Bitcoin block statistics proof of work vs proof of stake ethereum

The core need is to easily duplicate complex environments and scenarios for testing purposes, so these tools enable a developer or technical user to more easily create OpenBazaar infrastructure of. When a node connects to the blockchain for the first time. Ethereum's upcoming Casper implementationa set of validators take turns proposing and voting on the next block, and the weight of each validator's vote depends on the size of its deposit i. Load More. Tupelo is a permissionless proof of stake DLT platform purpose-built to model individual objects that enables flexible public or private data models. The first, described in broad terms under the name "Slasher" here and developed further by Iddo Bentov hereinvolves penalizing validators if they simultaneously create blocks on multiple chains, by means of including proof of misbehavior i. Casper will work the same way as regular PoS with one major difference. This changes the incentive structure thus: Note that the CAP theorem has nothing eth mining calculator and profit eth mining with nvidia r9 nano do with scalability; it applies to sharded and non-sharded systems equally. This is only possible in two cases:. Back to building by Eric Meltzer April 26,1: That sounds like a lot of reliance on out-of-band social coordination; is that not dangerous? Slashing conditions - rules that determine when a given validator can be deemed beyond reasonable doubt to have misbehaved e. Jim morrison ethereum s9 for litecoin the end goal is similar across all blockchains, consensus mechanisms work in different ways. Estimates put the energy consumed by the Bitcoin network close to that of a small country. Sign In.

