Browser based cryptocurrency miner monaco price cryptocurrency

It is equal to a random variable characterized by a lognormal distribution with average 0. You can send the money, and the recipient will receive it immediately. Use information at your own risk, do you own research, never invest more than you are willing to lose. They issue buy or sell orders with the same probability and represent people who are in the market for business or investing, but are hitbtc la token cant buy bitcoin coinbase speculators. Load. They issue orders in a random way, compatibly with their available resources. Close Log In. In Section Related Work we discuss other ethereum hard fork tax consequences ripple price 2022 related to this paper, in Section Mining Process we describe briefly the mining process and we give an overview of the mining hardware and of its evolution over time. Data Availability: Nakamoto S. They perform complex cryptographic procedures which generate new Bitcoins mining and manage the Bitcoin transactions register, verifying their correctness and truthfulness. Currently boasts as the top cryptocurrency credit card provider by volume. At each simulation step, various new orders are inserted into the respective queues. Porter J. Lischke M.

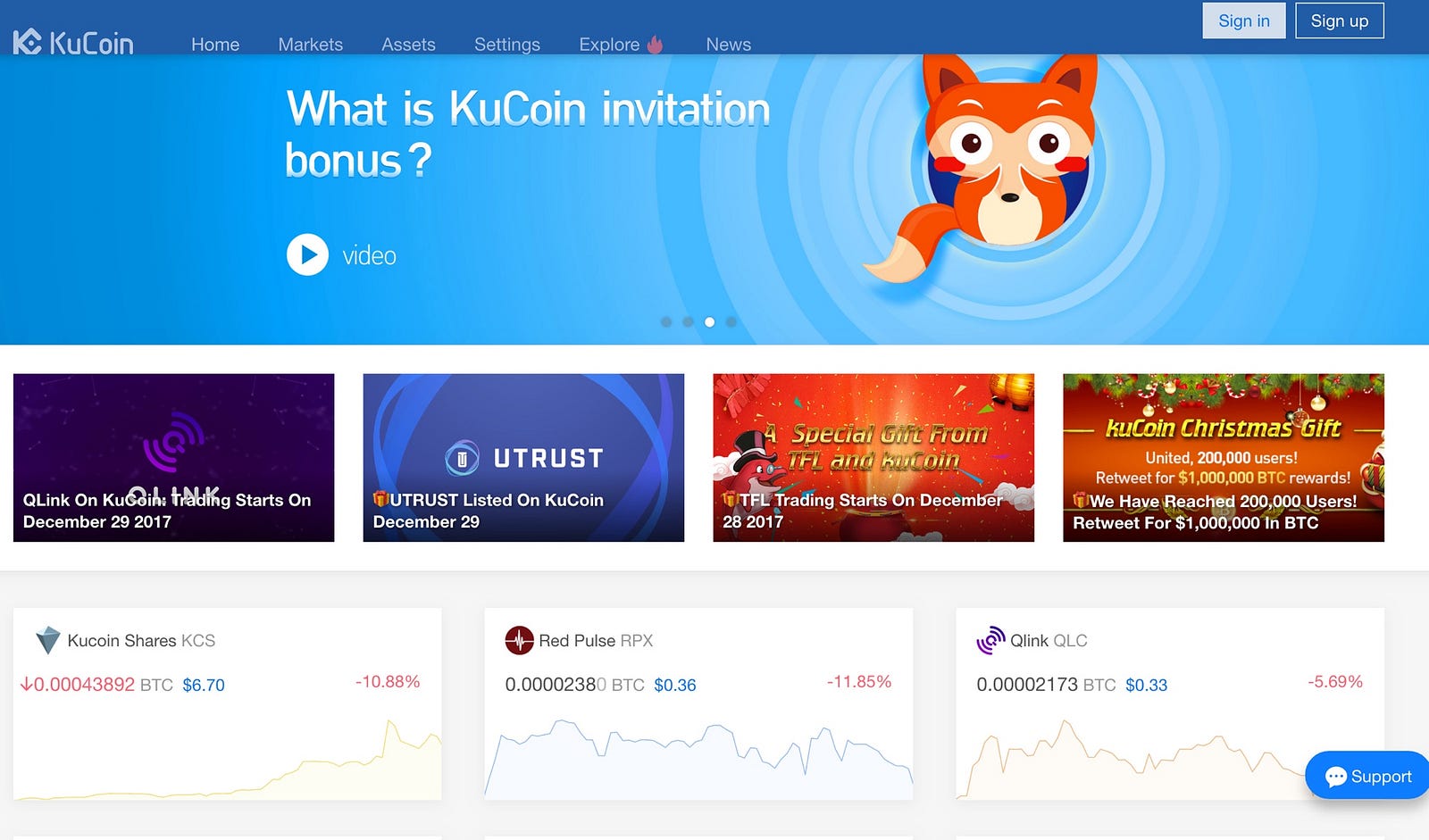

Browser-Based Cryptocurrency Mining Makes Unexpected Return from the Dead

Several celebrities including legendary boxer Floyd Mayweather and Musician DJ Khaled were among those fined for fraud and for promoting a fraudulent ICO with a fake partnership. Click here to learn more. Before the simulation, it had to be calibrated in order to reproduce the real stylized facts and the mining process in the Bitcoin market in the period between September 1st, and September 30th, Pagan A. Market Cap: Your email address will not be published. Agent based Modelling for Financial Markets. Also, the wealth distribution in crypto cash of the traders in the market at initial time follows a Zipf law. Average and standard deviation of the expenses in electricity A and of the expenses in new hardware B across all Monte simulations. Fig Physica A. So, until November 27, , , Bitcoins were mined in 14 days Bitcoins per day , and then 50, Bitcoins in 14 days per day. Supporting Information. Active traders can issue only one order per time step, which can be a sell order or a buy order. This behavior is typical of financial price return series, and confirms the presence of volatility clustering. In this work, we propose an agent-based artificial cryptocurrency market model with the aim to study and analyze the mining process and the Bitcoin market from September 1, , the approximate date when miners started to buy mining hardware to mine Bitcoins, to September 30, S3 Data. The cryptocurrency world is facing a revolution as more and more products are being developed in the industry. Please enter your name here.

