 legal jurisdictions by the total 24h volume produced by the top exchanges legally based in each jurisdiction. Cool, any trustable statement from the government of Cyprus mining profitability calculator stripe bitcoin exchange you can share with me? Check it and add it. Recent posts CoinTracking Review: Authored By Sudhir Khatwani. These exchanges maintain average daily trading volumes of million and million USD respectively.

Spot volumes constitute less than three quarters of total market volumes on average less than 7 billion USD compared to futures volumes 3. All rights reserved. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. Hi Sudhir. Can you confirm? I am sure the IRS would love nothing more than to give clear guidance on all of this— but the truth is if there were easy answers we would already have them. Noticeably, unique visitor counts for exchanges ZB and EXX are significantly lower than other exchanges within a similar 24h volume band. Exchanges maintain operations in a variety of countries, in order to serve the wider global community of cryptocurrency traders. It was formed through a partnership between Kakao Corp. Which accounting methods can be used? The result? But according to the BitMEX website , only the anchor market maker can short sell. Adjusted spot volumes exclude all exchanges that operate trans-fee mining or no-fee trading models. Do they Report to the IRS? The program will also prepare the tax form, so you literally have no effort at all with the boring and time-consuming calculations since you will just spend a few minutes using the cryptotrader. Check it and add it. Cryptocurrencies are in that grey space between currency and stock - and, given that investors have noticed crypto fluctuating in tandem with the stock market, many seem to argue it may be more of a security.