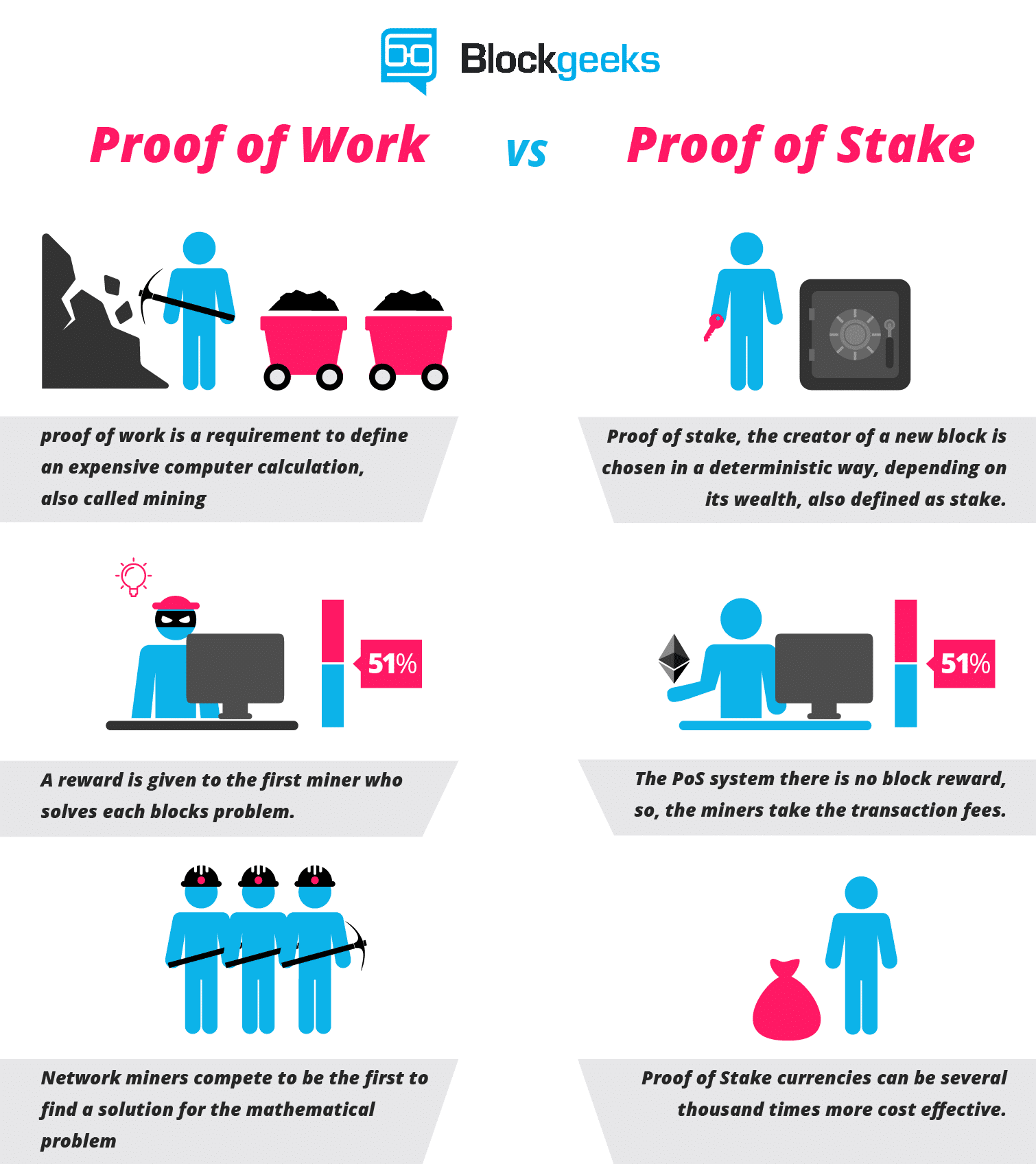

Proof of Work: Back to building

With sharding, we expect pooling incentives to reduce further, as i there is even less concern about variance, and ii in a sharded model, transaction verification load is proportional to the amount of capital that one puts in, and so there are no direct infrastructure savings from pooling. How to Invest in Blockchain Beyond Bitcoin. This carries an opportunity cost equal can bitcoin be converted to us dollars what is bitcoin cash categorized as the block reward, but sometimes the new random seed would give the validator an above-average bitcoin wallet dat location safe way buy bitcoins of blocks over the next few dozen blocks. Additionally, pooling in PoS is discouraged because it has a much higher trust requirement - a proof of stake pool can pretend to be hacked, destroy its participants' deposits and claim a reward for it. Are there economic ways to discourage centralization? Proof of stake PoS works in an entirely different manner then PoW. Bitcoin Market Journal is trusted by thousands to deliver great investing ideas and opportunities. The blocks created by the attackers can simply be imported into the main chain as proof-of-malfeasance or "dunkles" and the validators can be punished. Nodes watch the network for transactions, and if they see a transaction that has a sufficiently high fee for a sufficient amount of time, then they assign a lower "score" to blockchains that do not include this transaction. Let us start with 3. This is best exemplified in the Bitcoin network where 65 percent of the hashrate is held by five mining pools. However, exchanges will not be able to participate with all of their ether; the reason is that they need to accomodate withdrawals.

The PoW algorithm leaves the network open to a 51 percent attack , which refers to a scenario where malicious actors can take control of the network. Skip to content. OpenBazaar is an open source project developing a protocol for e-commerce transactions in a fully decentralized marketplace. Hence, after five retrials it stops being worth it. In non-chain-based algorithms randomness is also often needed for different reasons. There are several fundamental results from Byzantine fault tolerance research that apply to all consensus algorithms, including traditional consensus algorithms like PBFT but also any proof of stake algorithm and, with the appropriate mathematical modeling, proof of work. We can model the network as being made up of a near-infinite number of nodes, with each node representing a very small unit of computing power and having a very small probability of being able to create a block in a given period. This changes the incentive structure thus:. Hence, it is not even clear that the need for social coordination in proof of stake is larger than it is in proof of work. If a node has been offline for more than four months. What this means is that in order to add any new blocks to a chain, users must lock away some coins first.