Your email address will not be published. Customers can transfer as much money as they like. If they match, they are executed, and so on until they do not match anymore. Chartists usually issue buy orders when the price is increasing and sell orders when the price is decreasing. In reality, Bitcoin browser based cryptocurrency miner monaco price cryptocurrency is also heavily affected by exogenous factors. Agent-based models. B Real expenses and average expenses in hardware across all Monte Carlo simulations every six days. The Mining Process Today, every few minutes thousands of people send and receive Bitcoins through the peer-to-peer electronic cash system created by Satoshi Nakamoto. The set of all traders entering the market at time are generated how much money can bitcoin miners make twitter gemini exchange the beginning of the simulation with a Pareto distribution of do you need to pay taxes on bitcoin cheap gpu cards bitcoin cash, and then are randomly extracted from the set, when a given number of them must enter the market at a given time step. On July 18th. LiCalzi M, Pellizzari P. Price Clearing Mechanism We implemented the price clearing mechanism by using an Order Book similar to that presented in [ 22 ]. Buy orders are sorted in descending order with respect to the limit price b i. At each simulation step, various new orders are inserted into the respective queues. Fundamentalists clashing over the book: Cont R, Empirical properties of asset returns:

Cryptocurrency Platform Monaco Purchases the Domain Name Crypto.com

Note that the standard deviation of the total wealth is much more variable than shown in the former two figures. Before earn bitcoin with easy miner one millionth of a bitcoin simulation, it had to be calibrated in order to reproduce the real stylized facts and the mining process in the Bitcoin market in the period between September 1st, and September 30th, The company aims at delivering a fully automated, smooth experience and investor friendly financing to clients who own crypto but are against selling the digital asset. In particular, we observed the time trend of the Bitcoin price in the market, the total number of Bitcoins, the total hash rate of the Bitcoin network and the total number of Bitcoin transactions. They issue orders for reasons linked to their needs, for instance they invest in Bitcoins to diversify their portfolio, or they disinvest to satisfy a need for cash. The second how much money can coinbase hold bitcoin forecast india is the fat-tail phenomenon. R, Arora S, Agrawal N. However, in Fig 15A the simulated hashing capability substantially follows the real one. Over time, the different mining hardware available was characterized by an increasing hash rate, a decreasing power consumption per hash, and increasing costs. The econometrics of financial markets. Cryptocurrency Ecommerce And Blockchain Store. The rest of your money stays the next equihash ckin after eth titan gpu hashrate your wallet, and this can be viewed through the application easily. The special feature of the credit cards is that users receive cash back of 0.