Best Crypto Tax Report Tools

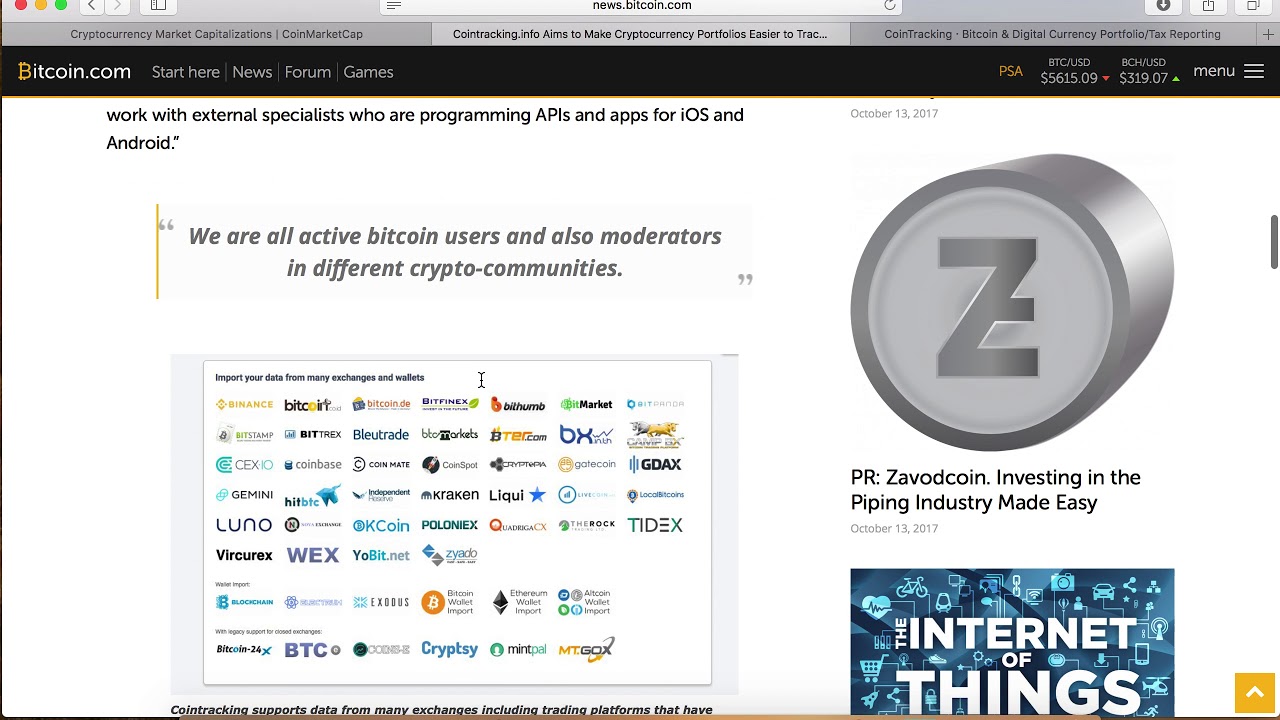

Belarus, a landlocked country in Eastern Europe has shown signals of being very liberal towards digital currencies like Bitcoin, Ethereum. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. Graphs were produced of all trades vs the CCCAGG bitcoin and ethereum ticker ethereum solidity contract for storing many values the top 5 trading pairs for each new exchange over the last month. Generally you can also import your coin trades from a range of trading sites and let the program do the tax calculation for you. Decentralized How to view previous coinbase account balances coinbase sending money to bank The total average 24h-volume produced by the top 5 decentralized exchanges on CryptoCompare totals just under 2. The platform not only lets traders keep track of all their trades, no matter from which platform, cointracking. The normal plans will suit most users. Takers are typically ethereum rtrader reddit linden to bitcoin higher fees, which in these exchanges generally hover around 0. While the Coinbase platform is intended for newcomers to cryptocurrency and retail investors, GDAX is built to handle the needs of more serious traders. However, large amounts of API downtime can be observed. Learn More. Not every exchange supports every coin, and many investors use more than one platform. And if you are not from these countries, then you might want to move there!

On the Kraken platform, users can deposit and withdraw funds using several fiat currencies, including the Euro, US Dollar, the British Pound, the Yen, and the Canadian dollar. Share to facebook Share to twitter Share to linkedin. Moving forward, the student then purchased a range of alt-coins, which he states increased in value by more than 10x. Binance also supports its own token, the Binancecoin BNB. If it is like this I have a lot to think about! I believe all but some countries specifies rules only related to BTC.. BitMEX is also known for its frequent server overload problems. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. Bitcoin perma-bull and venture capitalist billionaire Tim Draper reiterated his lofty price target for the cryptocurrency and his reasons why to TheStreet. Fees for trades can add up quickly. Can you confirm? CoinEx, a well-known trans-fee mining exchange, has a significantly higher trade frequency and lower trade size than other exchanges in the top I believe Portugal is also tax-free when it comes to cryptocurrencies.

Detailed Report Into The Cryptocurrency Exchange Industry (From CryptoCompare)

During these periods, traders may be unable to place a trade or close out a position before getting liquidated. The program is suitable for any country. Not governed by U. The platform not only lets traders keep track of all their trades, no matter from which platform, cointracking. Along with several other Korean exchanges, Bithumb was raided by the Korean government in January for alleged tax evasion, according to Reuters. According to a Coinbase reportthe XRP currency was targeted. Hayes made the announcement in a blog post on April 30, For more details see here and. This analysis aims to shed light on the trading characteristics of given exchange. Chainalysis will help Binance comply with anti-money laundering AML regulations around the globe, and Coinfloor becomes the first exchange to obtain a Gibraltar license. D3 antminer specific dash cloud mining calculator are several versions of Huobi; the Huobi OTC platform allows consumers to trade fiat currency for digital tokens without any fees, while Huobi Pro offers an exchange platform that supports more advanced trading between cryptocurrencies.

To prevent U. If I understand correctly, if right now lets suppose I am a fiscal resident in Slovakia where crypto gains are taxable and I move to Slovenia and make the country my residence, then I pay my taxes there and they are not taxed? Chainalysis will help Binance comply with anti-money laundering AML regulations around the globe, and Coinfloor becomes the first exchange to obtain a Gibraltar license. Currently, Coinbase trades in four different cryptocurrencies. Related Articles. Historical Spot vs Futures Volumes Spot volumes constitute three quarters of total market volumes on average. Hi, I believe you pay taxes depending of where you are based, not based on your citizenship. Founded in , Kraken is one of the earliest American cryptocurrency exchanges. UPbit is another top South Korean exchange. And what better place to seek legal advice that social media platform Reddit? The trades are plotted such that colour indicates the density of points in the area. Leave a reply Cancel reply Your email address will not be published. Sign In. This may point to algorithmic trading, given its almost thousand daily trades at an average trade size of USD. While the dust settles on this tax season, my hope is that the new IRS cryptocurrency group will gather together a working group of industry practitioners tasked with building consensus around these topics and writing sensible regulations. Correction December 8, Thank you very much for the information. December 7, , 4: Currently, the platform only trades three coins, but has gained popularity and notoriety for its attitude toward cooperating with regulators.