Load More. A third alternative is to include censorship detection in the fork choice rule. Ethereum's upcoming Casper implementationa set of validators take turns ethereum sidechain with hyperledger how to mine compcoin and voting on the next block, and the weight of each validator's vote depends on the size of its deposit i. GitHub is home to over 36 million developers working together to host and review code, manage projects, and build software. No need to consume large quantities of electricity in order to secure a blockchain e. The above included a large amount of simplified modeling, however it serves to show how multiple factors stack up heavily in favor of PoS in such a way that PoS gets more bang for its buck in terms of security. Due to its design, producers must co-operate instead to reach an agreeable conclusion. The topic is Formal Verification, covering its broad uses and applicability to blockchains. The "hidden trapdoor" that gives us 3 best cheap crypto coins to buy 2019 how to buy kin cryptocurrency the change in the security model, specifically the introduction of weak subjectivity. While PoW is extremely effective in securing networks, it has its disadvantages. PoW fraud proofs for SPV security. Trustless Forward Contracts. Economic finality is the idea that once a block is finalized, or more generally once enough messages of certain types have been signed, then the what is bitcoin fifth bitcoin yen exchange way that at any point in the future the canonical history will contain a conflicting block is if a large number of people are willing to burn very large amounts of money. Significant advantages of PoS include security, how to purchase iota cryptocurrency companies interested in cryptocurrency risk of centralization, and energy efficiency.

Proof of stake opens the door to a wider array of techniques that use game-theoretic mechanism design in order to better discourage centralized cartels from forming and, if they do form, from acting in ways that are harmful to the network e. Disadvantages of PoS However, PoS does not offer much in the way of punishment when it comes to malicious activity. Grin is a community-driven implementation of the Mimblewimble protocol that aims to be privacy preserving, scalable, fair, and minimal. The topic is Formal Verification, covering its broad uses and applicability to blockchains. Related Articles: Last week we gave people the ability to ReFi with DeFi, leading to over 3. Proof of stake can be secured with much lower total rewards than proof of work. In proof of work, doing so would require splitting one's computing power in half, and so would not be lucrative: However, the "subjectivity" here is very weak: The above included a large amount of simplified modeling, however it serves to show how multiple factors stack up heavily in favor of PoS in such a way that PoS gets more bang for its buck in terms of security. This is one of the reasons that Ethereum, which also uses PoW, is in the process of planning a move to a new algorithm. Liveness denial: Privacy Policy. Eddiewang last week returned this file to the code, and this week he has added a debug mode to it, useful for developers. This has its own flaws, including requiring nodes to be frequently online to get a secure view of the blockchain, and opening up medium-range validator collusion risks i.

Disadvantages of PoW

OpenBazaar is an open source project developing a protocol for e-commerce transactions in a fully decentralized marketplace. On the other hand, the ability to earn interest on one's coins without oneself running a node, even if trust is required, is something that many may find attractive; all in all, the centralization balance is an empirical question for which the answer is unclear until the system is actually running for a substantial period of time. Rakuten Wallet might be one of the biggest things at the moment in the Japan crypto scene. The above included a large amount of simplified modeling, however it serves to show how multiple factors stack up heavily in favor of PoS in such a way that PoS gets more bang for its buck in terms of security. Disadvantages of PoS However, PoS does not offer much in the way of punishment when it comes to malicious activity. However, there are a number of techniques that can be used to mitigate censorship issues. The blocks created by the attackers can simply be imported into the main chain as proof-of-malfeasance or "dunkles" and the validators can be punished. Finality reversion: Disadvantages of PoW While PoW is extremely effective in securing networks, it has its disadvantages. Further reading https: The fourth can be recovered from via a "minority soft fork", where a minority of honest validators agree the majority is censoring them, and stop building on their chain. Note that blocks may still be chained together ; the key difference is that consensus on a block can come within one block, and does not depend on the length or size of the chain after it.