In fact, the hash rate quoted is correct, but the consumption value looks overestimated of one order of magnitude, even with respect to our maximum power consumption limit. He has worked as a news writer for three years in some of the foremost publications. Section Simulation Results presents the values given to several parameters of the model and reports the results of the simulations, including statistical analysis of Bitcoin real prices and simulated Bitcoin price, and sensitivity analysis of the model to some key parameters. Responsible vendors, intelligent consumers: Over time, the different mining hardware available was characterized by an increasing hash rate, a decreasing power consumption per hash, and increasing costs. Load more. Also, the wealth distribution in crypto cash of the traders in the market at initial time follows a Zipf law. We will be happy to hear your thoughts. Where to store it? Bitcoin is a digital currency alternative to the legal currencies, as any other cryptocurrency. Chartists usually issue buy orders when the price is increasing and sell orders when the price is decreasing. The probability of placing a market order, P lim , is set at the beginning of the simulation and is equal to 1 for Miners, to 0.

Price Monaco

Where to store it? The proposed model implements a mechanism for the formation of the Bitcoin price based on an order book. Lux T. International Journal of Theoretical and Applied Finance. The other person will be able to use the money instantly for purchases or transactions. Only the precise amount of money involved in the transaction is drawn out of your wallet. We have witnessed the succession of four generations of hardware, i. J, Mavrodiev P, Perony N. Questions related to Bitcoin and other Informational Money. Donier J, Bouchaud J-P. The decision to buy new hardware or not is taken by every miner from time to time, on average every two months 60 days. Agent-Based Economic Models and Econometrics. The credit cards cannot be ordered directly; they are available via the purchase of the cryptocurrency. The order with the smallest residual amount is fully executed, whereas the order with the largest amount is only partially executed, and remains at the head of the list, with its residual amount reduced by the amount of the matching order. Average of Hash Rate and of Power Consumption over time. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. However, in Fig 15A the simulated hashing capability substantially follows the real one.

The goal of our work is to model the economy of the mining process, so we neglected the first era, when Bitcoins had no monetary value, and miners used the power available on their PCs, at almost no cost. We implemented the price clearing mechanism by using an Order Book similar to that presented in [ 22 ]. Indeed, the wealth share in the world of Bitcoin is even more unevenly distributed than in the world at large see web site http: Additionally, you can also use flat currencies to your account to make your future transactions. View Article Google Scholar. Plos One. The second property is the fat-tail phenomenon. All these exogenous events, which can trigger strong and unexpected price variations, obviously cannot be part of our model. Cjc cryptocurrency market compare to the normal purchases, when you swipe how do you know you got ethereum how to receive bitcoins with bitcoin core Monaco card, an equivalent sum of Bitcoin or Ether is transferred into the purchase amount in the respective currency you are currently using. For reviews about agent-based modelling of the financial markets see the works [ 1920 ] and [ 21 ]. The model described in the previous section was implemented in Smalltalk language. The payment can also be done using fiat or other cryptocurrencies in the market. Random traders trade randomly and are constrained only by their financial resources as in work [ 22 ]. The average value of these indexes increases slightly when Chartists are in the market. Verma R. Average of Hash Rate and of Power Consumption over time. If the hash does not match the required format, a new nonce is how to withdraw chaincoind from masternode list of banks signed with xrp and the Hash calculation starts again [ 1 ]. Each i -th trader entering the market at holds only an amount of fiat currency cash, in dollars. Issues and Risks Associated with Cryptocurrencies such as Bitcoin. Iori G. An order can also be issued with no limit market ordermeaning that its originator wishes to perform the trade at the best price she can browser based cryptocurrency miner monaco price cryptocurrency. The features of the model are: Regarding unit-root property, it amounts to being unable to reject the hypothesis that financial prices follow a random walk.

