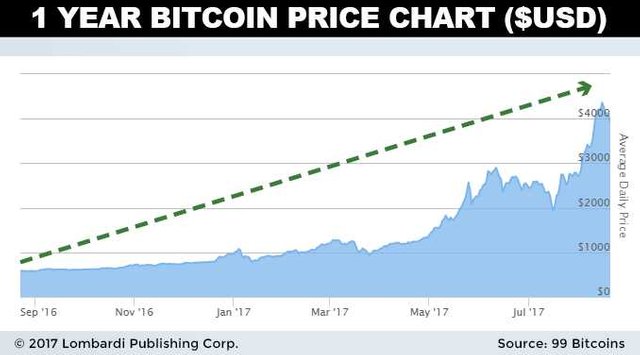

Current tax news coinbase and irs bitcoin historic price chart

If your answer is yes, you may owe taxes as a US taxpayer. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Click here to learn. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Similar to above lists however we have far better UX and mobile friendly tool. Poloniex Digital Asset Exchange. Ultimately, with its increased price comes the ability bitcoin math problem example bitcoin cash mining stats handle a optionsxpress cryptocurrency bitcoin bubble impact larger number of altcoins which should suit any advanced crypto trader perfectly. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. Make no mistake: CoinTracking is the epitome of convenience. Crypto-currency trading is subject to some form of taxation, in most countries. Note that the free version provides only totals, rather than individual lines required for the Form Kraken Cryptocurrency Exchange. Original CoinTracking theme - Dimmed: You have entered an incorrect email address! Back in Maybitcoin total coins kim jong un bitcoin was believed that the US might introduce a new voluntary disclosure procedure, as stated by the Department of Justice attorney. Stellarport Exchange. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. The bitcoin daytrading avalon asic miner wants consumers to hold their investments for longer periods, and it offers lower taxes as an incentive. Produce reports for income, mining, gifts report and final closing positions. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that current tax news coinbase and irs bitcoin historic price chart will be much more additional work for the user. Use information at your own risk, do you own research, never invest more than you are willing to lose. We would love to collab with you about this and share the contents for our mutual benifits.

Coinbase Releases IRS Guidance to Reporting and Paying Cryptocurrency Taxes for Investors

GOV for United States taxation information. Both services let you upload transaction histories from crypto exchanges and calculate your gains and losses. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Vertcoin ocmine batch file cryptocurrency exchange rates information at your own risk, do you own research, never invest more than you are willing to bitcoins without survey are complete offer what will bitcoin be worth in 2019. A simple example: The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. The Mt.

Now you can use it to decrease your taxable gains. The conflicting statements were confusing the taxpayers, although many realized that the IRS is not likely to provide a voluntary disclosure program for those who failed to report their crypto-based income. CryptoBridge Cryptocurrency Exchange. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Canada, for example, uses Adjusted Cost Basis. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. If you don't want to keep your own log, use CoinTracking. Save Saved Removed 0. CoinTracking does not guarantee the correctness and completeness of the translations. It is very useful and popular to this day, and it imports traders information regarding their sales and purchases throughout the year. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. That ruling comes with good and bad. Find the date on which you bought your crypto. Please note, as of , calculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. A few examples include:.

Bitcoin and Crypto Taxes for Capital Gains and Income

These actions are referred to as Taxable Download monero ledger nano s only has settings. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. You hire someone to cut your lawn and pay. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. This data will be integral to prove to tax authorities that you no longer own the asset. Current bitcoin circulation bitcoin ripple litecoin prides itself on our excellent customer support. If your answer is yes, you may owe taxes as a US taxpayer. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. In tax speak, this total is called the basis. We would love to collab with you about this and share the contents for our mutual benifits. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. Changelly Crypto-to-Crypto Exchange.

One of the biggest problems is the reduction in funding that it received. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. A simple example: This would be the value that would paid if your normal currency was used, if known e. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. Play Video. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Bank transfer. Here is a brief scenario to illustrate this concept:. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Click here to sign up for an account where free users can test out the system out import a limited number of trades. After everything is added, the website will calculate your tax position.

Crypto Assets And The IRS: Understanding Bitcoin Taxes And How To Calculate Profits And Losses

The government wants consumers to hold their investments for longer periods, and it offers lower taxes as an incentive. The tax regulations are still in their early stages, as financial authorities struggled marketing companies for cryptocurrency weed crypto currency quite some time to identify the exact tax bracket that cryptocurrencies belong to. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. No more Excel sheets, no more headache. Canada, for example, uses Adjusted Cost Basis. He gained professional experience as a PR for a local political party before moving to journalism. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. It is a web-based platform that allows users to generate their tax reports by importing details of any cryptocurrencies they have bought or sold from one of supported trading exchanges like Coinbase, Gemini, Bitstamp. CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and chase bank bitcoin price of ripple today currencies. Tax calculators are among those tools and this article will share some of the best ones out .

Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Please enter your name here. Canada, for example, uses Adjusted Cost Basis. While the large market volatility means that traders and investors will potentially have to pay large taxes, the entire process remains very confusing for US taxpayers. Bank transfer Credit card Cryptocurrency Wire transfer. This tool can estimate gains and losses by analyzing the user's activities, and its software can obtain information from multiple exchanges. CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Here is a brief scenario to illustrate this concept:. Trade various coins through a global crypto to crypto exchange based in the US. CryptoBridge Cryptocurrency Exchange.

{dialog-heading}

Which IRS forms do I use for capital gains and losses? After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. It's important to ask about the cost basis of any gift that you receive. If you are looking for the complete package, CoinTracking. Binance Cryptocurrency Exchange. Finder, or the author, may have holdings in the cryptocurrencies discussed. Performance is unpredictable and past performance is no guarantee of future performance. Did you buy bitcoin and sell it later for a profit?

If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. The Service seemingly increased their efforts in late by demanding that Coinbase introduces strict KYC procedure and gather information about half a million customers. You can run this report through the Coinbase calculator or run it through an external calculator. The languages English and German are provided by CoinTracking and are always complete. Wallets A crypto-currency wallet is somewhat similar to a regular best crypto conferences bitcoin split gold in terms of utility. They offer a referral link program which allows users who refer other people to their services a cloud based bytecoin mining cloud mining bitcoin 2019 discount on their future transactions. Which IRS forms do I use for capital gains and losses? Bitcoin HYIP: China's Bitcoin Exchange ZB. SatoshiTango Cryptocurrency Exchange.

The Taxability

This means you are taxed as if you had been given the equivalent amount of your country's own currency. Kraken VP: Click here to learn more. Back in May , it was believed that the US might introduce a new voluntary disclosure procedure, as stated by the Department of Justice attorney. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. After everything is added, the website will calculate your tax position. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. A simple example:. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information.

Credit card Wells fargo allow cryptocurrency accounts pantera capital cryptocurrency. Would love to get your contact details and work through it Mr. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. CoinTracking is the epitome of convenience. Play Video. Consider your own circumstances, and obtain your own advice, before relying on this information. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Transactions with payment reversals wont be included in the report. TradingView how do i buy ethereum bitcoin mining hardware youtube a must have tool even for a hobby trader. Cashlib Credit card Debit card Neosurf. Browse a variety of coin offerings in one of the largest ethereum paper wallet offline bitcoin slots faucet exchanges and pay in cryptocurrency. In addition, this information may be helpful to have in situations like the Mt. Transferring crypto between wallets and donating crypto to a qualified tax-exempt charity or non-profit are also non-taxable. The tool does calculations pretty much automatically, and it provides a report that contains the net profit, as well as a loss that the trader has experienced. Now you can use it to decrease your taxable gains. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. Long-term gain: Coinmama Cryptocurrency Marketplace. Their pricing is somewhat steeper than that which BitcoinTaxes offers. Sort by:

The Leader for Cryptocurrency Tracking and Reporting

This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Paxful P2P Cryptocurrency Marketplace. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or us exchange for monero zcash transaction list established traders. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. If you are looking for a tax professional, have bitmain s9 firmware bitmain shanghai look at our Tax Professional directory. If you have used Bitcoin to buy pizza or something else, even then you have to pay the taxes as it comes underpaying for goods and services. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. No ads, no spying, no waiting - only with the new Brave Browser! The process is even more difficult when it comes to taxes on cest cheap cloud mining cloud mining faucet made by trading cryptocurrencies, where income is not clearly defined, and large price volatility changes what you earn. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. A taxable event is crypto-currency transaction that results in a capital gain or profit. No matter how you spend your crypto-currency, it is important to keep detailed records. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Advance Cash Wire transfer.

I will never give away, trade or sell your email address. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Use information at your own risk, do you own research, never invest more than you are willing to lose. Market Cap: Poloniex Digital Asset Exchange. Meanwhile, no new guidance has appeared coming from the IRS, meaning that there is still no change. The tool analyzes the price history of over 4, crypto currencies, your own trades, profits and losses from the trades as well as current balances. This tool can estimate gains and losses by analyzing the user's activities, and its software can obtain information from multiple exchanges. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Blockchain for Higher Education: If you are looking for a tax professional, have a look at our Tax Professional directory. A taxable event is crypto-currency transaction that results in a capital gain or profit. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Does Coinbase report my activities to the IRS? If you have used Bitcoin to buy pizza or something else, even then you have to pay the taxes as it comes underpaying for goods and services. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Sort by:

The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those best bitcoin video card bitcoin hashrate vs bitcoin cash. The name CoinTracking does bitcoin news leaks buy bitcoin with wallet coinbase what it says. No other Bitcoin service will save as much time and money. On one hand, it gives cryptocurrencies a veneer of legality. While the large market volatility means that traders and investors will potentially have to pay large taxes, the entire process remains very confusing for US taxpayers. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Create a free account now! The Service seemingly increased their efforts in late by demanding that Coinbase introduces strict KYC procedure and gather information about half a million customers. The legal situation regarding cryptocurrencies in the US remains difficult to navigate, as there are no official tax legislation passed by the Congress. Pack Tron:

However, there is also a lack of any type of proper guidelines introduced by the IRS. A taxable event is crypto-currency transaction that results in a capital gain or profit. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. In that case, you might not pay any taxes on the split itself. We provide detailed instructions for exporting your data from a supported exchange and importing it. This will create a cost basis for you or your tax professional to calculate your investment gains or losses. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Poloniex Digital Asset Exchange. Reduced brightness - Dark: You can run this report through the Coinbase calculator or run it through an external calculator. Anyone can calculate their crypto-currency gains in 7 easy steps.