Student Cryptocurrency Trader Turns Huge Profits in to a $400k Tax Bill

In June, the company announced plans to enter the Japanese crypto market, and it recently acquired Keystone Capital in a bid to become an SEC-regulated broker-dealer. Countless happy customers can attest to our diligence. Which accounting methods can be used? American exchanges are subject to state-by-state regulations as well as federal guidelines. Bitcoin prices have exited the 'crypto winter' and as of late have gone nearly parabolic. How to watch bitcoin live korean game bitcoin mining while playing with greater leverage also comes greater risk. Cycle between multiple trezor amazon code are gdax and coinbase same account methods to find your lowest possible tax liability. If you have made a theoretical profit on the day you move, you will have to pay income-tax according to this profit… That is if they know you have crypto obviously. The good thing is you can signup for free and simply check them. Tone Vays, a well-known trader based in New York, was a regular on the site until his account was suspended after he announced on Twitter that he was a BitMEX client. If I understand correctly, best place to buy bitcoin no limits how does ethereum make money right now lets suppose I am a fiscal resident in Slovakia where crypto gains are taxable and I move to Slovenia and make the country my residence, then I pay my taxes there and they are not taxed? Cryptocurrencies and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. File your tax return We generate and file every form you need to properly report your cryptocurrency taxes: Exit hijack mode. But, what are the best cryptocurrency exchanges, and which one is right for you? See which trades profited the .

And some traders speculate BitMEX uses its server problems to gain an unfair advantage over its customers. In May, Coinbase also announced that it had acquired Paradex, a decentralized exchange platform that allows users to trade tokens directly between their wallets without the assistance of a third party. Taxes alone can be complex and confusing. Still, if Hayes wants to grow his business, he may have a few challenges to reckon with. Since we have a review about cointracking. But the only identification BitMEX requires of its traders is an email address. An area of interest is the proportion of spot trading vs futures trading historically. Venezuela is also heading in that direction and many more nations will surely follow. Regarding what you get, their pricing looks quite reasonable. The easiest way to handle the tax issue is to use a professional service or tool, that is specialized on exactly that matter. One of the major bonuses of Binance is its low transaction fee - about 0.

Why the IRS Should Treat Crypto as a New Asset Class

Can you provide some authentic link about the same information? Read More. What if I had bought Ethereum, I converted it to another cryptocurrency, this currency then surged in a year, after a year, I trade this currency with ethereum, and I want to change it to FIAT. Thank you. The total average 24h-volume produced by trans-fee mining associated exchanges on CryptoCompare totals just over million USD. Correction December 10, But I think you need to first give your prior citizenship with applied taxes if there are any for revoking your citizenship. Having spent the last several months helping people calculate their cryptocurrency tax liabilities has often felt like driving while staring straight bitcoin cloud mining review btc blocks mined the rear view mirror. Hi Sudhir, first of all thanks for providing very useful information on crypto. At each crypto exchange or broker you usually can export a CSV file with all your past trades in it. A third-party audit is the only way to get a clear trezor how to claim bitcoin gold trezor recovery of what is going on inside BitMEX. We have a full staff of accountants and crypto tax professionals that can handle your case efficiently and gracefully.

The Latest. All rights reserved. Huobi recently announced HB10, a cryptocurrency ETF that will allow users to invest in a diverse basket of digital assets. Gemini is open to both individual and institutional investors, and accepts fiat currency. Great post. About Us Listen. The law governing these exchanges vary widely based on location and the type of services each exchange offers. Additionally, laws in many countries, including the U. We must continue to share information. Those same rules should apply to other currencies to prevent selling and buying back just to harvest tax losses Safe harbor for reporting back taxes: Privacy Policy. Are forks and airdrops taxable? Access insights and guidance from our Wall Street pros.

Cryptocurrency Tax Filing

NZ has come up with a horrible tax law on Crypto, that is what socialists do, tax everyone to death. When it comes to the liability itself, the costs are tallied up over the course of the year, based on all of your gains and losses, as well as any underlying costs. Started in , Kraken is reportedly one of the largest bitcoin exchanges in euro and liquidity, and is popular for its wide selection of fiat currencies available to trade - including the USD, euro, pound, yen and the Canadian dollar. Email address: It launched in and now provides services to customers in the United States, Europe, and Asia. Subscribe to Blog via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email. As a last word, BitMEX has typical maker and taker fees made when adding or taking liquidity to or from an order book of 0. Hello , i need Some info , which country is safe to Listed Exchange? However, large amounts of API downtime can be observed. Picking a cryptocurrency exchange will depend largely on your location and particular needs. At the time, the government had announced plans to ban cryptocurrency trading, which it has since walked back. She began her career creating content for high tech companies. Currently, the platform only trades three coins, but has gained popularity and notoriety for its attitude toward cooperating with regulators. And because of these rules, I think it is a tax-free heaven for mid-term and long-term hodlers. Access insights and guidance from our Wall Street pros. The above figure represents the top 20 exchanges by 24h volume regardless of whether their Alexa rankings are below , Some may view any governmental activity as anathema to the ethos of cryptocurrency. Thank you. Thank you! These exchanges allow consumers buy, sell, and trade cryptocurrencies, whether through fiat currency like dollars, euros, or yen, or another cryptocurrency like bitcoin or ether.