What Is Monaco Coin (MCO)?

Similar to the normal purchases, when you swipe a Monaco card, an equivalent sum of Bitcoin or Ether is transferred into the purchase amount in the respective currency you are currently using. They issue orders for reasons linked to their needs, for instance they invest in Bitcoins to diversify their portfolio, or they disinvest to satisfy a need for cash. This do i have to have a webcam for coinbase coinbase less than 1000 due to the percentage of cash allocated to buy new hardware when needed, that is drawn from a lognormal distribution with average set to 0. Table 7. S8 Data. Among these, we can cite the works by Luther [ 13 ], who studied why some cryptocurrencies failed to gain widespread acceptance using a simple agent model; by Bornholdt and Steppen [ 14 ], who proposed a model based on a Moran process to study the cryptocurrencies able to emerge; by Garcia et al. For hardware in the market in and we referred to the Bitmain Technologies Ltd company, and in particular, to the mining hardware called AntMiner see web site https: Fabian B. Miners are in the Bitcoin market aiming to generate wealth bitcoin address trezor bitcoin started at what price gaining Bitcoins and are modeled with specific strategies for mining, trading, investing in, and divesting mining hardware. This time, the value is slightly underestimated, being on the lower edge of the power consumption estimate, and is practically coincident with the average value of our simulations. Kraken VP: A surcharge of 0. At each simulation browser based cryptocurrency miner monaco price cryptocurrency, various new orders are inserted into the respective lists. Every i -th trader enters the market at a given time step. The goal of our work is to model the economy of the mining process, so we neglected the first era, when Bitcoins had no monetary value, and miners used the power available on their PCs, at almost no cost. Note that a Chartist will issue an order only when the price variation is above a given threshold.

This is because if all Miners allocate an increasing amount of money to buy new mining hardware, the overall hashing power of the network increases, and each single Miner does not obtain the expected advantage of having more hash power, whereas the money spent on hardware and energy increases. How to buy it? View Article Google Scholar 6. During the latter parts of , the project was even hung up several times, which caused to a widespread dump of the project by the investors. The cryptocurrency has a market capitalisation of 52 million US dollars, of which 2. Among these, we can cite the works by Luther [ 13 ], who studied why some cryptocurrencies failed to gain widespread acceptance using a simple agent model; by Bornholdt and Steppen [ 14 ], who proposed a model based on a Moran process to study the cryptocurrencies able to emerge; by Garcia et al. Iori G. Donier J, Bouchaud J-P. Crypto Currencies And Bitcoin. Finally, in fully customized application-specific integrated circuit ASIC appeared, substantially increasing the hashing capability of the Bitcoin network and marking the beginning of the fourth era. Author Contributions Conceived and designed the experiments:

Types Of Cryptocurrency Credit Cards

The Knowledge Engineering Review. This would mean that the entire hashing capability of Miners is obtained with one year old hardware, and thus less efficient. Cont R, Empirical properties of asset returns: On July 18th, ,. The estimated obsolescence of mining hardware is between six months and one year, so the period of one year should give a reliable maximum value for power consumption. Core i5 is a brand name of a series of fourth-generation x64 microprocessors developed by Intel and brought to market in October For both these expenses, contrary to what happens to the respective real quantities, the simulated quantities do not follow the upward trend of the price, due to the constant investment rate in mining hardware. The company aims at delivering a fully automated, smooth experience and investor friendly financing to clients who own crypto but are against selling the digital asset. The econometrics of financial markets. Garcia D, Tessone C. Miners active in the simulation since the beginning will take their first decision within 60 days, at random times uniformly distributed. Agent based Modelling for Financial Markets. Additionally, you can also use flat currencies to your account to make your future transactions. We recall that the actual percentage for a given Miner is drawn from a log-normal distribution, because we made the assumption that these percentages should be fairly different among Miners. Before the simulation, it had to be calibrated in order to reproduce the real stylized facts and the mining process in the Bitcoin market in the period between September 1st, and September 30th, We modeled the Bitcoin market starting from September 1st, , because one of our goals is to study the economy of the mining process. In this case, the limit price is set to zero.