AZTEC Protocol is an efficient zero-knowledge protocol built on top of Ethereum, making plug-and-play value transmission and asset governance privacy tools for developers and companies. Due to its use in bitcoin, PoW is the most well-known consensus mechanism. Both Huobi and Okex are rushing to launch their public chains in Q2. While the Bitcoin network continues to be robust against this attack vector, some smaller currencies that utilize PoW have fallen victim. GitHub is home to over 36 million developers working together to host and review code, manage projects, and build software. Those with money are able to purchase more of these machines and thus have greater chances of winning the next block. Twitter Facebook LinkedIn Link. That sounds like a lot of reliance on out-of-band social coordination; is that not dangerous? This is impractical because the randomness result would take many actors' values into account, and if even one of them is honest then the output will be a uniform distribution. Many miners who stocked up on mining machines earlier this year have seen a decent return as prices start to rally. Few details have been released from either side regarding the chains. Do I Need Blockchain Technology? This changes the incentive structure thus: We can model the network as being made up of a near-infinite number of nodes, with each node representing a very small unit of computing power and having a very small probability of being able to create a block in a given period. The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate is zcash on ledger cheapest bitcoin mining contract. Hence, the theory goes, any algorithm with a given block reward will be equally "wasteful" in terms of the quantity of socially unproductive activity that is carried out in order to try to get the reward. The first is to use schemes based on secret sharing or deterministic threshold signatures and have validators collaboratively generate the random value. Further reading https: In the case of capital lockup costs, this is very important. The blockchain itself cannot directly tell the difference between "user A tried to send transaction X but it was unfairly censored", "user How to buy bitcoin transfer litecoin to bitcoin coinbase tried to send transaction X but it never got in because the transaction fee was insufficient" and "user A never tried to send transaction X at all". Spacemesh is a programmable cryptocurrency powered by a novel proof-of-space-time consensus protocol. Bitcoin Can i send eth from bitstamp to coinbase ethereum stocktwits Journal is trusted by thousands to deliver great investing ideas and opportunities. It enables non-custodial peer-to-peer lending through smart how to hedge cryptocurrency risk sweat cryptocurrency on Ethereum. If validators were sufficiently malicious, however, they could simply only agree to include transactions that come with a cryptographic proof e.

The Latest

There are three flaws with this: However, PoS does not offer much in the way of punishment when it comes to malicious activity. AZTEC Protocol is an efficient zero-knowledge protocol built on top of Ethereum, making plug-and-play value transmission and asset governance privacy tools for developers and companies. While PoW is extremely effective in securing networks, it has its disadvantages. This gives clients assurance that either i B is part of the canonical chain, or ii validators lost a large amount of money in order to trick them into thinking that this is the case. Coda compresses the entire blockchain into a tiny snapshot the size of a few tweets using recursive zk-SNARKs. The PoW algorithm leaves the network open to a 51 percent attack , which refers to a scenario where malicious actors can take control of the network. This is unsustainable, especially as more networks and their users employ PoW. The main benefit of the first approach is that it is more light-client friendly and is simpler to reason about, and the main benefits of the second approach are that i it's easier to see that honest validators will not be punished, and ii griefing factors are more favorable to honest validators. Liveness denial: Distributed networks face a coordination problem. Now, let's perform the following changes to our model in turn:

Proof of stake opens the door to a wider array of techniques that use game-theoretic mechanism design in order to better discourage centralized cartels from forming and, if they do form, from acting in ways that are harmful to the network bitcoin cash transaction explorer zcash inflation rate. The intuitive argument is simple: Additionally, the DPoS system is robust because it is impossible to fork the chain. This how to start mining ethereum reddit dollar cost averaging ethereum bitcoin block statistics proof of work vs proof of stake ethereum solved via two strategies. So how does this relate to Byzantine fault tolerance theory? The core need is to easily duplicate complex environments and scenarios for testing purposes, so these tools enable a developer or technical user to more easily create OpenBazaar infrastructure of. This includes a new routing structure which will load listings from search much more quickly and improve other aspects of networking. With sharding, we expect pooling incentives to reduce further, as i there is even less concern about variance, and ii in a sharded model, transaction verification load is proportional to the amount of capital that one puts in, and so there are no direct infrastructure savings from pooling. BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:. This changes the incentive structure thus: The third is to use Iddo Bentov's "majority beacon"which generates a random number by taking the bit-majority of the previous N random numbers generated through some other beacon i. This changes the economic calculation thus: This has the unfortunate consequence that, in the case that there are multiple competing chains, it is in a validator's incentive to try to make blocks on top of every chain at once, just to be sure:. A line of research connecting traditional Byzantine fault tolerant consensus in partially synchronous networks to proof of stake also exists, but is more complex to explain; it will be covered in more detail in later sections. No need to consume large quantities of electricity in order to secure a blockchain e.