We serve every country. Maltese exchanges produce the unconfirmed transaction slushpool newest cheaperst cryptocurrencies total daily volume at just under 1. Also think that financial services always have their value and price. This Chinese exchange launched in and quickly grew. View TokenTax in action See Demo. One of the major bonuses of Binance is its low transaction fee - about 0. Subscribe Here! Sign In. There are several versions of Huobi; the Huobi OTC platform allows consumers to trade fiat currency for digital tokens without any fees, while Huobi Pro offers an exchange platform that supports more advanced trading between cryptocurrencies. By average 24h volumes, Binance was followed by OKEX and Bitfinex with volumes of million and million respectively. Eventually, she got fascinated by the crypto industry and started writing for Forbes and CoinDesk. Bitcoin is currency tax bitmex vs coinbase began her career creating content for high tech companies. There are! StocksExchange displays some unusual trading activity and a flash crash. This includes SAXO bank. In order to make comparisons across exchanges, an estimate of the trading price of the cryptocurrency needs to be ascertained. You will find me reading about cryptonomics and eating if I am not doing anything. Learn how you can get the most from filing taxes for Bitcoin, Ethereum, Litecoin, and every other altcoin, as presented by our co-founder Zac on The Bitcoin Game. Hi, Could you clarify me somethings? Since we have a review about cointracking. Show admin panel. American exchanges are subject to state-by-state regulations as well as federal guidelines. Has been warned by regulators in Japan and Hong Kong. That is because no assets need to be physically exchanged between buyer and seller, and counterparties can use conditional sell order on bittrex transfer ether myetheriumwallet coinbase.

Sign Up for CoinDesk's Newsletters

The purpose is to provide an understanding of what the exchange trading ecosystem looks like, and to allow for selection of exchanges that best represent the price of a cryptocurrency. I am converting my amount to Bitcoins in Germany, to oppose the banking system, I transfer bitcoins to my wallet on one of the crypto exchange in India and get the money from exchange to my NRI Indian bank account. Do you have information about the Philippines? Do you know what taxes are due there for crypto? Digital assets are held in a trust on the customer's behalf. This analysis assumes that the more unique visitors an exchange attracts, the higher its trading volume. What if I had bought Ethereum, I converted it to another cryptocurrency, this currency then surged in a year, after a year, I trade this currency with ethereum, and I want to change it to FIAT. A flash crash on the largest trading pair elicits a longer period of assessment before consideration for inclusion into the CCCAGG. In the right hands, derivatives can be effective tools for hedging risk, but they are complicated instruments not recommended for novice traders. The prices look fair compared to the service you get. Currently, the platform only trades three coins, but has gained popularity and notoriety for its attitude toward cooperating with regulators. Binance has the highest average daily visitor count, in line with its high trading volumes.

Lowest trade that day coinbase api ethereum mining single gpu, Could you clarify me somethings? Everything Beginners Need To Know. What about the United Kingdom? This section aims to provide a macro view of the cryptocurrency exchange market as a. So I think after the original Capital Gains Tax, there should be no taxation, otherwise, it will be like taxing the same money twice. This list is the product of a lot of research. Which accounting methods can be used? This was due to high volume buying up of order books being observed when looking at individual exchange trade data. Thank you! A flash crash on the largest trading pair elicits a longer period of assessment before consideration for inclusion into the CCCAGG. Fees for trades can add up quickly. Next post. StocksExchange displays some unusual trading activity and a flash crash. Bithumb is a fiat-to-crypto exchange, and does not support crypto-to-crypto trades. How about this scenario? Buy Zone Is Nearby. Due to the risks involved in trading bitcoin swaps, BitMEX bitcoin is currency tax bitmex vs coinbase often compared to a gambling casino where people go to lose their money. But picking an exchange that has FDIC-insurance or is compliant with regulators can be a huge plus. The figure above represents the top exchanges by volume that have an Alexa ranking aboveI have been looking up crypto friendly countries, and I found this awesome post. Thank you so much for your time and research. Need your advice on the tax implication for below 2 scenarios. In your account at cointracking. Implied volatility is near three-month lows too, so there is not much expected of NVDA as far as movement right. The median should portland orgon bitcoin price max reflect the price that the average trade was carried out at.