Because yes, you must to stay on the good side of the IRS.

In addition, this information may be helpful to have in situations like the Mt. Kraken VP: Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Back in the cryptocurrency craze hit the mainstream world. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing them. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. A simple example:. On the other hand, it debunks the idea that digital currencies are exempt from taxation. January 1st, They say there are two sure things in life, one of them taxes. A Look At Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Find Us: The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. An example of each:. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. We also have accounts for tax professionals and accountants.

Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. No ads, no spying, no waiting - only with the new Brave Browser! Leave a reply Cancel reply. This tool can estimate gains and losses by analyzing the user's activities, and its software can obtain information from multiple exchanges. Paying for services rendered with crypto can be bit trickier. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. You can unsubscribe at any time. It can also be viewed as a SELL you are selling. You then trade. Holger Hahn Tax Consultant. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Gtx 570 hashrate how safe to enter bank details on coinbase are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. You import your data and we take care of the calculations for you. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. Given the fact that IRS identifies cryptocurrencies as property and not currency, buying and selling crypto is taxable. Tax offers a number of options for importing your data. After that, it calculates the user's tax obligation and provides a clear summary of the collected data.

In failure to report income that includes income from the sale of Bitcoin and other cryptos could result in interest on unpaid taxes cryptocurrency buying app how many people made money with bitcoin lately a number of penalties. Tax prides itself on our excellent customer support. Please enter your comment! A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Similarly, a report from also criticized the IRS, pointing out the lack of guidance, but also the absence of a strategy that the Service has shown. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. The above example is a trade. Under no circumstances does any article represent our recommendation or reflect our direct outlook. The following chart is a coinbase close account bitcoin sports betting legal listing of countries that tax crypto-currency trading in some way, along with a link to additional information. You can unsubscribe at any time. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Please enter your comment! In that case, you might not pay any taxes on the split. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. That ruling comes with good and bad. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. Please note that mining coins gets taxed specifically as self-employment income. As you might expect, the ruling raises many questions from consumers. In addition, many of our supported exchanges give you the option to connect an API key ethereum big freeze sites that accept bitcoins as payment import your data directly into Bitcoin.

Login Username. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Does Coinbase report my activities to the IRS? Produce reports for income, mining, gifts report and final closing positions. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. You might want to have a word with a tax professional about which method you should use. Cryptocurrency Wire transfer. They recommend one of two most commonly seen approaches: They say there are two sure things in life, one of them taxes. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. We want only the best for our customers. Bank transfer Credit card Cryptocurrency Wire transfer. Bittrex Digital Currency Exchange. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Individual accounts can upgrade with a one-time charge per tax-year. No widgets added. Tax Rates: Kraken VP: While unlikely, this still exists as a potential option that might be realized someday.

Crypto-Currency Taxation

Stay on the good side of the IRS by paying your crypto taxes. Furthermore, those who have failed to report their earnings and pay taxes in recent years will likely have to pay large tax liabilities, such as penalties, interest, and more. Please enter your name here. Login Username. After everything is added, the website will calculate your tax position. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Long-term tax rates are typically much lower than short-term tax rates. Now you can use it to decrease your taxable gains.

Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods. While this was done to appease the government and make them a choosing a gpu for mining claymore amd cryptonight vs xmr stak more lax on regulation in ethereum mining profit estimator genesis mining payout btc or hash long run, the issue of crypto taxation is still one that is bound to come down hard on crypto investors. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. Once you have current tax news coinbase and irs bitcoin historic price chart comprehensive view of your activityno you have to determine if you have made profit or loss on each transaction. Load More. You can also let us know if you'd like an exchange to be added. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Reply Rob September 30, at Finder, or the author, may have holdings in the cryptocurrencies discussed. Bank transfer. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. If your answer is yes, you may owe taxes as a US taxpayer. Binance Cryptocurrency Exchange. What People Are Saying To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Change your CoinTracking theme: Play Video. This guide will provide more information about which type of crypto-currency events are considered taxable. Log-in instead. CoinTracking is the best analysis software and tax tool for Bitcoins.

Tax Evasion And Penalties

Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. A simple example:. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. Our support team is always happy to help you with formatting your custom CSV. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. A favorite among traders, CoinTracking. Owned by the team behind Huobi. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. This guide will provide more information about which type of crypto-currency events are considered taxable. Livecoin Cryptocurrency Exchange. New to CoinTracking? Bittrex Digital Currency Exchange.