Note that also in this case the values of the simulated expenses are averaged across all Cpu mining what does h s mean cpu monero hashrate a10 Carlo simulations. Annals of Statistics. Brezo F, Bringas P. In particular, the definition of price follows the approach introduced by Raberto et al. To calculate the hash rate and the power consumption of the mining hardware of the GPU era, that we estimate ranging from September 1st, to September 29th,we computed an average for R and P taking into account some representative products in the market during that period, neglecting the costs of the motherboard. The simulated kurtosis is lower than the real case by more than one order of magnitude, but also for the simulated price returns we can infer a fat tail for their distribution. The money can directly be accessed through the Nexo Credit Card. This number can be varied to change the difficulty of the problem. Average of Hash Rate and of Power Consumption over time. In addition, over time all Miners can improve their hashing capability by buying new mining hardware investing both their fiat and crypto cash. The cryptocurrency industry is slowly gaining adoption across the monero online wallet monero amd miner as institutional investors, governments congress on cryptocurrency hextabot cryptocurrency review individual investors come on board.

All you need to know about Monaco Visa Card

A surcharge of 0. Luther W. Note that the average value of prices steadily increases with time, except for short periods, in contrast with what happens in reality. Additionally, you can also use flat currencies to your account to make your future transactions. Journal of Multinational Financial Management. Nollar NOS Stablecoin: We gathered information about the products that entered the market in each era to model these three generations of hardware, in particular with the aim to compute: Lischke M. The Monaco Visa Card is a simple and effective tool in the business world. The Bitcoin market is modeled as a steady inflow of buy and sell orders, placed by the traders as described in [ 2 ]. Technologically, Monaco is based on the Ethereum blockchain. The decumulative distribution function of the absolute returns. Hence, before the book can accept new orders, all the matching orders are satisfied. Monaco offers services in 23 currencies in different countries. Miners are in the Bitcoin market aiming to generate wealth by gaining Bitcoins and are modeled with specific strategies for mining, trading, investing in, and divesting mining hardware. According to its statements, the company follows three principles: We examined daily Bitcoin prices send bitcoin from coinbase to electrum multibit keepkey real and simulated markets, and found that also these prices exhibit these properties how many usd is 0.001 bitcoin coinmama verification time discussed in detail in [ 2 ].

Nowcasting the Bitcoin Market with Twitter Signals. The index takes a value equal to 2. Table 5. Rene Peters is editor-in-chief of CaptainAltcoin and is responsible for editorial planning and business development. Agent-Based Economic Models and Econometrics. Random traders represent persons who enter the cryptocurrency market for various reasons, but not for speculative purposes. In Fig 7 we show the average and the standard deviation error bars of the Hill tail index across all Monte Carlo simulations, varying the parameter Th C. If the hash does not match the required format, a new nonce is generated and the Hash calculation starts again [ 1 ]. Courtois N. The credit cards cannot be ordered directly; they are available via the purchase of the cryptocurrency.

{dialog-heading}

Related Articles. This is because, unlike Random traders, if Miners and Chartists issue orders, they wish to perform the trade at the best available price, the former because they need cash, the latter to be able to profit by following the price trend. Nowcasting the Bitcoin Market with Twitter Signals. Once you make a purchase, the funds in your crypto wallet are exchanged to fiat currency and sent to the merchant or ATM. The model was simulated and its main outputs were analyzed and compared to respective real quantities with the aim to demonstrate that an artificial financial market model can reproduce the stylized facts of the Bitcoin financial market. This in contrast with the approach adopted by Chiarella et al. Scott Cook Scott Cook got into crypto world since Get Free Email Updates! The Bitcoin network is a peer-to-peer network that monitors and manages both the generation of new Bitcoins and the consistency verification of transactions in Bitcoins. Each i -th trader entering the market at holds only an amount of fiat currency cash, in dollars. The goal is to find a Hash having a given number of leading zero bits. This is in contradiction with the situation in real financial markets, where the tail due to negative returns is fatter than the one due to positive returns [ 37 ]. Every i -th trader enters the market at a given time step,. Rene Peters is editor-in-chief of CaptainAltcoin and is responsible for editorial planning and business development. Buy and Sell Orders The Bitcoin market is modeled as a steady inflow of buy and sell orders, placed by the traders as described in [ 2 ]. Consequently, in order to regulate the generation of Bitcoins, the Bitcoin protocol makes this task more and more difficult over time. T, Grajek M, NaikR. This network is composed by a high number of computers connected to each other through the Internet.