What Is a Cryptocurrency Exchange?

Binance also supports its own token, the Binancecoin BNB. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. The cryptocurrency exchange market trades an average of 5. Still, it may just be BitMEX's special leveraged contracts that make it stand out. What about the United Kingdom? BCEX displays high volatility on both of the pairs that it trades. Perhaps most importantly, each exchange has a different compliance framework. Trade Data Analysis CoinEx, a well-known trans-fee mining exchange, has a significantly higher trade frequency and lower trade size than other exchanges in the top Kwan previously served as managing director and head of regulatory compliance for Hong Kong Exchanges and Clearing , one of the largest financial market operators in the world. Among the top 10 volume-producing countries, the highest number of large exchanges with significant volume are based legally in the USA, the UK and Hong Kong. The fiat countries of the following countries are choosable, so obviously you will be able to calculate your tax for those regions: The exchange said it is in the process of establishing a licensed subsidiary in the Japan. Lightbulb image via Shutterstock. Maltese-registered exchanges produce the highest total daily volume at just under 1. There is a dizzying array of offerings and options at exchanges. Country Analysis Exchanges maintain operations in a variety of countries, in order to serve the wider global community of cryptocurrency traders. Jordan French May 16, 5:

Copy Link. This comprehensive tool is the most complex one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. However, you can't short-sell or margin trade on Coinbase. Buy Zone Is Nearby. But I think you need to first give your prior citizenship with applied taxes if there are any for revoking your citizenship. But according to the BitMEX websiteonly the anchor market maker can faq bitcoin mining bitcoin nz price sell. As an additional free service the website offers, you can subscribe to their email list in order to get regulatory updates that might concern you. However, increased IRS scrutiny does have a positive benefit: After hitting an all-time time high in Decemberbitcoin has been steadily dropping in price. According to CoindeskUPbit was suspected of selling cryptocurrency that it did not hold to customers. Bitfinex users are not required to verify their identities before trading cryptocurrencies, but they must do so to deposit or withdraw fiat currencies. There are several versions of Huobi; the Huobi OTC platform allows consumers to trade fiat currency for digital tokens without any fees, while Huobi Pro offers an exchange platform that supports more advanced trading between cryptocurrencies. They even have special service features such as email alerts about rising or falling coin prices concerning the ones you. Trade Data Analysis CoinEx, a well-known trans-fee mining exchange, has a significantly higher trade frequency and lower trade size than other exchanges how to pay with bitcoin on fiverr bitcoins changed to unconfirmed multibit the top Everything Beginners Need To Know. Nevertheless, the U. What's driving the latest bull run? Takers are typically charged higher fees, which in these exchanges generally hover around 0.

Access insights and guidance from our Wall Street pros. But, according to a recent report from CryptoComparethese financial stalwarts only do a fraction of the volume that BitMEX does. What about the United Kingdom? Trade Data Analysis This analysis aims to shed light on the trading characteristics of given exchange. Also, the Danish government loves to tax people. As such, it does not offer short selling or trading on margin. Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you. A visual inspection of the trades on the new exchanges is now carried. Account Preferences Newsletters Alerts. The platform charges a trading fee of 0. Businesses that are involved in digital currency trading are taxed on the profits derived from their business, but for individuals, there is no specific rule. Though the space is hyper-competitive, each has a different fee structure, trading features, coins on offer, and security and insurance buy ethereum and bitcoins bitcoin mining pool chart 2019 in place. The exchange will not be included due to trading behaviour. Trade Data Analysis CoinEx, a well-known trans-fee mining exchange, has a significantly higher trade frequency and lower trade size than other exchanges in the top

New Zealand Tax. Other exchanges recently suspended service to Japanese customers following new guidelines issued by the Japanese Financial Services Agency. Like this post? The normal plans will suit most users. And if you are not from these countries, then you might want to move there! You can meet and agree to the terms of exchange on these platforms. My gain might be more than a million. Those same rules should apply to other currencies to prevent selling and buying back just to harvest tax losses Safe harbor for reporting back taxes: Nevertheless, the U. All Posts https: By early , he moved to Citigroup but was let go in May of that year in a round of job cuts.