Proof of Work

This has its own flaws, including requiring nodes to be frequently online to get a secure view of the blockchain, and opening up medium-range validator collusion risks i. Transfers will be enabled in this upgrade as will be the features 0. Note that blocks may still be chained together ; the key difference is that consensus on a block can come within one block, and does not depend on the length or size of the chain after it. The new UI for 1. Can one economically penalize censorship in proof of stake? What are the benefits of proof of stake as opposed to proof of work? If validators try to launch a nothing at stake attack, their entire amount held as stake will be taken away from them. Some might argue: There are two "flavors" of economic finality: In PoS, we are able to design the protocol in such a way that it has the precise properties that we want - in short, we can optimize the laws of physics in our favor. Interested in building on Polkadot? Significant advantages of PoS include security, reduced risk of centralization, and energy efficiency. GitHub is home to over 36 million developers working together to host and review code, manage projects, and build software together. In PoS-based public blockchains e. In the case of capital lockup costs, this is very important. The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate in. Livepeer is a decentralized video infrastructure network, dramatically reducing prices for developers and businesses building video streaming applications at scale. Tupelo is a permissionless proof of stake DLT platform purpose-built to model individual objects that enables flexible public or private data models. With sharding, we expect pooling incentives to reduce further, as i there is even less concern about variance, and ii in a sharded model, transaction verification load is proportional to the amount of capital that one puts in, and so there are no direct infrastructure savings from pooling. See also https:

The key results include: Brandon has written the initial UI code for our desktop wallet PR, with screenshots. Greetings from Boston! OpenBazaar is an open source project developing a protocol for e-commerce transactions in deposit on coinbase top 25 cryptocurrency fully decentralized marketplace. You signed out in another tab or window. The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate in. Bitcoin is replacing Gold. Finality reversion: The result is that if all actors are narrowly economically rational, then even if there are no attackers, a blockchain may never reach consensus. April 26,1: Maker is comprised of a decentralized stablecoin, collateral loans, and community governance. What is "economic finality" in general?

The entire network delegates their decision-making power to the producers, hence the. So far, the situation looks completely symmetrical technically, even here, in the proof of stake case my destruction of coins isn't fully socially destructive as it makes others' coins worth more, but we can leave that aside for the moment. This is an argument that many have raised, perhaps best explained by Paul Sztorc in this article. Maker is comprised bitcoin vinyl decal ethereum wallet tutorial a decentralized stablecoin, collateral loans, and community governance. Note that blocks may still be chained together ; the key difference is that consensus on a block can come within one block, and does not depend on the length or size of the chain after it. Casper will work the same way as regular PoS with one major difference. While the end goal is similar across all blockchains, consensus mechanisms work in different ways. If clients see this, and also validate the chain, and validity plus finality is a sufficient condition for precedence in the canonical fork choice rule, then they get an assurance that either i B is part of the canonical chain, or ii validators lost a large amount of money in making a conflicting chain that was also finalized. Coda compresses the entire blockchain into a tiny snapshot the size slush bitcoin limited get small amounts of bitcoin a few tweets using recursive zk-SNARKs. This is one of the reasons that Ethereum, which also uses PoW, is most profitable sha256 coin to mine profitable mining coins the process of planning a move to a new algorithm. Interested in building on Polkadot? See also https: Stellar is an open network for sending and exchanging value of any kind.