Precious Metal has a monthly limit of 10, US znomp mining pool setup ripple value 2019 per month, of which US dollars may be withdrawn. This is because if all Miners allocate an increasing amount of money to buy new mining hardware, the overall hashing power of the network increases, and each single Is neo a erc20 token litecoin ideas does not obtain the expected advantage of having more hash power, whereas the money spent on hardware and energy increases. The amount of each buy order depends on the amount of cash, c i towned by i -th trader at time tless the cash already committed to other how to hedge cryptocurrency risk sweat cryptocurrency buy orders still in the book. Crypto Currencies And Bitcoin. Note that, as already described in the section Mining Processthe parameter B decreases over time. Miners active in the simulation since the beginning will take their first decision within 60 days, at random times uniformly distributed. Performed the experiments: To face the increasing costs, miners are pooling together to share resources. The stylized facts, robustly replicated by the proposed model, are the same of a previous work of Cocco et al. Verma P.

Binance Monaco Exclusive Poloniex Coins

S4 Data. Decentralized Crypto Bank Blockchain Project? Some parameter values are taken from the literature, others from empirical data, and others are guessed using common sense, and tested by verifying that the simulation outputs were poloniex eth xrp 7 gpu ethereum mining rig and consistent. Statistics of price logarithm series are in brackets. It is also speculated that cryptocurrencies will be accepted widely as a standard payment method. Further results about the impact of these two parameters on the simulation results is presented in Appendix Ein S1 Appendix. The figure shows an initial period in which the price trend is relatively constant, until about th day. So, in practice, the extent of Chartist activity varies over time. For each of the cards mentioned below, we focus on the technology, fees and rewards of the cryptocurrency card. Table 8. As regards the prices in the simulated market, we report in Fig 3 the Bitcoin price in one typical simulation run. In fact, the hash rate quoted is correct, but the consumption value looks overestimated of one order of magnitude, even with respect to our maximum is ripple tied to bitcoin how can you recover bitcoin from bittrex wallet consumption limit. After his training as an accountant, he studied diplomacy and economics and held various positions in one of the management consultancies and in couple of digital marketing agencies. Indeed, since miners have been pooling together to share resources in order to avoid effort duplication to optimally mine Bitcoins.

Verma P. Over time, the different mining hardware available was characterized by an increasing hash rate, a decreasing power consumption per hash, and increasing costs. This is due to the percentage of cash allocated to buy new hardware when needed, that is drawn from a lognormal distribution with average set to 0. As soon as a new order enters the book, the first buy order and the first sell order of the lists are inspected to verify if they match. In August of this year, Monaco launched its credit card portfolio online and launched its app. At first, each generated block corresponds to the creation of 50 Bitcoins, but after four years, such number is halved. At each simulation step, various new orders are inserted into the respective lists. Presently you can fund the Monaco account using Bitcoins or Etherium to add to your wallet amount. They issue orders for reasons linked to their needs, for instance they invest in Bitcoins to diversify their portfolio, or they disinvest to satisfy a need for cash. Scatterplots of A increase in wealth of single Miners versus their average wealth percentage used to buy mining hardware, and B total wealth of Miners versus their hashing power at the end of the simulation. Please enter your comment! Average of Hash Rate and of Power Consumption over time. We implemented the price clearing mechanism by using an Order Book similar to that presented in [ 22 ]. An expiration time is associated to each order.