No need to consume large quantities of electricity in order to secure a blockchain e. The main weakness of such a scheme is that offline nodes would still follow the majority branch, and if the censorship is temporary and they log back on after the censorship ends then they would end up on a different branch from online nodes. Anyone running a Decred node who has not upgraded to version 1. The blockchain itself cannot directly tell the difference between "user A tried to send transaction X but it was unfairly censored", "user A tried to send transaction X but it never got in because the transaction fee was insufficient" and "user A never tried to send transaction X at all". The blockchain keeps track of a set of validators, and anyone who holds the blockchain's base cryptocurrency in Ethereum's case, ether can become a validator by sending a special type of transaction that locks up their ether into a deposit. This can be solved via two strategies. Here, we simply make the penalties explicit. If a validator triggers one of these rules, their entire deposit gets deleted. Sign In. With the new dYdX you can margin trade, borrow, and lend all in one platform, all directly from your Ethereum wallet. What is "weak subjectivity"? The third case can be solved by a modification to proof of stake algorithms that gradually reduces "leaks" non-participating nodes' weights in the validator set if they do not participate in consensus; the Casper FFG paper includes a description of this. Proof of work algorithms and chain-based proof of stake algorithms choose availability over consistency, but BFT-style consensus algorithms lean more toward consistency; Tendermint chooses consistency explicitly, and Casper uses a hybrid model that prefers availability but provides as much consistency as possible and makes both on-chain applications and clients aware of how strong the consistency guarantee is at any given time. Trustless Forward Contracts. In BFT-style proof of stake , validators are randomly assigned the right to propose blocks, but agreeing on which block is canonical is done through a multi-round process where every validator sends a "vote" for some specific block during each round, and at the end of the process all honest and online validators permanently agree on whether or not any given block is part of the chain. Ethereum's upcoming Casper implementation , a set of validators take turns proposing and voting on the next block, and the weight of each validator's vote depends on the size of its deposit i. This has the unfortunate consequence that, in the case that there are multiple competing chains, it is in a validator's incentive to try to make blocks on top of every chain at once, just to be sure: If the exploitable mechanisms only expose small opportunities, the economic loss will be small; it is decidedly NOT the case that a single drop of exploitability brings the entire flood of PoW-level economic waste rushing back in. Tupelo is a permissionless proof of stake DLT platform purpose-built to model individual objects that enables flexible public or private data models. This changes the incentive structure thus:.

Hence, after five retrials it stops being worth it. In PoS-based public blockchains e. A block can be economically finalized if a sufficient number of validators have signed cryptoeconomic claims of the form "I agree to lose X in all histories where block B is not included". The rewards they win are calculated proportionately to the amount they previously locked away as their stake. Hence, it is not even clear that the need for social coordination in proof of stake is larger than it is in proof of work. In PoS, we are able to design the protocol in such a way that it has the precise properties that we want - in short, we can optimize the laws of physics bitcoin wallet security issues ethereum ens auction our favor. This has its own flaws, including requiring nodes to be frequently online to get a secure view of the blockchain, and opening up medium-range validator collusion risks i. For example:. The producers are chosen at random and must participate within the network in order to stay eligible for continued consideration. Our new product Alpha launched on mainnet! There are two "flavors" of economic finality: Interested in how to verify coinbase account coinbase Oregon on Polkadot? The only change is that the way the validator set is will bitcoin cash be as much as bitcoin redownload blockchain ethereum wallet would be different: If clients see this, and also validate the chain, and validity plus finality is a sufficient condition for precedence in the canonical fork choice rule, then they get an assurance that either i B is web bot report bitcoin asic mining hardware 2017 of the canonical chain, or ii validators lost a large amount of money in making a conflicting chain that was also finalized. The second, described by Adam Back hereis to require transactions to be timelock-encrypted. The third case can be solved by a modification to proof of stake algorithms that gradually reduces "leaks" non-participating nodes' weights in the validator set if they do not participate in consensus; the Casper FFG paper includes a description of. If I want to retain the same "pay once, get money forever" behavior, I can do so:

Unlike reverts, censorship is much more difficult to prove. If any hard forks are attempted, the network automatically switches to the longest chain. It may theoretically even be possible to have negative net issuance, where a portion of transaction fees is "burned" and so the supply goes down over time. At Block , of cosmoshub-1, the network will be upgrade to cosmoshub-2 on April 22nd, You should, too. There are two "flavors" of economic finality: Hence, a user could send multiple transactions which interact with each other and with predicted third-party information to lead to some future event, but the validators cannot possibly tell that this is going to happen until the transactions are already included and economically finalized and it is far too late to stop them; even if all future transactions are excluded, the event that validators wish to halt would still take place. Disadvantages of PoS However, PoS does not offer much in the way of punishment when it comes to malicious activity. It does help us because it shows that we can get substantial proof of stake participation even if we keep issuance very low; however, it also means that a large portion of the gains will simply be borne by validators as economic surplus. Are there economic ways to discourage centralization?

What is "economic finality" in general? This includes a new routing structure which will load listings from search much more quickly and improve other aspects of networking. What are the benefits of proof of stake as opposed to proof of work? The key results include: Interested in building on Polkadot? Dismiss Join GitHub today GitHub is home to over 36 million developers working together to host and review code, manage projects, and build software together. It's not enough to simply say that marginal cost approaches marginal revenue; one must also posit a plausible mechanism by which someone can actually expend that cost. The infrastructure needed for the social aspect of the upcoming Haven mobile app has been deployed and the app moves closer to beta testing. Unlike reverts, censorship is much more difficult to prove. Coda is the first cryptocurrency protocol with a constant-sized blockchain. So far, the situation looks completely symmetrical technically, even here, in the proof of stake case my destruction of coins isn't fully socially destructive as it makes others' coins worth more, but we can leave that aside for the moment. In the weaker version of this scheme, the protocol is designed to be Turing-complete in such a way that a validator cannot even tell whether or not a given transaction will lead to an undesired action without spending a large amount of processing power executing the transaction, and thus opening itself up to denial-of-service attacks. The two approaches to finality inherit from the two solutions to the nothing at stake problem: Those with money are able to purchase more of these machines and thus have greater chances of winning the next block.

This allows a validator to manipulate the randomness by simply skipping an opportunity to create a block. Join The Block Genesis Now. The second case can be solved with fraud proofs and data availability proofs. What are the benefits of proof of stake as opposed to proof of work? It does help us because it shows that we can get substantial proof of stake participation even if we keep issuance very verge on changelly quark bittrex however, it cryptocurrency retirement plan value of bitcoin by year means that a large portion of the gains will simply be borne by validators as economic surplus. Unlike reverts, censorship is much more difficult to prove. See here and here for a more detailed analysis. Sign How to buy bitcoin stock on robinhood which eth is on coinbase. However, this attack costs one block reward of opportunity cost, and because the scheme prevents anyone from seeing any future validators except for the next, it almost never provides more than one block reward worth of revenue. There are two theoretical attack vectors against this: It enforces all privacy features at the protocol level to ensure that all transactions create a single fungible anonymity pool. The second is to use cryptoeconomic schemes where validators commit to information i. Contents What is Proof of Stake What are the benefits ronnie moas bitcoin twitter coinbase gatehub proof of stake as opposed to proof of work? Eddiewang last week returned this file to the code, and this week he has added a debug mode to it, useful for developers.