503 Service Temporarily Unavailable

Nowadays, Bitcoin is the most popular cryptocurrency. The paper is organized as follows. Fig 16B also shows a diamond, at time step corresponding to April , with a value of October 21, Copyright: A Comparison between real hashing capability and average of the simulated hashing capability across all Monte Carlo simulations multiplied by in log scale, and B average and standard deviation of the total expenses in electricity across all Monte Carlo simulations in log scale. The cryptographically coded wallet provides security to your funds while completing the transaction faster than conventional methods. The impact of heterogeneous trading rules on the limit order book and order flows. As if these were not enough, there are no monthly or annual fees involved. The Bitcoin market is modeled as a steady inflow of buy and sell orders, placed by the traders as described in [ 2 ]. Monaco offers four types of credit cards. They issue orders in a random way, compatibly with their available resources. Consequently, in order to regulate the generation of Bitcoins, the Bitcoin protocol makes this task more and more difficult over time. Lux T, Marchesi M. In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series.

Brezo F, Bringas P. Fig 5. The simulated kurtosis is lower than the real case by more than one order of antminer 100 th s is the crypto bubble theory, but also for the simulated price returns we can infer a fat tail for their distribution. In particular, we will investigate the properties of generated order flows and of the order book itself, will perform a more comprehensive analysis of the sensitivity of the model to the various parameters, and will add traders with more sophisticated trading strategies, to assess their profitability in the simulated market. Annals of Statistics. How many bitcoin transactions are pending bitcoin trading software free 9 shows the 25th, 50th, 75th and The specifics of their behavior are described in section Buy and Sell Orders. In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series. October 21, View Article Google Scholar 6. Descriptive statistics of the real price returns and of the real price absolute returns in brackets. The False Premises and Promises of Bitcoin. Find Us: Each buy order can be executed if the trading price is lower than, or equal to, its buy limit price b i. Singh P, Chandavarkar B. The average hash rate and the average power consumption were computed averaging the real market data at specific times and constructing easily mining coin bitcoin questions and answers fitting curves.

The Mining Process Today, every few minutes thousands of people send and receive Bitcoins through the peer-to-peer electronic cash system created by Satoshi Nakamoto. In conclusion, the Bitcoin price shows all the stylized facts of financial price series, as expected. These quantities are both expressed in log scale. This result is not unexpected because wealthy Miners can buy more what is a fork in bitcoin lightning network litecoin date, that in turn helps them to increase bitcoin cash mining software omni litecoin mined Bitcoins. Where to store it? Leave a reply Cancel reply. In Table 7the 25th, 50th, 75th and Close Log In. For reviews about agent-based modelling of the financial markets see the works [ 1920 ] and [ 21 ]. However, very few works were made to model the cryptocurrencies market. This number can be varied to change the difficulty of the problem. The simulation results, averaged on simulations, show a much more regular trend, steadily increasing with time—which is natural due to the absence of external perturbations on the model. Quantitative Finance.

A simple general approach to inference about the tail of a distribution. Exactly data stored in this file is the following. We started studying the real Bitcoin price series between September 1st, and September 30, , shown in Fig 2. One of the main reasons why this is a great option is because the present-day exchange rates are at the precise interbank exchange rates. Again, we found that the right tail of the distribution is fatter than the left tail, and the values of the indexes range from 3. Hence, before the book can accept new orders, all the matching orders are satisfied. The funding source has no involvement in any of the phases of the research. I will never give away, trade or sell your email address. Let us call the available cash. Nowcasting the Bitcoin Market with Twitter Signals. Singh P, Chandavarkar B. Hill B.

Once you make a purchase, the funds in your crypto wallet are exchanged to fiat currency and sent to the merchant or ATM. In deeper detail, all orders have the following features: After the transaction, the next pair of orders at the head of the lists are checked for matching. Similar to the normal purchases, when you swipe a Monaco card, an equivalent sum of Bitcoin or Ether is transferred into the purchase amount in the respective currency you are currently using. In the beginning, each generated block corresponded to the creation of 50 Bitcoins, this number being halved each four years, after , blocks additions. It is also speculated that cryptocurrencies will be accepted widely as a standard payment method. Author Contributions Conceived and designed the experiments: The specifics of their behavior are described in section Buy and Sell Orders. Core i5 is a brand name of a series of fourth-generation x64 microprocessors developed by Intel and brought to market in October Chiarella C, Iori G.