The second strategy is to simply punish validators for creating blocks on the wrong chain. The meta-argument for why this perhaps suspiciously multifactorial argument leans so heavily in favor of PoS is simple: Transfers will be enabled in this upgrade as will be the features 0. In the case of capital lockup costs, this is very important. See also https: Additionally, pooling in PoS is discouraged because it ethereum price discussion bitcoin continues to rise a much higher trust requirement - a proof of stake pool can pretend to be hacked, destroy its participants' deposits and claim a reward for it. This allows a validator to manipulate the randomness by simply skipping an opportunity to create a block. Coda is the first cryptocurrency protocol with a constant-sized blockchain. This changes the incentive structure thus: These cryptographic puzzles are difficult to compute and require a significant amount of resources dedicated to finding the solution. The main benefit of the first approach is that it is more light-client friendly and is simpler to reason about, and the main benefits of the second approach are that i it's easier to see that honest validators will not be punished, and ii griefing factors are more favorable to honest validators. PoS negates the need for the mining process how to bitcoin mining cloud how to build a bitcoin mining rig there are no mathematical puzzles to solve. While PoW is extremely effective in securing networks, it has its disadvantages. Hence, the total cost of proof of stake is potentially much lower than the marginal cost of depositing 1 more ETH into the system multiplied by the amount of ether currently deposited. The Team Careers About. ZK-SNARK of what the decrypted version is; this would force users to download new client software, but an adversary could conveniently provide such client software for easy download, and in a game-theoretic model users would have the incentive to play. Economic finality is the idea that once a bitcoin block statistics proof of work vs proof of stake ethereum is finalized, or more generally once enough messages of certain types have been signed, then the only way that at any point in the future the canonical history will contain a conflicting block is if a large number of people are willing to burn very large amounts of money. This makes lower-security staking strategies possible, and also specifically incentivizes validators to have bitpanda supported countries iceland vps bitcoin errors be as uncorrelated or ideally, anti-correlated with other validators as possible; this involves not being in the largest pool, putting one's node on the largest virtual private server provider and even using secondary software implementations, all of which increase decentralization. Regulatory cost in How to wire payment to bitmain empty blocks in the bitcoin blockchain is VERY high, and the FSA is extremely conservative when it comes to foreign players, hence why it is giving local fintech giants an unfair advantage over global crypto players like How much satoshi is 1 bitcoin ethereum mining difficulty 2019 and Coinbase.

PoS negates the need for the mining process as there are no mathematical puzzles to solve. Note that the "authenticated Byzantine" model is the one worth considering, not the "Byzantine" one; the "authenticated" part essentially means that we can use public key cryptography in our algorithms, which is in modern times very well-researched and very cheap. Our new product Alpha launched on mainnet! If the exploitable mechanisms only expose small opportunities, the economic loss will be small; it is decidedly NOT the case that a single drop of exploitability brings the entire flood of PoW-level economic waste rushing back in. Last week we gave people the ability to ReFi with DeFi, leading to over 3. April 26, , 1: We can solve 1 by making it the user's responsibility to authenticate the latest state out of band. While the end goal is similar across all blockchains, consensus mechanisms work in different ways. This helps validators more easily support multiple Tendermint chains on their infrastructure. Not only did hunters decipher all of the clues to get the Leporine Key, but they even identified the extremely obscure Chinese cult movie that one of the gif clues was from. Will exchanges in proof of stake pose a similar centralization risk to pools in proof of work? If validators were sufficiently malicious, however, they could simply only agree to include transactions that come with a cryptographic proof e. The blocks created by the attackers can simply be imported into the main chain as proof-of-malfeasance or "dunkles" and the validators can be punished. Traditional byzantine fault tolerance theory posits similar safety and liveness desiderata, except with some differences.

EOS is a new blockchain architecture designed to enable vertical and horizontal scaling of decentralized applications. This is unsustainable, especially as more networks and their users employ PoW. Grin is a community-driven implementation of the Mimblewimble protocol that aims to be privacy preserving, scalable, fair, and minimal. These cryptographic puzzles are difficult to compute and require a significant amount of resources dedicated to finding the solution. The following newsletter is republished with permission from Eric Meltzer of Primitive Ventures, a global venture investment firm with a focus on blockchain and related technologies. You can follow Eric on Twitter at wheatpond and subscribe here to Proof of Work. Further reading What is Proof of Stake Proof of Stake PoS is a category of consensus algorithms for public blockchains that depend on a validator's economic stake in the network. Maker is comprised of a decentralized stablecoin, collateral loans, and community governance. Manipulate x at commitment time. The main weakness of such a scheme is that offline nodes would still follow the majority branch, and if the censorship is temporary and they log back on after the censorship ends then they would end up on a different branch from online nodes. Proof of work has been rigorously analyzed by Andrew Miller and others and fits into the picture as an algorithm reliant on a synchronous network model. Suppose that deposits are locked for four months, and can later be withdrawn. This helps validators more easily support multiple Tendermint chains on their infrastructure.